MH Daily Bulletin: April 14

News relevant to the plastics industry:

At M. Holland

- M. Holland will be closed tomorrow, April 15, in observance of the Easter holiday.

- M. Holland is exhibiting at MD&M West in Anaheim, California, this week. MD&M West is the largest medtech conference in the U.S. If you’re attending, please stop by Booth #4111 to meet our Healthcare experts!

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose about 4% Wednesday as a large increase in U.S. crude inventories failed to soothe worries over tight global supply.

- In mid-day trading today, WTI futures were up 1.4% at $105.70/bbl, Brent was up 1.5% at $110.40/bbl, and U.S. natural gas was up 4.4% at $7.30/MMBtu.

- The International Energy Agency cut its oil demand outlook by 260,000 bpd this year due to lockdowns in China.

- CNOOC, China’s biggest offshore producer, is preparing to exit operations in the U.S., U.K. and Canada over concerns its assets could be hit with Western sanctions.

- U.S. crude stocks rose a higher-than-expected 9.4 million barrels last week, in part due to releases from the nation’s strategic reserves, while gasoline and distillate inventories fell.

- Gasoline shipments from Europe to the U.S. are down 23% from the same time last year as high prices at the pump weaken U.S. demand.

- First-quarter dealmaking in the U.S. oil and gas industry rose fourfold in value from the same time last year, driven mostly by buyer interest in North Dakota and Colorado basins.

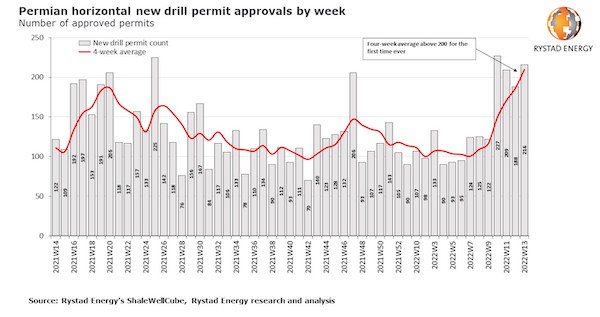

- A record 904 drilling permits were awarded last month for the U.S. Permian Basin, foreshadowing a boost in crude production capacity by early 2023.

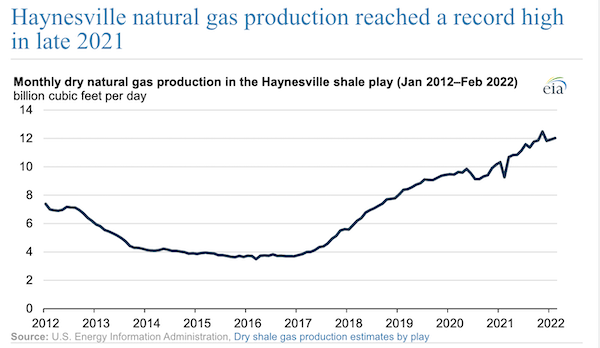

- Record amounts of dry natural gas are being produced from the Haynesville shale play in eastern Texas and Louisiana, the nation’s third-largest production site:

- A decade of cost scaling in the renewable energy sector reversed over the past year, with prices for wind and solar power in major global markets rising almost 30% due to supply-chain havoc and inflation.

- More oil news related to the war in Europe:

- Vitol, the world’s largest oil trader, said it would gradually phase out trading of Russian crude by the end of the year. The news corresponds with reports that more traders will begin cutting purchases of Russian oil starting in mid-May.

- Russia’s energy minister said the nation could start selling oil at $80/bbl if necessary to keep the industry going.

- German economists expect energy-market turmoil to dent the nation’s GDP growth by over two percentage points this year, as power prices hit a four-month high yesterday.

- Italy is looking to boost LNG imports from Egypt by 50% over the next two years to reduce its use of Russian energy.

Supply Chain

- More than 20 people were injured after a tornado touched down in Bell County, Texas, part of a large storm system sweeping the central U.S.

- Hundreds of people are being evacuated in New Mexico after a cluster of wildfires spread to over 13,000 acres Wednesday.

- Texas’ governor defied mounting pressure to immediately end truck inspections that have gridlocked some of the busiest trade lanes into the U.S. in recent days. While inspections were halted at one bridge in Laredo, the more dramatic truck backups and bridge closures are still in place at several points along the state’s 1,200-mile southern border.

- The Shanghai freight index dropped 13% over the past six weeks, the sharpest decline in its 10-year history. Analysts warn of massive logistics disruption if Shanghai-like lockdowns spread to the industrial province of Guangdong, where some virus-prevention measures were tightened last week.

- March throughput at the Port of Los Angeles rose 17% from February to 958,674 TEUs, the fourth-highest month of all time.

- The union president for some 22,000 U.S. West Coast dockworkers expects to reach a new employment agreement before existing contracts expire July 1, helping calm recent anxiety over the potential for disruption. The National Retail Federation is urging the two sides to quickly reach a new agreement.

- South Africa’s Port of Durban, the largest below the Sahara, is just starting to resume operations after a 36-hour halt caused by severe flooding.

- TransContainer expects about 30% of containers on the Russian market to be withdrawn from circulation starting in May, following the departure of the world’s largest shipping lines from the nation’s ports.

- North American freight volumes advanced in March but at a slower pace than the previous month, while expenditures surged 33.2% year over year.

- U.S. sales of Class 8 heavy-duty trucks were down 10.1% in March from a year ago, led by big declines at International (-29.1%), Peterbilt (-22.8%) and Volvo (-52.7%). Sales of medium-duty trucks were up 6.3%.

- Amazon will add a 5% fuel and inflation fee starting April 28 for online merchants that use its shipping services, a first for the company.

- Two Chinese carriers — Orient Overseas Container Line and its parent COSCO — are shipping more empty containers than loaded exports out of U.S. West Coast ports, setting the stage for a potential crackdown under new enforcement efforts at the Federal Maritime Commission.

- Lockdowns in Shanghai could cost automakers about 20% in lost production, according to Chinese trade leaders.

- Investors are starting to turn sour on the chip industry over fears of a glut in supplies, with the Philadelphia Stock Exchange’s Semiconductor Index down 23% so far in 2022. The news comes as Taiwan Semiconductor Manufacturing Company reported a 45.1% rise in first-quarter income to a new record, beating market expectations.

- Taiwan Semiconductor Manufacturing Company, the world’s largest computer chip foundry, expects tight supplies to continue as manufacturers beef up inventories for protection against further supply chain disruption.

- With China leading the way, over 1.2 million automated trucks and buses will hit roads across the globe within a decade, analysts predict.

- Some researchers are calling into question the environmental benefits of LNG-powered ships over concerns about methane leaks.

Domestic Markets

- The U.S. reported 41,192 new COVID-19 infections and 956 virus fatalities Wednesday.

- The U.S. administration is extending the nation’s formal public health emergency by another 90 days, allowing some emergency powers and programs to continue.

- Two new subvariants of Omicron — BA.2.12 and BA.2.12.1 — appear to be spreading rapidly in New York, potentially explaining the state’s status as a viral hot spot for the past few weeks, officials said Wednesday.

- The White House extended masking requirements on planes and transit for an additional 15 days to May 3, citing an uptick in COVID-19 cases.

- A broad swath of indicators suggests Utah was the most resilient state during the pandemic, while New Jersey was the least.

- Pfizer’s chief executive said the firm may produce a COVID-19 vaccine that could fight multiple variants by this fall. The firm will seek approval for COVID-19 booster shots for children as young as age 5.

- Some firms are ramping up office perks as an incentive to bring back workers who increasingly want to stay at home.

- First-time jobless claims rose by a higher-than-expected 18,000 to 185,000 last week.

- Led by higher fuel costs, U.S. producer prices rose a larger-than-expected 11.2% in March from a year ago, the fastest rise on record.

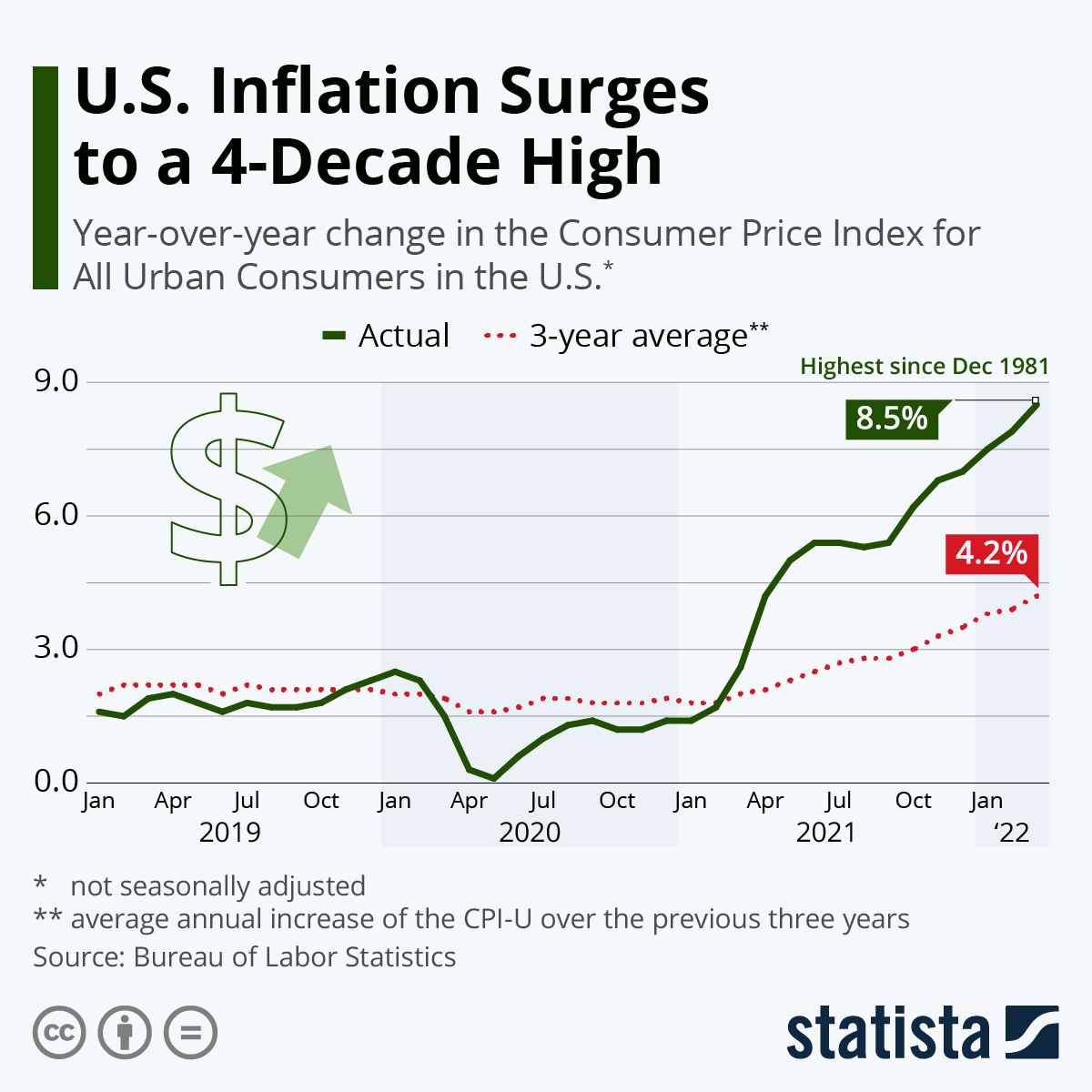

- Mountain states saw the worst inflation in the U.S. last month, with prices rising 10.4% compared to a national average 8.5%.

- Economists expect March data to show a 0.6% rise in retail spending for the month, primarily due to higher prices for energy and food.

- First-quarter profits at JPMorgan Chase fell 42% from a year ago as the bank stored away funds to prepare for higher defaults in case of recession.

- Manhattan rents hit a record-high for the second straight month in March and are up 23% from the same time last year, as the city’s bustling work and social life roars back.

- Although ticket prices at major airlines are 20% higher than 2019 levels, domestic flight demand is surging and could bring severe congestion over Easter weekend.

- Delta Air Lines reported a near-billion-dollar loss in the first quarter but said it returned to profitability in March and would operate at 84% of pre-pandemic capacity this summer.

- A pilot union at Southwest Airlines says rising fatigue among pilots is a threat to the airline’s safety.

- Bed Bath & Beyond failed for the second quarter in a row to show results in its turnaround plans, with sales falling 22% from a year ago.

- A lineup of new electric vehicles is expected to take the spotlight at this week’s International Auto Show in New York.

- Envision AESC, a Japanese maker of electric-vehicle batteries, announced plans for a $2 billion factory in Kentucky.

- Hyundai plans to make its first electric vehicles in the U.S. following the $300 million renovation of an Alabama assembly plant.

- Electric vehicle maker Lucid unveiled a new edition of its popular Air luxury sedan with a starting price tag of $179,000.

International Markets

- Global COVID-19 cases since the start of the pandemic surpassed 500 million, although the true count is likely much higher, according to the World Health Organization. Reported cases are down 24% week over week, the third straight week of declines.

- Shanghai reported over 27,000 new COVID-19 cases Thursday, a new high as the city’s lockdown extends into its third week. Other regions are cutting quarantine requirements for incoming travelers to reduce impacts to the economy.

- Canada’s sixth wave of COVID-19 is building, new data shows.

- Home prices in Hong Kong are down 6% from an August peak as more residents flee the island’s strict COVID-19 protocols.

- New Zealand reopened its borders to vaccinated Australians for the first time in the pandemic and plans to ease restrictions on other countries over the coming months.

- Canada’s central bank raised interest rates by half-a-percentage-point yesterday, the largest hike in 22 years.

- Consumer prices rose by an annual 7% in Britain last month, new data shows, the sixth consecutive month that inflation outpaced market forecasts. Prices will likely rise faster this month when a substantial cap on utility fees is lifted.

- Honda will invest $40 billion to introduce 30 electric models by 2030 with a targeted production volume of more than 2 million vehicles per year, the automaker announced.

- More news related to the war in Europe:

- The White House announced another $800 million in direct military aid to Ukraine yesterday.

- Over 600 Western firms have pledged to exit or cut back operations in Russia, as questions loom over how to deal with the financial consequences.

Some sources linked are subscription services.