COVID-19 Bulletin: September 1

More news relevant to the plastics industry:

Some sources linked are subscription services.

Hurricane Ida

- Hurricane Ida moved northeast into Mississippi, Alabama, parts of Florida and Tennessee Tuesday and is forecast to continue northward, threatening floods and tornadoes up through Massachusetts.

- Ida’s death toll has risen to at least four, with more than 1 million Gulf Coast residents still without electricity and officials saying it could take up to a month to restore power to hard-hit areas in Louisiana and Mississippi.

- Roughly half of New Orleans’ population, about 200,000 people, remain in the city, battling brutal August heat and widespread power outages. A heat advisory up to 106°F will remain in effect today for southern Louisiana and Mississippi.

- Health officials are concerned that Ida’s impact could worsen Louisiana’s COVID-19 outbreak, where just 41% of residents have been vaccinated against the virus. Facility damage and power outages have forced many hospitals to evacuate patients to other states.

- Truck drivers diverted to deliver relief supplies to battered areas are expected to further disrupt backlogged supply chains.

- Early forecasts suggest the storm could cost as much as $15 billion in insured losses.

- It appears the petrochemicals sector escaped catastrophic damage from the storm:

- Analysts expect it could take two to three weeks to restart oil production and fully resume operations at Louisiana’s refineries.

- Colonial Pipeline, the U.S.’s largest fuel line, restarted its main gasoline and distillate lines Tuesday.

- Exxon reports that its facilities suffered no major damage, and it expects only short-term shipment delays due to logistics challenges from the storm.

- LyondellBasell reports that its Lake Charles, Louisiana, facility suffered no production disruptions for PE and PP products, but that rail disruptions could cause shipment delays.

- Our sources indicate the Port of New Orleans will remain closed today.

- Kansas City Southern could not predict when traffic might resume on its main rail line through Louisiana as it assesses damage, warning that gridlock in the region could disrupt rail transportation nationally.

Supply

- Oil prices were lower ahead of OPEC’s meeting today to agree on production targets for the rest of the year. In late morning trading, WTI was down 1.0% at $67.73/bbl and Brent was off 1.1% at $70.86/bbl. Natural gas was 5.0% higher at $4.59/MMBtu.

- OPEC oil output rose to 26.9 million bpd in August, its highest level since April 2020 and a 210,000-bpd increase from July. The cartel anticipates tight supplies through May 2022.

- The White House is reviewing its policy for renewable projects on federal lands following strong stakeholder efforts this year to lower leasing rates and fees.

- BP and Royal Dutch Shell are among the largest trading houses shifting focus from volatile oil and natural gas markets to the emerging carbon-trading market.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Wildfires continue to make news:

- California’s Caldor Fire edged closer toward Nevada, expanding to 191,607 acres with just 16% containment as South Lake Tahoe’s evacuation orders expanded to 50,000 people.

- The Dixie Fire, California’s largest ever, surpassed 800,000 acres Tuesday with 48% containment.

- After spreading wildly Monday afternoon, California’s Chaparral Fire is about 50% contained.

- Minnesota’s Greenwood Fire has consumed 26,000 acres with 37% containment Tuesday.

- Canadian National Railway’s $30 billion bid to acquire Kansas City Southern was halted yesterday following a regulatory ruling from the Surface Transportation Board, which said a temporary voting trust crucial to the offer violated competitive standards for major mergers.

- The German Train Drivers’ Union was set to commence a six-day strike on freight services today with plans to expand the work stoppage to passenger services tomorrow, potentially crippling rail traffic in the country.

- Walmart is adding 20,000 permanent workers to its supply-chain operations ahead of the peak holiday season amid an economy-wide shift to e-commerce.

- Autonomous vehicle startup Gatik is scaling up its fleet of self-driving medium-duty box trucks for urban areas, opening a new hub in Fort Worth, Texas, to make deliveries for many Fortune 500 companies.

- Logistics company Schneider National has ordered 50 battery-electric trucks from Freightliner eCascadia, the single largest purchase of zero-emission tractors to date.

- Nippon Yusen KK, Japan’s largest shipping company, plans to launch the world’s first autonomous container ship in an area with heavy marine traffic for a 236-mile voyage between Tokyo Bay and the coastal city of Ise. The company recently set an ambitious goal for half of all domestic ships to pilot themselves by 2040.

Domestic Markets

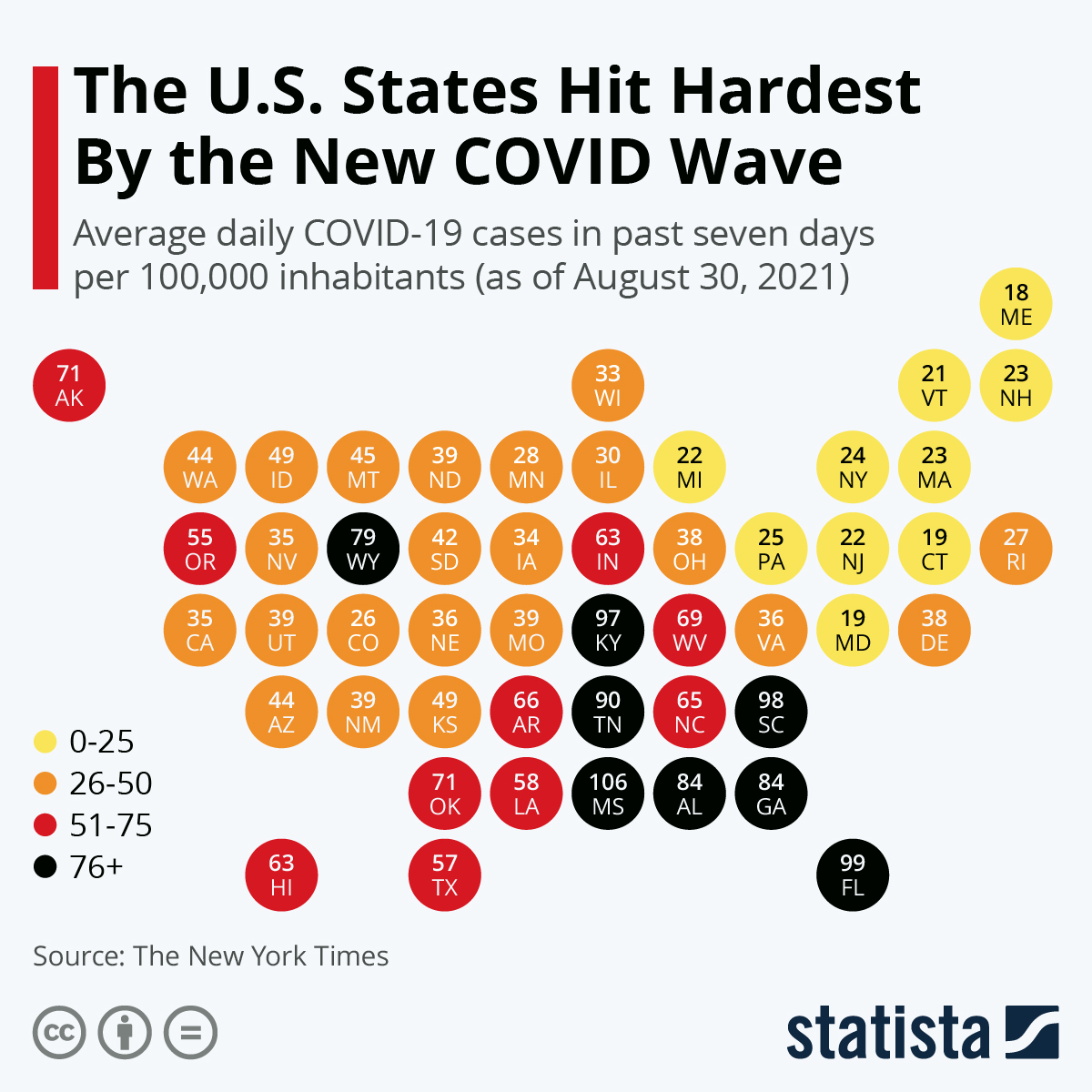

- The U.S. reported 140,704 new COVID-19 cases and 1,397 virus fatalities Tuesday.

- A new poll suggests COVID-19 vaccine hesitancy may be dropping, with only 1 in 5 Americans now saying they are unlikely to get shots. Roughly 14 million Americans received their first dose of a COVID-19 vaccine in August, up from about 10 million in July.

- Alabama, Georgia, Texas, Florida and Arkansas are reporting less than 10% of available ICU bed capacity due to surging COVID-19 patients.

- California reported 14,968 new COVID-19 cases Monday, the most since January, as roughly 30% of new infections in Los Angeles are among fully vaccinated people. The state’s lawmakers rejected a bill to mandate vaccines or weekly testing for employees of all the state’s private and public employers, while roughly 80% of residents over age 12 have received at least one dose of a COVID-19 vaccine, a milestone.

- North Carolina reported 5,351 new COVID-19 cases Tuesday, pushing its seven-day average to 6,745, the highest since January.

- Florida’s daily COVID-19 fatality rate in August could be significantly understated due to a reporting change made by the state’s health department. Similarly, Tennessee’s virus hospitalizations were underreported by as much as 20% the past 14 months.

- Despite a recent court ruling allowing Florida school districts to issue mask mandates, the Florida Department of Education made good on threats to withhold funding from school districts that imposed them.

- Employees of Colorado hospitals and healthcare facilities will be required to get at least one dose of a COVID-19 vaccine by the end of September. The state is seeing an uptick in virus cases among children, prompting health officials to encourage mask-wearing and other restrictions in schools.

- Pennsylvania issued a new mask mandate for all public schools and childcare facilities amid a statewide increase in COVID-19 infections.

- COVID-19 cases among schoolchildren in Utah are 3.5 times higher than a year ago, accounting for 287 of the state’s 1,218 new infections reported Tuesday.

- A Texas school district is closing all campuses after a second teacher died of COVID-19 in just the first few weeks of fall classes.

- New York will forego a COVID-19 vaccine requirement for school employees in favor of weekly virus testing for unvaccinated people.

- AstraZeneca will require all its U.S. employees to be vaccinated against COVID-19.

- Google pushed back its return-to-office date to January 2022.

- Deutsche Bank will require anyone entering its U.S. headquarters to be vaccinated against COVID-19.

- New CDC data shows current COVID-19 vaccines continue to provide robust protection against severe disease, including from the highly transmissible Delta variant.

- Procter & Gamble is once again boosting production of consumer staples including toilet paper and paper towels, harkening back to the early days of the pandemic when essential items flew off store shelves.

- Walmart became the latest U.S. retailer prepping to administer millions of COVID-19 booster shots to Americans this fall.

- Demand for travel nurses is surging amid rising COVID-19 cases, with new data showing roughly 30,000 open positions nationwide with three-month salaries as high as $8,000 per week.

- The U.S. issued a “Level 3: Reconsider Travel” alert warning for Canada due to the country’s rising COVID-19 infections.

- U.S. consumer confidence dropped to 113.8 in August, its lowest level in six months, as rising cases of the COVID-19 Delta variant undermine spending.

- Private payrolls rose by just 374,000 in August, according to ADP, well below the expected 600,000.

- Despite the pandemic, public healthcare enrollment lowered the U.S.’s number of uninsured by 1.6 million people last year.

- Single-family home prices in the U.S. rose at their fastest pace on record in June, up 19.1% in 20 key urban markets compared to a year ago.

- The pandemic has taken a significant toll on U.S. social security reserves, with a new report showing the program’s benefits will exceed its income this year on the way to a full depletion of reserves by 2034.

International Markets

- Mexico suffered 504,158 new COVID-19 cases in August, the worst month of the pandemic.

- The U.K. saw an uptick in COVID-19 infections Tuesday, reporting 32,181 new cases compared to 26,476 Monday.

- Israel reported a record 10,947 new COVID-19 infections Monday. The nation’s booster campaign will require vaccine passport holders to get third shots of the Pfizer/BioNTech vaccine within six months of their second dose. The country is also tightening pandemic restrictions ahead of religious ceremonies this month.

- Singapore reported 147 new COVID-19 cases Monday, the seventh straight day of more than 100 infections.

- Stringent pandemic restrictions in most parts of New Zealand were eased Tuesday, while about 1.7 million people in its largest city of Auckland will remain in lockdown for another two weeks.

- As Indonesia and Thailand ease pandemic restrictions following a recent decline in infections, health officials are warning about a new wave of COVID-19 cases due to low vaccination rates in Southeast Asia.

- The EU has fully vaccinated 70% of its adult population against COVID-19, a milestone. The bloc will soon release tightened rules for American travelers after agreeing Monday to remove the U.S. from its safe travel list.

- A COVID-19 vaccine developed by the U.K.’s GlaxoSmithKline and South Korea’s SK Bioscience began late-stage clinical trials.

- India’s economy remained robust during the brutal second wave of COVID-19 earlier this year, with GDP growing more than 20% year over year in June on a near-50% boost in its manufacturing sector.

- The COVID-19 Delta variant is taking its toll on China’s services industry, with an official purchasing managers survey contracting for the first time since February 2020.

- British consumer borrowing in July dropped to its lowest levels since February, while the nation’s factory output grew at the weakest pace in six months in August due to supply chain disruptions. Industrial output also weakened in France, Germany, the rest of the eurozone economy and many Asian nations.

- South Korea’s exports rose 34.9% year over year in August on surging demand for semiconductor chips and petrochemicals, while imports rose 44% from a year earlier, the fastest growth since 2010.

- South Korea’s SK Innovation announced plans to invest more than $1 billion in a new battery factory in China, adding to the company’s production capacity for automakers including Ford, Volkswagen and Hyundai.

At M. Holland

- M. Holland will be closed Monday, Sept. 6 in observance of the Labor Day holiday.

- During last week’s Plastics Reflections Web Series event, panelists from M. Holland, BPI, LyondellBasell and MTS Logistics discussed how global supply chain complexities are impacting the plastics industry. Click here to access the recording.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.