MH Daily Bulletin: April 19

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose over 1% Monday after Libya declared force majeure at several oilfields, including its biggest, due to political protests.

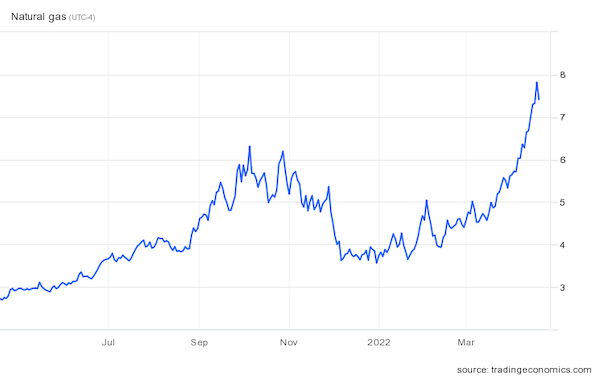

- In mid-morning trading today, WTI futures were down 4.7% at $103.10/bbl and Brent was down 4.5% at $108.10/bbl. U.S. natural gas was down 3.6% at $7.54/MMBtu, remaining near its highest in over a decade:

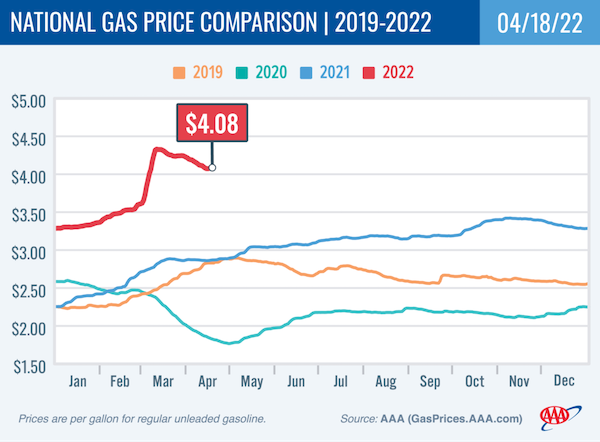

- Yesterday’s national average price for a gallon of U.S. gas dropped to $4.08, roughly 19 cents lower than a month ago but $1.21 higher than a year ago:

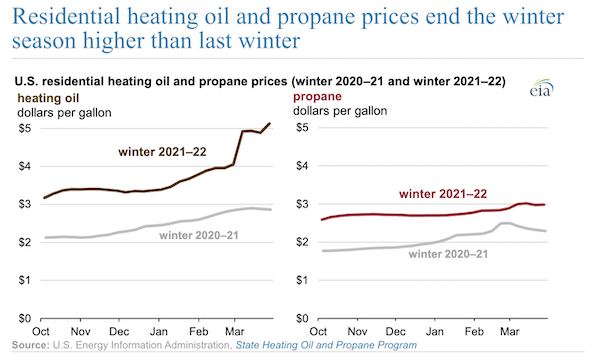

- Average heating oil prices in the U.S. ended the winter season at $5.13 per gallon, more than $2 higher than last year amid elevated demand and declining inventories:

- U.S. shale production from major basins is set to rise 132,000 bpd in May to 8.648 million bpd, the largest monthly increase of the pandemic, according to the government.

- The U.S. Energy Department will soon unveil plans for a $6 billion program aimed at keeping aging nuclear plants in service following a string of reactor retirements last year.

- OPEC+ produced 1.45 million bpd below its production targets in March, largely on a decline in Russian output. Saudi Arabia boosted exports. Chinese refinery throughput fell to a six-month low in March on declining demand, and coal production jumped 15% to a near-record.

- China’s plans for wind farms in Tibet could provide enough electricity to power the U.K., Germany and France combined, officials say. The nation is already on track to install 140 GW of clean energy capacity this year, the most in the world.

- A merchant ship carrying up to 1,000 tonnes of oil sank off the northern coast of Africa Sunday, authorities said.

Supply Chain

- More supply chain news related to lockdowns in China:

- At least 373 million people covering roughly 40% of the nation’s GDP are under lockdowns that started April 2.

- More than 470 bulk cargo ships were queued up outside Chinese ports last week, according to Bloomberg.

- Maersk halted refrigerated container shipments into Shanghai due to reduced trucking capacity from ports.

- More container and bulk ships are skipping Asia’s largest refueling hub in Singapore as they re-route from Shanghai.

- Despite efforts to reopen factories in Shanghai, most workers will be expected to live onsite, and authorities are silent on how to deal with disrupted supply lines and access to markets. Tesla entered a “closed-loop” system Monday that pays employees a daily stipend to sleep and eat meals on factory floors, as city officials said a similar system could be imposed even after lockdowns are eased.

- Lockdowns were renewed yesterday in Tangshan, a steel hub about 100 miles from Beijing. The nation’s steel output fell 6% in March from a year ago.

- Volkswagen, BMW and Bosch resumed some production in the northeast city of Changchun following a month of shutdowns.

- Food security concerns are driving Chinese demand for U.S. grain exports, pushing up corn prices to their highest level in a decade.

- Texas’ governor ended enhanced inspections of commercial vehicles at the U.S.-Mexico border, after the initiative caused trucks to wait for hours or days to go through crossings.

- Trans-Atlantic westbound air freight volume rose 25% in March as worsening port bottlenecks on the U.S. East Coast forced more ocean importers into the air.

- Port Houston handled a record 308,557 TEUs in the first quarter, up 20% from a year ago.

- Among major less-than-truckload carriers, the average fuel surcharge rose from 28.3% in the fourth quarter to 42.1% in March.

- The U.S. Postal Service will slow delivery times for nearly one-third of first-class packages from May as part of an effort to lower costs and reduce reliance on air freight.

- Backups at English Channel ports are damaging Britain’s trade with the EU, trucking groups say.

- Micro-fulfillment centers will proliferate to over 7,300 by 2030, up from 86 at the end of 2021, led by grocery retailers looking to expand same-day delivery services, according to analysts.

- Scammers are taking increased advantage of the growing container shipping market, offering knockdown or slightly lower-cost containers that never materialize, small firms report.

- After losing its 25-year spot as the world’s largest container shipper by capacity in January, Maersk is falling even further behind Mediterranean Shipping Co., the latest data shows.

- Companies looking at shifting sourcing from Asia-Pacific to Mexico and Latin America could face years of difficult restructuring and high costs, analysts say.

- Global PC shipments fell 5.1% in the first quarter, the first decline after two years of double-digit growth.

- India is emerging as Apple’s top manufacturing target in Asia outside of China, with its share of the tech firm’s supplier base expected to grow from 1.3% in 2021 to up to 7% this year.

- Chinese aluminum imports rose 16% by value in the first quarter, despite volumes declining by almost a fifth.

- U.S. regulators approved CSX’s plan to acquire short line operator Pan Am Systems, a bid to expand CSX’s network in New England.

- Uber Freight and Transplace, the third-party logistics provider Uber acquired last summer, will combine their businesses under the Uber umbrella by the fourth quarter of this year.

- Taiwanese liner Yang Ming Marine Transport is adding dual-fuel LNG capacity to five 15,000-TEU newbuilds it has on order.

- Russia has destroyed almost one-third of Ukraine’s infrastructure since late February, worth some $100 billion.

- Top U.S. officials are holding a week of high-level meetings with other nations as part of ongoing efforts to address global food shortages caused by Russia’s invasion of Ukraine. The latest concerns come from Asia, where rice farmers are cutting back harvests amid a shortage of fertilizer.

Domestic Markets

- The U.S. reported 54,009 new COVID-19 infections and 281 virus fatalities Monday.

- Philadelphia’s renewed indoor mask mandate began yesterday amid an uptick in COVID-19 cases, as a group of businesses and residents sued the city’s top officials.

- Over 15% of people getting tested for COVID-19 in certain parts of Manhattan are positive, prompting officials to recommend indoor masking.

- A federal judge overturned the White House’s recent extension of mask mandates for air travel and other public transport, leading most U.S. airlines and the TSA to immediately drop enforcement.

- The U.S. government removed all countries from its “Level 4: Do Not Travel” list yesterday.

- U.S. health officials cited new research out of Israel in recommending a second COVID-19 booster dose for people over age 60 yesterday.

- It is increasingly likely that millions of COVID-19 vaccine doses that the U.S. planned to export to low-income countries will expire, barring new funding from Congress. At the same time, small businesses are criticizing a proposal that would redirect unused pandemic aid for the purpose.

- Johnson & Johnson lowered its earnings guidance for the year amid falling sales of its COVID-19 vaccine.

- Pfizer bid $100 million to acquire an Australian company that has developed a smartphone app it claims can detect COVID-19 with 92% accuracy.

- There were about 1.1 jobless claims per 1,000 people in the labor force last month, a 54-year low, reducing the odds employees will be laid off.

- More than 8,000 employees at 15 northern California healthcare facilities are planning a one-day strike next Monday to protest staffing shortages and unsafe working conditions.

- Verizon boosted its starting wage to $20 an hour, a response to continued tightness in the U.S. job market.

- Union organizers won the right to hold an election at a small Amazon facility in New Jersey, in what will become the fourth site to hold a vote this year.

- Apple employees seeking to unionize a high-profile store at New York’s Grand Central Terminal are seeking minimum pay of $30 per hour, according to a just-launched website.

- Delta Air Lines is testing SpaceX’s Starlink satellite broadband technology on Gulfstream jets, its chief executive said.

- Goldman Sachs economists say the U.S. has a 15% chance of recession within a year and a 35% chance of recession within two years.

- The average U.S. mortgage rate hit 5% yesterday, the highest in over a decade. Surveyed Americans think rates will rise as high as 6.7% a year from now and 8.2% in three years.

- A key index of U.S. homebuilder sentiment fell to 77 this month, the fourth decline in a row and the lowest reading in over a year and a half.

- Tourism in Florida topped pre-pandemic levels for the second quarter in a row, as passenger volumes at airports in Miami and Orlando surged.

- Penske ordered 750 of Ford’s E-Transit cargo vans for initial use in Southern California.

- GM’s latest patent would enable autonomous vehicles to be used to train new drivers.

International Markets

- Shanghai reported the first deaths from its current wave of COVID-19 yesterday, as Chinese authorities imposed restrictions on more cities including Tangshan and Xi’an. The deaths announcement was met with skepticism about China’s official COVID-19 reporting.

- China vowed to stick with its zero-COVID-19 strategy at least through the end of the year.

- Environmentalists are alarmed at growing mountains of plastic waste caused by Hong Kong’s zero-COVID-19 strategy and its heavy use of single-use plastics for safety and barrier protection.

- Almost 100% of Indonesians on the nation’s most populous island of Java have COVID-19 antibodies either from prior infection or vaccination, new data shows.

- Foreign airlines, caught off guard by the U.S. lifting of mask mandates for domestic travel, are scrambling to adjust their own masking rules for international travel.

- More news related to the war in Europe:

- The World Bank reduced its forecast for global economic growth this year from 4.1% to 3.2%, citing Russia’s invasion. Russia’s economy will decline over 11%, the group said.

- U.S. economic officials warned of growing isolation for nations that maintain business ties to Russia.

- Russia’s central bank made a rare public disclosure that it has failed to find non-hostile currencies in which to place most of its sanctioned reserves.

- China unveiled new support measures to boost lending to individuals and small businesses after reporting its biggest decline in consumer spending and the worst unemployment rate since the early months of the pandemic yesterday.

- Brazil’s government failed to publish a widely followed economic survey for the third consecutive week as striking public workers, including those at the Central Bank, demand wage increases of up to 26% to counter rampant inflation. Average real wages in the nation are down 8.8% during the pandemic.

- Stellantis and LG Energy are teaming up to build a $4 billion electric vehicle battery plant in Windsor, Ontario, that will be one of North America’s largest when it is completed in 2024.

- Mitsubishi is pairing with Japanese petroleum conglomerate Eneos Holdings to produce sustainable aviation fuel by 2027.

Some sources linked are subscription services.