COVID-19 Bulletin: September 8

More news relevant to the plastics industry:

Some sources linked are subscription services.

Hurricane Ida

- Hurricane Ida’s death toll increased to 67 people across eight states yesterday, with the majority in New York and New Jersey.

- Roughly 14,000 people are without homes in one Louisiana parish, with the storm damaging 75% of the area’s structures alongside a power outage forecast for the rest of the month.

- Talos Energy successfully domed an oil spill caused by Ida from an abandoned well, calling attention to the environmental risks of the estimated 18,000 miles of abandoned pipelines in the Gulf of Mexico.

- Category 3 Hurricane Larry continued its northward Atlantic path yesterday, with initial storm surges hitting the U.S. East Coast as Bermuda preps for heavy rainfall and coastal flooding. The storm is expected to brush Canada’s easternmost provinces this weekend.

Supply

- Oil prices extended Monday’s losses yesterday on further signals of tepid demand in Asia, the world’s top-importing region. The downward price pressure was muted by 79% (1.44 million bpd) of U.S. Gulf Coast production still shuttered following Hurricane Ida.

- Energy futures were higher in mid-day trading, with WTI up 1.5% at $69.39/bbl and Brent up 1.3% at $72.65/bbl. Natural gas was 7.1% higher at $4.89/MMBtu.

- Following increased pressure from climate-focused investors, Exxon will begin measuring methane emissions from a natural gas production facility in New Mexico, with potential plans to expand the initiative to other shale production areas in Appalachia and Louisiana.

- Talos Energy filed notice of dispute under the USMCA against the Mexican government for designating state-controlled Pemex as operator of the 700-million-barrell Zama field in the Gulf of Mexico.

- Mexico’s president wants to divert $12 billion recently received from the International Monetary Fund for bolstering central bank reserves to help pay down the $115 billion in debt of Pemex, the state-owned petroleum company.

- Sixty percent of plastics manufacturers report experiencing shortages of plastic resins, with consultant AlixPartners expecting tight supplies to persist for as long as three years.

- Maryland and New York are considering following Maine and Oregon in imposing extended producer responsibility laws for plastic waste.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- A powerful 7.0-magnitude earthquake hit southwest Mexico Tuesday, killing at least one and causing extensive building damage and rock falls. Some 1.6 million people were left without electricity across central Mexico.

- Authorities lifted evacuation orders for California’s South Lake Tahoe, with the 216,000-acre Caldor Fire now roughly 50% contained. The state’s Dixie Fire increased slightly to more than 917,000 acres yesterday with 59% containment, while the Monument Fire grew to 183,371 acres with 37% containment.

- Minnesota’s Greenwood Fire is now stagnant after burning 26,000 acres.

- Class 8 truck bookings in August rose to their highest levels in five months as manufacturers began accepting new orders for 2022.

- Kansas City Southern resumed merger talks with Canadian Pacific after a competing merger deal with Canadian National stalled when the Surface Transportation Board ruled against its proposed structure.

- Shipments of primary plastics processing machinery decreased for the second consecutive quarter amid continued supply-chain disruption, the Plastics Industry Association reported.

- The U.S.’s proposed $3.5 trillion infrastructure bill is headed for debate in the House Ways and Means Committee on Thursday and Friday.

- IT managers are scrambling to maintain their networks as the global semiconductor shortage has stretched lead times for some PCs as long as four months.

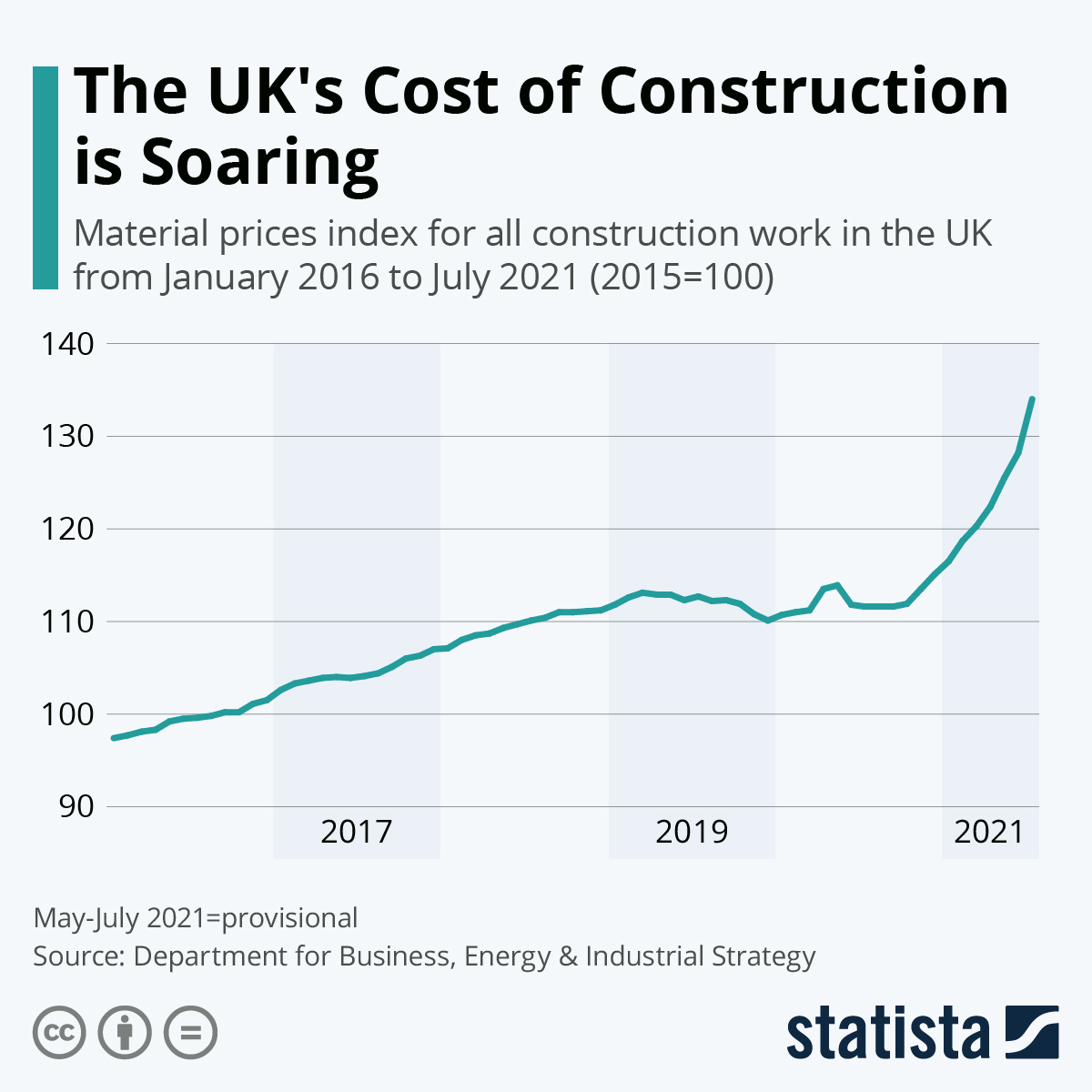

- Parts shortages and supply-chain disruptions have hit the U.K. construction industry:

- Costco has re-established purchase limits on some products in response to renewed hoarding by consumers as COVID-19 infections surge.

- Supply chain disruptions are continuing to hit U.S. fast-food chains, with KFC recently saying it is unable to promote chicken tenders due to a shortage of boneless meat.

- Romanian shipbuilder ICE Marine Design has completed trials of two zero-emissions passenger and car ferries for Ontario, Canada.

- Logistics conditions remain strained. Among recent challenges, many suppliers are requiring 24-hour notice for outbound shipments, and global supply constraints have increased the portion of imports in super sacks, which are more costly and difficult to handle.

Domestic Markets

- The U.S. reported 261,683 new COVID-19 cases and 1,513 virus fatalities Tuesday.

- The U.S. has now vaccinated 75% of its eligible population with one dose of a COVID-19 vaccine, a milestone.

- Los Angeles County reported 167 cases of the highly infectious Mu COVID-19 variant first identified in Colombia, the most concentrated outbreak in the nation.

- Central Texas hospitals ran out of ICU beds for the first time in the pandemic. The state reported more than 300 children hospitalized with COVID-19 Saturday and Sunday, a pandemic high.

- Florida reported more than 46,000 new COVID-19 cases Monday, smashing its previous one-day record. At 1.56 per 100,000 people, the state also has the highest virus fatality rate in the nation.

- Tennessee saw record-high COVID-19 hospitalizations of more than 3,600 patients for the seventh straight day on Tuesday.

- Idaho officials have activated crisis standards of care for hospitals in the state’s northern region, warning that surging COVID-19 patients will soon prompt the last-resort measure of rationing care.

- Maine’s seven-day average of new COVID-19 cases rose to 383, up from 105 a month ago, as virus hospitalizations in the state rose to their highest level since January.

- Total new COVID-19 cases in Massachusetts rose 17.2% to 11,789 last week, despite more than 75% of residents having received at least one dose of a vaccine.

- Ohio reported over 7,000 COVID-19 infections last week, nearing peaks last hit in January.

- New Jersey recorded 1,648 new COVID-19 infections Monday along with five virus deaths, while hospitalizations dropped to 1,015 patients, the fourth straight day of declines.

- Parts of Hawaii will require people to be vaccinated against COVID-19 in order to dine indoors, as the state reported 499 new virus infections Tuesday.

- Indiana reported nearly 7,200 new COVID-19 cases among school students and staff last week, its second consecutive week of record infections for the demographic.

- Nearly a quarter of Oklahoma’s new COVID-19 infections between Aug. 22-28 were among children aged five to 17.

- COVID-19 outbreaks at schools in Michigan have tripled since last week.

- Roughly two thirds of parents of children under the age of 18 support mask mandates for teachers and students, a new poll shows.

- Rhode Island will put healthcare staff on a 75-day unpaid leave if they do not to get vaccinated against COVID-19 by Oct. 1.

- United Ground Express, a subsidiary of United Airlines, is joining its parent company in mandating COVID-19 vaccines for its employees.

- American Airlines pilots will begin picketing in coming weeks at the carrier’s major hubs to protest overburdened schedules and fatigue as U.S. air travel rapidly picks up.

- Postings on job-search site Indeed.com were up 39% at the end of August from February 2020, with the largest increases in software development jobs that can be done remotely.

- Just 33.1% of employer offices were occupied in 10 major U.S. cities for the week ending Aug. 25, down from 34.8% in July amid resurgent COVID-19 cases throughout the nation.

International Markets

- The U.K. reported 37,489 new COVID-19 cases Tuesday and 209 virus fatalities, its highest daily death toll since March. The nation will require vaccine passports for access to nightclubs and other indoor venues by the end of the month.

- Japanese lawmakers are considering COVID-19 vaccine passports for people to resume commercial activities.

- South Korea is extending national pandemic curbs to Oct. 3 after reporting 2,050 new COVID-19 cases Tuesday. More than 70% of the nation’s population has received at least one dose of a vaccine.

- Singapore reported 328 new COVID-19 infections Tuesday, the most in more than a year.

- Philippines officials backtracked on plans to ease public movement restrictions in the capital amid the region’s recent surge in COVID-19 infections.

- Thailand reported 13,821 new COVID-19 infections Tuesday, its lowest in six weeks, as officials plan to ease pandemic restrictions in tourist-heavy Bangkok and Pattaya.

- Hong Kong is keeping strict three-week quarantine requirements for inbound travelers from several nearby countries.

- The EU is expected to remove Japan and five other countries from its safe travel list, a move that would significantly tighten quarantine and testing requirements for inbound travelers.

- Sweden will remove most of its remaining pandemic restrictions Sept. 29.

- Mexico recorded 15,784 new COVID-19 cases and 1,071 deaths yesterday as its third wave of the virus accelerated.

- Hong Kong’s Cathay Pacific Airlines fired staff who were not vaccinated against COVID-19.

- German industrial output rose 1% in July, beating analyst expectations after a 1% decline the previous month, a signal that supply bottlenecks are starting to ease.

- The U.K. plans to raise payroll taxes to help pay the increased healthcare costs of the pandemic.

- The eurozone economy grew 2.2% in the second quarter from the first quarter and 14.3% from the same time last year, beating analyst expectations.

- Chinese exports rose 25.6% year-over-year in August, up from a 19.3% annual increase in July.

- Intel’s autonomous vehicle unit Mobileye is planning to deploy 50 robo-taxis in Munich next year, with plans to scale up the technology throughout the rest of the country and other EU nations in the coming years.

- Toyota announced plans to invest over $13.5 billion to develop new electric vehicle battery technology over the next decade, hoping to become an industry leader by 2030.

- Hyundai is planning to offer hydrogen fuel cell versions for all its commercial vehicles by 2028, with plans to achieve cost competitiveness comparable to electric vehicle batteries by 2030.

- French car maker Renault is mulling a possible partnership with parts supplier Plastic Omnium to manufacture hydrogen storage tanks for one of its upcoming vans.

- BMW has significantly boosted orders for battery cells as electric cars made up more than 11% of the company’s deliveries during the first half of 2021.

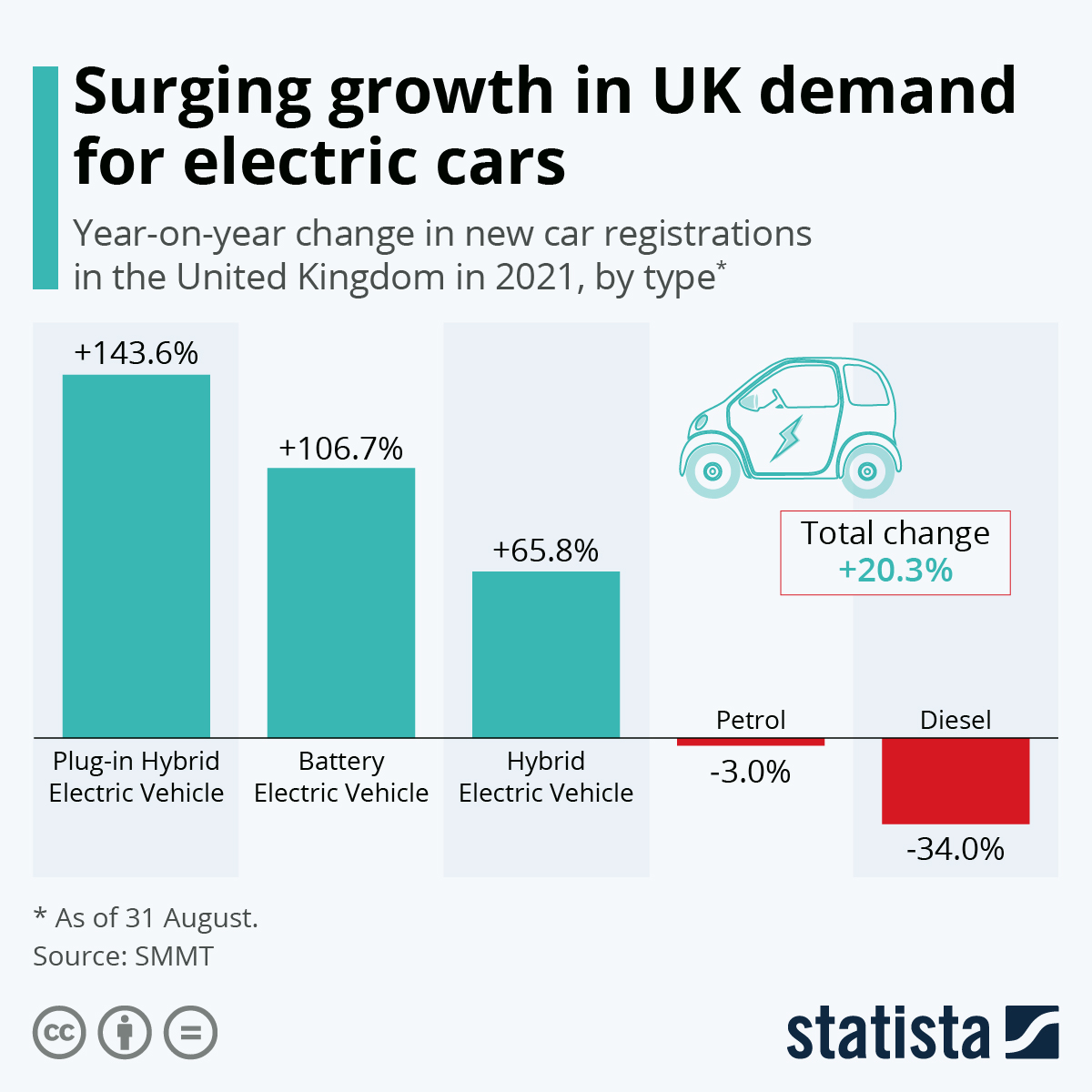

- Demand for gas and diesel cars in the U.K. have shrunk a respective 3% and 34% compared to 2020, while demand for electric vehicles reach all-time highs.

- VW plans to establish an investment fund to support decarbonization projects and startups.

- Swedish Plastic Recycling will invest more than $116 million in a new facility capable of recycling all plastic packaging from Swedish homes with no C02 emissions, the company claims.

- Spanish-German Siemens Gamesa has started manufacturing recyclable offshore wind turbine blades for commercial use, with plans to sell the blades to utilities in Germany, France and the U.K.

- India’s government will give roughly $3.5 billion in incentives to automakers over the next five years in a bid to boost production of electric vehicles.

At M. Holland

- During our latest Plastics Reflections Web Series event, panelists from M. Holland, BPI, LyondellBasell and MTS Logistics discussed how global supply chain complexities are impacting the plastics industry. Click here to access the recording.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.