MH Daily Bulletin: April 8

News relevant to the plastics industry:

At M. Holland

- M. Holland has launched a new Healthcare Packaging line card to meet the product needs of medical device and pharmaceutical packaging manufacturers.

- M. Holland’s Color & Compounding experts shared insight on the current pigment shortage and how it’s impacting the industry.

- M. Holland will be exhibiting at MD&M West in Anaheim, California, from April 12-14. MD&M West is the largest medtech conference in the U.S. If you’re attending, please stop by Booth #4111 to meet our Healthcare experts!

- In case you missed it, watch M. Holland’s Plastics Reflections webinar about the current and future state of the North American plastics industry. Click here to access the recording.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell half a percent Thursday, extending weekly losses amid uncertainty that the eurozone will be able to effectively sanction Russian energy exports.

- In mid-morning trading today, WTI futures were up 0.3% at $96.32/bbl, Brent was up marginally at $100.60/bbl, and U.S. natural gas was off 0.7% at $6.32/MMBtu.

- Global oil supply disruption from Russia’s invasion could reach 5 million bpd, on top of the 2.2 million bpd of pandemic output curbs that OPEC+ has yet to return to the market.

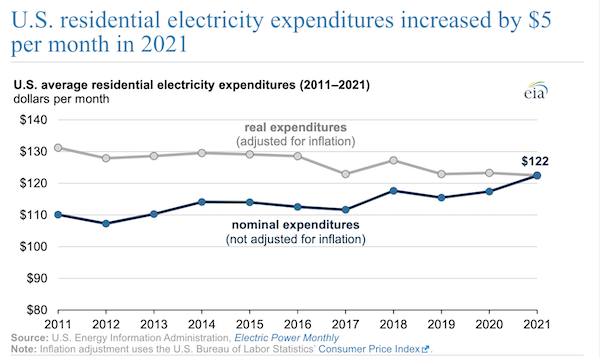

- Household electricity bills in the U.S. rose by $5 per month to average $122 in 2021:

- The ramp-up of oil production in Canada’s Alberta province is being held back by a lack of skilled workers.

- British officials are asking the nation’s central bank to reverse a new push for green energy projects in favor of building more oil capacity in the North Sea.

- Canada’s federal government approved this week a $12 billion Equinor-backed plan to build a floating offshore oil project in the Atlantic’s Flemish Pass near the coast of Newfoundland.

- More oil news related to the war in Europe:

- The EU agreed by a narrow margin last evening to ban Russian coal imports, a move projected to cost Russia $4.4 billion per year in lost revenue. The EU’s top diplomat said Thursday that discussions over an oil embargo will follow despite pushback from Germany, among other nations.

- Following Europe’s announcement, Japan said it would ban Russian coal imports.

- Russia said its oil production may decline up to 5% in April, the steepest drop since the beginning of the pandemic. Unable to sell their products and running out of storage space, some Russian refineries face imminent shutdowns.

- Cargoes of Russian Sokol crude from the Far East have sold out for next month on high demand from buyers in Asia amidst steep price discounting.

- The U.S. is preparing to process Jones Act waivers for crude transport as it releases oil from its strategic reserve.

- European energy officials met with top American industry executives in Texas yesterday to discuss boosting U.S. LNG shipments.

- Finland and Estonia are the latest European nations planning to cut Russian gas deliveries by jointly investing in a floating LNG terminal.

- Plans for a massive underwater gas pipeline from the Eastern Mediterranean to Europe could take more than a decade to build, providing little hoped-for relief for energy-starved Europe.

- It may now be impossible for Europe to reach its pandemic-era goal of replenishing gas stocks by 80% this year to ward off winter energy shortages.

Supply Chain

- Power should be restored to Puerto Rico today following a Wednesday night power-plant fire that downed the island’s entire grid.

- With 85% of the state in drought, Texas is facing its driest conditions in more than a decade, threatening more wildfires and damage to livestock, crops and the state’s power grid. Water conservation efforts in California, meanwhile, have largely underwhelmed.

- More reports suggest the U.S. will see an above-average number of hurricanes this year.

- A Boeing 757 cargo jet operated by DHL broke in two after skidding off the runway in Costa Rica yesterday after the crew reported hydraulic problems that forced an emergency landing.

- The volume of goods moving through the port of Shanghai has recently fallen by 40%, analysts say, as the city’s extended lockdowns continue to batter automakers, chip builders and other key industrial suppliers.

- Chinese lockdowns have taken a toll on the global air cargo market, with overall shipment volumes and capacity both falling sharply last month.

- As of Wednesday, there were more container ships stuck outside U.S. East Coast ports than off the busiest gateways in the West, a stark turnaround from much of the pandemic.

- Irish freighter operator ASL Aviation is set to double its fleet with an order for 20 converted 737-800 aircraft.

- Danish retailer Flying Tiger Copenhagen is suing freight forwarder DSV over high shipping rates and a lack of capacity.

- At $113.19 billion in trade, Mexico has edged out China as the U.S.’s top trading partner this year.

- A supply crisis is headed for the U.S. warehouse market, real estate firm JLL predicts.

- Walmart will start paying in-house truck drivers up to $110,000 in their first year amid a historically tight labor market.

- U.S. Xpress’ most recent trial saw an autonomous truck travel 6,350 miles in 5.5 days, almost double human mileage capacity.

- FedEx’s chief executive says the carrier plans to put autonomous trucks on highways this summer.

- Amazon has added five heavy-duty electric trucks to its British operations, a European first.

- By 2030, the number of delivery vehicles in the world’s 100 largest cities will balloon by more than one-third from 2019 to 7.2 million, according to McKinsey & Co.

- Conagra Brands saw a 22% profit decline in its most recent quarter, prompting the firm to raise prices for most of its products.

- More supply chain news related to the war in Europe:

- Shipping containers piled up at the Port of Rotterdam last week as dockworkers refused to handle Russian cargoes.

- Over 1,000 rail cars full of commodity exports remain stuck at the Ukrainian border.

- Frontline and Euronav are considering an all-stock merger that would produce the world’s biggest tanker fleet, a bid to capitalize on higher rates caused by the exit of Russian vessels from the market.

Domestic Markets

- The U.S. reported 40,251 new COVID-19 infections and 754 virus fatalities Thursday.

- Half of states are seeing rising COVID-19 cases again, even as nationwide infections dropped about 5% the past two weeks. The nation’s top infectious disease adviser warned recent upticks in infections could become a surge in the fall.

- COVID-19 cases are rising again in Los Angeles, San Diego and San Francisco. Health experts worry California’s less frequent virus updates will give a false sense of security.

- Philadelphia will likely reinstate an indoor mask mandate next week as COVID-19 cases climb.

- A federal court of appeals reinstated the U.S. administration’s COVID-19 vaccine mandate for federal workers yesterday.

- Congress departed for a two-week recess without passing the latest $10 billion aid deal for COVID-19 testing and vaccination efforts, putting the measure in limbo. Lawmakers in the House, meanwhile, approved $55 billion for restaurants and small businesses that did not receive aid during earlier rounds of pandemic relief, but it is unclear whether the bill will pass the Senate.

- More states are putting millions of dollars into programs to hire and train nurses ahead of a forecasted 200,000-worker shortage by the end of the decade.

- High numbers of COVID-19 fatalities caused the average U.S. life expectancy to fall for the second year in a row in 2021, down a half-year to 76.6, the lowest in a quarter-century.

- The head of the St. Louis Federal Reserve signaled he was in favor of a 3.25% interest rate by the second half of this year.

- Employers say they set aside an average 3.9% of total payroll for wage increases in 2022, the largest percentage since 2008.

- New U.S. manufacturing jobs were minted at a rate of about 32,000 a month over the past year, the fastest pace in more than 25 years.

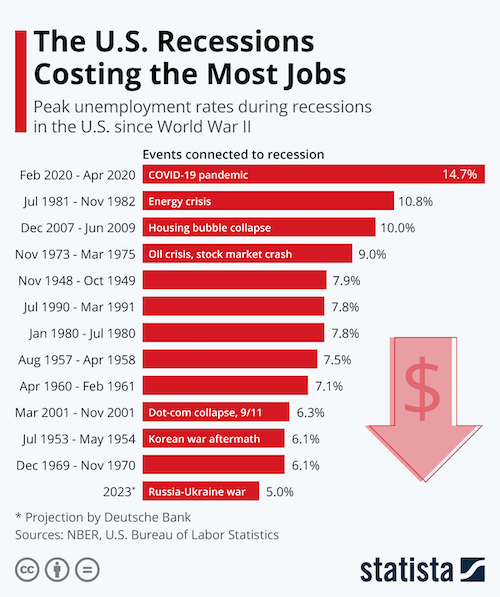

- The U.S. economy suffered one of the sharpest employment declines of any previous recession in just two months in 2020:

- Wall Street banks, once among the mWith the average U.S. mortgage rate hitting 4.72% this week, its highest in three years, home sellers are racing to list their properties before an expected cooling of the market. In a similar vein, companies will likely speed up refinancings to take advantage of the last remnants of low rates.

- Homes in the wealthiest U.S. suburbs have seen comparatively small price gains compared to suburbs across the nation.

- Unibail-Rodamco-Westfield, Europe’s largest mall operator, will shed most of its $13.2 billion of U.S. properties by the end of 2023 and likely incur steep losses as mall real estate continues to lose its appeal.

- Used car prices have declined for two months now, with March seeing the biggest drop since the beginning of the pandemic.

- EVgo, the U.S.’s largest rapid-charging network, will partner with Chase Bank to install charging stations at some 50 U.S. branches by next summer.

- Tesla opened a $1.1 billion auto-assembly plant in Texas yesterday, its second opening of a so-called Gigafactory the past month.

- PepsiCo is looking at a large-scale rollout of electric vehicles to help reduce its emissions 75% by the end of the decade.

International Markets

- Shanghai today announced a record 21,000 new COVID-19 cases and a third consecutive day of mass-testing, as food shortages rise and city officials prepare over 130,000 makeshift beds for infected residents. Including Shanghai, Chinese lockdowns now affect more than 193 million people and 22% of the nation’s GDP.

- Deltacron, a hybrid of the Delta and Omicron COVID-19 variants first discovered in France in February, has been detected in Australia as health officials try to determine whether it might combine the virulence of Delta and the contagiousness of Omicron.

- Nearly two-thirds of Africans may have contracted COVID-19 so far, according to the World Health Organization.

- European health regulators are declining for the moment to offer second COVID-19 boosters to the general population, citing uncertain effectiveness.

- Nearly 3,000 COVID-19 fatalities were added to the U.K.’s official figures yesterday after the discovery of a data processing error.

- German lawmakers rejected a plan to make COVID-19 vaccines mandatory for anyone over age 60.

- Even mild COVID-19 infection sharply increases the risk of blood clots, new international research suggests.

- More news related to the war in Europe:

- In a rare public admission about the impact of Western sanctions, Russia’s prime minister said the nation is in its worst shape in over 30 years. Russia missed dollar-bond payments due to foreign bondholders this week and has until early May to pay creditors before defaulting.

- The U.S. Senate voted unanimously yesterday to ban Russian oil imports and scrap normal trade relations with Russia and Belarus, a move that codifies into law a similar order from the White House made weeks ago.

- The United Nations voted Thursday to suspend Russia from its Human Rights Council.

- Ireland’s inflation jumped to 6.7% in March, the highest in nearly 40 years.

- Mexican consumer prices rose 7.45% year over year in March, the fastest pace in over two decades and more than double the central bank’s target.

- Brazil’s currency is up 17.5% so far this year on a wave of positive sentiment that is sharply at odds with the nation’s worsening economic conditions.

- Beijing’s anti-COVID measures will exacerbate a slowdown in revenue growth for China’s largest tech firms, already reeling from regulatory clampdowns during the pandemic.

- A major British airport warned passengers to expect the delays plaguing the travel industry to continue for months due to labor shortages and COVID-19 infections among staff.

Some sources linked are subscription services.