COVID-19 Bulletin: October 29

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- U.S. crude benchmark WTI rose slightly Thursday with OPEC and its allies expecting tight global supplies in the fourth quarter. Futures were higher in morning trading today, with WTI up 0.4% at $83.12/bbl and Brent up 0.1% at $84.41/bbl. U.S. natural gas was 4.8% lower at $5.51/MMBtu.

- The average price for gas in the U.S. rose 3 cents on the week to $3.40/gallon, up $1.25 compared with the same time last year.

- Refining margins rose above $16/bbl yesterday, the highest in nearly five years.

- U.S. coal stocks ended the month of August at their lowest level since at least 1997, down 13.2% compared with July levels.

- Chevron returned to profitability in the third quarter and registered record-high free cash flow. Exxon Mobil also reported strong quarterly results and positive cash flow.

- Shell’s chief executive defended the oil major’s business model Thursday, setting up a showdown with an activist investor calling for a breakup of the company to improve its environmental and financial performance.

- European gas futures slid almost 10% Thursday after Russia announced it would pump more gas to Germany and Austria, erasing fears that the continent could run low on the vital fuel this winter.

- Gasoline prices in the U.K. rose to an all-time high Thursday, breaking a previous record from 2012.

- Gas stations in China have started limiting diesel sales as supplies tighten alongside record-high prices for coal and natural gas.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Maersk, MSC and ZIM will temporarily halt calls to the Port of Seattle due to growing congestion.

- Oregon’s Port of Coos Bay will acquire the former Georgia Pacific Mill site to return it to use as a cargo-handling base.

- Global Container Terminals is adding a berth at its Bayonne, New Jersey, terminal capable of handling ultra-large containerships.

- Trucking companies have begun cannibalizing parts from their own vehicles for maintenance due to rising shortages.

- Delivery times for semiconductor chips in October increased one day to about 21.9 weeks, the smallest rise in nine months, signaling that shortages may be finally easing. Delivery times are nearly double the pre-pandemic average of 9-12 weeks, while anecdotal evidence suggests buyers are hoarding products.

- Production at Volkswagen and Stellantis, the two largest European carmakers, fell a respective 35% and 30% in the third quarter on continued effects of the global chip shortage.

- The semiconductor shortage has forced Phillip Morris to prioritize existing customers over new ones for its IQOS heated tobacco devices.

- Industrial real-estate giant Prologis expects supply-chain disruptions to last into 2023, more dire than many forecasts that suggest global pressures should ease next year.

- The European Central Bank estimated the bloc’s exports would have been almost 7% higher in the first half of the year without supply chain bottlenecks.

- Chinese officials are predicting a sharp slowdown in domestic e-commerce growth over the next five years on an expected slowdown in consumer spending and broader economic deceleration. The nation’s zero-tolerance approach to COVID-19 has contributed to disruptions.

- The U.S. dairy cow herd is shrinking at the fastest pace in 12 years because of higher feed costs, likely leading to higher prices for butter, milk and other products.

- Luxury apparel retailer Neiman Marcus saw a 6% gain in third-quarter revenue despite reducing inventory 21% from a year ago.

- Ship owner Costamare more than quadrupled net profit to $115.2 million in the third quarter on a doubling of voyage revenue from a year ago.

- Third-quarter net profit at Class I freight railroad Norfolk Southern jumped 32% to $753 million, with revenue per unit rising 14%.

- Less-than-truckload carrier Old Dominion Freight Line saw a 42% rise in third-quarter net income to a record $286.6 million on a 32.3% gain in revenue.

- Logistics firm Ryder is acquiring Midwest Warehouse & Distribution, an Illinois-based provider of warehousing, distribution and transportation for food and consumer goods companies.

- Truck-engine maker Navistar has agreed to pay a $52 million civil fine to resolve a Justice Department probe over its emissions.

- Supply chains, which account for roughly 80% of the world’s total carbon emissions, will require as much as $100 trillion of investment to reach net-zero emissions by 2050, new data shows.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The U.S. is averaging roughly 70,000 new COVID-19 cases per day, a 20% drop over the past two weeks and a 57% drop since Sept. 1. The nation reported 99,384 infections and 1,776 virus deaths Thursday.

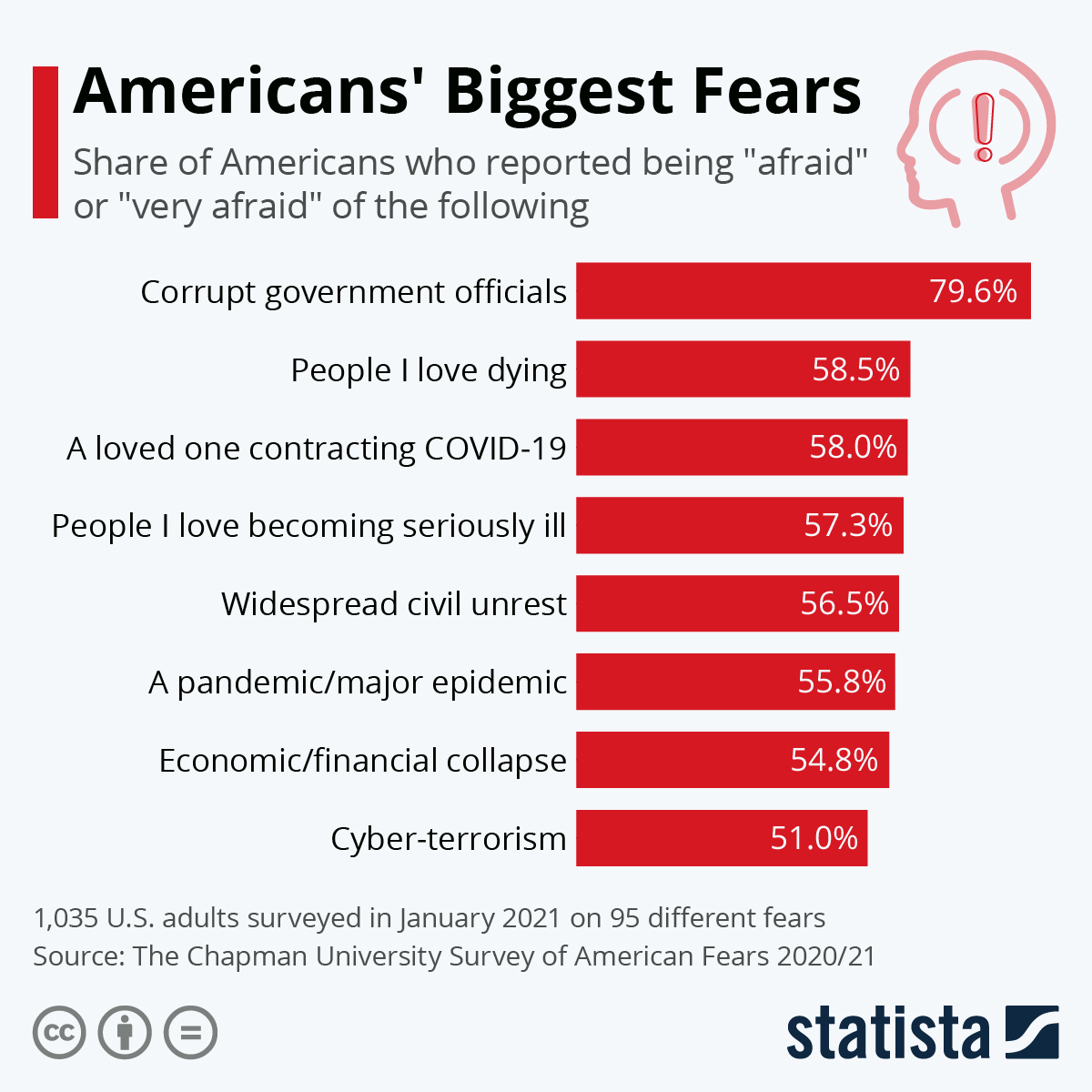

- Most Americans rank their third-biggest fear as a loved one contracting COVID-19, consistent with data showing a near 40% risk of infection to members of the same household.

- Arizona officials say COVID-19 has been the leading cause of death in the state since March 2020.

- California is readying more than 4,000 sites to vaccinate children ages 5 to 11 against COVID-19 in the first week of the shots’ approval, expected next week.

- Vaccinated people over 80 who were infected with breakthrough cases of COVID-19 were less likely to die from the virus than unvaccinated people under 50, new data shows.

- After exploring whether existing COVID-19 vaccines need to be reformulated to fight variants like Delta, top White House health officials have decided that the current mix of vaccines and boosters will provide sufficient protection for the foreseeable future.

- Millions more Americans became eligible for COVID-19 booster shots after the CDC this month added mental health conditions to the eligibility criteria.

- Citigroup is the first major U.S. bank to require all employees to be vaccinated against COVID-19 by the federal government’s Dec. 8 deadline.

- Roughly 5% of unvaccinated adults say they have left a job due to COVID-19 vaccine mandates.

- A New York City judge denied the police union’s request to temporarily halt enforcement of the city’s COVID-19 vaccine mandate by today’s deadline. More than 10,000 of the city’s 35,000 police officers had yet to get shots as of Thursday.

- Merck raised its financial outlook on projections of $7 billion in sales of an as-yet unapproved antiviral pill that could be taken to fight COVID-19 from home.

- Merriam-Webster is adding “ghost kitchen” and “curbside delivery” to its dictionary in a nod to pandemic-induced changes in the dining industry.

- Consumer spending rose 0.6% in September month over month, slower than the 1% gain in August, while personal income fell 1% on the expiration of pandemic unemployment benefits.

- The U.S. economy expanded at its slowest pace in over a year in the third quarter, with GDP rising just 2% compared to projections of 2.6% on rampant COVID-19 cases and supply chain disruptions.

- Some 66% of S&P 500 companies have beaten expectations for earnings and revenue in the third quarter so far, sending U.S. stock indexes to record closes Thursday.

- The White House released a $1.75 trillion social-spending and climate framework Thursday, pitching the still-developing package in a bid to encourage other lawmakers to move quickly on a separate, $1 trillion infrastructure bill. The bills missed a vote planned for Thursday evening as negotiations continue.

- Uncertainty over the White House’s potential switch-up of Federal Reserve leadership is complicating the central bank’s looming decisions on phasing out pandemic measures, including monthly asset purchases and extremely low interest rates.

- Despite recording a 15% year-over-year sales increase in the third quarter, Amazon’s growth was the slowest in at least seven years, with the company citing a cooldown in online shopping and rising labor costs that are expected to further impact results through the holiday quarter.

- Even with $6 billion of costs from supply chain disruption, Apple posted a respective 29% and 62% jump in third-quarter sales and profits from the same time last year, slightly below analyst estimates.

- A 30% gain in construction sales boosted Caterpillar’s quarterly revenue by 25% to $12.4 billion, just shy of analyst estimates.

- Higher third-quarter sales at Boeing were undercut by $183 million in lost revenue due to production disruption of its Dreamliner 787 jet.

- Facebook is renaming itself “Meta” as it shifts to an emerging computing platform focused on virtual reality, where people and businesses can gather and communicate in virtual environments.

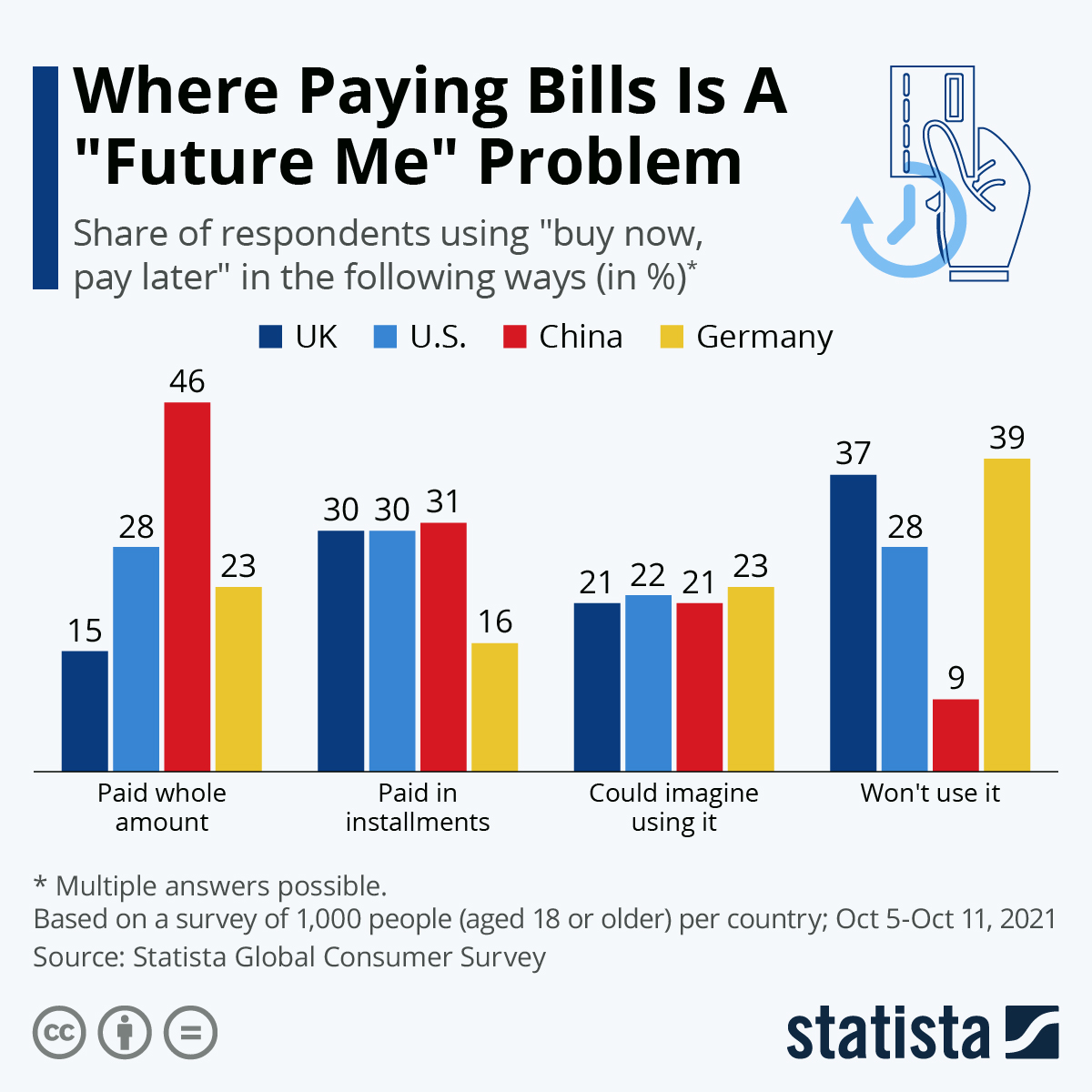

- “Buy now, pay later” offerings are rising in popularity among banks, drawing increased scrutiny from federal regulators who say the practice makes debt easy to incur and forget about.

- The return of international travelers to the U.S. is predicted to add billions of dollars in American retail sales for the remainder of 2021.

International Markets

- Global COVID-19 cases and deaths are rising for the first time in two months as the virus surges across Europe, facilitated by extremely low vaccination rates in the continent’s eastern nations.

- Hospitals in Germany reported a 40% increase in occupied hospital beds and a 15% rise in ICU patients compared to a week ago, with officials warning of likely cuts to services.

- Russia reported all-time highs for new COVID-19 infections and deaths on Thursday, with officials in Moscow ordering all non-essential services to shut down until Nov. 7.

- The U.K. reported 39,478 new COVID-19 infections and 166 virus deaths Thursday, as data from the nation’s virus tracking app suggests the most recent wave is much bigger than official numbers. The nation’s prime minister has begun wearing a face mask in the halls of parliament for the first time in months.

- Despite rising infections globally, COVID-19 cases across Central and South America are declining, with last week seeing the region’s lowest death and infection rates in over a year.

- Canada’s British Columbia province is suspending surgeries and denying access to diagnostic appointments due to the loss of more than 4,000 healthcare workers who failed to get COVID-19 vaccines by yesterday’s deadline.

- South Korea’s single-day COVID-19 infections topped 2,000 Thursday for the first time in 20 days.

- The financial and tech hub of Singapore reported more than 5,000 single-day COVID-19 cases for the first time during the pandemic.

- Australia is the latest nation to recommend COVID-19 vaccine boosters for its population.

- Fewer than 10% of Africa’s 54 nations are expected to hit a year-end target of fully vaccinating 40% of their populations, the World Health Organization says.

- Ireland has been ranked the best country in the world for handling the COVID-19 pandemic with the least social and economic upheaval.

- The European Central Bank plans to keep its key interest rate in negative territory for at least another year despite surging inflation in the euro zone, a contrary outlook to the U.S. Federal Reserve’s looming phaseout of easy-money policies.

- Top Chinese officials said they have no plans to open borders and abandon the nation’s zero-tolerance approach to COVID-19 despite increasing isolation of the world’s second-largest economy.

- Junk-bond issuance by China’s riskier companies has nearly halted, as financial crisis looms over the nation’s $40 billion of real estate debt that must be rolled over by the end of next year.

- Taiwan’s economy grew a slower-than-expected 3.8% in the third calendar quarter, with domestic spending softening due to COVID-19 and exports remaining strong.

- Eurozone GDP jumped at an annual pace of 9.1% in the third calendar quarter, significantly faster than the economies of the U.S. and China.

- Migration to rich countries plummeted by a third last year, the largest drop since records began in 2003, as the pandemic closed many businesses and borders.

- Saudi Arabia’s state-owned mining company plans to significantly boost investments in exploring for lithium and nickel over the next two decades, as the nation positions itself to become a major supplier of battery materials for the electric vehicle market.

- Governments currently plan to allocate roughly $470 billion for clean energy investment by the end of the decade, up 20% compared to funds in the pipeline in July.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.