COVID-19 Bulletin: November 8

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose above $81/bbl Friday following OPEC’s decision to stick to gradual monthly production increases. Futures were higher in late morning trading as traders await the likely release of crude from the U.S. Strategic Petroleum Reserve. WTI was up 0.9% at $82.03/bbl and Brent up 1.1% at $83.61/bbl. U.S. natural gas was 0.7% higher at $5.56/MMBtu.

- Saudi Aramco hiked December prices for customers in Asia, the U.S. and Europe on Friday, a day after OPEC+ stuck to its plan to boost output at a gradual pace. Traders see the move as a sign OPEC will continue resisting calls from the U.S. to pump more oil.

- Higher U.S. natural gas exports are pushing domestic prices up, with utilities from the Pacific Northwest to New England filing requests to raise rates this winter.

- German gas orders via a key Russian pipeline signaled only a marginal increase in shipments today, throwing doubt into the Russian president’s recent pledge to export more gas to Europe amid a supply crunch.

- U.S. clean energy startup Helion Energy raised $500 million for a small-scale nuclear fusion project which, if successful, could begin producing more power than it uses.

- Canada’s two largest pipeline companies, Enbridge and TC Energy, reported better-than-expected quarterly results on higher pipeline volumes.

- Oil shipping and storage operator Euronav reported a third-quarter net loss of $105.9 million compared to a near $50 million profit a year ago, as constrained OPEC production and COVID-19 lockdowns depressed demand.

- Flint Hills Resources will transfer its polypropylene assets to affiliate business unit INVISTA. Both are Koch Industries companies.

- Ninety-eight people were killed and scores more injured when a fuel tanker exploded in Freetown, Sierra Leone, Friday night.

- Despite strong demand for renewable energy, wind turbine installations in the U.S. are expected to fall 30% next year due to supply chain issues and uncertainty over tax credits.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- After a daylong standoff Friday, House lawmakers passed a $1 trillion package of highway, broadband and other infrastructure improvements, which now awaits White House approval to become law. Among other provisions, the bill would set aside $5 billion on expanding electric-vehicle highway charging.

- A bipartisan legislative bill would allow states and local governments to spend pandemic relief aid on a broader array of infrastructure projects.

- Comments from corporate executives on recent quarterly earnings calls suggest expectations for relief from supply chain disruptions are being pushed well into 2022 and beyond. Only about a fifth of businesses judge the worst of the disruptions has passed, new survey results show.

- The average price for transporting a 40-foot container from Shanghai to Los Angeles last week dropped to $9,857, more than 10% below a record high six weeks ago.

- Global air freight demand was up by more than 9% from pre-pandemic levels in September, new data shows, despite capacity constraints of roughly the same amount.

- Maersk will require all office workers to be vaccinated against COVID-19, the world’s largest shipping line announced.

- Schneider National relied on ocean-carrier capacity secured by its Asia-based operations to deliver more than 1,600 intermodal containers in the third quarter, with plans to get another 1,600 in the fourth quarter.

- Airbus delivered just 36 commercial aircraft in October, its lowest monthly delivery since February, due to ongoing supply chain disruptions.

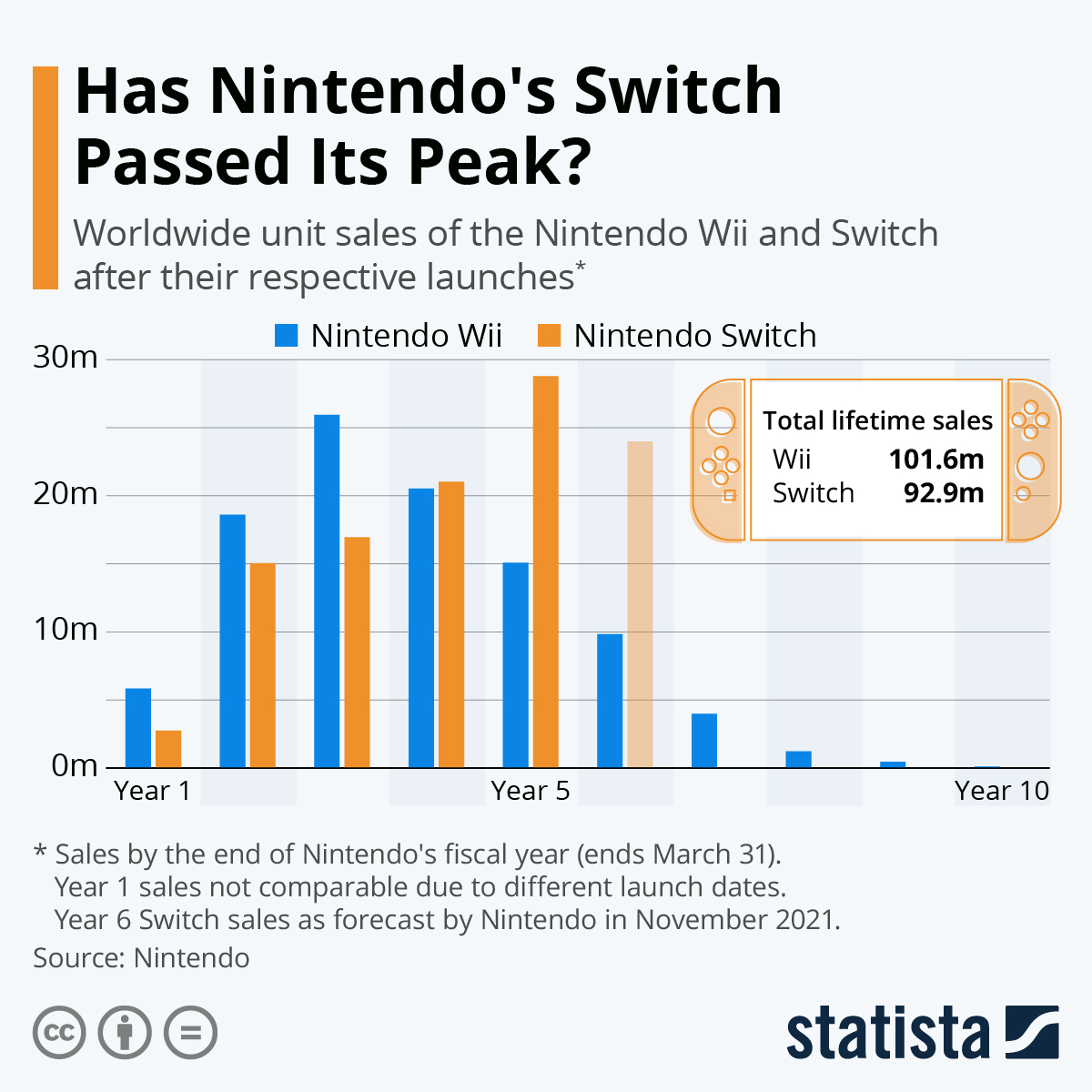

- The global semiconductor shortage is taking its toll on Nintendo, prompting the company to consider swapping components and altering product designs.

- DHL sharply raised its 2021 earnings outlook following a 29% jump in quarterly operating profit.

- The U.S. and Europe reached agreement to temporarily end their tariff war that impacted European steel and aluminum as well as a variety of U.S. exports subject to retaliatory tariffs.

- McDonald’s expects a 4% rise in commodity prices next year following a 2% rise in 2021, primarily on beef, fats, oils and eggs.

- Facing cost inflation, supply chain snags, and rising labor costs after more than 1,000 workers walked off their jobs in a wage dispute, Kellogg will raise prices for its products.

- Starbucks employees in Buffalo, New York, will vote over the next four weeks on whether to establish the first-ever unionized location among the chain’s thousands of corporate-run stores.

- Industrial parts distributor Fastenal’s daily sales grew 14.1% in the third quarter from a year ago.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

- Our Logistics team reports the following:

- Bulk trucking capacity is very limited as demand is exceeding supply.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand exceeds supply.

- Port congestion continues to be very problematic, delaying deliveries of imported containers.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply.

Domestic Markets

- The U.S. reported 21,968 new COVID-19 infections and 119 virus fatalities Sunday.

- A federal appeals court in New Orleans temporarily blocked the White House’s new rules that require large employers to ensure their workers are vaccinated against COVID-19 or test weekly. Eleven states are suing the White House over the mandate for private-sector employers with at least 100 employees.

- Los Angeles expanded its COVID-19 proof-of-vaccine requirement for entry into almost all indoor businesses, including malls, gyms, coffee shops, and other venues. The mandate was already in effect for restaurants, bars, and nightclubs.

- The U.S. has canceled its contract with COVID-19 vaccine manufacturer Emergent several months after an inspection at its Maryland plant uncovered multiple problems that led to millions of botched Johnson & Johnson and AstraZeneca vaccine doses.

- Alaska now has the highest COVID-19 case rate in the U.S., averaging 570.9 cases per 100,000 people in the past week, more than four times the national average.

- Arizona yesterday reported over 3,000 COVID-19 infections for the fourth day in a row.

- The city of Chicago will close its public schools on Nov. 12 so that students can get vaccinated against COVID-19.

- Apple began lifting its mask mandate for customers at its retail stores.

- Roughly 5% of U.S. and Canadian postings for jobs paying above $80,000 per year include COVID-19 vaccine mandates, double the amount from the month prior.

- The White House has secured millions of Pfizer’s COVID-19 antiviral pills as it awaits FDA authorization.

- U.S. labor costs rose sharply in the third quarter while labor productivity fell nearly 5%, new data shows. Large companies are increasingly dropping many of their standard educational or background requirements in a bid to hire more.

- The U.S. is bracing for a surge in international travelers as restrictions are lifted today, with United Airlines preparing for a 50% increase in inbound vaccinated travelers and Delta reporting a 450% increase in international bookings over the past six weeks. Airlines are on a hiring spree for pilots and are expected to onboard the highest number in more than three decades.

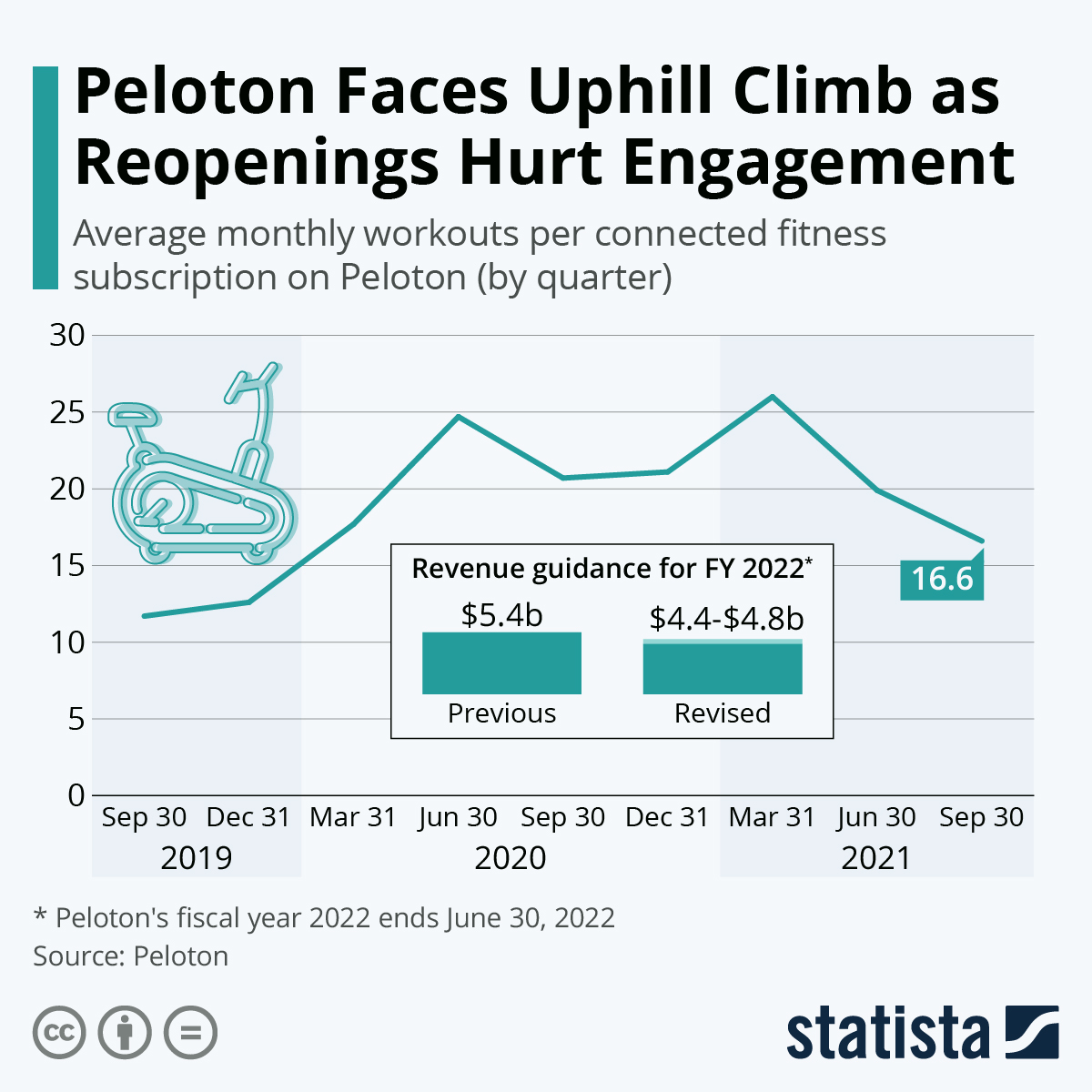

- Home fitness maker Peloton warned its annual revenue could be 20% below earlier projections, disappointing investors following booming product sales during lockdowns.

- Electric-truck startup Nikola is expected to pay $125 million to settle regulatory investigations into misleading statements made by the firm’s founder.

- A solar-powered micro factory housed in a shipping container is processing single-use plastics and roto-molding waste into useful products.

International Markets

- The U.K. reported 29,889 new COVID-19 infections and 62 virus deaths Sunday, while new data showed that roughly 1 in every 50 people had COVID-19 for the week ending Oct. 30.

- Germany reported 37,120 new COVID-19 infections Friday, its second consecutive daily record. Health ministers are urging the entire population to get booster shots.

- Denmark reported 2,598 new COVID-19 infections Thursday, its highest single-day total of the year.

- Russia reported 41,335 new COVID-19 cases Saturday, a record, despite a nationwide “paid holiday” aimed at curbing new infections.

- Lawmakers in France voted to continue the use of the country’s required COVID-19 health pass until July 2022.

- China reported 89 new COVID-19 infections yesterday, bringing its total case count to more than 800 since mid-October.

- South Korea’s new COVID-19 cases fell below 2,000 for the first time in six days, as the nation continues to reopen its economy and ease restrictions.

- Japan is easing quarantine restrictions after reporting no new COVID-19 deaths for the first time in 15 months.

- The U.S. has begun welcoming visitors from the U.K. for the first time in nearly two years. The reopening is expected to provide a much-needed financial boost for British airlines.

- Border crossings between the U.S. and Mexico reopened to non-essential travelers today after 20 months.

- A new study shows that life expectancy in Russia dropped by more than two years in 2020 because of the pandemic.

- At least one of Australia’s four main flu strains has been eradicated due to COVID-19 lockdowns.

- China’s record trade surplus has exceeded analyst estimates for three straight months, reaching $84.5 billion in October.

- Volkswagen will permanently allow office employees to pick five days a month to work from home even after COVID-19 restrictions lift.

- Mexico’s annual inflation rate likely reached 6.14% in October, what would be the highest since December 2017.

- World leaders are headed into week two of Scotland’s COP26 climate summit, as concern grows that commitments to cut emissions are not enough to prevent the most destructive effects of global warming.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.