COVID-19 Bulletin: March 25

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell around 2% yesterday amid renewed fuel demand concerns and fresh pandemic lockdowns in Europe. Energy futures were lower in mid-day trading today, with the WTI down 4.5% at $58.42/bbl, Brent 3.7% lower at $62.01/bbl and natural gas down 3.1% at $1.93/MMBtu.

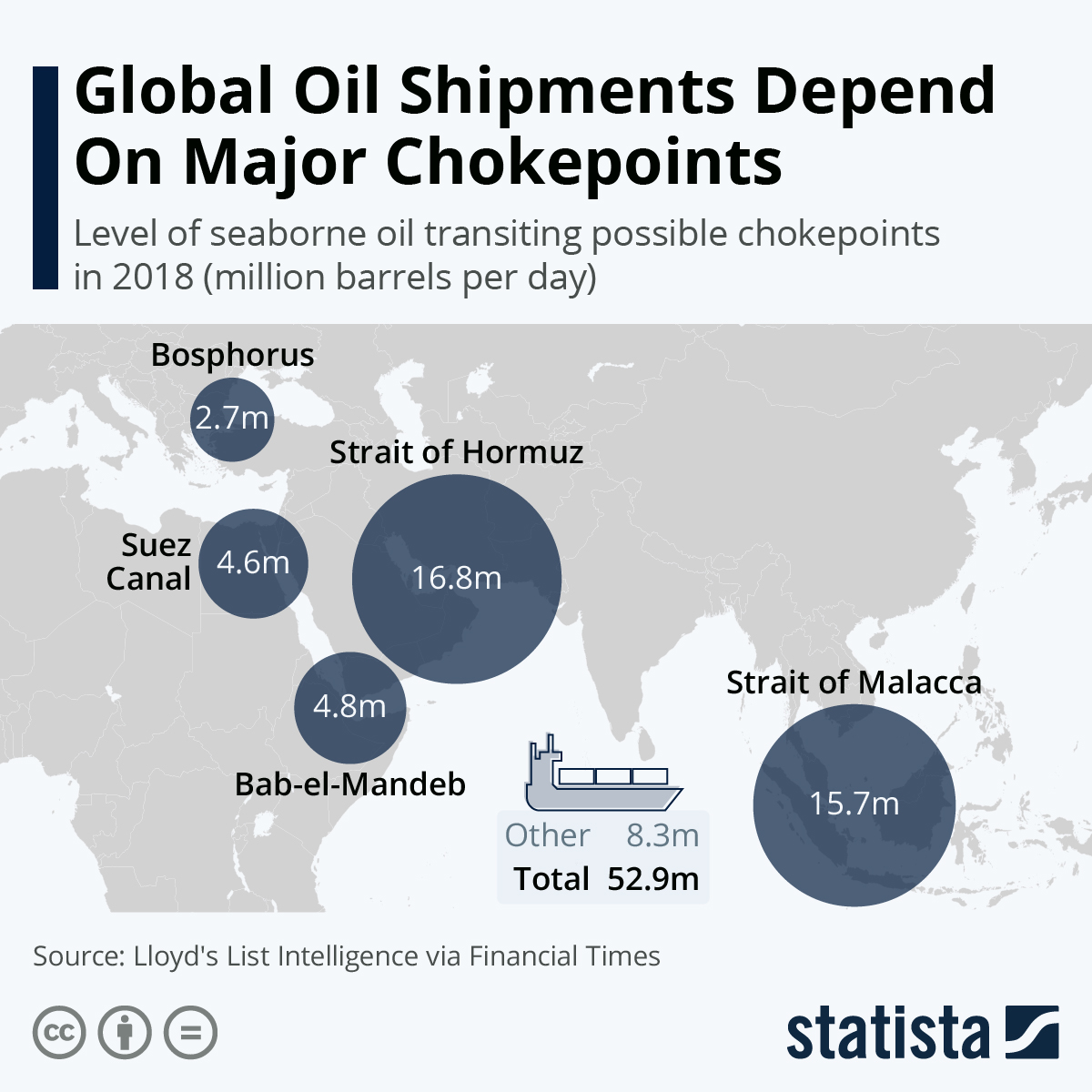

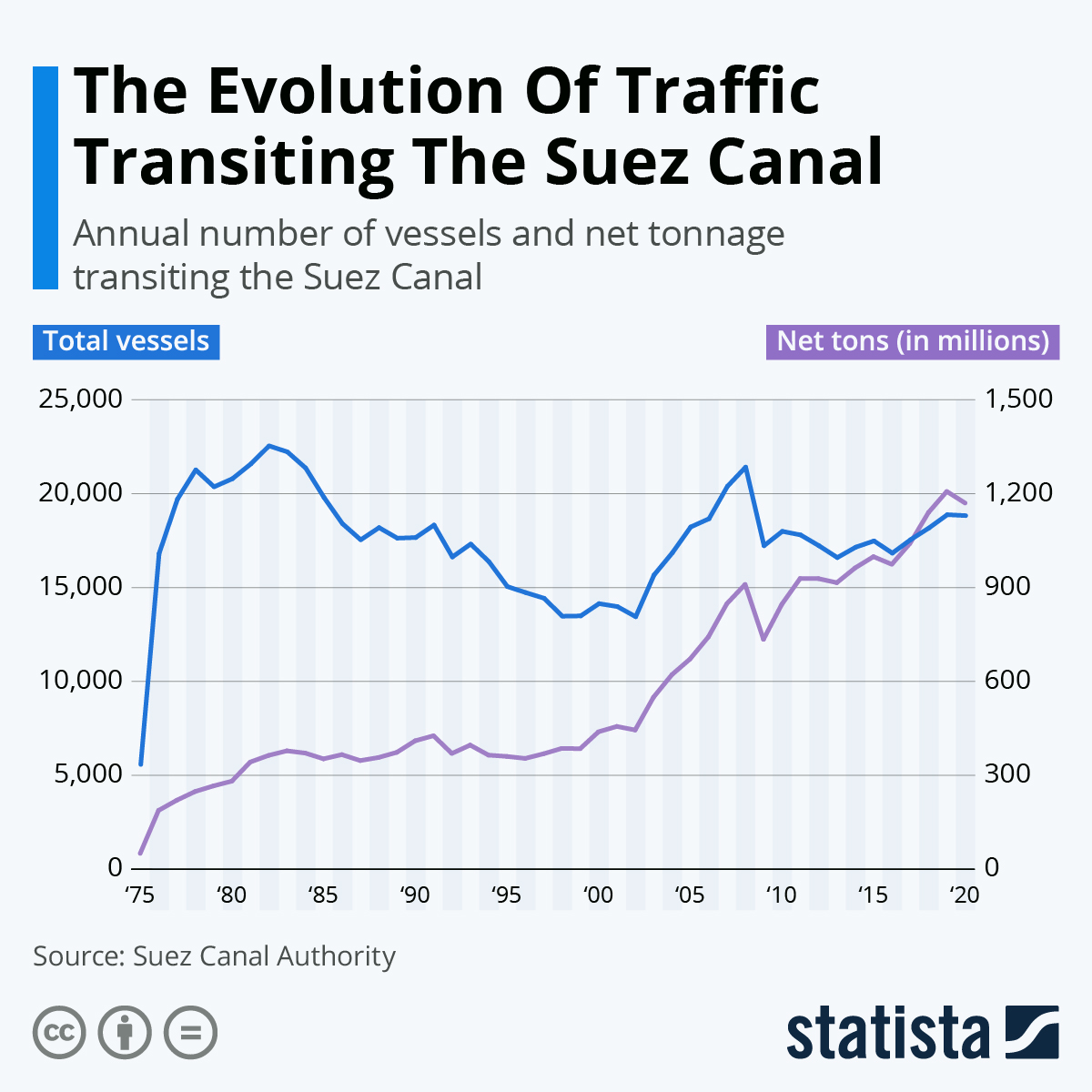

- As many as 10 crude tankers carrying 13 million barrels of oil could be affected by the disrupted traffic in the Suez Canal, which was blocked Wednesday when a giant container ship ran aground.

- The offshore oil and gas sector is set to significantly increase capital expenditures this year to around $44 billion, up from $12.3 billion in 2020 and $40 billion in 2019.

- At around 600,000 bpd, Iran’s crude oil exports are rising this month compared to February and March last year.

- The hits to Europe’s travel industry caused by new lockdown measures in Germany, France and Italy could carry over into the oil and gas industry.

- Fourteen states are suing the U.S. administration to challenge a pause on new oil and gas leasing on federal lands and waters.

- On the Scottish archipelago of Shetland, energy company Nova Innovation has installed the “first ever” electric vehicle charging point powered entirely by tidal renewable energy.

- The renewable energy industry is lobbying for a 10-year extension of tax credits to help fight climate change, saying that without an extension, it will be unable to reach goals of decarbonizing the electric grid by 2035 and becoming carbon neutral by 2050.

- A new report by Oregon-based sustainability firm Good Company shows that advanced recycling facilities generate low emissions comparable to those produced by hospitals, college campuses or auto manufacturers.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- About 180 ships are gridlocked around Egypt’s Suez Canal, halting trade on the crucial route for a second day after a giant container ship ran aground, disrupting $9.6 billion in trade each day. Clearing the canal, which handles about 10% of seaborne trade, could take days or more as ballast water, fuel and even containers are removed from the stranded ship.

- The disruption of the Suez Canal is the latest in a string of supply chain disruptions impacting international manufacturers as the U.S. economy stages its strongest rebound in decades, causing production backlogs and rising input prices.

- GM and Honda announced extensions of their production cutbacks in North America due to the semiconductor shortage affecting the global automotive industry.

- Hyundai, which has so far avoided production issues related to the semiconductor shortage, expects to experience disruptions next month.

- Heavy rainfall in eastern Australia has caused widespread flooding, forcing more than 18,000 people to evacuate and disrupting supplies of commodities.

- Taiwan’s leading automotive display producer will start manufacturing in North America to lower logistics costs.

- Credit rating agencies are upgrading container lines on improved earnings and cash flows.

- Container line Hapag-Lloyd is restructuring its debt with a $357 million bond linked to the company’s plan to cut emissions by 60% by 2030.

- Taiwan-based Evergreen is ordering 20 container ships with capacity for 15,000 boxes each.

- The values of dry-bulk vessels are rising by millions of dollars per week amid surging demand for commodities shipping.

- The world’s largest wood pulp exporter says a worldwide container squeeze could cause a supply crunch for toilet paper.

- A shortage of corrugated material is requiring some suppliers to ship in boxes that may not be stackable. Such unstackable packaging should be clearly marked. In the interest of safety, we urge clients and our fulfillment partners to notify anyone involved in logistics operations to be mindful of the shortage and careful to heed warning labels that may appear on resin containers.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 86,903 new COVID-19 cases and 1,454 deaths in the U.S. yesterday. Over 130 million vaccine doses have been administered, with 13.4% of the population fully vaccinated.

- Total U.S. COVID-19 infections surpassed 30 million yesterday, the most in the world, with health officials raising concerns that infection rates are again rising in many states and more than a third of Americans remain reluctant to get vaccinated.

- Half of U.S. states are experiencing rising COVID-19 infection trends this week.

- U.S. COVID-19 deaths are averaging fewer than 1,000 per day for the first time since November, with over 70% of older Americans having received at least one vaccine shot.

- AstraZeneca released new data showing its COVID-19 vaccine is 76% effective, a slightly downgraded efficacy rate after U.S. regulators expressed concern that initial figures relied on outdated information.

- The COVID-19 vaccination rate for Hispanic populations is below 10% in 16 states, a worrying disparity compared to rates of up to 25% or more for other populations.

- The White House plans to use $10 billion of the $1.9 trillion relief package passed earlier this month to help close racial and wealth gaps in vaccine coverage.

- The U.S. Treasury has issued about 37 million stimulus payments worth $83 billion this week under the American Rescue Plan Act, bringing the total disbursements so far to $325 billion.

- First-time jobless claims fell to 684,000 last week, the lowest weekly filings of the pandemic.

- U.S. GDP growth was revised upward to 4.3% for the fourth quarter, with economists expecting growth to accelerate to 4.9% this spring and 7.0% in the summer.

- United Airlines is adding over two dozen flights to its schedule beginning Memorial Day weekend.

- Starbucks announced a plan to make its coffee sourcing carbon neutral by 2030.

- Data from the Online Car Buyer Report shows that Carvana sales volume rose by 37% in 2020, averaging a new sale every 2.2 minutes.

- The U.S. government is holding firm to a gradual phase-in program for cruise lines, maintaining restrictions on cruises until November and dashing industry hopes for a swift restart this summer.

- British electric vehicle maker Arrival is building a production facility in Charlotte, North Carolina, to fulfill a UPS order for 10,000 fully electric vehicles.

- The Miami Heat plan to open vaccinated-only sections of their arena to fans, where masks will still be required but social distancing guidelines will be relaxed.

- As part of a new diversity and sustainability initiative, BFA Industries, the parent company of subscription makeup brands Ipsy and BoxyCharm, aims to remove 100% of its virgin plastic waste by the end of 2030.

- Malaysia is returning a container of plastic waste to the U.S., saying that the shipment violates new regulations set forth by the United Nations.

International

- Brazilian COVID-19 fatalities topped 300,000 Wednesday, the second highest toll behind the U.S., as the nation looks to start vaccinating 1 million people per day.

- A new “double mutant” strain of COVID-19 has been detected in India, raising concern as cases in the country continue to rise.

- Canada expects to double its supply of COVID-19 vaccine doses by the end of next week, ramping up the country’s otherwise slow rollout as less than 7% of the population has received one shot of a vaccine so far.

- Mexico is mobilizing its armed forces and medical personnel to accelerate its rollout of COVID-19 vaccines as the country’s virus death toll approaches 200,000.

- A third wave of COVID-19 is hitting Central Europe especially hard, with Hungary this week overtaking the Czech Republic as the country with the world’s highest daily virus deaths per capita.

- Vienna and two other provinces in eastern Austria will go back into lockdown for several days over Easter, a bid to take pressure off strained hospital resources as infections increase.

- New COVID-19 cases in Poland set a record of almost 30,000 Tuesday.

- Belgium increased pandemic restrictions for the first time since October, including business and school closures for at least four weeks.

- Despite a successful vaccination campaign, the U.K. government is mulling increased border restrictions to prevent the influx of virus mutations.

- After significant early setbacks, including the near-death of its founder from a stroke, biopharmaceutical pioneer CureVac is set to get European approval for its COVID-19 vaccine by June.

- Rapid-response tests on arrival after travel could be just as effective as quarantining to stop imported cases of COVID-19, a British study shows.

- Slow global vaccine rollouts could stall a travel recovery for years, as Greece and other tourism-dependent countries advocate for vaccine passports to encourage travelers to return.

- A rise in U.S. spending brought on by the latest round of stimulus payments is expected to boost Chinese exports, with about $60 billion forecast to be spent on Chinese goods.

- Interest rates in Europe are falling deeper into negative territory, forcing banks to pay some homeowners with variable-rate mortgages each month.

- Mexico, which saw foreign investment drop 12% in 2020, failed for the second year in a row to make the list of the top 25 countries for foreign investment, which was led by the U.S., Canada, Germany, the U.K. and Japan.

- Britain’s Nationwide Building Society told all of its 13,000 office-based staff they may work from anywhere in the country as the company canceled leases on three of its offices.

- Toyota, Isuzu and Hino, who together control 80% of the Japanese truck market, plan to collaborate on electric, fuel-cell, connected and autonomous driving technologies and streamline logistics for commercial vehicles.

- British Airways is returning its Airbus A380 jumbo jets to service as other major airlines plan to permanently retire the four-engine aircraft over sustainability and cost concerns.

- The first commercial scale plant to recycle all types of plastic using high pressure steam has begun construction in the U.K. and is expected to process 80,000 metric tons of plastic waste per year by 2022.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- M. Holland is proud to be named among the Plastics News Best Places to Work again this year. We also were recently named among the Best Places to Work by Crain’s Chicago Business.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.