COVID-19 Bulletin: May 19

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices were lower in mid-day trading, with the WTI down 3.2% at $63.42/bbl and Brent down 2.9% at $66.71/bbl. Natural gas was down 1.1% at $2.98/MMBtu.

- Colonial Pipeline’s computer network shut down for hours on Tuesday morning, preventing clients from reserving and tracking fuel in transit. The company says the disruption was caused by added security measures being installed after last week’s ransomware attack.

- While East Coast gas shortages caused by last week’s cyberattack are starting to ease, experts predict it will take another 5-10 days for stations to return to full capacity.

- Oman’s state-owned oil firm announced plans to build a green hydrogen plant powered by 25 gigawatts of renewable energy that will produce millions of tonnes of zero-carbon green hydrogen per year.

- Royal Dutch Shell secured investor backing for its energy transition strategy, with plans to reduce net carbon emissions up to 8% by 2023 from 2016 levels with a goal of reaching net-zero emissions by 2050.

- Despite a nationwide lockdown in 2020, U.S. residential energy consumption fell by 4% year over year, with warmer winter months offsetting increased retail electricity consumption.

- The EU’s benchmark carbon price hit $68.53 per metric ton on Monday, closing in on its highest levels since the market launched in 2005, with experts expecting it to soar even higher in the coming months.

- Banks are on pace to commit more financing to green initiatives in 2021 than fossil fuel projects.

- Neste, the world’s largest maker of renewable diesel fuels, will spend $230 million to begin making sustainable jet fuel.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Torrential rains and lightening disrupted production at four U.S. Gulf Coast refineries this week — Exxon’s Baton Rouge, Louisiana, facility and Motiva, Total and Valero operations in Port Arthur, Texas.

- The 12-14 inches of rainfall that yesterday inundated Lake Charles, Louisiana, home to several petrochemical facilities, will probably qualify as a 100-year event, with more rain forecast for the region.

- The global semiconductor shortage is worsening, with lead times at their longest since 2017.

- CEOs from major tech companies expect the ripple effects from the global chip shortage to impact the availability and price of IT hardware for the next year to year-and-a-half.

- Mazda expects the ongoing chip shortage to curb output by 70,000 to 100,000 vehicles globally this fiscal year but plans to fully leverage available inventory to help minimize the impact.

- General Motors is stockpiling partially finished vehicles at a Michigan State University parking lot while it awaits the necessary computer chips to complete assembly.

- Lamborghini will transition to hybrid vehicles over the next ten years with plans to launch its first fully electric vehicle in the second half of the decade.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- On Tuesday, the U.S. recorded 27,819 new COVID-19 cases and 760 deaths. Over 277.2 million vaccine doses have been administered, with 38.2% of the population fully vaccinated.

- The U.S. has reported new virus case counts below 30,000 for four days in a row.

- The country’s seven-day moving average on Monday was 32,032, while the 14-day average was 35,520, highlighting a continued decline over the past month.

- The number of new cases across the U.S. are dropping by at least 5% in every state, with an average of 1.8 million vaccines administered daily over the past week.

- The CDC reports that 60% of American adults have received at least one COVID-19 vaccine dose.

- After getting clearance to use Pfizer/BioNTech’s COVID-19 vaccine in children aged 12-15, the U.S. inoculated 600,000 children last week.

- A new report published by the CDC shows that roughly 39% of adults in rural counties have received at least one shot of a COVID-19 vaccine compared with 46% of people in urban counties.

- The governor of Texas issued an executive order banning cities and counties from setting mask mandates.

- New York is opening up a mobile vaccination site outside the Barclays Center ahead of a Brooklyn Nets playoff game this weekend, offering a chance to win future playoff tickets or NBA merchandise for those who get jabbed. Both the New York Knicks and the Brooklyn Nets announced they will have stadium sections for fully vaccinated fans at upcoming playoff games.

- JPMorgan Chase told employees they no longer must wear masks on premises if they have been vaccinated provided that they show documentation of vaccination.

- The CDC lifted COVID-19 testing requirements for cruise passengers who have been vaccinated.

- With COVID-19 case numbers falling across the U.S., several Major League Baseball teams plan to return to full capacity at stadiums, including the Houston Astros, the Boston Red Sox and the Cleveland Indians.

- Single-family housing starts dropped by more than 13% in April compared to March, with homebuilders citing the surging prices of commodities as the reason for the slowdown.

- Add ready-to-build lots to lumber and labor shortages as a major obstacle disrupting growth in the housing industry.

- Ninety thousand restaurants, 14% of the U.S. total, were forced to shutter during the pandemic, a lower casualty rate than earlier expected.

- Walmart is raising its earnings forecast after reporting a 37% gain in U.S. e-commerce sales and a 6% increase in same-store sales last quarter.

- Target joined Walmart in reporting brisk sales growth in the latest quarter, with a 23% year over year increase in same store and digital revenues.

- Analysts are warning that air carriers may devalue frequent flyer miles as airlines try to recoup losses of the pandemic.

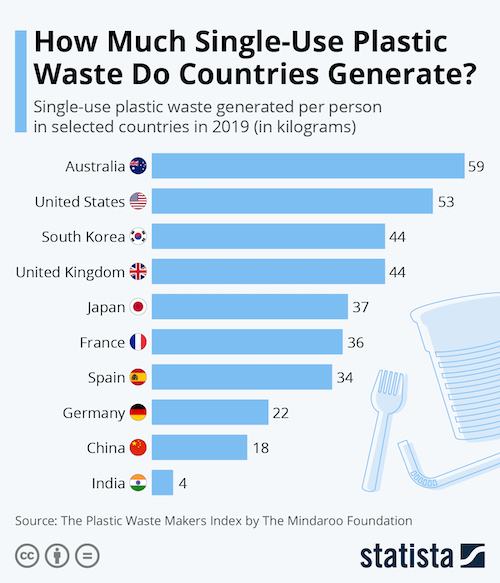

- A new analysis from the Plastic Waste Makers index has revealed that just 20 companies are responsible for creating more than half of the single-use plastic waste in the world.

- Rivian Automotive announced plans to start selling three different models of its electric vehicles — a pickup truck, SUV and delivery van — over the next few months, challenging Tesla’s dominance in the electric market.

- Executives from the Center for Auto Safety and the AFL-CIO are urging Congress to draft legislation prioritizing vehicle safety and worker welfare for the future autonomous vehicle market.

International

- India reported 4,529 new COVID-19 deaths on Wednesday, its second consecutive daily record, while new infections fell to 267,334.

- The virus is rampant across the country’s rural areas, threatening villages with no access to healthcare facilities.

- The country is unlikely to resume exports of COVID-19 vaccines until at least October, wreaking havoc on vaccination efforts across Africa.

- A quickening rise in COVID-19 cases throughout Nepal is threatening to overwhelm the country’s healthcare system. India is planning shipments of liquid oxygen to the country to help treat severe patients.

- Indonesia is preparing for a spike in COVID-19 infections as revelers return from celebrating Eid al-Fitr, where thousands traveled to their hometowns to visit extended families.

- Thailand reported 35 new COVID-19 deaths Wednesday, a record, as the nation struggles to contain a third wave of the virus.

- Doctors in Tokyo are calling for the 2021 Olympic Games to be cancelled amid a continued surge in COVID-19 infections, saying that hospitals are already at peak capacity and have no room to spare for a new influx of cases.

- Some 200 residents of two high-rise buildings in Germany have been put under quarantine after several people within the buildings tested positive for the Indian variant of COVID-19. Scientists are warning the variant could become the dominant strain of the virus in the U.K., while Zambia reported its first case of the strain.

- After extending the interval between first and second doses of COVID-19 vaccines to 6 to 8 weeks from 3 to 4 weeks, Singapore plans to inoculate its entire adult population with at least one dose of a COVID-19 vaccine by early August.

- After misfires in its early inoculation efforts, Canada is on pace to surpass the U.S. in the number of citizens receiving first shots.

- South Africa’s vaccination campaign has gotten off to a slow start, with less than 40,000 people inoculated in the first two days.

- Spain approved a plan to administer Pfizer’s COVID-19 vaccine to those under 60 who received a first shot of the AstraZeneca jab.

- The U.K. is set to authorize use of Johnson & Johnson’s single-shot COVID-19 vaccine, hoping the convenience of a single shot will boost inoculations before mutations spread widely.

- Sweden is seeing a significant drop in COVID-19 infections due to rising vaccination levels, reporting just over 10,000 cases since Friday, down from almost 14,000 one week earlier.

- The U.S. extended border restrictions with Mexico until June 21.

- EU governments agreed to lift quarantine requirements for vaccinated travelers entering the bloc.

- A recent trial of a COVID-19 vaccine produced by GlaxoSmithKline and Medicago is showing promising results, with the companies reporting no serious side effects while also producing antibody levels 10 times higher than in those who recovered from the virus.

- Economists are calling the pandemic “the great divergence,” describing the widened gap between rich nations with rebounding economies and developing nations still facing record-breaking virus waves and low vaccine availability.

- New car sales in Europe were up over 250% year over year in April but remained below pre-pandemic levels.

- With the pandemic easing in some regions, countries are grappling with what to do with the 129 billion face masks used and ultimately discarded around the world, with efforts underway to repurpose them into building and roadway materials, benches, carpet, and garden furniture.

- Circular economy companies GoZERO and TerraCycle have established collection services to gather and recycle or repurpose discarded face masks.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.