COVID-19 Bulletin: November 11

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices dipped Wednesday as the White House continued to indicate it may pull more from strategic U.S. crude reserves. Reserve withdrawals already topped a previous record at 1.6 million barrels in October.

- Energy futures were higher in mid-day trading, with WTI up marginally at $81.42/bbl and Brent up 0.1% at $82.70/bbl. U.S. natural gas was 4% higher at $5.08/MMBtu.

- U.S. consumers face their biggest surge in energy costs in 12 years, with electricity prices rising 6.5% year over year in September alongside steep increases in natural gas (+28%), fuel oil (+59%) and propane (+35%).

- Russia boosted gas flows to Europe Wednesday, easing some of the bloc’s supply concerns and causing wholesale prices to drop ahead of the winter season. The nation’s oil and gas discoveries fell to the lowest in five years in the first half of 2021.

- After unsuccessfully approaching OPEC producers to boost production, Japan is warning of the long-term economic effects of continued high oil prices on the nation’s pandemic recovery.

- Offshore drilling contractors Noble Corporation and Maersk Drilling announced plans to merge into a combined modern fleet of 20 floaters and 19 jackup rigs.

- The U.S. and China issued a surprise joint pledge Wednesday to combat the worst effects of climate change, announcing plans to curb methane use, halt illegal deforestation and other measures. Absent from the agreement was any mention of phasing out fossil fuel vehicles.

- Shell’s clean energy unit will sell renewable energy credits to oilfield firm Baker Hughes’ U.S. facilities over the next two years.

- U.S.-based Charm Industrial announced it has buried the equivalent of 5,000 tonnes of carbon dioxide in a “bio-oil” generated from agricultural waste, a new but expensive method for trapping carbon that could gain broader support among firms.

- Cost is one of the main factors preventing airlines from buying into sustainable alternative fuels, with prices three to four times more expensive than standard jet fuel.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- The White House unveiled a new supply chain dashboard that will be updated two times per month, detailing the status of delayed imported goods at ports throughout the U.S.

- The U.S. president paid a visit to the Port of Baltimore Wednesday, highlighting planned improvements and upgrades as part of the $1 trillion infrastructure bill Congress recently passed. He is expected to sign the bill into law Monday. If passed, the legislation would grant $125 million in federal funding to vessel owners looking to divert ships from the U.S. West Coast to less-congested ports on the Gulf and East Coast.

- The Georgia Ports Authority will spend $8 million to convert five inland facilities in Georgia and North Carolina into pop-up container yards to help ease congestion and alleviate supply chain disruption.

- Several national and state trucking associations are suing the White House over its COVID-19 vaccination and testing rules for companies with over 100 employees.

- GM has resumed production of Chevrolet Silverado pickup trucks at its plant in Oshawa, Canada, after closing it in December 2019 to retool its assembly line.

- Rising food costs and ongoing supply chain disruption are prompting U.S. food banks to ration servings and make meal substitutions for families seeking food for the holidays. Wheat prices rose above $8/bushel for the first time in almost a decade.

- Nineteen nations at the COP26 climate summit in Scotland have signed onto a plan to support the establishment of at least six “green” shipping corridors by 2025.

- French shipping line CMA CGM will partner with French utility ENGIE to develop a synthetic methane and liquified biomethane (BioLNG) bunker fuel.

- Thailand will begin offering COVID-19 vaccines to migrant workers in a bid to ease the nation’s labor shortage.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The U.S. reported 95,929 new COVID-19 infections and 1,625 virus fatalities Wednesday. New cases are rising in most states.

- COVID-19 cases in New Mexico are rising quicker than any other state in the U.S., with daily cases up 48% over the past two weeks, compared to a 6% average rise nationwide.

- Colorado has started sending thousands of free rapid COVID-19 tests to residents amid a recent surge in virus infections.

- COVID-19 infections in Arizona continue to rise, with the state reporting more than 3,000 new cases six out of the past seven days while virus hospitalizations hit a two-month high.

- Nevada’s COVID-19 test positivity rate rose to 7%, the highest level since August.

- Connecticut’s positivity rate rose to the highest in six weeks.

- Despite having one of the highest vaccination rates in the U.S., Vermont’s COVID-19 cases have risen 55% the past two weeks, with daily cases hitting all-time highs above 400.

- A public school in New York City’s Queens borough has closed its doors and will go fully remote for the next 10 days after 19 students and three staff members tested positive for COVID-19.

- Less than 1% of New York City’s municipal workforce is on unpaid leave for not complying with its COVID-19 vaccine mandate, accounting for roughly 2,600 workers, down from 9,000 at the start of the month.

- Atlanta lifted its indoor mask mandate earlier this week following a drop in its COVID-19 positivity rate the past two weeks.

- The U.S. has administered roughly 900,000 initial doses of Pfizer’s COVID-19 vaccine to children aged 5 to 11 in the age group’s first week of eligibility.

- Pfizer/BioNTech has formally asked the U.S. FDA to authorize COVID-19 booster doses for all adults over 18.

- COVID-19 test maker Ellume is recalling more than 2 million at-home COVID-19 tests over concerns they could return false positive test results.

- There were 267,000 first-time unemployment claims last week, a pandemic low.

- The average employer health coverage cost for a family plan rose 4% in 2021 to $22,221, up from $21,342 in 2020.

- The U.S. is facing a highway death “crisis,” with 2020 driving fatalities at the highest level since 2007 despite a decline in driving during lockdowns. The death rate is up 18.4% through the first six months of this year.

- The CDC is warning of an increased global threat of measles after 22 million infants missed getting vaccinated against the virus during the COVID-19 pandemic.

- Roughly 25% of financial services firms expect to reduce their New York City workforces over the next five years amid a shift to lower-cost locations throughout the country.

- Spending at U.S. discount stores is up 65% compared to the same period in 2019 and 21% from the week prior, as high inflation impacts consumer behavior.

- Despite hourly earnings increasing 0.4% in October for American workers, top line inflation for the month rose 0.9%, bringing real wages down 0.5% for the period.

- The median price for a single-family home rose 16% in the third quarter from a year ago to $363,700. Sales, meanwhile, are taking only one week on average to close, forcing buyers to bypass traditional home-buying safeguards.

- Manhattan apartment rents surged 18% in October from a year earlier, the most on record.

- Electric vehicle firm Lordstown finalized an agreement to sell its Ohio manufacturing plant to Apple supplier Foxconn.

- Grocer Kroger is partnering with Bed Bath & Beyond to begin selling some of its more popular products on the grocer’s website and at select stores.

International Markets

- Germany reported nearly 40,000 new COVID-19 cases Tuesday, its third day of record infections the past week.

- The U.K. reported 39,329 new COVID-19 infections yesterday, up from 33,117 the day before. The nation also recorded its first case of COVID-19 in a pet dog.

- France is seeing the beginning of a fifth COVID-19 wave, with the nation reporting 11,833 new infections Wednesday, its second consecutive day above 10,000 and a roughly 40% rise from a week earlier.

- Russia reported over 40,000 COVID-19 cases and 1,237 deaths Thursday, both records, only two days after parts of the country reopened from a week-long workplace shutdown. Roughly 83% of the country’s virus hospital beds were filled as of Wednesday.

- Slovakia saw a record-high 7,055 new COVID-19 infections Tuesday, while the Czech Republic reported 14,539 cases, nearing a record.

- Italy expanded authorization for COVID-19 booster shots in a bid to get ahead of an expected fourth virus wave this winter.

- Following the U.S., Israel approved giving children aged 5 to 11 doses of Pfizer’s COVID-19 vaccine. The nation began a series of “war games” to test its readiness for a potential new, more lethal virus strain.

- China placed 9,000 tourists visiting the Gobi Desert into quarantine after a COVID-19 case was detected in a nearby city. The northern Chinese city of Shenyang is requiring overseas visitors to quarantine in a hotel for 28 days and then avoid leaving their residences for an additional 28 days, part of the country’s strict “zero COVID” strategy.

- China shut down businesses that handle imported food in the port city of Dalian after a local COVID-19 outbreak.

- New Zealand ended nearly three months of pandemic lockdowns in its largest city of Auckland yesterday.

- Ontario, Canada, will delay plans to lift several pandemic restrictions amid a spike in COVID-19 cases.

- The U.S. announced plans to rush deliver 300,000 Johnson & Johnson COVID-19 vaccine doses to humanitarian and front-line workers in conflict zones through the international COVAX vaccine sharing program.

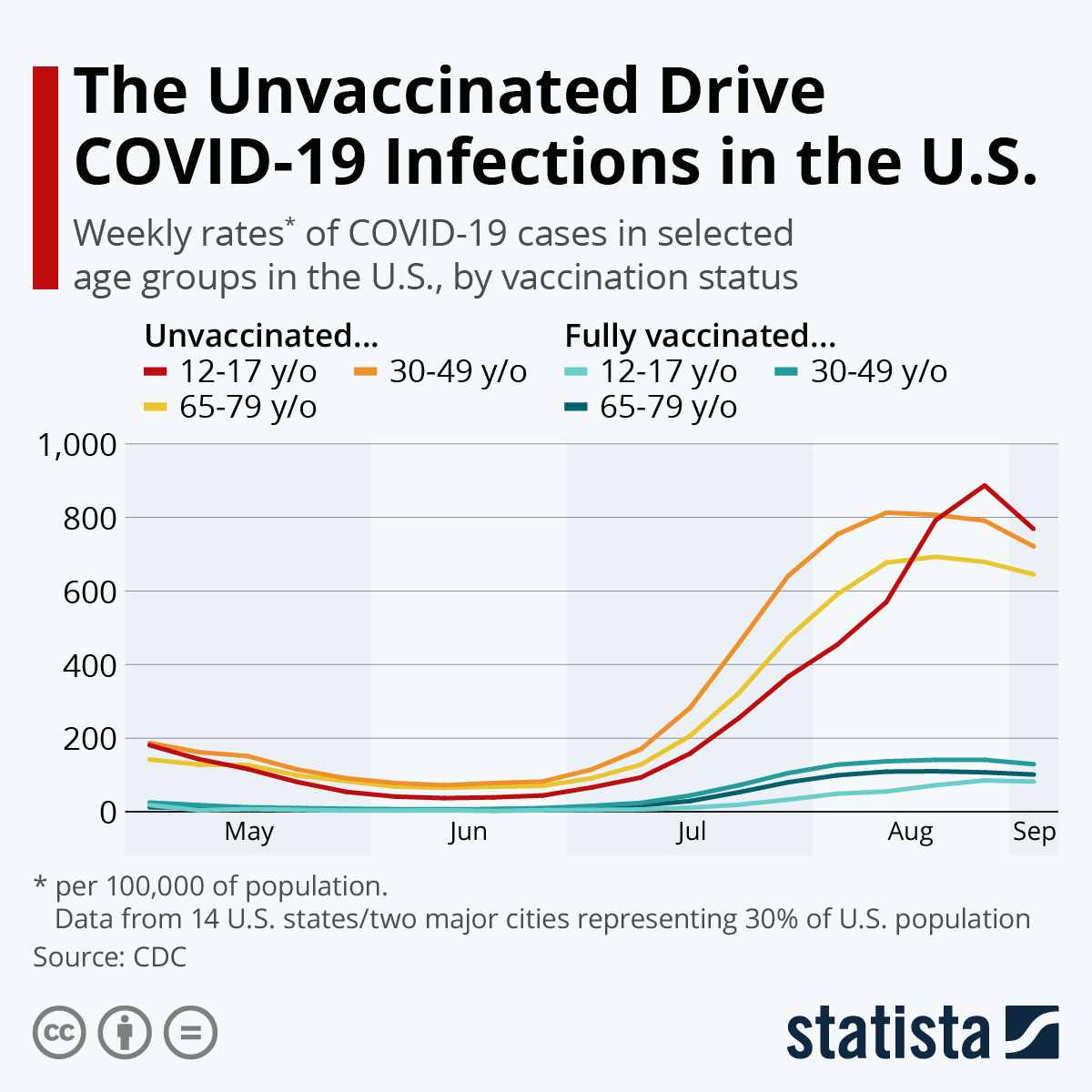

- New research from Australia shows people fully vaccinated against COVID-19 are 16 times less likely to die or be hospitalized with the virus compared to unvaccinated peers.

- Japan is one of the first large purchasers of Merck’s new COVID-19 antiviral pill.

- The European Commission approved a contract to buy up to 60 million COVID-19 vaccine doses developed by French biotech firm Valneva, as the EU combats another virus wave.

- The U.S. has resumed issuing travel visas to China, the first time since February 2020.

- China’s population is likely already shrinking after researchers predicted up to 10.5 million newborns this year, roughly the same as projected deaths.

- Chinese property giant Evergrande again averted default with another set of last-minute bond payments, temporarily easing fears of a liquidity crisis in the nation’s property sector.

- China launched on Wednesday a 4.6 billion euro-denominated bond issue in its second major foreign currency transaction in a month, a bid to take advantage of Europe’s exceptionally low yields.

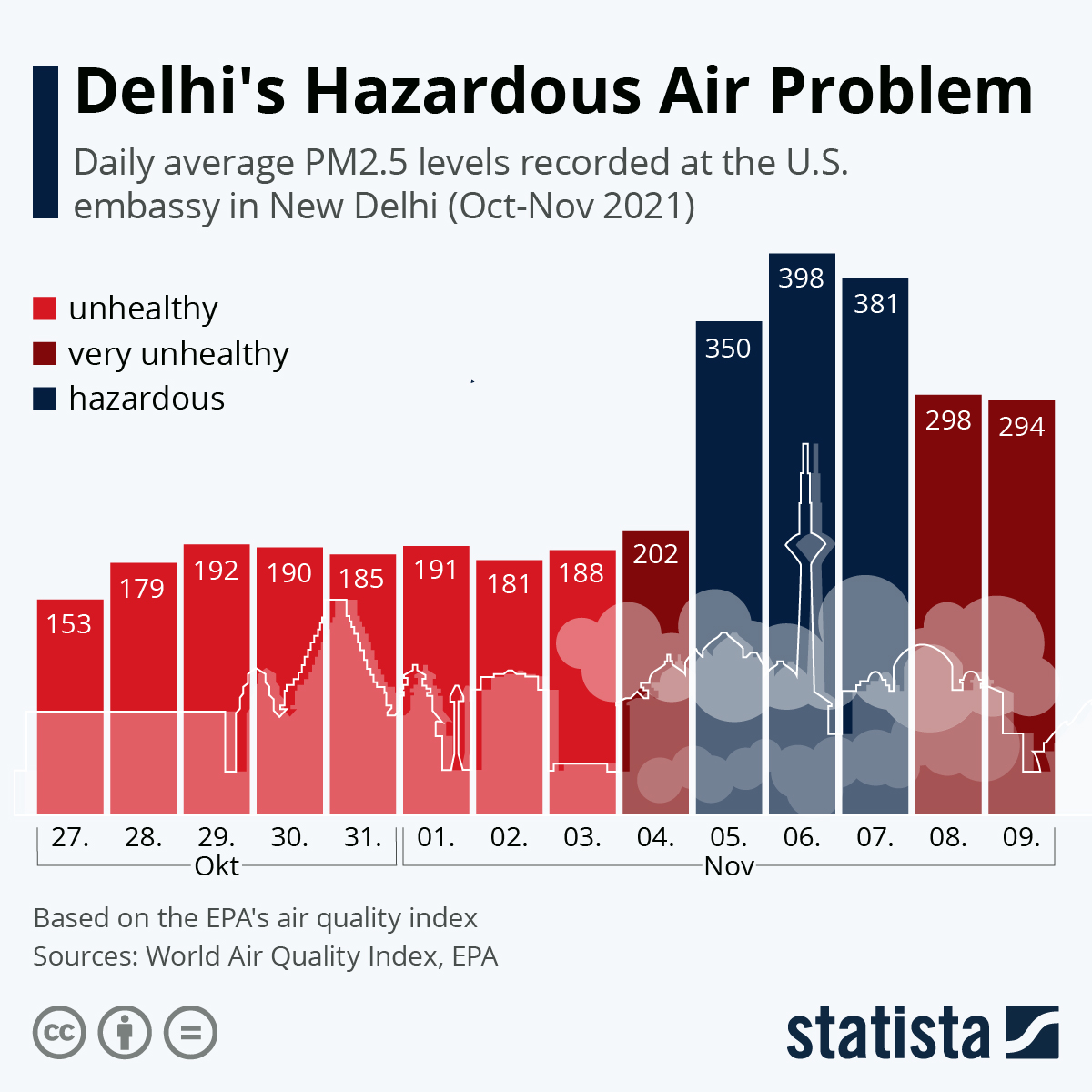

- Toxic air pollution in India is rising alongside the rebound of the nation’s economic activity, with New Delhi seeing four straight days last week of hazardous conditions.

- The International Chamber of Commerce is proposing new definitions for “sustainability” that would impact roughly a third of global trade, the first time a global standard for the term has been recommended.

- India is calling for $1 trillion in global investment by the end of the decade to finance its recent pledge of net-zero emissions by 2070.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.