COVID-19 Bulletin: November 9

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose slightly Monday on positive signs of global economic growth and a White House announcement that it may take action to address high gasoline prices this week, possibly by tapping further into the country’s emergency crude reserves.

- Crude futures were higher in late morning trading, with WTI up 1.1% at $82.88/bbl and Brent up 0.7% at 83.98/bbl. U.S. natural gas was 8.0% lower at $5.00/MMBtu.

- The British government approached Qatar to seek a long-term gas deal and shore up supplies as shortages in Europe lead to soaring wholesale prices.

- Spending on new LNG projects in the U.S. halted in 2020 and has stayed near zero since, despite record demand for North American exports of the fuel.

- China’s coal imports reached 26.9 million tons in October, up 96.2% from a year ago amid signs the country’s power shortage is easing.

- Occidental Petroleum will stop hedging its oil output next year as prices remain near multi-year highs.

- The death toll of a fuel tanker explosion in Sierra Leone on Sunday night rose to 115.

- More than 105 nations at the COP26 climate summit in Scotland have backed the U.S. plan to cut global methane emissions by 30% from 2020 levels by 2030. Separately, Japan was one of the notable absences on a COP26 plan that would phase out the use of coal in many nations.

- Exxon Mobil is partnering with Malaysia’s state energy firm Petronas to explore potential collaborative projects in the carbon capture and storage industry.

- Creating a global carbon market is at the top of the list for officials at Scotland’s COP26 climate summit, with negotiations picking up urgency as the summit winds down without agreement.

- During the pandemic, medical waste has become the leading contributor to plastic waste entering oceans.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Truck drivers traveling alone in their cabs are exempt from a new White House rule mandating COVID-19 vaccinations for employees of large private companies, the U.S. labor secretary said.

- The benchmark Baltic Dry Index fell to 2,715 Nov. 5, its lowest since June 10.

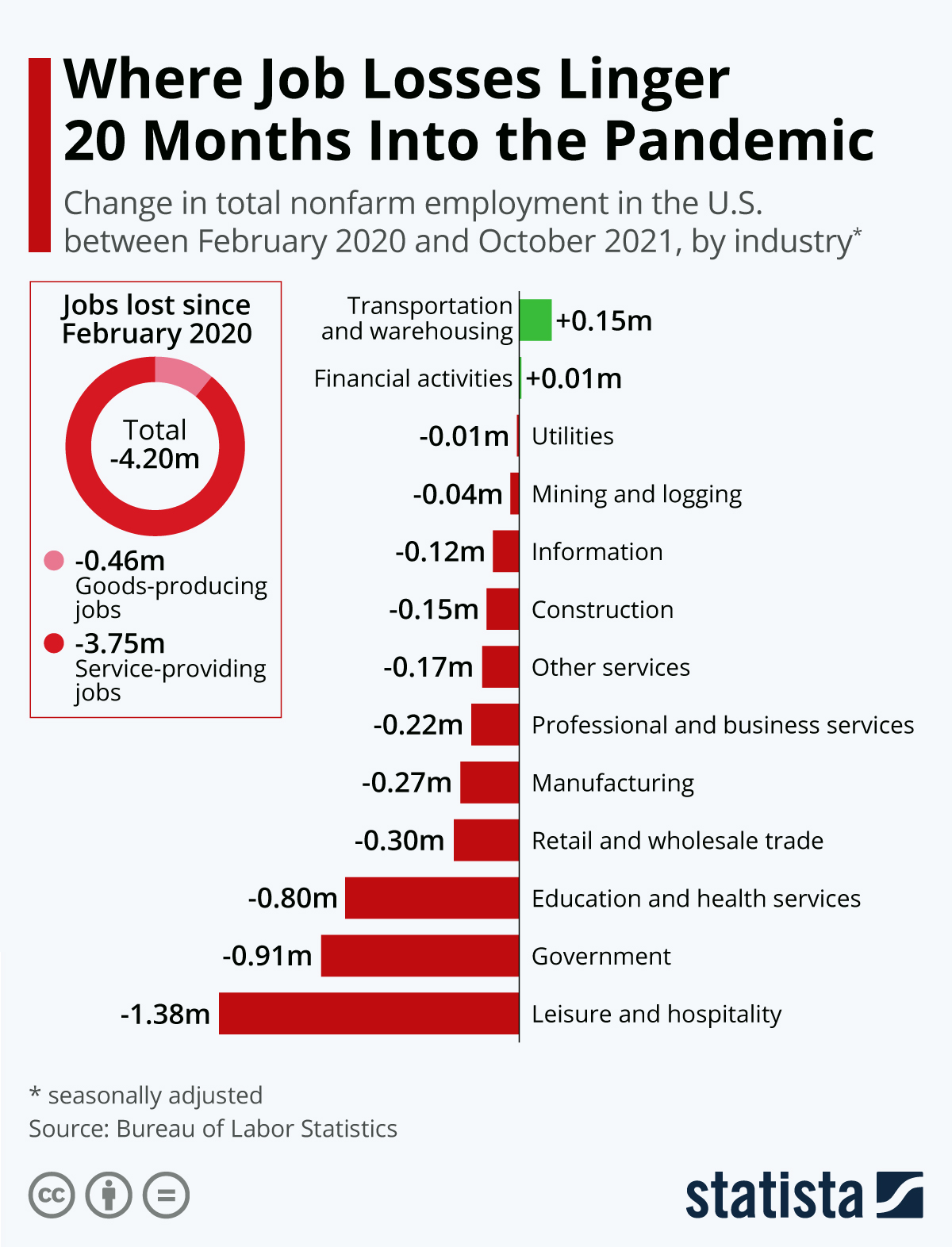

- Warehousing and storage companies added more than 20,000 jobs on a seasonally-adjusted basis in October, making it one of the best performing industries in the latest jobs report:

- The $1 trillion infrastructure bill U.S. lawmakers passed Saturday is the first substantial spending plan for roads and bridges in years and gives the federal government broader spending authority for $550 billion in new funds. Manufacturers and construction companies are expected to be the biggest beneficiaries.

- S&P 500 companies, excluding finance, increased their inventories by an average of 15% in the second quarter versus the same time in 2019, a costly measure to avoid future supply chain disruptions.

- Central Illinois retailers are feeling the effects of congestion at Southern California ports, with backorders building up for months and deliveries often short by half.

- FedEx is expected to deliver up to 100 million more shipments this holiday season than in 2019 thanks to boosted capacity, which the shipper’s CEO attributes to investments in e-commerce and modernized air cargo fleets.

- Freight rail lines CSX and Norfolk Southern are lobbying against giving Amtrak passenger trains access to Gulf Coast routes, arguing they would cause systematic failures in freight services.

- Autonomous vehicle company Gatik is using completely driverless trucks for middle-mile deliveries for Walmart in Arkansas, the first commercial use of autonomous vehicles with unmanned cabs.

- A complex new system of quotas is causing uncertainty among U.S. importers following the new U.S.-EU agreement to lift steel and aluminum tariffs.

- Concerns are growing over a looming shortage of magnesium from China, yet another critical component used in the production of vehicles.

- Every major semiconductor chipmaker has pledged to comply with a U.S. request for information regarding the global chip shortage, the commerce secretary said, as the administration aims to alleviate bottlenecks that have idled U.S. car production and caused shortages of electronics.

- Mexico’s automobile production is at its lowest in a decade due to the computer chip shortage, which could suppress the nation’s GDP this year by up to 1%.

- Consumers will likely find leaner inventories and higher prices for products from fashion retailers this holiday season, while sales boom at secondhand apparel retailers.

- Macy’s is raising its minimum wage to $15/hour in a bid to attract more workers for the busy holiday season.

- Global food prices in October hit their highest level in a decade, with United Nations officials warning of rising hunger and malnutrition, particularly in Latin America.

- Genco, the largest U.S. headquartered dry bulk shipper, raised its dividend after posting its best quarterly profits since 2008. Eagle Bulk, another U.S.-based operator, reported record quarterly income.

- Air cargo handler IAG saw quarterly revenue rise by more than 34% from the same time last year, partially on a resurgence in passenger flight volumes.

- A new proposal from the International Maritime Organization would charge vessel operators $100 for each metric ton of CO2 emitted per trip, a move that could bring in more than $1 trillion over the next three decades to help fund a global network of alternative fueling stations.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The U.S. reported 125,491 COVID-19 infections and 1,218 virus deaths Monday.

- More than 90% of COVID-19 deaths in Texas since mid-January have been from unvaccinated people, new data shows.

- Pfizer will seek FDA clearance for its COVID-19 booster shot for anyone over the age of 18.

- Regeneron said its experimental COVID-19 antibody drug reduced the risk of contracting the virus by 81.6%, a potential breakthrough for people who do not respond to vaccines due to impaired immune systems.

- A federal court upheld United Airlines’ policy of requiring COVID-19 vaccinations, a persuasive decision that could inform other rulings on the federal government’s broader vaccine mandate.

- Almost 9% of Boeing’s U.S. workforce is seeking COVID-19 vaccine exemptions on religious or medical grounds, the company said.

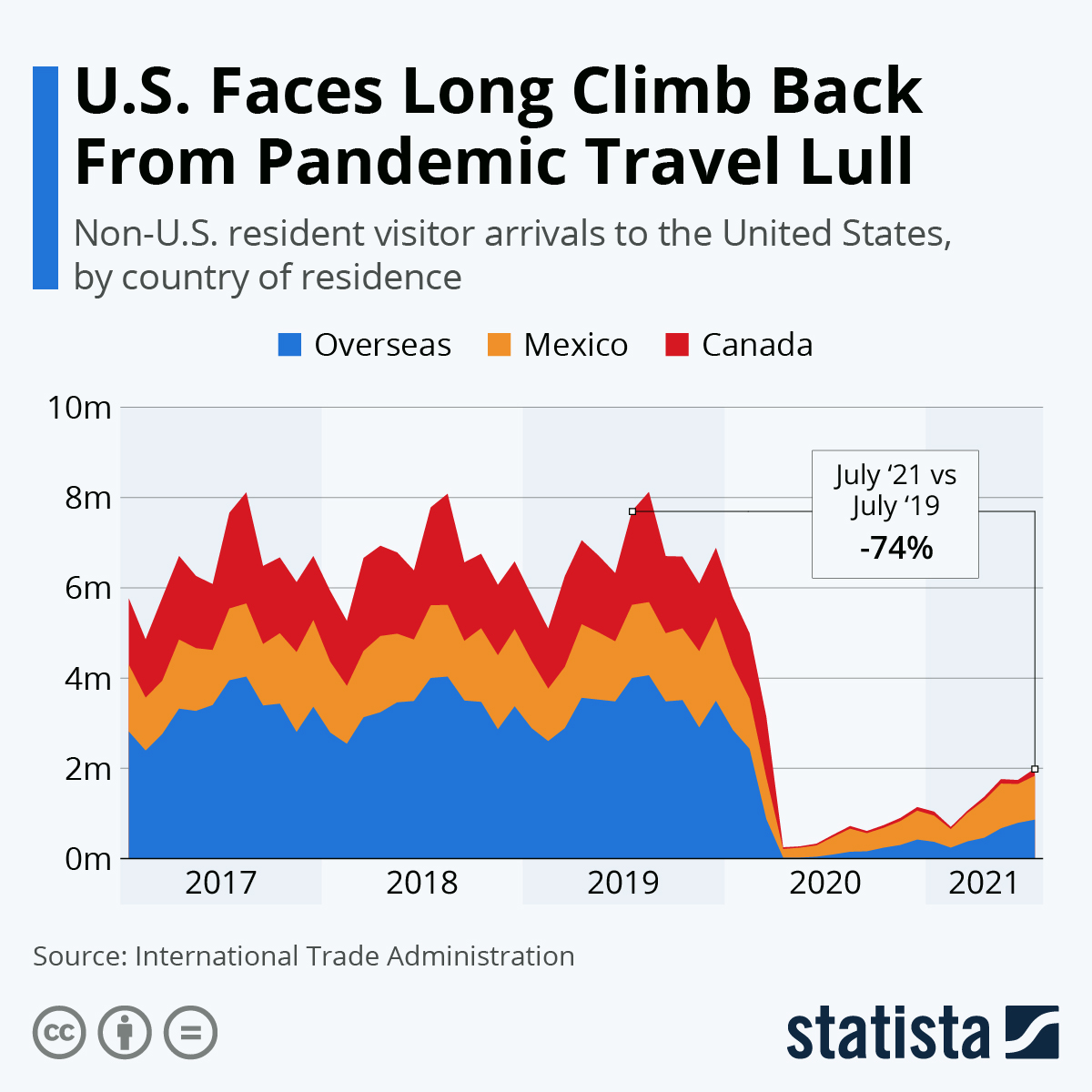

- There were happy reunions of families and friends following the U.S.’s reopening yesterday of its borders to non-essential travelers for the first time in 18 months:

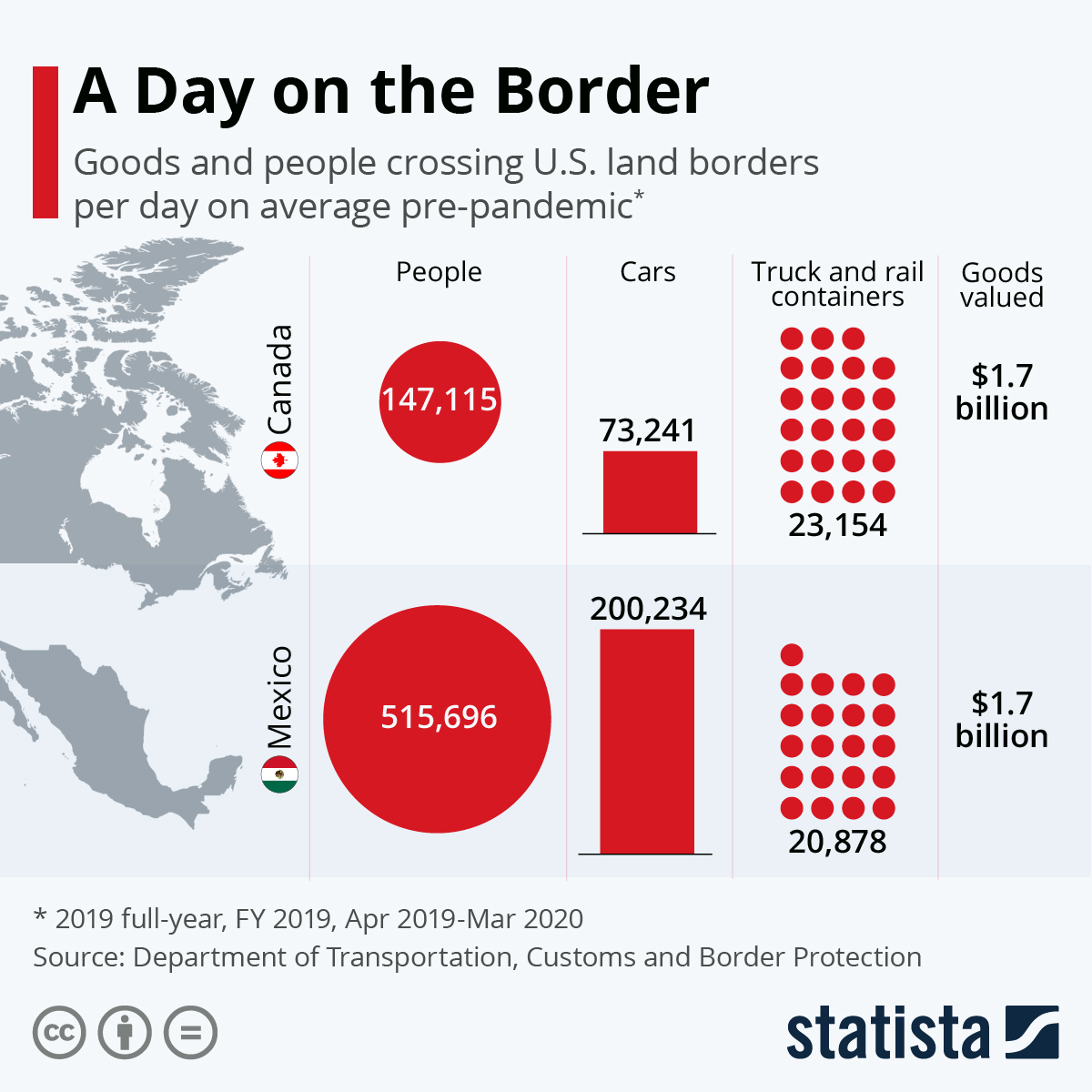

- Long wait times are expected at the land borders with Canada and Mexico, as crossings of both people and freight return to pre-pandemic levels:

- Despite an immediate increase in transatlantic airline bookings following the U.S.’s reopening of its borders, concerns remain over a lack of demand for business travel, normally a major source of airline profit.

- The U.S. is offering $184 million in extra payroll assistance to 158 aviation manufacturing businesses, the second round of stimulus for the industry that has seen particularly harsh effects from the pandemic.

- Short-term inflation expectations increased in October, while consumers’ expectations for how much money they will earn and spend over the next year rose to the highest level in eight years. The head of the Federal Reserve’s Philadelphia branch does not expect the central bank to raise interest rates until monthly asset purchases have stopped.

- Banks largely eased credit standards for businesses, real estate investors and households in the third quarter on a generally more favorable economic outlook.

- More than 4,000 proposed mergers were subject to review by the U.S. Justice Department and Federal Trade Commission between March 2020 and September 2021, sharply higher than normal.

- Movie theater chain AMC reported nearly 40 million attendees in the third quarter, up from 22 million the prior quarter but still significantly behind pre-pandemic levels.

- Ford sold $2.5 billion of “green” bonds to fund its transition to making electric vehicles, a first for the automaker and the largest ever such sale.

- General Motors’ Cadillac has largely completed a restructuring of its U.S. dealer network and is expected to have 40% fewer dealers in 2022 than in 2018, as the carmaker ramps up production of electric vehicles in a bid to challenge Tesla.

- PepsiCo will receive its first set of Tesla electric semi trucks in the fourth quarter, a move expected to reduce the company’s fuel costs and emissions.

- The Justice Department has opened an investigation into electric-van startup Workhorse, the third electric vehicle startup to come under scrutiny from both federal prosecutors and securities regulators in the past 14 months.

- A California-based aviation startup is taking preorders for two jet-powered “flying motorcycles” for delivery in 2023.

- Struggling General Electric said it will split into separate aviation, energy and healthcare businesses.

International Markets

- Total global COVID-19 cases surpassed 250 million Monday, with new cases down 36% over the past three months.

- COVID-19 increased death rates in OECD countries by 16%, reducing life expectancy in 24 of the 30 nations.

- Germany on Monday recorded its highest seven-day COVID-19 rate since the pandemic began. Neighboring Austria began to ban unvaccinated people from restaurants and hotels amid the surge.

- Despite having one of Europe’s highest COVID-19 vaccination rates, Denmark will reimpose several pandemic restrictions amid a recent uptick in cases.

- Greece is the latest European nation to see record new COVID-19 cases.

- Singapore will stop giving free hospital treatment to COVID-19 patients who are unvaccinated by choice.

- Sao Paulo, Brazil, reported zero COVID-19 deaths for the first time since the start of the pandemic.

- Pfizer’s COVID-19 booster shot extends strong protection for at least 9-10 months, a new study out of Israel shows.

- Chinese exports surged 27% in October compared to a year ago, higher than analyst expectations and just a percent lower than September’s rise. The nation’s domestic housing troubles continue, however, with the largest sell off in high-yield bonds shaving about a third of bond holders’ wealth in just the past six months. New bank lending in China also plunged in October from September.

- German industrial output in August was about 9% below its 2015 level compared to a 2% gain for the euro zone, as makers of cars and factory equipment falter under parts and labor shortages.

- Japan’s government cut its view on the nation’s economic condition for the first time in more than two years based on factory output, employment and retail sales data. Despite the forecast, the nation’s services sector sentiment index for October rose to its highest level in nearly eight years.

- International tourism receipts are down significantly from pre-pandemic levels due to the loss of Chinese travelers, for many years the world’s biggest tourism spenders:

- Australian lawmakers agreed to a $132 million plan to boost investments in hydrogen refueling and charging stations for electric vehicles (EVs), declining to adopt other environmental measures such as EV rebates or phasing out coal.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.