MH Daily Bulletin: April 12

News relevant to the plastics industry:

At M. Holland

- M. Holland will be closed on Friday, April 15, in observance of the Easter holiday.

- M. Holland has launched a new Healthcare Packaging line card to meet the product needs of medical device and pharmaceutical packaging manufacturers.

- M. Holland shared insight on the current pigment and additive shortages facing the plastics industry. What can be done to ease the strain? Read more here.

- M. Holland is exhibiting at MD&M West in Anaheim, California, this week. MD&M West is the largest medtech conference in the U.S. If you’re attending, please stop by Booth #4111 to meet our Healthcare experts!

- In case you missed it, watch M. Holland’s Plastics Reflections webinar about the current and future state of the North American plastics industry. Click here to access the recording.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell over 4% Monday as fuel consumption stalls in China over COVID-19 lockdowns. WTI closed below $95/bbl, its lowest in over a month.

- In mid-day trading today, WTI futures were up 7.1% at $101.00/bbl, Brent was up 6.9% at $105.20/bbl, and U.S. natural gas was up 4.1% at $6.91/MMBtu.

- In a rare move, the U.S. administration will temporarily allow high-ethanol gasoline to be sold in the hot summer months in a bid to tame fuel prices. Critics warn that corn crops are dwindling due to war in Europe and should be preserved for the global food supply.

- U.S. gasoline prices have fallen for two straight weeks after hitting a record-high in early March, now averaging $4.11/gallon.

- TotalEnergies plans to boost U.S. LNG output next year by expanding production at Louisiana’s Cameron site, the firm said.

- Weeks of protests at British fuel depots are starting to cause shortages at filling stations, according to a trade group.

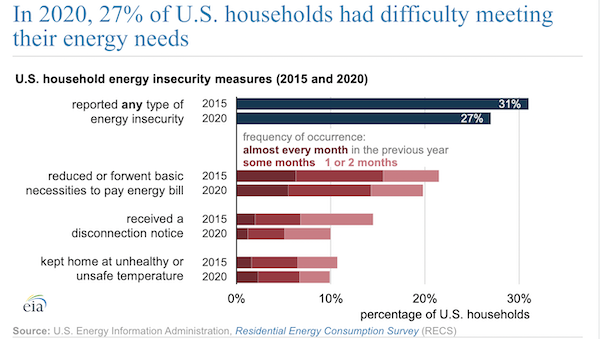

- Almost 30% of U.S. households reported difficulty paying energy bills or said they kept their home at an unsafe temperature to avoid high energy costs during the first year of the pandemic:

- More news related to the war in Europe:

- In a move that could tighten global oil supplies, the EU’s executive arm began drafting proposals for an embargo of Russian oil despite the lack of agreement among member nations. OPEC reaffirmed that it would not pump more oil despite massive supply shocks from the potential measure.

- Fuel demand in India rose to a three-year high in March, boosted by discounted crude supplies from Russia.

- Italy reached an agreement to ramp up gas imports from Algeria by around 40% in its first major deal to find alternative suppliers besides Russia.

- Hungary walked back its dissension from European ranks, saying it would continue paying for Russian gas in euros and not rubles, as Moscow has demanded.

- Japan’s government directed power companies to ensure they have at least three weeks of reserves and is urging them to sell spare gas to each other rather than overseas amid concerns of a sudden cutoff in Russian supplies.

- A Russian firm says it will proceed with a planned nuclear plant in Finland despite uncertainty over the effect of sanctions on government permits.

- Chevron won new rights to produce from Argentina’s Vaca Muerta formation, the world’s fourth-largest shale oil reserve, with an initial planned investment of $78.7 million.

- Architects of the EU’s carbon market say some elements need revising in light of expectations that fuel-market upheaval will last longer than thought. Some firms, including Poland’s biggest utility, argue relaxing standards now would hamper efforts to shift to cleaner fuel.

Supply Chain

- In the U.S., Winter Storm Silas will produce severe weather from the Plains to the Midwest and South throughout the week, including bouts of unusual mid-April snowfall in some regions.

- The value of global trade fell 2.8% from February to March on a slowdown in container-ship traffic from Russia and Ukraine.

- In March, global airfreight capacity was down 6.5%, volumes were down 4.5%, and rates were up 27% from a year ago. Rates rose the fastest on Europe-Asia lanes forced to bypass Russian airspace.

- Logistics operators are preparing to divert refrigerated containers destined for Shanghai over heavy congestion at the port’s electric plug-in areas.

- Utah-based trucker L.W. Miller Cos. shut down its livestock hauling division due to a “perfect storm” of logistics disruption.

- American Eagle says its acquisition of fulfillment specialist Quiet Logistics has cut down delivery times by 35%.

- Supply chain visibility startup Tive raised $54 million in a recent funding round for its real-time analytics software.

- Global PC shipments fell 5.1% from a year ago in the March quarter, new data shows, signaling one of the first slowdowns in booming pandemic sales.

- GM’s first-quarter sales fell 21.4% in China from a year ago, highlighting the risks for automakers of not taking extreme measures to keep factories running amid lockdowns. In one example, CATL, the world’s biggest maker of electric-vehicle batteries, imposed a “closed-loop” system that shuttles employees directly between dormitories and the factory floor.

- BMW’s chief executive expects the global semiconductor shortage to last into 2023, while Volkswagen predicts an even longer timetable.

- Ford may walk back its $2 billion exit from India with the potential construction of an export base for electric vehicles in the nation’s southern Tamil Nadu state.

- Toy maker Mattel will spend $50 million to expand manufacturing in Monterrey, Mexico.

- Del Monte Foods hopes a broad transformation of its operations, including packaging, will help it achieve net-zero emissions by 2050.

- Houston’s port authority aims to cut net emissions to zero by 2050.

- Heavy-duty truck maker AB Volvo, with the greatest exposure to Russia among major truck makers, will set aside over $400 million to cover losses from suspending operations in the country.

Domestic Markets

- The U.S. reported 43,574 new COVID-19 infections and 322 virus fatalities Monday.

- Average daily COVID-19 cases were up 2% on Saturday from two weeks ago, the first rise after weeks of recovery from Omicron.

- COVID-19 cases in New York City and Philadelphia are up 50% over the past two weeks. Officials in Philadelphia reinstated an indoor mask mandate.

- Many U.S. colleges and universities are reinstating mask mandates to combat outbreaks of the BA.2 subvariant on campus.

- COVID-19 hospitalizations in Florida have fallen to their lowest level of the pandemic, new data shows.

- Arizona ended its pandemic state of emergency yesterday and will scale back reporting on virus hospitalizations.

- COVID-19 testing sites across the nation are shutting down as cases reach pandemic lows in many cities, officials say. Low demand is also causing a surprise build in antiviral inventories.

- Inflamed heart conditions were much more likely to result in people infected with COVID-19 over their vaccinated peers, new research shows.

- Inter-island cruises have returned to Hawaii for the first time in more than two years but will be limited to 50% of capacity.

- Lawmakers in New York state agreed to allow bars and restaurants to permanently sell alcohol to-go, a lifeline to their survival during the pandemic.

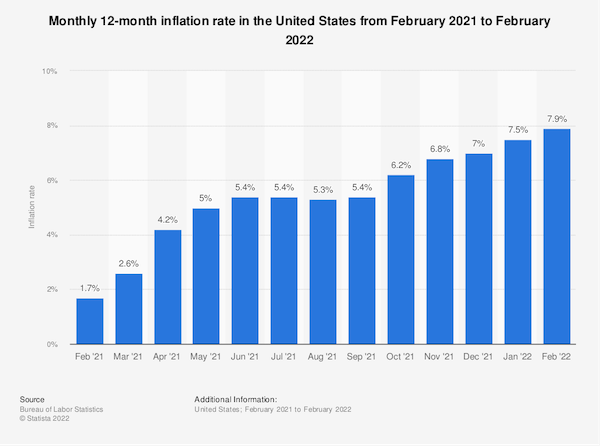

- U.S. consumer prices rose 8.5% in March from a year earlier, while Americans’ one-year inflation expectations hit an all-time high, driving slowdowns in spending at restaurants and retailers.

- Analysts expect banks in the S&P 500 to report first-quarter profit of about $28 billion, down 36% from a year ago, as the pandemic-era streak of exceptional performance comes to an end.

- Bonds backed by subprime car loans or credit cards are demanding the highest premiums over interest-rate benchmarks since mid-2020, as investors turn skittish over the slow-growth effects of inflation on healthy consumer debt.

- The U.S. workforce is missing almost 5 million males between ages 25 and 54, economists say.

- Developers are being forced to rethink expensive renovations as offices in the U.S.’s largest cities remain less than half full (42% on average), even as other parts of the economy, including restaurants and airports, quickly refill with people.

- California lawmakers have proposed a new law that would shorten the 40-hour workweek to 32 hours for companies with more than 500 employees.

- Rising mortgage rates could lead to a pullback in home purchases from individuals and families, with data already showing an uptick in new-construction sales to bulk institutional buyers.

- Georgia’s Hartsfield-Jackson Atlanta International Airport reclaimed its spot as the world’s busiest airport with 75.7 million passengers in 2021, a 76% increase from the year prior. Sharply rebounding volumes are clogging airports and causing more frequent delays, reports suggest.

- FAA fines for unruly passengers are reaching tens of thousands of dollars as airline incidents become more frequent.

- Architects are increasingly turning to “mass timber,” an engineered wood product similar in strength to concrete and steel, to build multistory buildings with low carbon footprints.

- Etsy’s efforts to evolve from a niche online marketplace to a major e-commerce player are sparking backlash, with over 20,000 sellers signing a petition yesterday in protest of higher commission fees.

- PG&E, California’s biggest utility, will pay $55 million over five years to avoid criminal sanctions for starting several of the most devastating recent wildfires in the state.

International Markets

- Shanghai started easing lockdowns in some areas Monday despite reporting a record of more than 25,000 new COVID-19 infections. Measures were tightened in other regions, including Beijing and the factory hub of Guangzhou, whose borders were closed to most arrivals. U.S. officials, meanwhile, continue pulling American employees from the nation.

- New data from Canada suggests up to 10% of patients recently infected with the BA.2 subvariant previously suffered an infection with another strain.

- New COVID-19 cases in South Korea — for months a virus hotspot — have fallen 29% over the past week, prompting officials to ease some restrictions.

- The World Health Organization has started monitoring two new subvariants of Omicron that recently appeared in small numbers across the globe.

- Germany warned it may have to throw away over 3 million COVID-19 shots by June due to a lack of demand.

- Chinese producer (+8.3%) and consumer (+1.5%) prices rose faster than expected in March, new data shows, fueled by persistent supply chain bottlenecks and COVID flare-ups weighing on economic activity.

- Britain’s economy grew a slower-than-expected 0.1% in February, the latest data shows, signaling weakness even before the war in Ukraine further upset the flow of goods into the nation.

- Sri Lanka’s financial crisis is worsening, with the nation halting payments on foreign debt and warning of a default yesterday amid dwindling dollar stockpiles for essential food and fuel imports.

- London’s Heathrow Airport saw 4.22 million passengers in March, its busiest of the pandemic and seven times the level from a year ago.

- More news related to the war in Europe:

- Ukraine’s economy could shrink up to 45% this year due to Russia’s invasion, the World Bank predicts.

- Swedish telecommunications firm Ericsson AB is suspending its business in Russia indefinitely. More broadly, tech spending in Russia is expected to fall 39% this year.

- French banking giant Société Générale is selling its Russian assets and business units and expects to take a $3 billion loss.

- The Ukrainian refugee count has topped 4.6 million since late February, according to the United Nations.

- Mercedes-Benz aims to cut its carbon footprint in half by the end of the decade with more purchases from suppliers with CO2-neutral parts, the firm announced.

- Chinese electric-vehicle battery maker CATL plans to open a plant in Germany that would be its first overseas factory.

Some sources linked are subscription services.