COVID-19 Bulletin: September 29

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose to their highest levels in three years Tuesday, topping $80/bbl before dipping to $79.09/bbl, a 0.6% decline, and snapping a five-day rally. U.S. natural gas futures traded at their highest levels since 2014 for the second day in a row.

- Crude futures were mixed in late morning trading, with WTI up 0.2% at $75.44/bbl and Brent down slightly at $79.08/bbl following news of an unexpected build in U.S. crude inventories. Natural gas was 5.0% lower at $5.59/MMBtu.

- PennEast Pipeline is dropping plans for a gas pipeline project between Pennsylvania and New Jersey after failing to secure water quality permits. In the past year, two pipeline projects were canceled, and one was delayed to 2022 due to permitting obstacles.

- The recent rally in global LNG prices has widened the economic incentive to switch to oil and could boost oil demand by 400,000 bpd over the next two quarters, analysts predict.

- American consumers could see their highest energy bills in a year following a slowdown in shale drilling while demand spiked during summer heat waves and the economy rebounded from the pandemic.

- EU leaders scheduled a meeting for next month to discuss the bloc’s skyrocketing energy prices, which have surged more than 300% since the start of the year.

- The Chinese government is considering raising electricity prices for industrial consumers in a bid to spur power producers to increase output, a move that could also be extended to the residential market. Ripples from the nation’s severe energy crunch threaten to raise global coal and food prices.

- With inventories expected to remain low in the coming months, spot LNG prices in Asia are likely to stay above $25/MMBtu this winter and possibly break records set last year.

- Braskem Idesa reached an agreement with Mexico’s state-owned oil company, Pemex, to build a $400 million ethane import terminal in Veracruz along with an ethane supply agreement until the terminal begins operations in late 2024/early 2025.

- Australia’s New South Wales state, the nation’s biggest coal producer, is hoping to lower its carbon emissions by 50% from 2005 levels by the end of the decade.

- Canada-based pipeline operator Enbridge has inked new deals with Royal Dutch Shell and Vanguard Renewables to produce renewable natural gas and “blue” hydrogen in a bid to reach net zero carbon emissions by 2050.

- Canada’s second-largest pension fund is planning to fully end investments in its oil production assets by the end of 2022.

- A new facility in the Netherlands is proving the recyclability of expanded foam polystyrene.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Category 4 Hurricane Sam is continuing its northwest March in the Atlantic and is expected to generate swells with severe surf and rip conditions on the U.S. East Coast late this week.

- New vehicle sales in the U.S. are set to fall 25% in September on depleted inventories at dealerships, despite continued strong consumer spending.

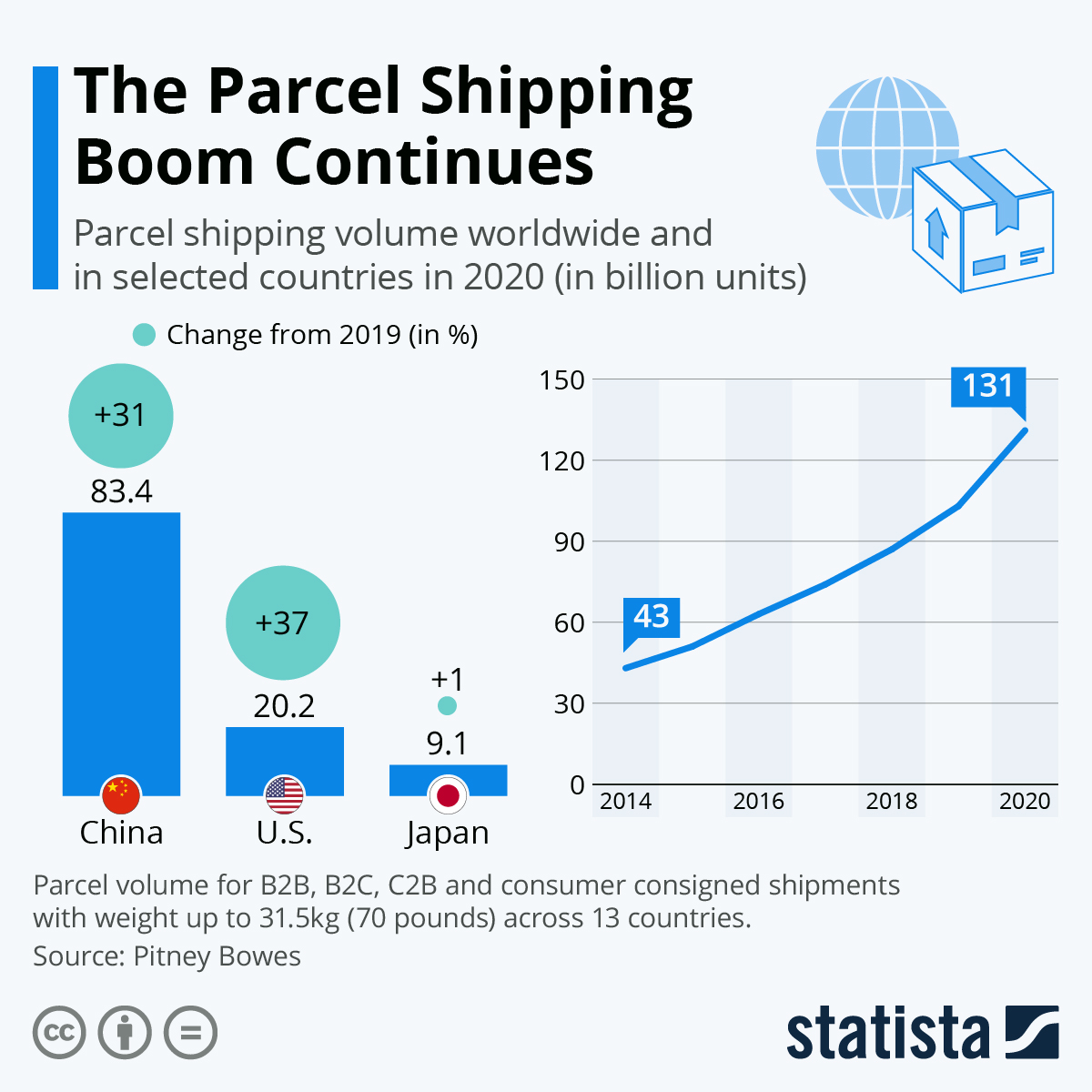

- DHL is investing $300 million to expand the square footage of its U.S. distribution network by 70% over the next five years, hoping to meet surging demand increases.

- After reporting its second-busiest month in history in August, the Port of Savannah is launching a large expansion project to better accommodate volumes and reduce congestion, which currently stands at more than 30 ships at anchorage with wait times up to seven days.

- Costco has chartered three small ocean vessels and leased several thousand containers to move merchandise from Asia to the U.S. and Canada in a bid to bypass clogged shipping networks ahead of the upcoming holiday season.

- Rite Aid is partnering with Uber Eats to handle last-mile delivery from over 2,100 locations across 17 states.

- Midwestern supermarket chain Hy-Vee is bringing aisle-scanning robots to five grocery stores in Iowa, Missouri and Nebraska, with plans to use the technology to reduce the incidence of sold-out items by up to 30%.

- FedEx announced plans to partner with manufacturing firm Paccar and self-driving startup Aurora to test the use of autonomous vehicles in the firm’s Dallas-Houston parcel lanes.

- GM’s commercial electric-vehicle unit will begin manufacturing a new midsize electric cargo van with a 250-mile range at an assembly plant in Canada in the second half of 2023, snagging Verizon as its first major purchaser.

- Toyota acquired automotive software company Renovo in a bid to fast-track the development of fully autonomous vehicles.

- The pandemic has prompted Chinese tech companies such as Alibaba, Meituan and JD.com to roll out additional courier robots to deliver packages to customers in a bid to increase contactless services and avoid exposure to the coronavirus.

- With global trade expanding rapidly, already high levels of shipping emissions are also expected to increase.

Domestic Markets

- The U.S. reported 111,162 new COVID-19 infections and 2,543 virus fatalities Tuesday.

- Pfizer/BioNTech has formally requested FDA approval for its COVID-19 shot to be used in children aged 5 to 11. Clearance is not expected until November.

- A large North Carolina hospital system fired 175 employees for failing to meet a COVID-19 vaccine mandate deadline, with similar situations facing thousands of healthcare workers in New York and dozens of police officers in Massachusetts.

- South Carolina’s ban on mask mandates in schools was temporarily blocked by a federal district court ruling. In other legal news, a federal court ruled New York City can lawfully impose COVID-19 vaccine mandates on teachers, while California prison staff face a new order requiring vaccination.

- The Federal Emergency Management Agency has paid nearly $2 million to cover the costs of COVID-19 patient funerals in Idaho.

- Montana added nearly 6,000 new COVID-19 cases and 57 virus hospitalizations last week, with the state averaging 109.3 virus patients in statewide ICUs per day, topping last November’s record.

- Texas averaged more than 250 COVID-19 deaths per day over the past month.

- Florida reported 5,056 new COVID-19 infections and four virus fatalities Monday, as new case positivity in the state dropped to 8.6% last week, the fifth straight week of declines.

- Illinois reported 2,375 new COVID-19 cases and 33 virus deaths Tuesday, as the state’s test positivity rate dropped to 3.1%, the lowest since July.

- Connecticut is averaging 14 daily COVID-19 cases per 100,000 residents, the lowest rate in the U.S. over the past two weeks.

- California continues to have among the lowest levels of COVID-19 transmission in the U.S.

- New York’s COVID-19 vaccine mandate for healthcare workers is helping boost the state’s vaccination rates, with 92% of nursing home staff having now received at least one vaccine dose, up from 70% in mid-August.

- New York City’s mayor announced that all public-school staff must be vaccinated against COVID-19 by Friday at 5 p.m.

- Roughly 37% of people with COVID-19 still experienced symptoms six months after infection.

- People who received a COVID-19 booster dose reported mostly mild to moderate side effects, with 71% saying they had pain at the injection site, 56% reporting fatigue and 43% reporting a headache.

- COVID-19 misinformation has created a run on ivermectin, causing problems for veterinarians who need the medicine to treat animals as well as doctors and hospitals who are seeing patients overdose on the drug.

- Roughly 71% of people unvaccinated against COVID-19 say the recently approved booster dose is proof that the vaccines are ineffective, new survey results show.

- Ford will require all hourly and salaried employees to disclose their COVID-19 vaccination status by Oct. 8.

- The $3.5 trillion reconciliation bill pending in Congress includes a significant increase in fines for companies that fail to comply with the administration’s vaccine mandate, raising potential fines for noncompliance to $70,000 and for willful violations to $700,000.

- A gauge of U.S. consumer confidence fell to 109.3 in September, its lowest level since February.

- The number of flights between Western Europe and North America is set to increase 7.5% by early November as the U.S. lifts its ban on travelers from most European countries. German carrier Lufthansa has already reported increased demand for flights to the U.S.

- There are early signs that a recent slowdown in U.S. spending has bottomed out as COVID-19 cases decline from summer peaks, despite many economists maintaining lowered forecasts for third-quarter growth.

- The latest data shows that U.S. home prices jumped nearly 20% in July from the same time a year ago, the 14th consecutive month of accelerating prices and the biggest rise in three decades.

- Banks have announced more than $54 billion in deals through late September, the most since the 2008 financial crisis.

- United Airlines is preparing to terminate nearly 600 employees for failing to meet its Sept. 27 deadline to get vaccinated.

- Walmart is increasing support for working women as the pandemic reduces the proportion of women in its workforce this year.

- Sales for Lego, the world’s top toymaker, are up 46% in the first half thanks to an increased online presence and the opening of hundreds of new physical stores.

- Electric-vehicle makers are aiming to decrease reliance on lithium and boost use of solid-state batteries, a safer but costlier alternative.

- Sabic and Microsoft have collaborated to introduce the Ocean Plastic Mouse, the computer giant’s first device using ocean-bound plastic waste.

International Markets

- The U.K. reported 37,960 new COVID-19 cases and 40 virus deaths Monday, as the country has now fully vaccinated more than two-thirds of its population against the virus.

- Romania recorded over 11,000 new COVID-19 infections Tuesday, the most since the start of the pandemic, along with 208 deaths, as the nation struggles to increase its vaccination numbers.

- Syria is reporting a record surge in COVID-19 infections, topping more than 440 per day over the past week, the highest since the start of the pandemic.

- Authorities in Vietnam’s Ho Chi Minh City predict the region’s true COVID-19 infection numbers could be 40% higher than officially recorded.

- Victoria, Australia’s second-most populous state, reported 867 new COVID-19 infections over the last 24 hours, topping New South Wales, which reported 863 new cases, for the first time since the pandemic.

- New Zealand is easing its home isolation requirements as part of a new phased approach to reopen borders.

- Chile is lifting its pandemic state of emergency amid a significant drop in the nation’s COVID-19 infection numbers and a high vaccine rate.

- With more than 90% of its adult population fully vaccinated against COVID-19, Ireland was ranked the best country to be in during the pandemic by Bloomberg.

- Thailand is waiving quarantine requirements in Bangkok and nine other regions to vaccinated travelers beginning Nov. 1, as the country’s daily COVID-19 infections dropped to 9,489 Tuesday.

- India is planning to create its own mRNA COVID-19 vaccine by the end of the year.

- Sweden will begin offering a third shot of the COVID-19 vaccine to people older than 80.

- Facebook is collaborating with major humanitarian organizations to create digital COVID-19 vaccine marketing campaigns tailored to dozens of countries.

- Vietnam’s economy shrank 6.2% year over year in the third quarter, the biggest contraction on record.

- International air travel prices could increase due to the rising costs of fuel and increased environmental taxes, some industry leaders predict.

- EU lawmakers are backing legislation to make member nations and companies operating within them lower overall methane emissions.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.