MH Daily Bulletin: April 11

News relevant to the plastics industry:

At M. Holland

- We’re proud to share that M. Holland was named a finalist for the Manufacturing Leadership Awards in the Transformational Business Cultures category. Thank you to the Manufacturing Leadership Council for this recognition, and congrats to all 2023 finalists! Click here to read more.

Supply

- Oil fell slightly Monday after rising for three straight weeks, a response to concerns over further U.S. interest-rate hikes that could curb global demand.

- In mid-morning trading today, WTI futures were up 1.9% at $81.23/bbl, Brent was up 1.3% at $85.29/bbl, and U.S. natural gas was up 0.6% at $2.19/MMBtu.

- Citigroup expects oil prices to fall below $80 due to a slower-than-expected recovery in China and additional supply from Iraq and Venezuela.

- U.S. gasoline prices are up for the second week in a row to an average of $3.64 per gallon, according to AAA.

- U.S. production of diesel hit 5 million gallons per day for the first time ever in January, extending a two-year biofuel business boom.

- Shares of Pioneer Natural Resources jumped 8.5% Monday following a report that Exxon Mobil is in talks with the U.S. shale producer over a potential acquisition.

- Occidental Petroleum is spending more than $1 billion to build the first in a planned fleet of plants using direct-air capture to pull CO2 out of the air, a bid to allow the company to keep operating as a crude driller decades into the future.

- An expansion of Canada’s Trans Mountain crude pipeline, set to begin in 2024, will cut producers’ reliance on U.S. refiners and potentially lead to better prices, experts say.

- Russia cut its crude production by 700,000 bpd in March, new data shows, exceeding a planned cut of 500,000 bpd announced the month before.

- More Russian diesel is being sent to Latin America, as the nation’s exports seek new markets outside Europe.

- Japan is slashing its reliance on Russian coal as buyers source more fuel from suppliers in Indonesia and South Korea.

- India’s fuel demand jumped by an annual 5% in March to a record-high as consumption in the world’s third-largest crude importer continues to grow.

- India proposed a $2 billion subsidy scheme this week that aims to push domestic production of hydrogen fuels.

- Installers of U.S. residential solar units are bracing for a slowdown this year as California, the sector’s biggest market, prepares to slash subsidies underpinning more than a decade of high growth.

- China’s state-owned energy firm Sinopec announced plans to build a pipeline to transfer hydrogen from renewable projects in Inner Mongolia to cities in the country’s East.

Supply Chain

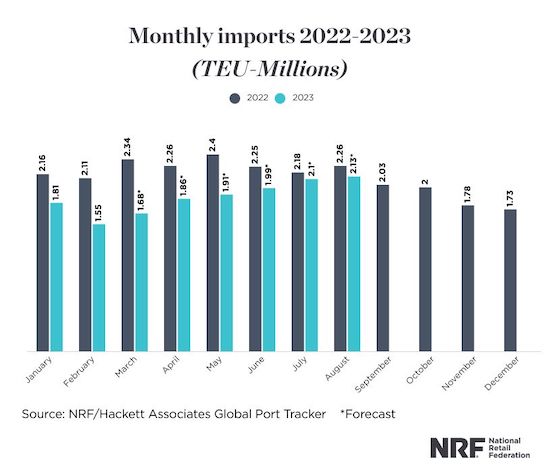

- Major U.S. ports are projected to import 1.68 million TEUs in March, up 8.9% from February but 28.2% below the level from a year ago, according to the Global Port Tracker:

- The port of entry in Laredo, Texas, regained its top spot among the nation’s 450 international gateways for trade in February, recording $24.6 billion in two-way trade.

- CMA CGM ordered 16 container ships from China State Shipbuilding for a total of $3.1 billion.

- Walmart executives say they will need at least the same number of workers for order fulfillment even as the retailer scales up automation.

- The U.S. Postal Service is seeking approval to hike the price of first-class mail stamps by 5.4% to 66 cents, effective July 9.

- Boeing resumed deliveries of 767 freighters after a multi-week pause to address quality issues.

- Manufacturing disruptions at Conagra Brands led to stock shortages for some products last quarter, executives said.

- Prices for widely used DRAM computer chips could fall as much as 10% in the current quarter due to a global supply glut, analysts say.

- Taiwanese chipmaker TSMC is in talks with the White House over concerns about rules attached to U.S. subsidies for domestic chip development, including sharing excess profits.

- In the latest news from the auto industry:

- China’s auto sales were flat in March from a year earlier, while total first-quarter sales fell by 13.4%.

- Auto production in Mexico rose 13.12% in March from a year earlier, new data shows.

- Trucks, vans and SUVs now represent the majority of cars on the road in every U.S. state.

- Chinese electric-vehicle giant BYD launched a new, homegrown chassis suspension system this week as the automaker ramps up efforts to sell more premium cars.

Domestic Markets

- Bank of America says the U.S. economy is at risk of shrinking in the second quarter on new data showing higher interest rates are cooling the economy.

- American’s inflation expectations for a year from now rose to 4.7% this month, the first increase in inflation expectations in five months, according to a widely tracked survey:

- The U.S. dollar rose Monday after new jobs data pointed to a continued tight labor market, heightening expectations of another Federal Reserve rate hike in May.

- Americans say access to credit is at its most difficult in nearly a decade, according to a new survey from the New York Fed.

- Overall U.S. bank credit has been stalled at about $17.5 trillion since January, raising the potential for a worse-than-expected credit crunch if the Federal Reserve continues with its path of interest-rate hikes at its next meeting in May.

- Online prices in the U.S. dropped 1.7% in March from a year earlier, the seventh straight decline and the sharpest retreat in four months, according to Adobe’s Digital Price Index.

- The percentage of Americans working from home surged from 5.7% in 2019 to 17.9% in 2021, highlighting the pandemic’s upending of work habits across the country.

- Prospects for more union gains at Amazon have faded since a labor organizing victory at a Staten Island warehouse last year.

- Amazon-owned Whole Foods Market is exploring building commercial kitchens that would make prepared meals for the grocer’s supermarkets.

- Tupperware Brands has engaged financial advisers and is seeking new financing, according to reports, sending the firm’s shares down 49% Monday.

- Retailer Shoe City filed for bankruptcy protection and plans to close its 39 stores.

- About 150 employees of a Tyson Foods chicken plant in Arkansas went on strike Monday as the company preps to shut the facility.

- Thousands of professors and staff at Rutgers University went on strike this week for the first time in the school’s 257-year history, protesting pay and working conditions.

International Markets

- The World Bank revised its 2023 global growth outlook slightly upward to 2% this week from 1.7% forecast in January, although officials warned of greater possible pressure from debt crises in developing countries.

- New leadership at the Bank of Japan indicated the country’s ultra-loose monetary policy will remain in place for now as inflation has yet to hit 2% as a trend.

- Economists expect Canada’s central bank to leave interest rates unchanged at its meeting on Wednesday despite recent data showing surprising economic gains.

- Annual inflation in Egypt climbed to 32.7% year over year in March, just shy of an all-time record, following a series of currency devaluations and other monetary challenges.

Some sources linked are subscription services.