COVID-19 Bulletin: October 12

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices jumped to multi-year highs Monday, rising over 1.5% amid a global energy crisis that has spurred power and gas shortages in several nations.

- Oil futures were steady in late morning trading, with WTI up slightly at $80.71/bbl and Brent down slightly at $83.50/bbl. U.S. natural gas futures were up 1.6% at $5.43/MMBtu.

- Oil prices are on track to outpace copper prices this year by the largest amount since 2002 and are topping an index of raw material prices by the biggest margin in more than a decade.

- Citigroup expects oil prices to rise to $90/bbl this winter as inventories drop to their lowest levels on record, a result of increased demand from more industries switching from high-priced natural gas to oil.

- Utility companies in New York and New England are warning that surging global natural gas prices will lead to higher heating bills this winter.

- Natural gas demand in the EU’s industrial sector in October was 12% below pre-pandemic levels as companies cut usage in response to surging prices.

- Saudi Aramco agreed to cut prices and supply additional crude to several Asian buyers in November as consumers begin switching to oil for more power generation.

- China’s gasoil exports in October are expected to be down 47% from September due to soaring domestic prices and tight export quotas.

- China-based ENN Natural Gas inked a 13-year deal to purchase LNG from U.S.-based Cheniere Energy starting July 2022.

- Japan’s Eneos (formerly Nippon Oil) announced plans to buy Japan Renewable Energy for $1.8 billion in a bid to expand its low-carbon business.

- Chevron set a target to cut operational emissions to net-zero by 2050.

- Exxon will build a 500,000-ton-per-year advanced recycling facility in Baytown, Texas, one of the largest in the country, slated to begin production in late 2022.

- Qatar’s state-owned petroleum company, Qatar Petroleum, is changing its name to Qatar Energy to highlight a focus on energy efficiency and environmentally friendly technology.

- Italian energy infrastructure company Snam has launched a new program aimed to invest and provide support to startups working on new hydrogen projects.

- Spanish major Repsol produced renewable hydrogen using biomethane as raw material for the first time, a process that could significantly reduce carbon emissions in the fuel manufacturing process.

- An additional 24 countries have signed onto a U.S.- and EU-led effort to lower methane emissions 30% by 2030.

- U.S. shale producer APA announced it has ended routine gas flaring at its onshore operations.

- Building and operating the emerging U.S. offshore wind industry could be worth $109 billion to businesses in its supply chain over the next 10 years, analysts predict.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Southern California’s Huntington Beach reopened Monday following last week’s offshore oil spill.

- California utilities are again warning of preemptive power cuts ahead of expected high winds in the coming days that will increase the chance for wildfires.

- Import volume grew 11% in August at the ports of New York/New Jersey, Virginia, Charleston and Savannah, as congestion on the West Coast forces shippers to seek alternatives.

- Nearly 80,000 shipping containers are stacked on the docks of the Port of Savannah, a 50% increase over normal levels, while some ships are waiting nine days before getting a spot to dock.

- U.S. ports are expected to process 4 million more TEUs by the end of the year compared to 2020, a number that would be even higher but for persistent supply chain disruptions.

- Russia is hoping to start shipping year-round via the Northern Sea, which passes through the Arctic Ocean, with forecasts that the route will become a major shipping lane by 2023.

- China’s Cosco Shipping will debut its new Transpacific BCO Express Line later this week, opening two new trade routes to Los Angeles and Prince Rupert, Canada, in a bid to improve schedule reliability.

- North American PC shipments dropped by 9% compared to the same time last year, largely a result of supply chain problems dragging down market growth following record demand levels reached in 2020.

- Car sales in China dropped 17% in the third quarter from a year ago, the first decline in more than a year due to continued effects of the global chip shortage.

- JPMorgan’s chief executive forecasted that supply chain disruptions hampering economic growth will be erased as early as 2022 due to high levels of consumer spending, currently around 20% more than pre-pandemic levels.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The U.S. reported 116,202 new COVID-19 infections and 1,182 virus fatalities Monday.

- The U.S. administered more than 7 million COVID-19 vaccine doses last week, the most since July.

- The surge of COVID-19 infections driven by the Delta variant may be starting to wane, with new infections throughout the U.S. dropping by 22% over the last two weeks, while hospitalizations have dropped 20%. The decline prompted the White House’s top medical adviser to say families can safely trick-or-treat outdoors for Halloween this year.

- Hundreds of thousands of U.S. troops have yet to be vaccinated against COVID-19 despite the military’s imminent deadline for getting the shots. In contrast, data shows that most U.S. employees in the private sector are complying with vaccine mandates.

- Michigan is one of a handful of U.S. states seeing an uptick in COVID-19 cases, with its seven-day average at 3,541 as of last Friday, while hospitalizations from the virus have been steadily rising since August.

- Chicago’s mayor will allow the city’s public workers to opt out of a COVID-19 vaccine mandate through the end of the year, provided they get regular virus tests.

- The governor of Texas, which currently leads the nation in average daily COVID-19 deaths, issued an order prohibiting “entities” in the state from enforcing vaccine mandates, setting up a clash with a pending federal vaccine/testing mandate for businesses with more than 100 employees.

- California’s COVID-19 death toll since the start of the pandemic crossed 70,000 Monday.

- Florida’s COVID-19 positivity rate dropped below 5% Friday for the first time since July.

- Teaching vacancies in Florida have surged to 5,100 since the beginning of the school year, as pandemic stress and low pay drive teachers from their jobs.

- A new trial shows that AstraZeneca’s antibody cocktail halves the risk of severe illness or death in people suffering from mild or moderate COVID-19.

- The FDA will meet Thursday and Friday to discuss authorizing COVID-19 booster doses to recipients of Moderna and Johnson & Johnson vaccines.

- Ambulance service providers are “hemorrhaging” workers, threatening service cuts and long waits for 911 systems.

- Several studies over the past year show that stressors caused by the pandemic could lead to a rise in heart disease among women.

- Goldman Sachs downgraded its outlook for the U.S. economy, lowering its growth projection from 6.0% to 5.6% for this year and from 4.4% to 4.0% in 2022, citing expiring relief programs and weaker consumer spending.

- U.S. House lawmakers are set to vote on a short-term increase to the government’s borrowing limit today, potentially averting another showdown on debt and spending in less than two months.

- Southwest Airlines flight cancellations stretched into their fourth day Monday, with roughly 10% of flights cut due to staffing shortages and bad weather.

- Roughly 36% of workers in 10 major U.S. cities were back in the office last week, the highest level since the start of the pandemic.

- Amazon updated its return-to-office plans, allowing individual teams to decide how many days corporate employees will be required to be at the office during the week while mandating all employees live within commuting distance.

- A growing number of millennial homebuyers are pooling their finances with partners, friends or roommates to purchase houses as home prices surge.

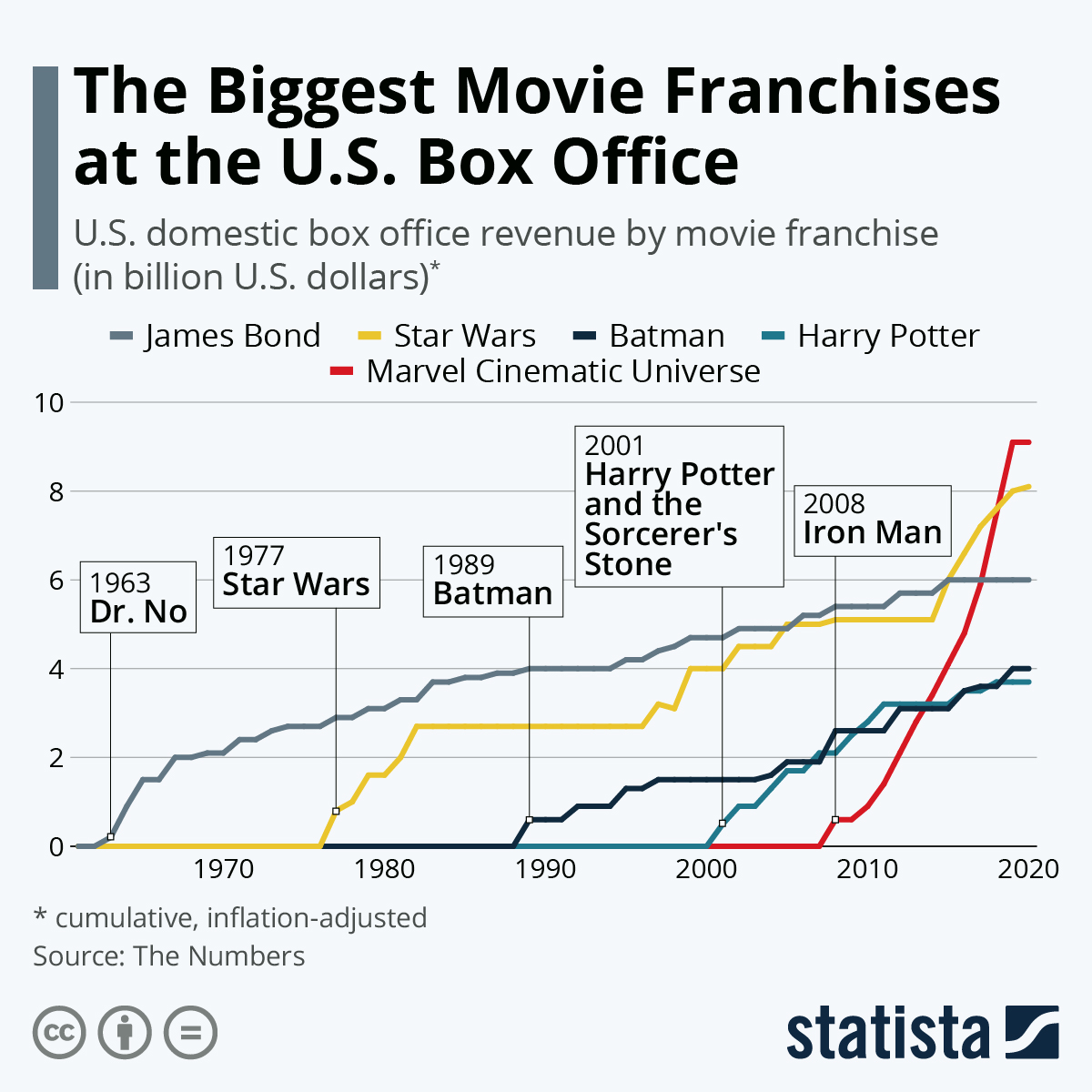

- The pandemic continues to cause uncertainty in box office returns, with the most recent installment of the James Bond franchise pulling in a muted $56 million in its debut weekend.

International Markets

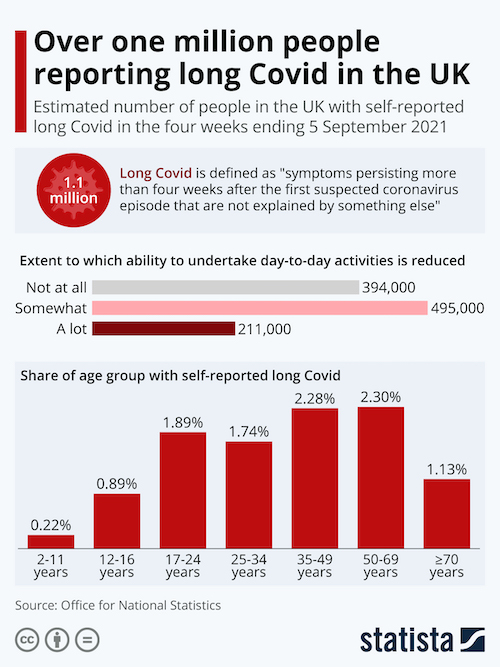

- The U.K. surpassed 40,000 new COVID-19 infections Monday for the first time since July. Rough estimates show more than 1 million people in the nation are suffering from long-haul COVID-19 symptoms.

- Nearly 20% of critically ill COVID-19 patients in England are unvaccinated pregnant women.

- Mexico’s Health Ministry reports that COVID-19 infections in the country so far this month are down 43% and deaths are down 24%.

- Tokyo reported just 49 new COVID-19 cases Monday, marking the third consecutive day of low infection numbers in Japan’s capital.

- Hong Kong officials are waiting to see a rise in COVID-19 vaccination rates before loosening travel restrictions, a contrast to other Asian nations that have begun reopening borders amid a decline in infections.

- Thailand is scrapping its mandatory COVID-19 quarantine requirements for fully vaccinated travelers from 10 low-risk countries, including the U.S., starting Nov. 1.

- New Zealand announced a COVID-19 vaccine mandate for teachers and healthcare workers after the nation extended pandemic restrictions in Auckland, its largest city, by another week.

- Germany has stopped offering free rapid COVID-19 antigen tests, hoping to spur vaccine uptake among its hesitant population.

- Indonesia further eased its COVID-19 restrictions, allowing travelers from 18 other countries to enter the nation and cutting quarantine protocols from eight to five days.

- The World Health Organization is recommending that all immunocompromised people receive a booster dose of an authorized COVID-19 vaccine.

- A new French study of more than 22 million people found that being vaccinated against COVID-19 reduces the risk of hospitalization or dying from the virus by 90%.

- The COVID-19 vaccine developed by Pfizer/BioNTech is the world’s most sought-after jab, with the manufacturer having shipped over 1.6 billion doses to 130 countries since the start of the pandemic.

- New research from the U.K. has identified a possible genetic link between Alzheimer’s disease and severe COVID-19 infection.

- Debt from the world’s low-income countries climbed to a record $860 billion in 2020, as the pandemic caused major financial problems and spurred the creation of large stimulus packages. The pandemic has also put an estimated 100+ million people into poverty, the United Nations says.

- A new government report from India warns that volatile prices for crude oil, edible oils and metal products pose concerns for the country’s economic growth.

- Passenger numbers at London’s Heathrow airport were just 38% of pre-pandemic levels in September, driven mostly by a decline in traffic from North America.

- Volkswagen will decide on the location of its planned battery cell plant in Eastern Europe in the first half of 2022.

- Despite ongoing struggles to raise funding, China’s Evergrande New Energy Vehicle Group is planning to start building electric vehicles next year.

- Tesla aims to deliver its first group of vehicles from a new factory in Berlin in December, with plans to build up to 10,000 vehicles per week next year.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.