MH Daily Bulletin: April 13

News relevant to the plastics industry:

At M. Holland

- Establishing corporate sustainability goals and using reporting platforms are quickly becoming an expectation from every stakeholder in the plastics industry. Click here to read how M. Holland is working with more and more customers every year to incorporate sustainable materials into plastic products and further environmentally friendly practices.

- We’re proud to share that M. Holland was named a finalist for the Manufacturing Leadership Awards in the Transformational Business Cultures category. Thank you to the Manufacturing Leadership Council for this recognition, and congrats to all 2023 finalists! Click here to read more.

Supply

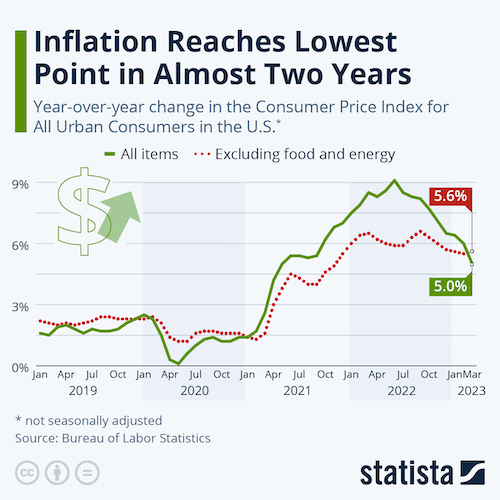

- Oil prices rose 2% Wednesday to their highest in over a month on forecasts that cooling U.S. inflation will spur the Federal Reserve to end its rate-hike campaign.

- In mid-morning trading today, WTI futures were down 0.5% at $82.85/bbl, Brent was down 0.6% at $86.81/bbl, and U.S. natural gas was down 3.4% at $2.02/MMBtu.

- The global oil market could see tightness in the second half of 2023, the International Energy Agency warns.

- China’s crude imports jumped more than 22% in March compared with the prior-year period.

- China’s coal imports jumped to a three-year high in March as the nation prepares for a sharp economic recovery.

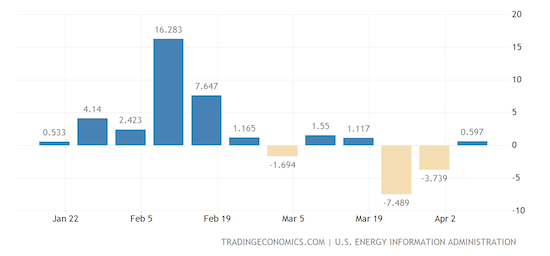

- U.S. crude stocks rose by a modest 600,000 barrels last week, putting current inventories about 3% higher than the five-year seasonal average, according to the U.S. administration.

- The U.S. administration could start refilling strategic crude reserves as soon as this year, officials indicated.

- U.S. producer Diamondback Energy announced that it is looking to sell its non-core assets in the Permian Basin, the latest in shale-patch M&A activity following news of Exxon Mobil’s potential acquisition of Pioneer Natural Resources.

- Western embargoes on seaborne imports of Russian crude have upended traditional shipping routes, evidenced by average fuel-tanker rates more than doubling since Feb. 5.

- Colombian crude output is set to fall by as much as 7.2% this year due to growing civil unrest and attacks on energy infrastructure.

- China is facing a second summer of regional power outages with electricity demand forecast to peak beyond grid capacity.

Supply Chain

- U.S. container imports hit 1.85 million TEUs in March, down 27.5% from the same month last year but 4.2% higher than pre-pandemic levels.

- Average U.S. diesel prices fell for the 10th straight week and are down by $1.24 per gallon since mid-October.

- G7 finance leaders pledged to give low- and middle-income countries a bigger role in diversifying supply chains to improve resiliency.

- Shipping experts and surveys suggest consumers are stepping back from an intense focus on speedy delivery times as concerns about costs and certainty become more important.

- U.S. truckload pricing is forecast to fall more than 13% in the second quarter amid excess truck capacity and soft demand.

- China’s Cosco Shipping expects first-quarter profit to fall 75% to about $1 billion.

- Teamsters union drivers ended strikes against food distributor Sysco in Louisville and Indianapolis.

- Colorado lawmakers passed the U.S.’s first right-to-repair legislation for farm equipment, making manufacturers provide buyers with manuals for diagnostic software and other aids.

- Brookfield Infrastructure Partners plans to acquire shipping container lessor Triton International in a $13 billion deal.

- Japanese shipper Kumiai Senpaku ordered 10 large multipurpose cargo vessels from China State Shipbuilding.

- The flow of U.S.-made semiconductors into Russia has surged despite Western sanctions, experts say.

- Germany’s Merck plans to build a $328 million specialty gas plant in Hometown, Pennsylvania, to support its growing semiconductor business.

- In the latest news from the auto industry:

- The U.S. administration released a proposal Wednesday for the nation’s toughest-ever restrictions on car pollution, a bid to accelerate the transition to electric vehicles from combustion engines.

- The average price for a new vehicle in the U.S. fell below MSRP for the first time in 20 months in March, but prices were still up about 3.8% from a year earlier.

- Truck maker AB Volvo saw first-quarter profit rise 45% year over year to a record $1.76 billion.

- Toyota’s distribution arm is consolidating operations and expanding capacity at Florida’s Port of Jacksonville.

- Electric truck-maker Nikola submitted plans for a hydrogen production plant in Buckeye, Arizona.

- Mercedes-Benz saw global sales growth of 3% in the first quarter, including a big boost from electric models.

- Shares of Harley-Davidson dropped as much as 6% in Wednesday trading after the motorcycle maker’s CFO announced plans to leave next month.

Domestic Markets

- Initial jobless claims rose by 11,000 last week to 239,000, higher than expected, suggesting the labor market is slowing.

- Producer prices fell by 0.5% in March compared with February, the biggest drop since early in the pandemic, and were up just 2.7% from March 2022.

- A majority of traders are betting that the Federal Reserve will raise its borrowing rate once more in May to a range of 5% to 5.25%, even after the latest inflation data showed consumer price rises cooling in March.

- The U.S. government posted a $378 billion budget deficit in March, up significantly from $193 billion a year ago.

- American Airlines says first-quarter profit will likely come in below expectations, joining other U.S. airlines warning of impacts from high labor and fuel costs.

- U.S. industrial conglomerate Emerson Electric has agreed to buy National Instruments for $8.2 billion, capping a year-long pursuit of the measurement equipment maker.

- JPMorgan Chase is asking all managing directors to return to the office five days a week.

- The U.S. government ended its national emergency response to COVID-19 Monday but left in place the separate public health emergency until it expires on May 11, continuing to bar unvaccinated non-citizens from entering the country.

International Markets

- The International Monetary Fund says global economic growth will slow to 2.8% this year from 3.4% in 2022, partly a result of public debt growing faster than expected in the U.S. and China.

- China’s exports surged nearly 15% in March, led by strong demand from Europe and Asia and a more than doubling of exports to Russia.

- Asia’s economic growth this year is projected to outpace that of developed countries outside the region by almost 5%, economists say.

- New leadership at Japan’s central bank plans to continue monetary easing to achieve a 2% inflation target, an opposite course from the rate-hike cycle pursued by many other major economies.

- Public sector labor strikes contributed to flat GDP growth in the U.K., possibly foreshadowing a weak economy ahead.

- Lower food prices led to lower-than-expected retail inflation in India this month, new data show.

- South Korean import prices dropped by 6.9% year over year in March, the fastest rate of decline in over two years.

- The U.S. administration announced new export controls on over two dozen companies in China, Turkey and elsewhere over their support for Russia’s military and defense industries.

- LVMH, the world’s largest luxury company, saw first-quarter sales rise 17% on a sharp rebound in demand from China.

Some sources linked are subscription services.