COVID-19 Bulletin: November 19

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices finished slightly higher on Thursday after dropping to six-week lows as investors wondered how much crude major economies would release from strategic reserves at the urging of the U.S.

- Crude futures were hammered in late morning trading on concerns about renewed COVID-19 lockdowns, with WTI down 3.8% at $76.05/bbl and Brent down 3.2% at $78.62/bbl. U.S. natural gas was 0.9% higher at $4.95/MMBtu.

- Saudi Arabian crude exports rose to 6.52 million bpd in September, the fifth consecutive monthly increase and the highest since January.

- Gas stockpiles in the U.S. East Coast, the nation’s largest importing region, fell to their lowest level since 2017, spurred by a 51% drop in October deliveries from Europe, normally the top foreign supplier. Natural gas futures rose about 2% Thursday on the news, while LNG exports climbed to near record highs on increased production at Cheniere Energy’s plant in Louisiana.

- The U.S. Environmental Protection Agency proposed an extension of a deadline for oil refiners to comply with new biofuel blending laws.

- Spot freight rates for LNG tankers in Asia surged to $316,750 per day Tuesday, a fivefold increase from two months prior.

- Less than 1% of global LNG trades have been declared carbon neutral to date, prompting the International Group of Liquified Natural Gas Importers to draft a proposal for benchmark definitions of the term.

- U.K. utility National Grid boosted earnings projections with power prices remaining well above historical norms. European coal plants are also enjoying surging profits after running at full capacity during the bloc’s energy crunch.

- Two dozen European companies are planning long-term investments of $94 billion to convert most of the bloc’s gas pipelines to carry zero-emissions hydrogen.

- Oil and gas companies have raked in record amounts of private-sector financing during the ultra-low interest rates of the pandemic, issuing a record $198.8 billion of bonds in 2020, $37.2 billion more than the previous record from 2013.

- Royal Dutch Shell has acquired a 51% stake in a floating wind project offshore western Ireland, expected to develop 1.35 GW of power generation.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Access to the Port of Vancouver, Canada’s largest gateway, remains blocked after days of torrential rain and landslides. Twenty vessels and several hundred thousand tons of grain are stuck in transit, according to Quorum, a company that monitors Canada’s grain transportation system.

- U.S. imports from Asia fell 2.4% in October from record highs, with the month remaining the third busiest on record.

- High shipping rates and lingering effects of the pandemic will slow growth in the maritime industry over the next four years, the United Nations says. Smaller countries dependent on deliveries by sea are likely to take the brunt of the impact.

- California will allow trucks to carry heavier payloads in a bid to reduce congestion at the Ports of Los Angeles and Long Beach.

- U.S. rail freight traffic totaled 502,613 carloads and intermodal units last week, down 4.7% compared to a year ago, with a slight gain in carloads offset by a steep decline in intermodal traffic.

- The federal government will begin reviewing possible logistics congestion caused by ultra-long railroad trains. Recently, a grain elevator in North Dakota claimed the longest train in U.S. history at more than 1.6 miles.

- The federal government is reviewing the impact of precision scheduled railroading, likely an attempt to get ahead of regulatory concerns relating to the proposed merger of Canadian Pacific and Kansas City Southern.

- The EU is considering relaxing state-aid rules to allow for the funding of new chip plants in a bid to ease shortages throughout the bloc.

- Ford and GM are looking to produce their own computer chips after years of shortages, with both automakers recently announcing new ties with some of the biggest names in semiconductors.

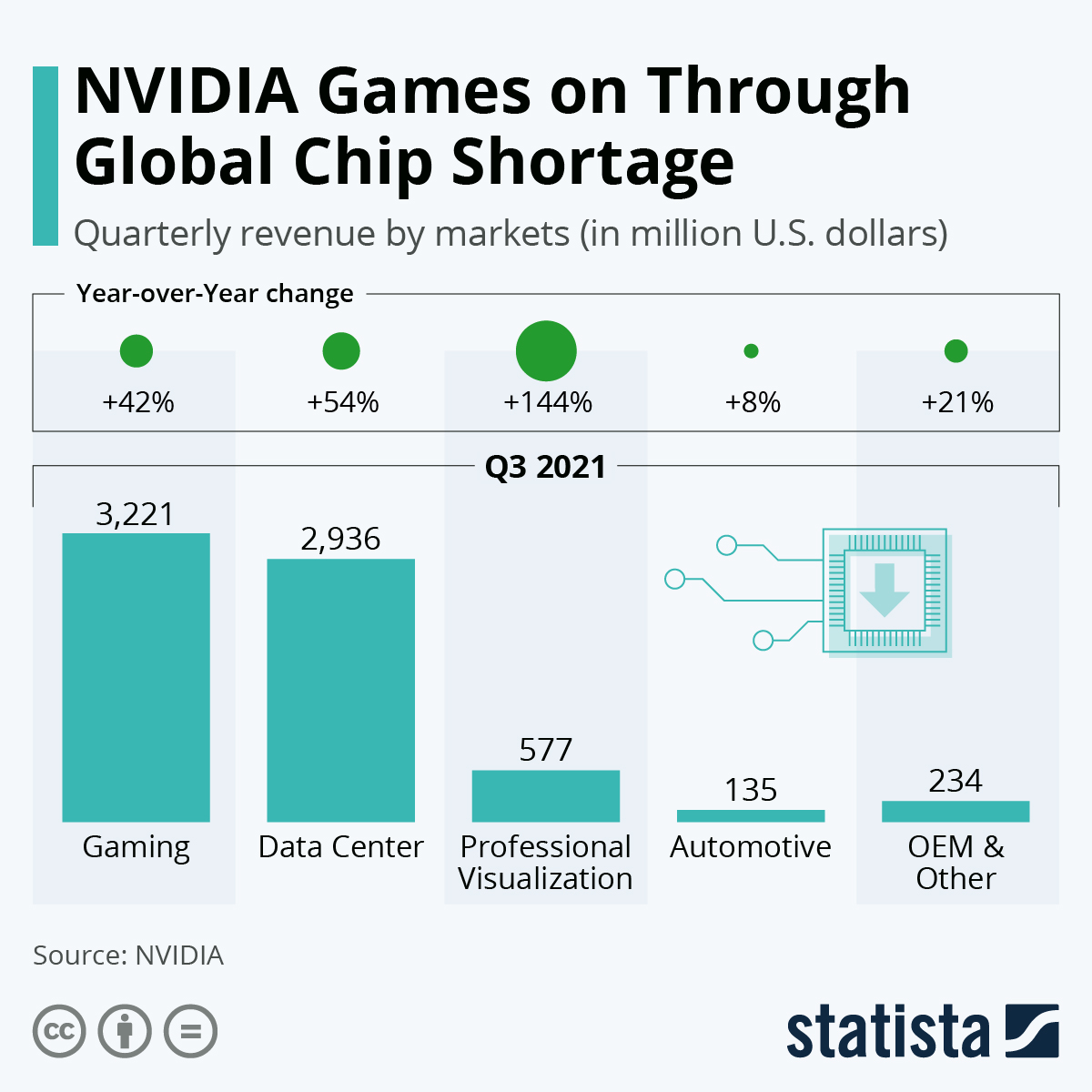

- Stocks of chipmakers Nvidia, Qualcomm and AMD are all up more than 30% the past month, with analysts expecting their collective earnings to be up 56% in the third quarter from a year ago.

- Walmart will begin drone deliveries of select health and wellness products in the 6,000-person town of Pea Ridge, Arkansas.

- Kroger unveiled a new collaborative cloud tool to help consumer products companies improve demand planning by adding visibility to supply chains.

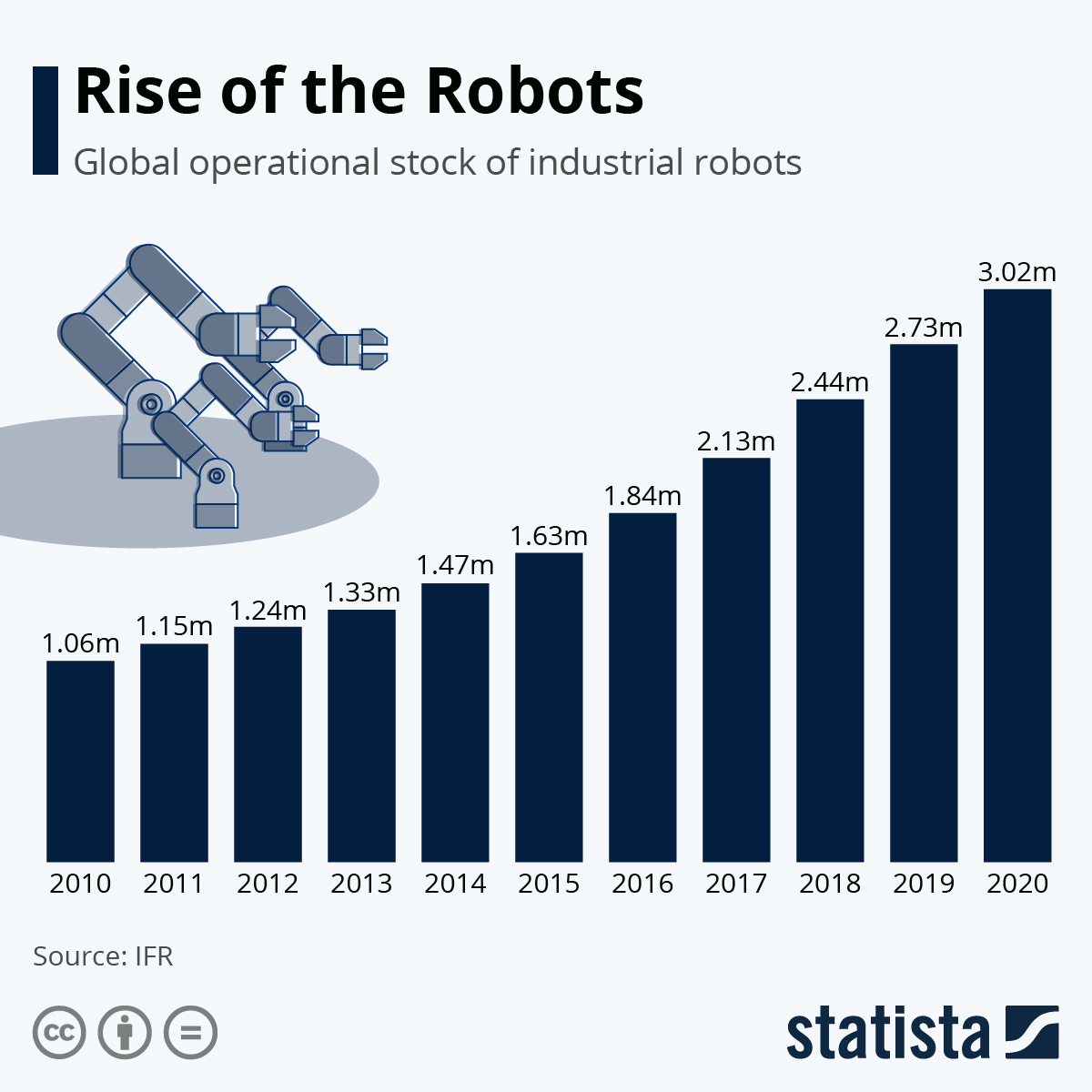

- A record 3 million industrial robots are operating in factories around the world, a 10% increase this year driven by growth in China.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The U.S. reported 109,578 new COVID-19 infections and 1,262 virus fatalities Thursday.

- Michigan continues to lead the nation for new COVID-19 cases, with a rate of 504 infections per 100,000 residents the past seven days.

- COVID-19 cases in Minnesota are up 47% in the past week, with virus hospital admissions up 24% and ICU units near capacity at some hospitals.

- Rising COVID-19 cases in Boston are forcing some hospitals to airlift patients to neighboring states. On Thursday, Massachusetts and Utah became the latest states to expand booster dose eligibility to anyone over 18.

- The overwhelming number of COVID-19 cases and deaths in Missouri have come from unvaccinated people and people with only one shot of the vaccine, new data shows.

- Florida’s governor signed legislation that imposes per-violation fines of $10,000 for small businesses and $50,000 for larger enterprises that enforce COVID-19 vaccine mandates. It was one of four new state laws passed relating to vaccines and face masks.

- Over 10% of U.S. children aged 5 to 11 have received their first doses of COVID-19 vaccines.

- Roughly one-third of U.S. hospital workers have yet to be vaccinated against COVID-19, the CDC said.

- Up to 1.6 million Americans lost their sense of smell for more than six months after contracting COVID-19.

- The U.S. will pay $5.3 billion for 10 million doses of Pfizer’s COVID-19 antiviral pill awaiting regulatory approval.

- The House of Representatives passed the $1.75 trillion Build Back Better Act, which now goes to the Senate for approval.

- The market for industrial real estate grew at the fastest rate since 2008 in the third quarter, with occupancy increasing by more than 500 million square feet year over year.

- The TSA expects 20 million air passengers traveling for Thanksgiving, still well short of the pre-pandemic level of 26 million in 2019.

- Cash-back credit card issuers are offering an average of 1.11% per dollar spent, the highest level in a decade, to encourage more consumer borrowing after Americans reduced debt during the pandemic.

- CVS Health announced the closure of 900 retail stores over the next three years as it focuses more on e-commerce operations.

- Macy’s is considering spinning off its e-commerce operations after reporting strong quarterly growth Thursday. Recently, the retailer announced plans for a new online marketplace through its website for third-party sellers.

- Starbucks partnered with Amazon for their first jointly operated grab-and-go store in New York City, as both companies capitalize on a pandemic-induced rise in takeout services.

- Ford announced plans to produce 600,000 electric vehicles per year over the next two years, doubling original production targets.

- Apple’s first fully autonomous electric vehicle could go to market in as little as four years, new reports suggest.

- GM’s fledgling commercial electric-vehicle unit secured an order for 5,400 vehicles from Merchants Fleet, a business and government vehicle lessor.

International Markets

- A new variant of the COVID-19 Delta strain, AY.4.2, now accounts for 12% of new cases in the U.K., though researchers say it is less likely to cause symptoms. The nation reported 46,807 new infections Thursday, the most in a month, alongside 199 virus deaths.

- Germany reported more than 65,000 new COVID-19 cases Thursday, its second record in as many days, with infections in some parts of the nation rising 14-fold over the past month and the head of Germany’s disease control agency declaring a “nationwide state of emergency.” Several regions are reimposing strict lockdowns, a rising trend among European nations.

- The Netherlands reported 20,829 new COVID-19 infections Wednesday, its second straight day of cases topping 20,000, but will keep schools open despite all-time highs for new cases in children as young as 4.

- Austria became the first EU nation to reimpose a full lockdown amid rising COVID-19 infections and is mandating vaccines for all eligible citizens by February.

- Slovakia will impose new COVID-19 restrictions on unvaccinated people as the nation’s healthcare system overflows with virus patients.

- Russia registered a record number of COVID-19 fatalities for the third day in a row.

- Half a million people in Poland were forced to quarantine due to COVID-19 exposure, with the nation reporting more than 24,000 new cases the past two days.

- Greece will bar unvaccinated people from all public indoor spaces starting next week to help combat rising COVID-19 infections.

- Hungary is mandating COVID-19 booster shots for all healthcare workers.

- Italy made its first large purchase of new COVID-19 antiviral pills developed by Merck and Pfizer.

- Britain’s AstraZeneca says its COVID-19 antibody drug offers 83% protection from the virus for six months, as it plans to price the drug commercially in contrast to its nonprofit vaccine scheme.

- The Philippines authorized the U.S. pharmaceutical company Novavax’s COVID-19 vaccine for anyone over 18, the ninth vaccine approved in the nation.

- Hong Kong will allow quarantine-free travel to mainland China starting the first week of December, sooner than originally planned.

- Japan will allow up to 5,000 international travelers to enter the country per day starting Nov. 26, up from 3,500 per day currently.

- Japanese lawmakers approved a $490 billion pandemic recovery package, including direct cash payments to most small families and smaller companies. More than $880 million in additional funding will go to domestic suppliers of electric-vehicle batteries.

- Analysts expect a global shortage of up to 4 billion needles through the end of 2022 after India announced it would halt syringe exports to boost its domestic vaccine drive.

- India economists expect the economy to grow a better-than-expected 7.5% next year on higher exports, retail sales and power demand.

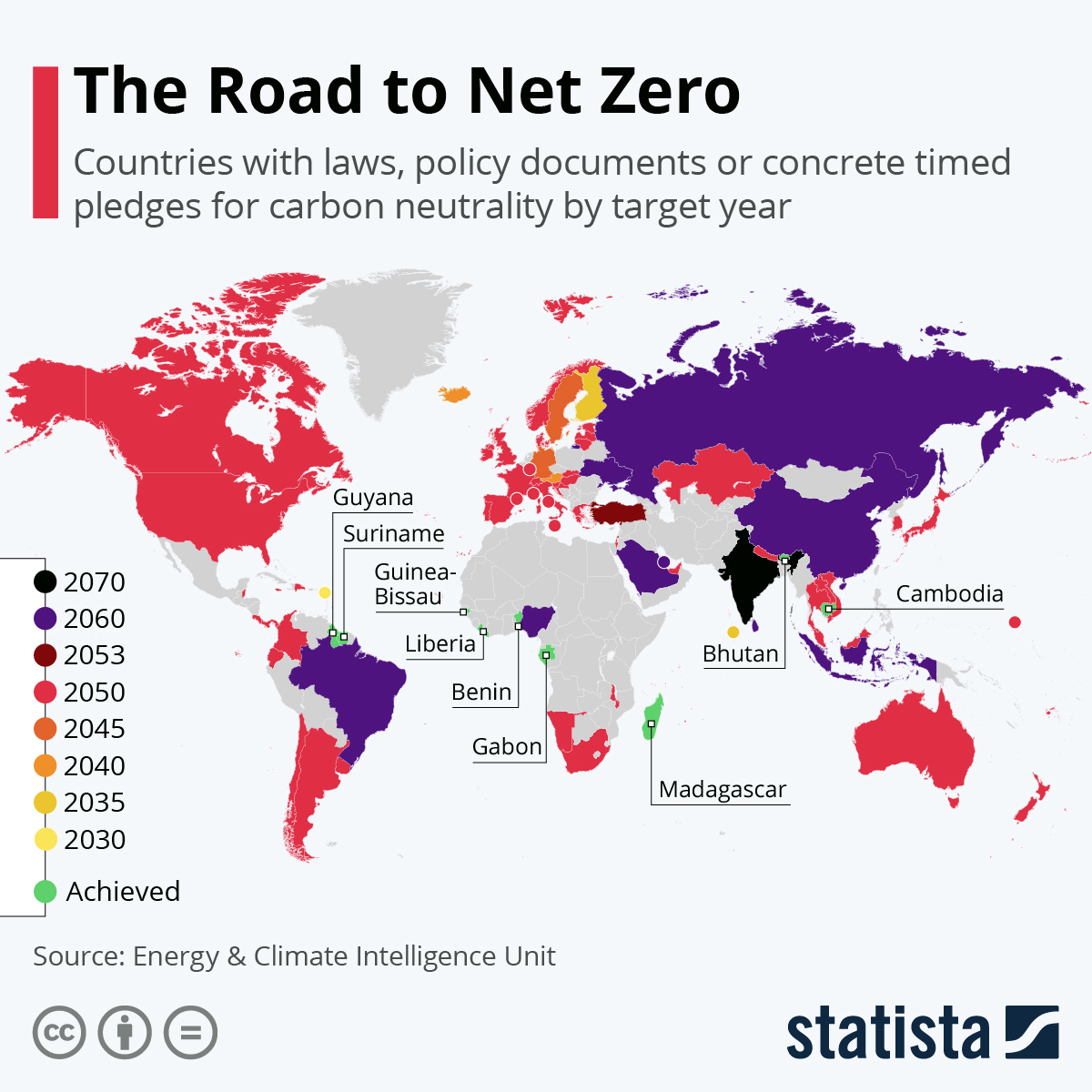

- Moody’s estimates that G20 financial firms have nearly 20% (roughly $22 trillion) of their portfolios tied to carbon-intensive industries, as growing net-zero pledges from governments spur action in the financial and industrial sectors:

- Mercedes’ parent Daimler plans to manufacture its first in-house electric motor at a plant in Berlin, which the company expects could boost the average range of electric vehicles up to 7%.

- The Suez Canal Authority is reviewing at least three proposed green hydrogen projects submitted by global clean energy alliances.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.