COVID-19 Bulletin: September 13

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- More than 1.2 million bpd of U.S. Gulf Coast oil production remained offline over the weekend following Hurricane Ida’s landfall two weeks ago. The U.S. Coast Guard is beginning investigations into roughly 350 oil spills caused by the storm.

- Oil prices were higher in mid-day trading today, with WTI up 0.9% to $70.37, Brent up 0.7% to $73.46 and natural gas 6% higher to $5.24.

- The number of active U.S. oil and gas rigs rose by six last week, including four Louisiana offshore platforms shut down by Hurricane Ida.

- OPEC is expected to revise down its 2022 oil demand forecast today to reflect industry changes amid the world’s COVID-19 resurgence.

- Despite being fully constructed, Russia’s controversial Nord Stream 2 gas pipeline to Europe remains idle awaiting clearance from German regulators, officials say.

- Harvard University, with a nation-leading endowment of $42 billion, announced it will halt all investments in fossil fuel companies following years of pressure from university stakeholders.

- A slowdown of wind in the North Sea coupled with low natural gas inventories have sent electricity prices soaring in Europe, an unexpected impact of the continent’s growing dependence on wind power.

- Between now and 2023, power companies are expected to install large-scale battery systems capable of deploying 10,000 megawatts of power, 10 times the capacity that existed in 2019 as production costs rapidly decline.

- The U.K. plans to introduce legislation requiring all new homes to have electric vehicle charging stations, a global first.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- A tropical disturbance in the Gulf of Mexico became the Atlantic basin’s latest named storm, Nicholas, which dumped heavy rains on eastern Mexico Sunday. It is expected to continue a northward path along the Texas coast throughout the week, potentially disrupting energy production and processing.

- Category 2 Hurricane Olaf slammed into northwestern Mexico Friday, drenching the region with torrential rain and knocking out power to most of Baja California’s 3.77 million residents.

- Typhoon Chanthu dumped torrential rains and forced more than 2,000 evacuations in Taiwan Sunday before heading to mainland China, where authorities in

- Shanghai issued a typhoon warning. The Chinese ports of Xiamen and Ningbo asked vessels to adjust their navigation plans ahead of the storm.

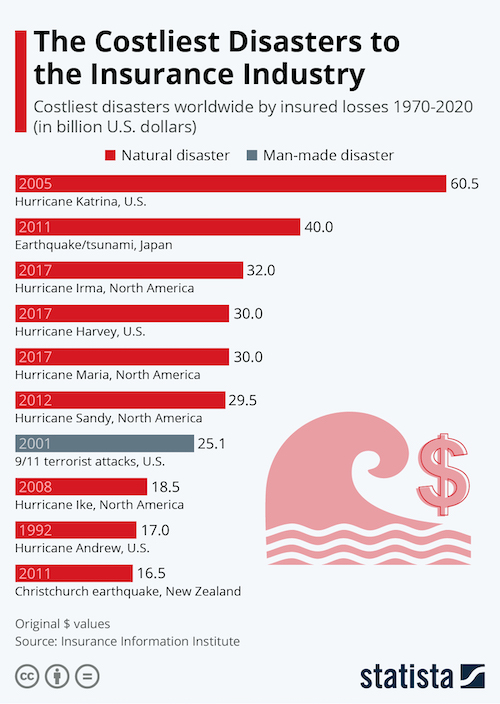

- Damage from Hurricane Ida could total $95 billion, AccuWeather predicts, making it the seventh costliest hurricane to hit the U.S. since 2000.

- Canadian National has five days to improve its already accepted takeover with Kansas City Southern or else lose the deal to rival Canadian Pacific Railway, the latest developments in a hotly contested battle for the U.S. railroad.

- Google delayed the launch of a new low-cost smartphone in India due to the global semiconductor shortage.

- One-fifth of the manufacturing cost of premium vehicles will be semiconductor chips by 2030, up from just 4% in 2019.

- Deal-making among U.S. auto dealers has picked up 27% so far this year as larger companies scoop up smaller rivals amid an industry-wide shift to online vehicle shopping and delivery.

- Class 8 truck production is currently running at a monthly deficit of more than 11,000 units from maximum output levels, a shortage not expected to ease until 2023.

- The cost of extended COVID-related border closures is rapidly rising, with the U.S.-China Business Council recently ranking it among the top three challenges for member firms this year.

- The top six container operators control more than 70% of all container capacity, the result of five years’ worth of industry consolidation that may have exacerbated shipping disruptions during the pandemic. With the cost of shipping a container from China to Europe up 500% in the past year, shippers are enjoying their best earnings since 2008.

- Last week’s World Container Index for average global container shipping spot rates on major trade lanes was four times the level from a year ago at more than $10,000. CMA CGM announced it would freeze its daily rates until February.

- International seafarers will see a pay raise of 4.5% over the next two years after striking a deal with a group of maritime employers.

- A fight is brewing among California lawmakers over a proposal that would boost state oversight of warehouse productivity trackers, a response to reported conditions at major employers including Amazon.

- UPS is acquiring same-day delivery company Roadie, a crowd-sourced platform that can provide instant local deliveries of smaller shipments direct from retail.

- Despite continued production stoppages, General Motors affirmed its profit outlook of up to $13.5 billion for 2021, while also predicting the global semiconductor shortage to stabilize next year.

- DHL has deployed autonomous floor cleaning bots in 60 of its North American facilities.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Domestic Markets

- The U.S. reported 33,807 new COVID-19 cases and 279 virus fatalities Sunday.

- Twenty-six states have fully vaccinated more than half their population against COVID-19, with the most vaccinated states showing the lowest new infection numbers, while three states — Connecticut, Massachusetts and Vermont — have fully vaccinated two-thirds of residents.

- Texas reported 408 new COVID-19 fatalities Friday, its highest daily death toll of the pandemic.

- Alaska reported 846 new COVID-19 cases Thursday along with 206 virus hospitalizations, the most since the start of the pandemic.

- Utah-based Intermountain Healthcare is suspending most surgeries at 13 of its 24 hospitals in western states because of overwhelming COVID-19 hospitalizations, mostly among the unvaccinated.

- An upstate New York hospital is pausing baby deliveries amid mass resignations following an employee COVID-19 vaccine mandate.

- Hospitalizations in Florida are declining, though 20.06% of hospital beds and 42.33% of ICU beds in the state were occupied by COVID-19 patients yesterday.

- New daily COVID-19 cases in West Virginia have increased by 52% over the past week, averaging 123 new cases per 100,000 people, the highest rate in the country.

- Oklahoma’s attorney general announced plans to sue the White House over its recent COVID-19 vaccine mandates, as the state reported more than 7,300 new virus cases since Friday.

- New Jersey’s unvaccinated residents are six times more likely to be hospitalized with COVID-19 than those who are vaccinated, new data shows, as the state reported 2,173 new infections and 15 virus deaths Friday.

- COVID-19 deaths among Americans under 55 years of age are matching the highs of last winter’s surge.

- New York City is moving forward with plans to bring back its 300,000 municipal employees to the office today, without an option of remote or hybrid remote work.

- Milwaukee, Wisconsin’s largest school district will require all employees to be vaccinated against COVID-19 by Nov. 1 and will offer $100 to any student who gets vaccinated.

- More than 18,000 Mississippi students have contracted COVID-19 in the first month of the school year, as pressure grows for greater protections for teachers.

- Kentucky lawmakers voted to scrap a statewide mask mandate for public schools in favor of district-by-district policies, as the state reported 5,252 new COVID-19 cases late last week.

- An Alabama man died of a heart condition after being rejected for an ICU bed by 43 regional hospitals in three states due to overcrowding and understaffing.

- U.S. bars and restaurants lost 41,500 jobs in August, the largest monthly decline of any sector and the first decline since December, as resurgent COVID-19 cases weigh on indoor dining.

- Most unvaccinated U.S. voters still do not plan to get a COVID-19 vaccine, new survey results show, despite the White House’s recent six-pronged plan that will mandate vaccines for companies with more than 100 people.

- Virologists say the highly transmissible COVID-19 Delta variant will likely remain the dominant virus strain, with new virus waves likely driven by sub-variants rather than completely new strains.

- The White House is releasing an additional $25 billion in federal relief funds to healthcare organizations struggling to contain recent surges of COVID-19 patients.

- Pfizer/BioNTech is expected to release results of clinical trials of its COVID-19 vaccine in children aged 5 to 11 in the coming weeks. U.S. regulators have vowed to move quickly on approval.

- A leading developer of AstraZeneca’s COVID-19 vaccine says that booster shots could be unnecessary for many vaccine recipients, and priority should be given to countries with low supply.

- Delta Air Lines’ decision to add a $200 monthly health insurance surcharge to unvaccinated employees has led to a 20% increase in vaccinations.

- Home prices rose 16.8% in June from the same time a year ago, the fastest growth rate on record.

- Not counting rehires from people who lost their job during the pandemic, the U.S. is forecast to add just 2.6 million jobs through 2030 as automated technology expands and retiring Baby Boomers shrink the labor pool.

- Google is hoping to replenish 20% more water than its offices and data centers use by 2030, a new potential trend-setting sustainability goal.

International Markets

- Europe reported a 3% increase in COVID-19 deaths last week fueled by a spike in the U.K., making it the only continent to report a weekly increase.

- France announced a blanket ban on unvaccinated travelers from the U.S., with those traveling for essential business required to test negative and quarantine for seven days upon arrival.

- Switzerland is now requiring COVID-19 vaccine certificates to enter restaurants, cinemas or fitness centers, hoping the new measures will increase the country’s vaccination numbers.

- The U.K. dropped its plans for a COVID-19 vaccine passport for attending certain indoor activities and events.

- Japan reported 8,892 new COVID-19 infections Friday, as officials are set to hold discussions this week on administering booster shots in the near future.

- A COVID-19 outbreak in the southern Chinese city of Putian prompted officials to suspend all bus and train services and close all indoor venues.

- Australia reported more than 1,900 single-day COVID-19 cases Friday, a record, as the nation prepares to trial vaccine passports.

- New Zealand recorded 33 new COVID-19 cases of the Delta variant Monday, all in Auckland, prompting authorities to extend lockdown measures in the city for at least another week to curb the outbreak.

- Israel is preparing to administer a fourth round of COVID-19 vaccines to some residents, potentially within six months from now.

- Despite a rising COVID-19 wave, South Africa loosened pandemic restrictions following sustained civil unrest over the rules.

- Canada added 90,200 jobs in August, bringing the country’s unemployment rate to 7.1%, the lowest of the pandemic.

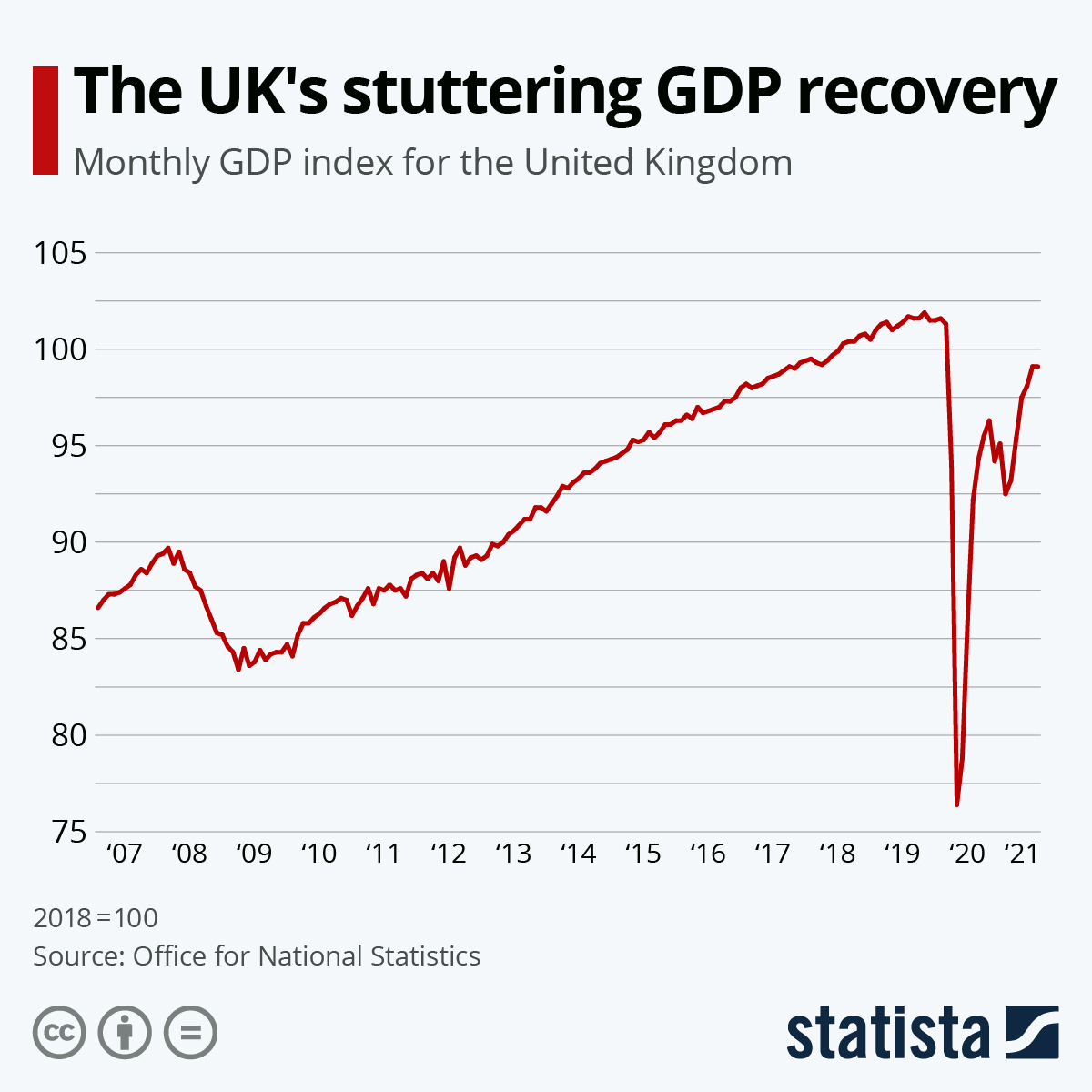

- The U.K. economy grew just 0.1% in July, far lower than analysts’ expectations.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.