MH Daily Bulletin: April 18

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose about 4% WeOil prices fell about 1% last Thursday following news of a larger-than-expected build in U.S. crude stocks.

- In mid-day trading today, WTI futures were up 1.3% at $108.30/bbl, Brent was up 1.4% at $113.30/bbl, and U.S. natural gas was up 7.18% at $7.82/bbl.

- Beginning this week, the U.S. administration will resume selling leases for onshore oil and natural gas drilling while raising royalty rates by 50% to 18.75%, the first rate rise in more than a century.

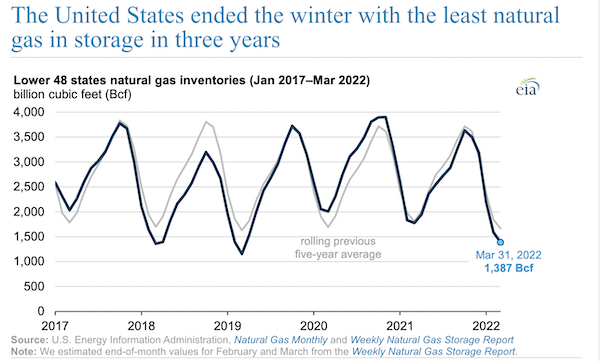

- U.S. natural gas storage is at a three-year low for this time of year, the result of a cold winter and high demand for exports:

- Chinese refiners could lower output up to 900,000 bpd on a crash in demand from recent lockdowns. Lower demand in Asia is also keeping Europe as the top spot for LNG deliveries, where premiums are higher.

- Japan plans to boost spending on foreign LNG projects to ensure supply, the government said.

- Exxon Mobil is in early talks to build a second hydrogen production and carbon-capture facility at a refinery in southeast Australia after announcing a separate project for Houston last month.

- Mexico lawmakers began debate on constitutional amendments that would restore the government monopoly over the nation’s electricity industry, which are not expected garner the necessary two-thirds of support.

- American utilities are expected to invest roughly $140 billion this year and next on replacing infrastructure and reducing carbon emissions, substantially more than any year since data collection began in 2000.

- Utilities and some states are proposing installing small modular reactors (SMRs) in existing coal plants, touting the relative low cost and safety of the emerging nuclear technology.

- More oil news related to the war in Europe:

- Roughly 3 million bpd of Russian oil could be shut-in due to sanctions or an inability to find buyers starting in May, the International Energy Agency projected.

- EU officials began drafting proposals for an embargo on Russian oil with a “phase-in” plan that would give heavy users, such as Germany, more time to find alternative suppliers.

- Amid reports of a sharp drop in production, Russia’s energy ministry declined to publish data on oil and gas output as scheduled on April 2.

- Russia walked back demands that future gas payments be made in rubles for at least one European nation, Austria, after its chancellor paid a visit to Moscow. Meanwhile, EU lawyers formally found that Russia’s proposed mechanism of switching to rubles would violate sanctions.

- Italy’s prime minister is confident that Europe can lower its energy dependence on Russia sooner than previously estimated, after the nation reached an agreement to increase gas imports from Algeria.

- Marathon purchased 1 million barrels of June-loading Murban crude from the UAE, as more refiners turn to the Middle East to replace Russian supplies.

Supply Chain

- China’s Zhengzhou airport economic zone, a central manufacturing area that includes Apple supplier Foxconn, announced a 14-day lockdown Friday due to rising COVID-19 cases. Some iPhone and MacBook makers in Shanghai and Kunshan also halted production.

- Authorities in Shanghai are attempting to kickstart the city’s economy by allowing some factories to bring back workers this week.

- An ultra large containership stuck in the Chesapeake Bay for the past five weeks was freed yesterday on its third re-floating attempt.

- Drewry’s World Container Index of international freight rates is down 13% since about a month ago.

- The Cass Freight Index, a barometer of freight volumes and market conditions, increased just 0.6% year over year in March from 1.6% in February, while first-quarter volumes slowed to a 0.4% annualized growth rate from a 4.3% increase in the fourth quarter.

- Bank of America downgraded several transportation stocks last week, including UPS, Union Pacific, Canadian Pacific and Schneider, citing deteriorating demand and falling prices.

- U.S. ports are expected to see 2.13 million TEUs of imports this month, down 1.1% from the same time last year, according to the Global Port Tracker.

- The global order book for container ships just surpassed 6.5 million TEUs, a 15-year high, with several of the largest carriers planning vessels near or exceeding a record 24,000-TEU capacity mark.

- Over 35,500 U.S. rail cars were loaded with chemicals over the last 13 weeks, a record dating to the mid-1980s and an 11.7% jump from the same time last year.

- A proposed merger between tanker owners Frontline and Euronav would control about 10% of the vessels that dominate global energy supply chains, including 69 very large crude carriers.

- Maersk Air Cargo, the shipping line’s newest unit, began operations out of Denmark’s second largest airport at Billund last week.

- China’s COSCO shipping line projects a $4.34 billion net profit for the first quarter, a record.

- A fire last week caused significant damage to California’s car-focused Port of Benicia in the San Francisco Bay, which also hosts a Valero refinery.

- Early signs suggest Apple’s years-long effort to design computer chips in-house is paying off, spurring higher sales of Mac computers and providing greater stability than third-party suppliers.

- Stellantis signed a multi-year deal with Qualcomm for next-generation computer chips in its vehicle lineup, as more automakers work directly with chip suppliers to get better control over supply chains.

- Rivian’s CEO warned of a looming shortage of electric vehicle batteries due to limited production capacity and inadequate raw material supplies, noting that current capacity is less than 10% of projected demand in a decade. Rivian is forecasting that it will run at just 50% capacity this year due to ongoing shortages of key parts hampering vehicle production.

- Trucker U.S. Xpress is testing a self-driving truck service between Atlanta and the Dallas-Fort Worth area using Kodak Robotics technology.

- Chinese display maker BOE Technology is expanding shipments of panels to Apple and other buyers by 70%.

- Idaho became the 27th state to report an outbreak of Avian flu, which has forced the culling of 27 million chickens and poultry in the U.S. and driven prices higher for poultry and eggs, which have experienced a near 300% increase since November.

Domestic Markets

- Amid comparatively small COVID-19 case counts, many Americans celebrated Easter ceremonies in-person for the first time during the pandemic yesterday, as the nation reported 7,181 new virus infections and nine virus fatalities.

- Although the BA.2 subvariant of Omicron rapidly became the U.S.’s dominant strain, public health officials are optimistic that an expected new wave of hospitalizations has not erupted. Still, some states are seeing elevated rates of new infections per capita, including Vermont, Rhode Island, Alaska, New York and Massachusetts.

- California health officials say the state has no plans to impose new pandemic restrictions despite a rise in COVID-19 cases the past 10 days.

- Reinfections with COVID-19 are taking up greater proportions of new cases, data shows.

- Health experts say the next phase of the pandemic will be marked by greater individual choice over decisions to wear masks, get boosters, or isolate after infection or exposure.

- The FDA authorized a first-of-its-kind test that detects COVID-19 using breath samples, delivering results within three minutes.

- Pfizer will soon request booster-shot authorization for children aged 5 to 11 following positive clinical results.

- Costco yesterday ended its special COVID-19 shopping hours for seniors, healthcare employees and emergency workers.

- U.S. retail sales rose 0.5% in March, the third consecutive increase but slightly below market expectations. The month also saw the first year-over-year decline in online spending (-3.3%) as foot traffic rose (+11.2%), signaling a return to pre-pandemic balances between online and in-person shopping.

- Wells Fargo, Goldman Sachs, Morgan Stanley, Citigroup and Bank of America reported double-digit declines in first-quarter profits last week, as rising volatility and inflation put an end to the pandemic-era financial boom. At the same time, consumer spending on credit cards is rising, a positive signal.

- Economists expect several million people who dropped out of the labor force during the pandemic to remain out indefinitely, potentially worsening worker shortages for years to come. Meanwhile, quitting rates are declining from their highest levels of the pandemic, indicating less favorable conditions for workers.

- U.S. housing demand remains at historically strong levels despite interest rates climbing at the fastest pace in years, leading some to expect a market cooldown in the coming months.

- Rents in Miami are up 58% since the start of the pandemic, the sharpest increase in the nation.

- There were about 1.2 million new vehicles en route to dealership lots at the end of March, roughly half the amount from a year earlier and a third of the pre-pandemic norm.

- Once completed in 2025, JPMorgan’s new Park Avenue headquarters in Manhattan will be the tallest and largest New York building to operate with net-zero emissions.

International Markets

- A new investigation by the World Health Organization shows that COVID-19 has killed significantly more people than official totals indicate, estimating that roughly 15 million people had died from the virus by the end of last year, compared to the 6 million virus fatality total officially reported. At least one-third of the newly compiled deaths are estimated to have occurred in India.

- Shanghai reported 3,590 symptomatic cases of COVID-19 over 24 hours during the weekend, a record, as Chinese officials recommitted to the nation’s zero-COVID approach despite growing food shortages. Pandemic restrictions were tightened in several cities, including Xi’an in the northwest and Suzhou near Shanghai, while economists downgraded the nation’s projected GDP growth this year from 5.5% to under 5%.

- Hong Kong will start to ease pandemic restrictions April 21 as infections fall to under 1,000 per day from tens of thousands per day last month.

- South Korea, for months a COVID-19 hotspot, will begin lifting social distancing rules this week as cases fall below 100,000 per day.

- More news related to the war in Europe:

- Moody’s says Russia may be in default after failing to meet contractual terms on its foreign debt payments earlier this month.

- A growing number of U.S. tech and finance firms are moving their Russian operations to Dubai, helping fulfill the city’s goal of becoming an international commercial hub.

- Mondelez, Nestle and PepsiCo are dealing with staff defections in Eastern Europe over their perceived willingness to keep some operations in Russia.

- French beauty-products maker L’Occitane International reversed course and will close its stores and e-commerce website in Russia, the firm said.

- Airlines forced to divert around Russian airspace is causing longer flight times and higher ticket prices for many international travelers.

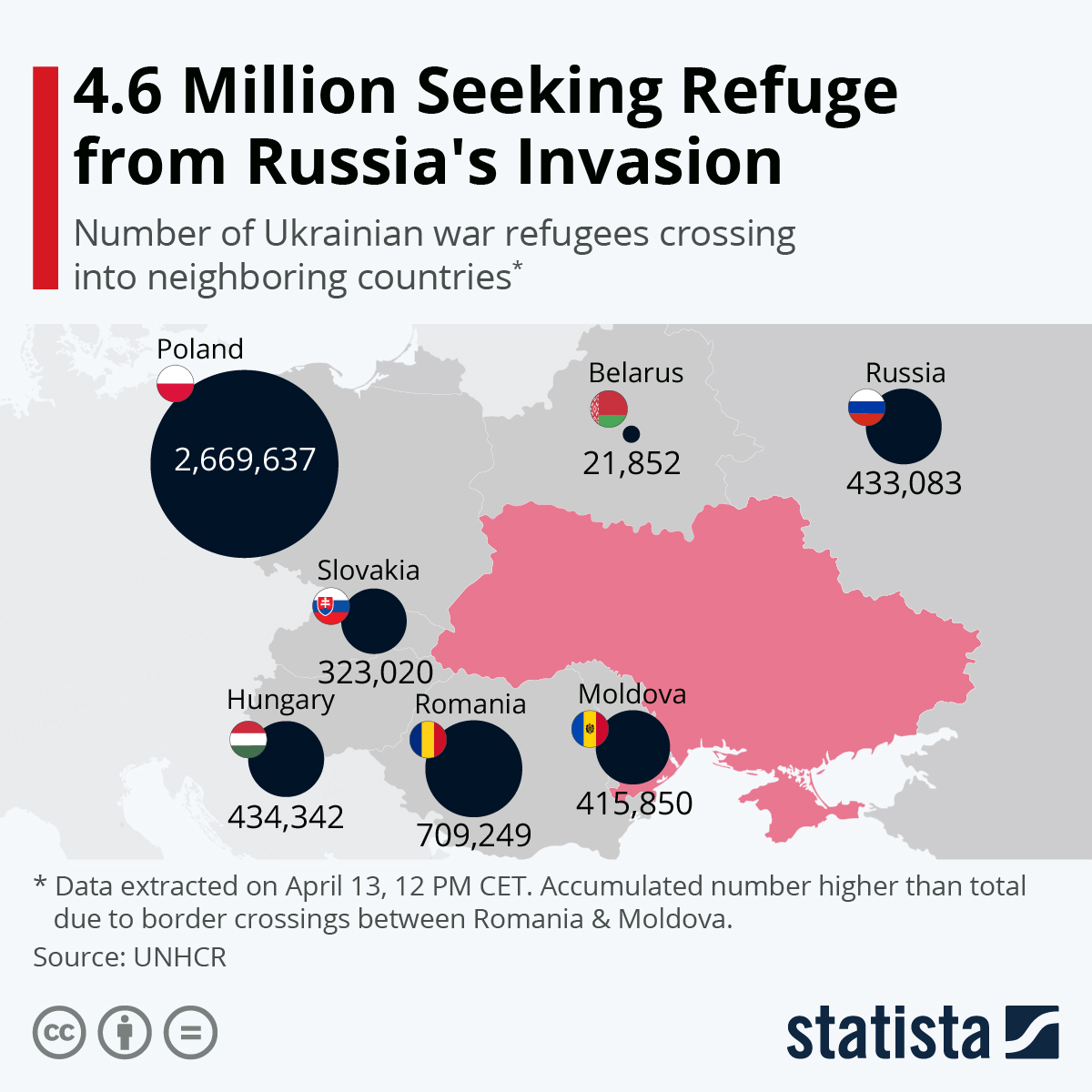

- Over 4.6 million refugees fled Ukraine during the first 50 days of Russia’s invasion, according to the United Nations.

- China’s retail sales fell in March for the first time since 2020, dropping 3.5% from a year ago, while its jobless rate jumped to 5.8%, its highest since May 2020.

- China’s imports unexpectedly fell 0.1% in March from a year earlier amid the nation’s strict pandemic measures, while its export growth slowed to 14.7% for the month, compared to a 16.3% increase in January and February.

- The International Monetary Fund is downgrading this year’s growth forecasts for 143 economies that account for some 86% of global gross domestic product due to surging inflation. High debt levels from pandemic borrowing will also contribute to more foreign-debt defaults, economists say.

- Mercedes-Benz successfully drove an electric vehicle (EV) on a 621-mile route with a single charge, a potential breakthrough in the next phase of EV innovation.

- Global packaging supplier TricorBraun announced plans to acquire North American packaging distributor PBFY.

Some sources linked are subscription services.