COVID-19 Bulletin: March 29

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude prices initially dipped on news that the giant container ship blocking the Suez Canal, through which nearly 10% of the world’s oil passes, was refloated. Futures were higher in mid-day trading, with the WTI up 0.7% at $61.39/bbl and Brent 0.4% higher at $64.80/bbl. Natural gas was 1.1% higher at $1.99/MMBtu.

- China Petroleum & Chemical Corp. (Sinopec) will increase capital spending this year by 23.8% following the recovery of oil prices and energy demand.

- China generated 53% of the world’s coal-fired power in 2020, a rising rate despite climate pledges and hundreds of new green energy plants.

- In an effort to upend OPEC’s grip on the oil market, Abu Dhabi began trading futures for Murban crude on Monday, marking the first time a Persian Gulf OPEC member has allowed its oil to be freely sold and shipped anywhere in the world.

- Chevron and Exxon are taking a go-slow approach to resuming aggressive drilling in the Permian Basin, accounting to just 5% of recent output, versus 28% last spring.

- Royal Dutch Shell’s $54 billion bet on the natural gas industry is looking less likely to pay off as falling prices for wind and solar power, coupled with new green goals from governments and businesses, accelerate a shift away from gas.

- Emerging markets face a setback in their carbon emission plans as they subsidize fossil fuels to help economically struggling citizens.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- After nearly a week, the container ship blocking the Suez Canal was “successfully refloated” and on the move, a first step toward clearing the logjammed waterway.

- The ship — the length of the Eiffel Tower — became stuck after encountering wind gusts exceeding 40 mph, which had caused many other ships to suspend passage through the canal.

- More than 320 vessels have been stranded due to the blockage.

- The U.S. Navy has offered to help free the vessel, as disruptions in global commerce are expected to be felt for months ahead.

- It is unclear whether the $3 billion of liability insurance for the ship’s owner will be enough to cover losses on claims that have already started to pour in.

- U.S. consumers could face shortages and rising prices for toilet paper, coffee and furniture among other products due to the blockage.

- The Suez Canal blockage has overshadowed another ongoing logjam for global shippers at the Ports of Los Angeles and Long Beach, where a backlog of 28 ships await berths to unload.

- Sweden’s Port of Gothenburg is preparing to open a container terminal for short sea, intra-European transport.

- In an agreement with Union Pacific, logistics company Savage will build and operate an intermodal rail terminal in Pocatello, Idaho.

- Orient Overseas Container Line is set to order up to 10 dual-fuel vessels with capacity for 15,000 containers each. The container line recently posted record results for 2020.

- The global semiconductor shortage continues to affect automotive production:

- Nissan will idle production at assembly plants in Tennessee and Mississippi for April 1 and 5.

- Volkswagen will decrease production over the Easter holiday period at its Mexican facilities.

- Stellantis said it will suspend production at five North American facilities starting this week.

- Following sanctions imposed by the U.S., China announced new tax breaks to help expand its semiconductor industry, allowing chipmakers to import machinery and raw materials tax-free through 2030.

- San Francisco startup Baton is developing a network of “drop zones” where long-haul truckers can leave loaded trailers at 24-hour facilities. The trailers are then handed off to local fleets to transport the cargo to its destination.

- The U.S. trade representative is set to proceed with tariffs on goods from Austria, Britain, India, Italy, Spain and Turkey in retaliation for their digital services taxes against U.S. tech companies. The official also signaled unwillingness to lift tariffs on Chinese imports soon.

- A surge in costs of raw materials and supply chain problems are causing Chinese exporters to raise their prices, sparking fears of global inflation.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- U.S. COVID-19 cases rose to their highest level in nearly a month on Friday, hitting 77,339 with 1,265 deaths.

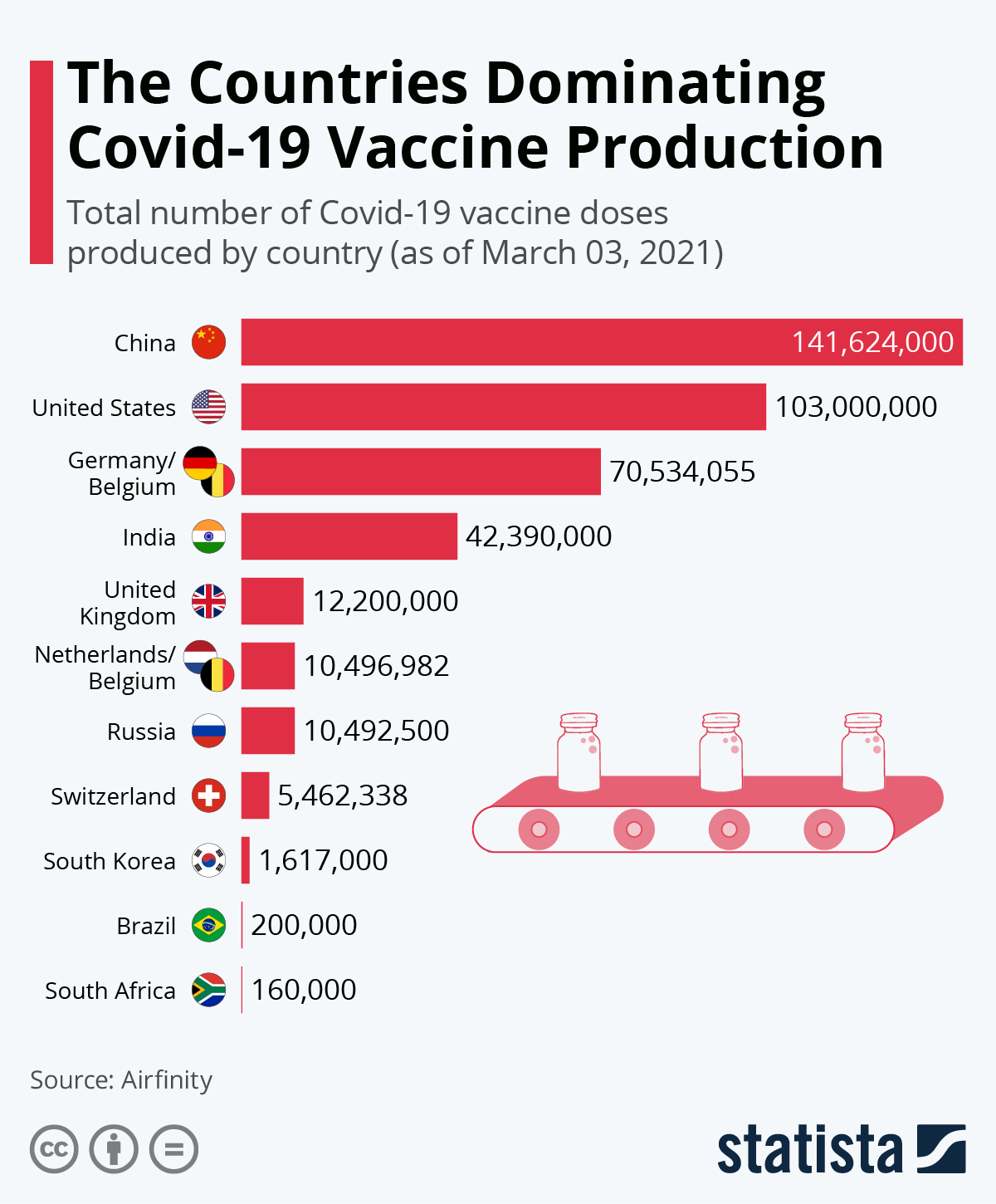

- There were 43,694 new COVID-19 cases and 506 deaths in the U.S. yesterday. Over 143 million vaccine doses have been administered, with 14.8% of the population fully vaccinated.

- GlaxoSmithKline and Vir Biotechnology have asked U.S. regulators to grant emergency authorization for an antibody drug to prevent high-risk COVID-19 patients from developing severe symptoms.

- Innovations in face mask technology could sterilize air before a person breathes it in, providing even greater protection against the risk of viral spreading.

- Some COVID-19 vaccine recipients are experiencing “COVID arm,” a rash or pain around the injection site that can emerge a week after the initial shot.

- Rates of adults experiencing symptoms of anxiety and depression rose between August and February, as the pandemic takes an increasing toll on mental health.

- The White House’s updated COVID-19 vaccine campaign is taking a localized turn, focusing on community groups that can target specific populations skeptical of the shots.

- The latest $1.9 trillion economic relief package will inject billions of dollars into K-12 schools to expand in-person learning and help districts come up with ways to reverse the pandemic “learning loss” among many students.

- Vaccinating children against COVID-19 will be the key to achieving herd immunity, but that process is still months away.

- U.S. consumer spending fell 1% in February, the largest drop in 10 months, which economists predict will be temporary.

- U.S. consumer confidence hit a one-year high late this month.

- The unemployment rate was less than 4% in 10 states but more than 8% in seven others, underscoring the nation’s largely regional economic recovery from the pandemic.

- Business bankruptcies rose 29% last year, but consumers, benefiting from stimulus money, experienced a 46% drop in Chapter 13 bankruptcies and a 22% drop in Chapter 7 filings.

- The White House will split an upcoming spending plan into two parts, with one part focusing on infrastructure and the other on child care and healthcare programs.

- Roughly 1.45 million people over age 55 have left the U.S. labor force since last February, a trend that could impair future economic growth.

- Jeep announced plans to establish a new electric vehicle charging network designed for electric off-roading.

International

- Global COVID-19 infections rose for the fifth consecutive week.

- Home to less than 3% of the world’s population, Brazil’s 3,000+ daily COVID-19 deaths make up roughly a third of total virus fatalities across the globe and display an alarming spike in deaths among those under 50 years old. Millions of Brazilians have been thrown back into poverty as government pandemic aid dries up and the country’s president was frozen from Facebook for spreading vaccine misinformation and false remedies for the virus.

- Brazil plans to join the vaccine race, aiming to introduce its own COVID-19 vaccine by July.

- Mexico’s death toll from the pandemic is estimated to be at least 60% higher than the confirmed number, or more than 300,000.

- Cases in India’s Maharashtra state rose to 40,414 Sunday, the highest since last March, as officials there prepare for a total lockdown.

- India, the world’s largest vaccine manufacturer, has suspended exports of COVID-19 shots after rising domestic infections signal another wave of the virus. The move has left developing countries scrambling to find alternative shots to keep their vaccine rollouts on track.

- France, Italy, Belgium and Germany are among the European nations experiencing a rebound in coronavirus infections, prompting governments to impose new restrictions and speed up vaccinations. The bloc’s rollout continues to be slow, with only 13.7 vaccine doses given per 100 inhabitants, compared to 39.4 in the U.S. and 46.7 in the U.K.

- The U.K. said it expects to receive its first delivery of Moderna’s COVID-19 vaccine sometime in April, hoping to offset new restrictions on exports from the European Union and a reduction in supplies caused by delays in vaccine production from India.

- Germany’s chancellor is warning of new federal measures to keep a third wave of coronavirus under control. Germany will receive its first batch of Johnson & Johnson single-dose COVID-19 vaccines in mid-April.

- French COVID-19 patients in ICUs hit a new high for 2021 at 4,872, rivaling levels of last November’s second wave.

- The rise of cases in the European Union poses a challenge to the U.K., which must ward off the influx of variants from the continent.

- Johnson & Johnson will provide 400 million doses of its one-shot vaccine to the African Union.

- The launch of a vaccine jointly developed by the Serum Institute of India and U.S.-based firm Novavax is being pushed back to September from June.

- China picked the United Arab Emirates as the first foreign partner to make millions of doses of its state-backed Sinopharm vaccine.

- Japan joins China and the European Union with plans to issue digital health certificates to citizens vaccinated against COVID-19.

- Housing prices are rapidly inflating at rates of up to 10% annually, turbocharged by trillions of dollars in stimulus payments deployed worldwide.

- Honda has announced plans to sell its only U.K. manufacturing plant in Swindon, England, with a loss of 3,500 jobs.

- A yearlong bull market for industrial metals is weakening this month as the undoing of China’s government stimulus slows demand.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- M. Holland is proud to be named among the Plastics News Best Places to Work again this year. We also were recently named among the Best Places to Work by Crain’s Chicago Business.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.