COVID-19 Bulletin: March 31

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell more than 1% on Tuesday as the Suez Canal reopened to traffic and the price of the U.S. dollar rallied.

- Crude futures were off in mid-day trading today, with the WTI down 0.3% at $60.38/bbl, and Brent down 0.6% at $63.79/bbl. Natural gas was 0.9% lower at $1.98/MMBtu.

- OPEC+ experts will revise down estimates for global oil demand in 2021 ahead of the group’s meeting on Thursday to decide on continued production cuts.

- Saudi Arabia is pressing private companies to invest to diversify its oil-dependent economy, with state-controlled Aramco and Sabic expected to fund more than half of the $1.3 trillion investment.

- The U.S. transportation secretary suggested the federal government will not support a ban on gas-powered vehicles after 2035, despite a recent law in California and a private sector push toward electric vehicles. On Monday, he ruled out a mileage tax to help pay for an infrastructure spending bill in the works.

- The price of diesel declined for the week of March 29, snapping a 20-week run of gains.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Port authorities are girding for a flood of arrivals as diverted ships and delayed Suez vessels begin to arrive on top of regularly scheduled traffic.

- The six-day blockage of the Suez Canal could trigger a capacity plunge of up to 30% in the coming weeks, Maersk said.

- The Suez Canal Authority is increasing the number of vessels moving through the waterway each day until a backlog of queued ships is cleared.

- The White House is expected to roll out a $2 trillion job and infrastructure spending plan today that will fund road and bridge projects for the next eight years.

- Sweden’s Volvo Group and California-based Aurora are partnering to build self-driving systems for long-haul freight.

- Battery-cell supply constraints are keeping Tesla from scaling up production of a long-awaited electric semi-truck.

- Toyota and Nissan are preparing for long-term disruption and production cuts at Japanese facilities following a recent factory fire at chipmaker Renesas Electronics.

- French logistics giant Geodis plans to roll out remotely operated forklifts in its warehouses.

- The Defense Department contracted with Virginia Tech to develop a 5G-connected warehouse capable of real-time inventory tracking.

- Rising wood prices, surging e-commerce and pandemic consumer buying patterns have led to an increase in demand for corrugated boxes, driving up prices and adding to supply chain problems.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

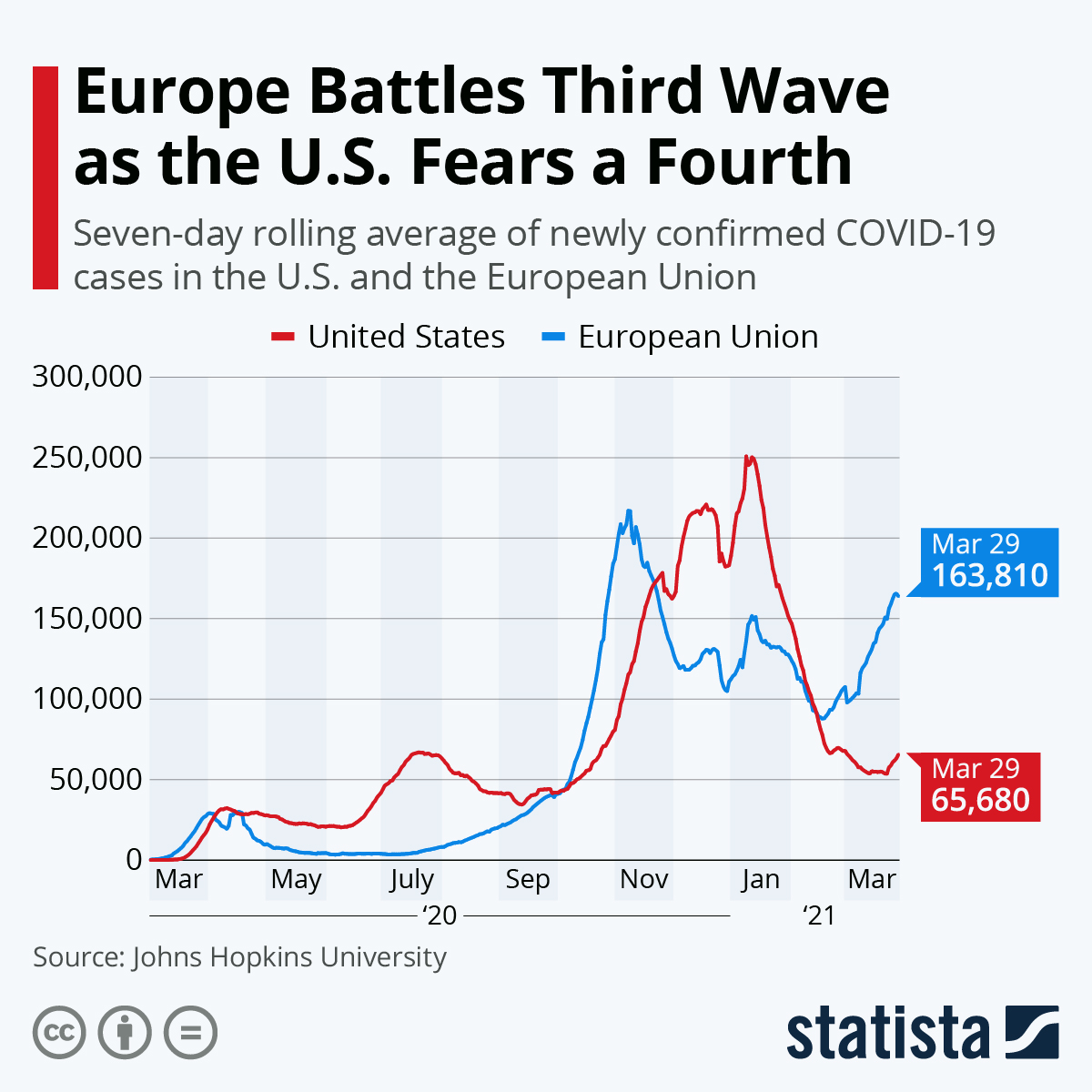

- COVID-19 infections are trending higher in 33 states this week.

- There were 61,240 new COVID-19 cases and 875 deaths in the U.S. yesterday. Over 147 million vaccine doses have been administered, with 15.4% of the population fully vaccinated.

- Despite an aggressive vaccination effort, COVID-19 deaths in the U.S. are expected to bottom in the next two weeks before plateauing and beginning to rise again.

- Arkansas, Delaware and Wisconsin will expand COVID-19 vaccinations to all adults by next week.

- Reluctance to get a COVID-19 vaccine in the U.S. is waning, led by attitude shifts among Southerners and Black Americans.

- Pfizer/BioNTech’s vaccine proved 100% effective in tests on 12- to 15-year-olds, opening the door to vaccinations for children.

- Pfizer/BioNTech is beginning to test a freeze-dried version of its vaccine that doesn’t require ultracold storage, potentially boosting availability in rural and low-income areas.

- Three recent studies suggest that pregnant women can pass on protective vaccine antibodies to their newborns.

- Las Vegas casinos are setting up COVID-19 vaccination clinics for their hotel and hospitality workers ahead of a July 1 date to return to in-person activities.

- After being shut down for more than a year, Universal Studios Hollywood is opening its doors to California residents on April 16.

- Private payrolls added 517,000 jobs in March, the biggest increase in six months.

- Consumer confidence in the U.S. rose for the third consecutive month in March to its highest level since the start of the pandemic.

- After falling to an all-time low of 2.65% in January, the 30-year fixed-rate mortgage hit 3.17% last week, the highest level in more than nine months.

- Accumulated household savings during the pandemic will help fuel economic growth through 2023, the president of the Federal Reserve’s Richmond branch said.

- Small U.S. businesses owned by older Asians were the hardest hit business group by closures and revenue declines during the pandemic.

- As lockdowns end and drivers begin returning to roads, higher demand for the gasoline additive ethanol could further lift already high corn prices, which have gained 50% in the past six months.

- Apple is hosting its annual developers’ conference in an online-only format for the second year in a row this June, a result of persistently high COVID-19 cases in the U.S.

- Wells Fargo plans to bring its employees back to the office in September.

- Citing a rebound in travel demand, Delta Air Lines announced it will resume selling middle seats beginning May 1, ending social-distancing measures put in place since the start of the pandemic.

- Alaska Air will purchase 23 Boeing 737 MAX jets, a further sign of confidence in the jets after a 20-month safety ban.

- U.S. automobile sales jumped more than 8% in the first quarter.

- Automakers, parts companies and the United Auto Workers union are urging White House action to support a “comprehensive plan” on electric vehicles, along with tax credits and other financial incentives.

- Mercedes will begin producing a new electric delivery van in the U.S. later this year.

- Lexus, the luxury auto brand owned by Toyota, will introduce 20 new or improved electric vehicle models by 2025.

- Volkswagen drew criticism after revealing its announcement that it would rename its U.S. operations as “Voltswagen of America” was an April Fool’s joke intended to draw attention to its commitment to electric vehicles.

- American autonomous vehicle company Motional has partnered with Lyft and Hyundai to create a robo-taxi service set to debut in select U.S. cities in 2023.

- Chewy posted more than $2 billion in sales in the latest period, evidence of the pandemic’s boost to online shopping and pet ownership.

- A new calculator from startup company Watershed shows companies how transitioning to a fully remote or hybrid workspace reduces a company’s overall carbon emissions.

International

- More than 5,000 COVID-19 patients are in French ICUs, the highest this year as the nation’s hospitals may soon have to find more space for critically ill patients, government officials say.

- Federal officials in India warned states to be stricter with lockdowns to avoid overwhelming hospitals in the latest surge of the virus.

- A third wave of COVID-19 is emerging in Russia while some regions are beginning to ease curbs.

- Brazil’s government will spend an additional $1 billion to prop up its health system amid the latest wave in COVID-19 infections, currently the worst in the world.

- The European Union’s vaccine rollout continues to be hampered by manufacturing delays, logistical bottlenecks and a lengthy approval process for shots.

- In the U.K., multiracial districts with some of the highest COVID-19 death rates are putting up the greatest resistance to vaccinations.

- Germany barred AstraZeneca’s COVID-19 vaccine for those under age 60, citing rare instances of blood clots. Meanwhile, Spain has removed an upper age limit of 65 years for AstraZeneca’s vaccine.

- Researchers across the world are testing the use of mixing COVID-19 vaccines from different providers to alleviate supply chain bottlenecks and to see if they produce better efficacy results than two doses from the same provider.

- Spanish lawmakers made mask-wearing mandatory in all public spaces, indoor or outdoor, until the end of the pandemic.

- Iran reported more than 10,000 new COVID-19 cases yesterday, its highest number since early December.

- Turkey recorded 37,303 new COVID-19 cases yesterday, the highest since the beginning of the pandemic. With Ramadan approaching, the surge has forced the country to reimpose strict social-distancing measures across the country.

- Greece reported 4,340 new COVID-19 cases yesterday, a record, as the nation’s hospitals remain under severe pressure.

- Ireland is extending its hotel quarantine requirements to travelers from an additional 43 countries, including France, Germany, Italy and the U.S.

- The twin-island resort nation of Antigua and Barbuda has seen a sevenfold increase of COVID-19 cases alongside an influx of American travelers in December.

- Austria is in talks with Russia to purchase a million doses of its Sputnik V COVID-19 vaccine, despite the shot not having received approval from European regulators.

- Canada will significantly increase the number of new permanent residents it accepts over the next three years, a bid to boost the country’s economic recovery from the pandemic.

- The International Monetary Fund will raise its forecasts for the global economy in 2021 and 2022, largely due to the increasing pace of vaccinations and recent fiscal stimulus in the U.S.

- Producer prices in Brazil rose in February at their fastest rate in seven years, adding inflation to the economic woes in the country along with rising interest rates, a weak currency and rampant coronavirus. In a positive sign, the economy added a net 401,639 jobs in February, the largest gain since 1992.

- Japan’s industrial output fell 2.1% in February from the previous month, as economists expect an economic contraction in the current quarter.

- South Korea’s factory activity increased 4.3% in February from the previous month, the fastest pace in eight months amid a boost in semiconductor and chemicals production.

- Kenyans are paying $70 for a single dose of Russia’s Sputnik V COVID-19 vaccine.

- Plane maker Airbus predicts air travel demand on the industry’s most-used larger-model jets won’t recover to pre-pandemic levels until 2023.

Our Operations

- M. Holland will be closed on April 2 (Good Friday) in observance of the Easter holiday.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- M. Holland is proud to be named among the Plastics News Best Places to Work again this year. We also were recently named among the Best Places to Work by Crain’s Chicago Business.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.