COVID-19 Bulletin: November 2

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose half a percent Monday on expectations that OPEC will keep its gradual pace of monthly production increases. Energy futures were mixed in late morning trading, with WTI down 0.7% at $83.45/bbl, Brent down 0.4% at $84.36/bbl and U.S. natural gas up 5.5% at $5.47/MMBtu.

- OPEC’s monthly output rose by just 140,000 bpd in October, less than half the group’s planned increase, on production difficulties in Angola and Nigeria. Output in Russia, meanwhile, increased in October for the second straight month.

- Bank of America forecasts Brent could reach $120/bbl by June 2022.

- The surge of transatlantic travel after the U.S. reopens its borders Nov. 8 could boost demand for crude by up to 250,000 bpd, traders predict.

- China is buying more LNG from the U.S. than ever before, sending benchmark rates for spot deliveries into Asia up to $56/MMBtu in early October, more than 10 times the rate last year.

- China will release state reserves of diesel and gasoline to boost market supply and stabilize fuel prices.

- The three largest power producers in China, accounting for roughly 44% of the nation’s generation, reported third-quarter losses due to soaring coal prices and price caps on consumers.

- Electricity prices in Japan hit their highest levels in 10 months at $0.48 per kWh, fueled by rising prices for LNG and coal.

- Norway’s Equinor discovered an estimated 62 million barrels of crude at a reservoir offshore Norway, its sixth discovery this year.

- Australian miner BHP temporarily halted its plan to divest thermal coal assets amid the recent surge in prices.

- The U.S. EPA will today release sweeping new proposals to limit methane emissions at all existing and new oil and natural gas wells nationwide.

- Canada announced but did not give details of plans to impose a hard cap on emissions from the oil and gas sector.

- Semco Maritime has inked a deal with U.S. offshore wind developer Vineyard Wind to create a wind service and maintenance hub off the coast of New Bedford, Massachusetts.

- Norway’s Equinor has developed new floating technology that will allow construction of a 1 GW offshore wind farm in Scotland, more than 30 times larger than the company’s first offshore farm built in 2017.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- For the third time since 2005, the National Hurricane Center has used up all 21 names allotted for Atlantic Ocean storms this year.

- California state utility PG&E was subpoenaed by the federal government and could take a loss of more than $1.1 billion over potential liability for starting this year’s Dixie Fire, the second-largest wildfire in state history.

- American Airlines canceled more than 250 flights Monday, its fourth straight day of cancellations due to bad weather and staffing shortages.

- U.S. manufacturing growth eased slightly in October, while the average lead time for production materials climbed to 96 days, the most since 1987.

- Truckers are rejecting fewer loads, with an index measuring the rejection rate for contracted moves falling below 20 for the first time since July 2020 last week.

- UPS is expected to raise fuel surcharges by 1% on all U.S. air and ground services starting Nov. 15.

- Amazon will no longer require fully vaccinated U.S. warehouse employees to wear masks at work unless mandated by state or local law.

- Yiwu, the Chinese hub of Christmas decoration manufacturing, has seen raw materials and electricity outages drive up the cost of exports by up to 10% since June.

- Despite reporting lower quarterly earnings from last year due to the ongoing chip shortage, Ford, Stellantis and GM all raised full-year guidance as they better adapt to production disruptions in the fourth quarter.

- Indian automaker Tata Motors is reporting a six-month waiting period for electric vehicles and up to a two-month waiting period for other models due to the ongoing chip shortage.

- Union Pacific reported shipments by auto and car-part makers on its trains fell 18% in the third quarter.

- Even sales of products such as paints and coatings that don’t use microprocessors are being hit by the global chip shortage, as manufacturers produce fewer vehicles, appliances and other devices.

- Southeast Asian factories are gradually returning to production as COVID-19 cases in the region drop and restrictions are lifted.

- A new gauge developed by economists at Bloomberg tracks the extent of global supply shortages causing higher inflation and supply chain disruption.

- Indonesia has secured a $7.5 billion investment agreement with Dubai port operator DP World for expansion of its logistics infrastructure, notably at seaports.

- C.H. Robinson’s CEO recommended boosting immigration to the U.S. to help alleviate truck driver shortages that have worsened at least 30% since the start of the pandemic.

- Hapag-Lloyd raised its full year earnings outlook after reporting a more than tripling of earnings thorough the first nine months of this year.

- Japanese container line ONE reported earnings nearly quadrupled in the latest quarter from the prior year period.

- Chinese shipper COSCO reported a $12.5 billion net profit for its container division in the first nine months of 2021, nearly double that of the same period last year.

- Tonnage moving through the Panama Canal increased 8.7% in FY 2021 from the previous year.

- The effects of Brexit rippled into nine-month results at Dublin Port, with overall throughput falling 3.3% compared to the same period in 2019.

- Employees at some Amazon warehouses in Germany started striking Monday over working conditions and wages.

- The U.S. Department of Transportation and the California State Transportation Agency are teaming up in the Emerging Projects Agreement to coordinate assessment and support for infrastructure and port projects.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The U.S. reported 121,139 new COVID-19 infections and 1,201 virus fatalities Monday.

- Roughly two-thirds of Americans have now received at least one dose of a COVID-19 vaccine. The nation administered more than 1.4 million doses Sunday, the most since May.

- The White House says the 28 million U.S. children eligible to receive COVID-19 shots will be able to get one, despite delays in approving a second vaccine beyond Pfizer’s shot. The CDC is meeting today to decide on authorizing the shot.

- Federal contractors will be given broad flexibility in how they implement COVID-19 vaccine mandates among staff, a partial concession made by the White House considering less strict vaccine requirements for businesses with 100 or more employees. Twelve U.S. states are suing the U.S. administration over the mandate.

- Daily COVID-19 cases in Colorado have risen 91% since September, as roughly 90% of the state’s surgical and ICU beds are filled amid overwhelming numbers of virus patients.

- COVID-19 was the third leading cause of death in Montana last year.

- New York City issued a statewide call for volunteer firefighters after more than 9,000 municipal employees were placed on leave Monday for failing to get vaccinated against COVID-19.

- A Chicago judge temporarily halted the city’s mandate for police officers to get vaccinated against COVID-19 by the end of the year.

- Pennsylvania’s governor is offering five days of paid leave to state employees who get vaccinated against COVID-19 by the end of the year.

- Local governments in California’s Bay Area are starting to lift mask mandates amid high levels of COVID-19 vaccinations and few hospitalizations.

- Pfizer raised guidance after reporting that revenues more than doubled in the third quarter, with COVID-19 vaccine sales as the largest contributor.

- Amazon-backed electric vehicle maker Rivian Automotive could be valued at more than $60 billion when it debuts on the Nasdaq stock exchange next week.

- The U.S. Department of Energy plans to award $199 million to fund 25 projects aimed at lowering emissions from cars and trucks, including boosts to electric vehicle charging infrastructure and incentives to produce electric freight trucks.

- The U.S.’s richest people pledged tens of billions in donations to support renewable energy development across the world.

International Markets

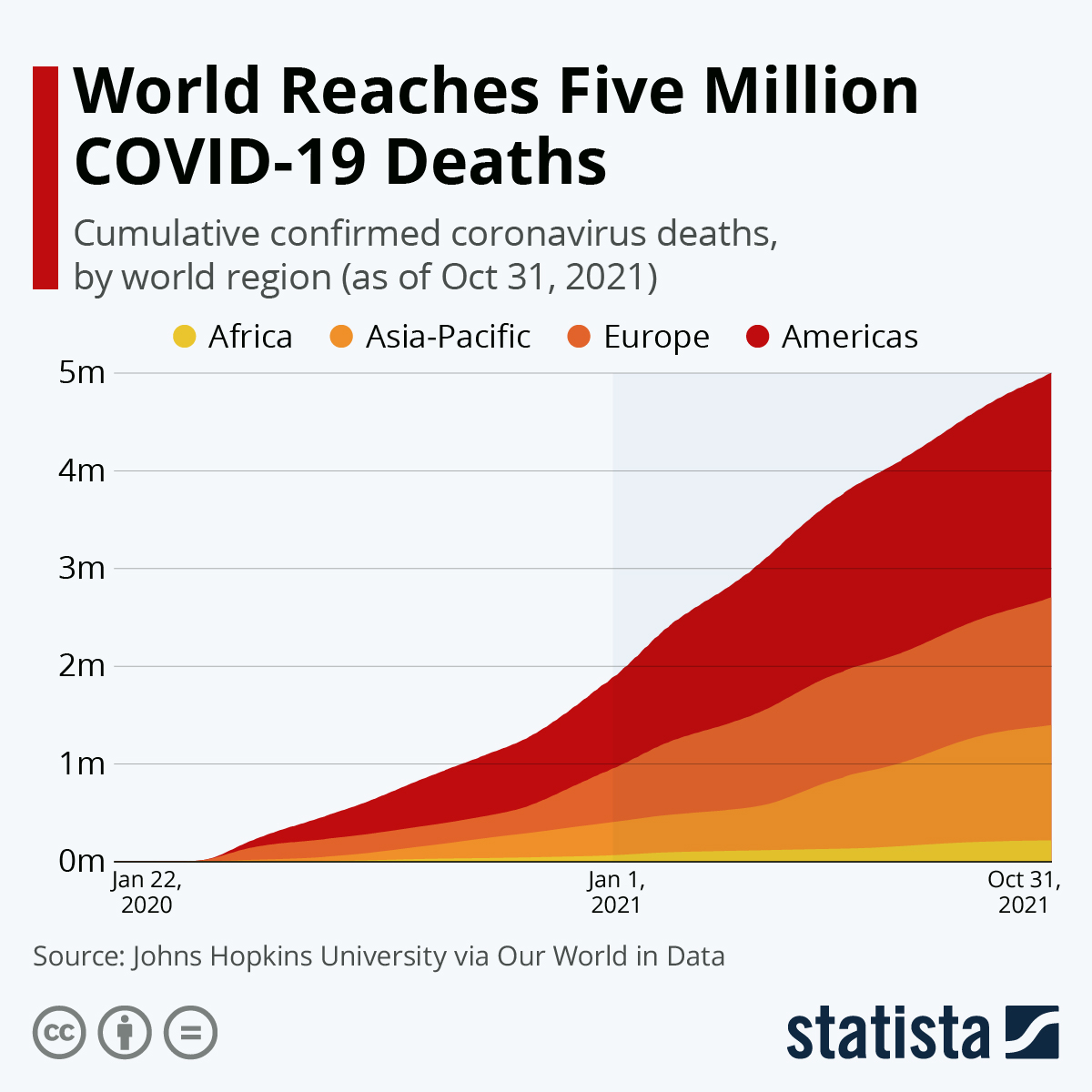

- More than 60% of the 5 million people who died from the virus did so in 2021:

- The real pandemic death toll could be as high as 10 million, health experts say.

- New COVID-19 cases in the U.K. dropped 13.5% week over week with the nation reporting more than 40,000 cases and 40 virus deaths Monday.

- Russia reported 40,402 new COVID-19 infections Monday, its third straight day above 40,000, and 1,158 virus fatalities.

- Rising COVID-19 infections in Germany have prompted state officials to reopen mass vaccination centers.

- Daily COVID-19 hospital admissions in France are at their highest level since early September.

- Daily COVID-19 cases in Poland are at their highest levels since April.

- Businesses and schools were ordered to shut down in Beijing’s Tiantongyuan neighborhood, the largest in Asia, following four new local COVID-19 cases.

- Police were deployed to enforce a lockdown in northern New Zealand after two COVID-19 cases of unknown origin were detected.

- Australia reopened its borders Monday, allowing the first international flights to land at its airports in nearly 20 months.

- Starting Nov. 8, Canadians can enter the U.S. with only proof of vaccination, no longer needing the additional requirement of a negative virus test.

- Thailand’s capital Bangkok welcomed its first wave of fully vaccinated travelers in 18 months Monday.

- Hong Kong is ending quarantine exemptions for senior executives and bankers entering the island.

- Despite having one of the highest COVID-19 vaccination rates in the world, Singapore still expects to suffer at least 2,000 virus deaths per year.

- People unvaccinated against COVID-19 are 32 more times likely to die from the virus than vaccinated peers, new research from the U.K. shows. Researchers also found that even vaccinated people are likely to spread the Delta variant to members of their household at the same rate as unvaccinated people.

- The Oxford English Dictionary has chosen “vax” as 2021’s word of the year.

- October manufacturing activity in Canada rose at its quickest pace in seven months, with a purchasing managers’ index rising to 57.7 from 57.0 in September.

- Thailand’s main airline is significantly downsizing its operations despite a broader economic and travel reopening.

- Irish airline Ryanair reported its first quarterly profit since before the pandemic, although full-year guidance was lowered on rising fuel costs and continued low passenger volumes.

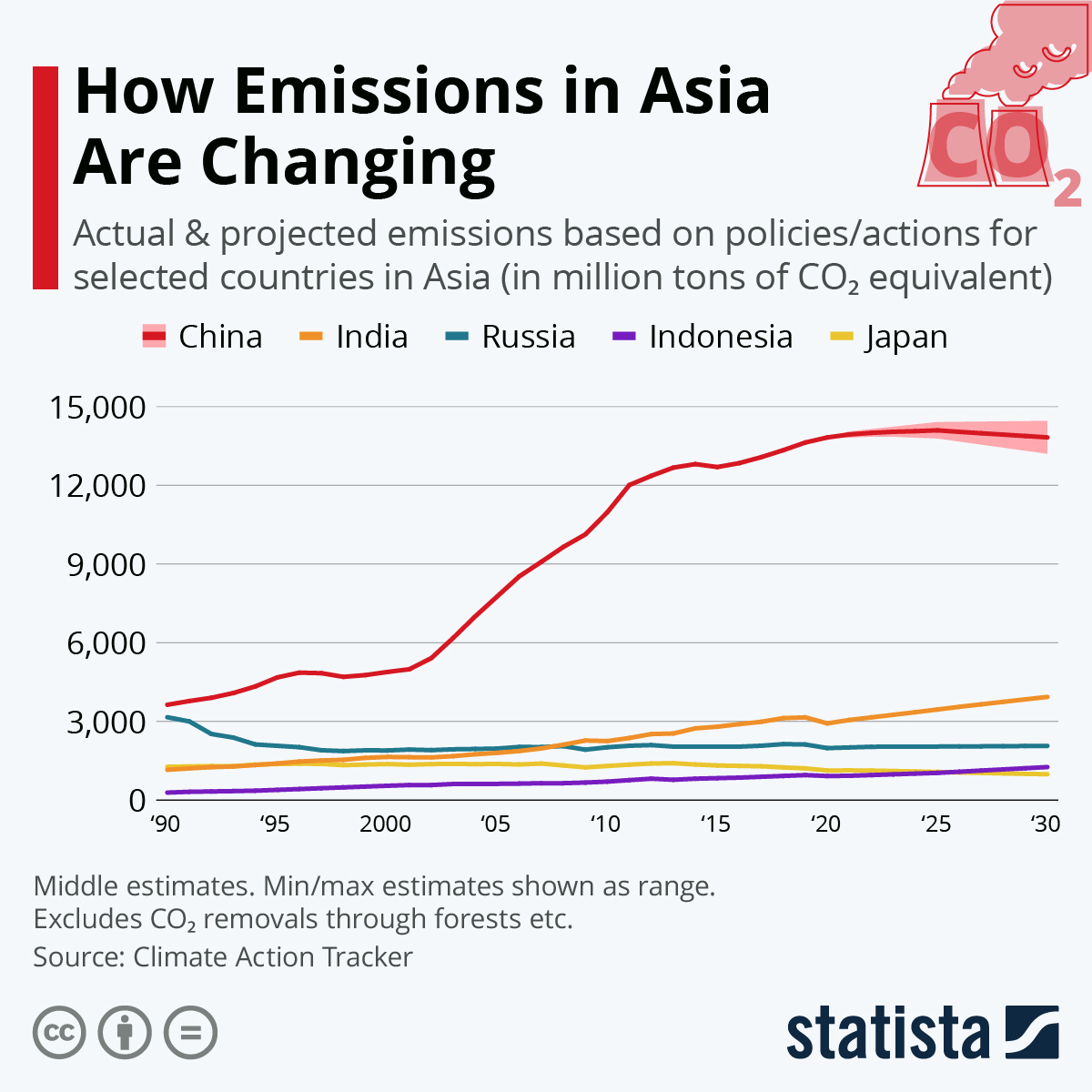

- India, the world’s third largest carbon emitter, pledged to reach net-zero emissions by 2070.

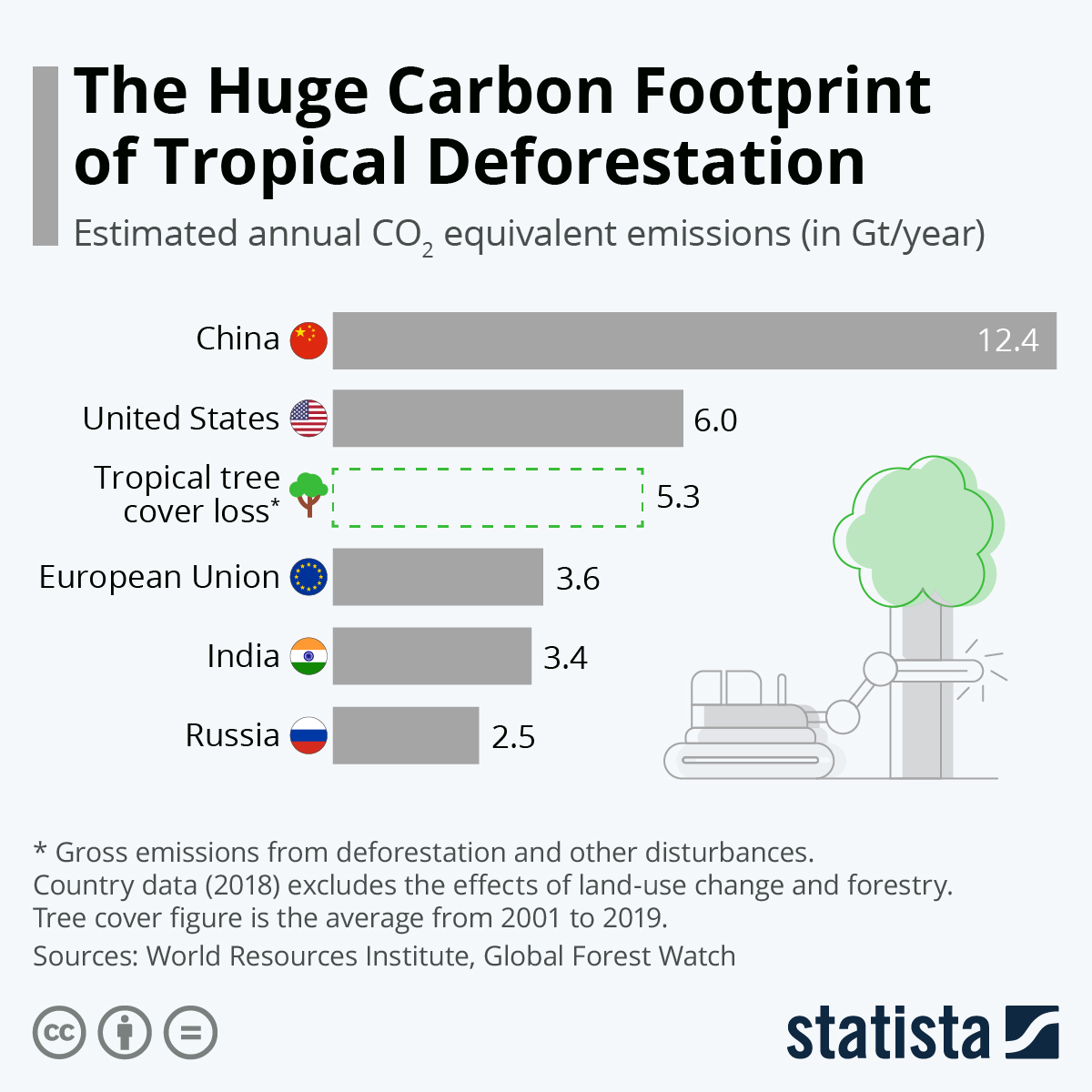

- One hundred countries, representing 85% of the world’s forests, have pledged to halt and reverse deforestation by 2030.

- The U.K. pledged to fund green investments of more than $4.11 billion over the next five years, including support for clean infrastructure projects in developing economies.

- Chinese manufacturer Gangfeng Lithium has inked a three-year contract with Tesla to begin supplying the automaker with electric vehicle battery lithium.

- Tesla will open its charging network for other electric vehicles (EVs) in the Netherlands as part of a pilot program to boost EV infrastructure.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.