MH Daily Bulletin: April 14

News relevant to the plastics industry:

At M. Holland

- Establishing corporate sustainability goals and using reporting platforms are quickly becoming an expectation from every stakeholder in the plastics industry. Click here to read how M. Holland is working with more and more customers every year to incorporate sustainable materials into plastic products and further environmentally friendly practices.

- We’re proud to share that M. Holland was named a finalist for the Manufacturing Leadership Awards in the Transformational Business Cultures category. Thank you to the Manufacturing Leadership Council for this recognition, and congrats to all 2023 finalists! Click here to read more.

Supply

- Oil fell more than 1% Thursday on worries that economic stagnation will lead to lower demand over the summer.

- Crude prices are on pace for a fourth straight weekly gain in mid-morning trading today, WTI futures were up 0.1% at $82.25/bbl, Brent was off 0.1% at $85.99/bbl, and U.S. natural gas was down 1.1% at $1.99/MMBtu.

- OPEC flagged downside risks to summer oil demand in a monthly report released on Thursday, which highlighted rising inventories and challenges to global growth.

- OPEC’s crude production fell to 28.80 million bpd this month, about 86,000 bpd lower than in February, new data shows.

- The U.S. Energy Department approved LNG exports from a planned $39 billion project in Alaska.

- Spot LNG prices have dropped to their lowest in nearly two years, prompting increased demand in Asia.

- French utility EDF warns it may have lost $1.1 billion in output due to drawn-out strikes at its nuclear reactors and hydro plants earlier this year.

- TotalEnergies is reportedly eyeing a $5 billion acquisition of independent Neptune Energy Group, which has assets in Norway, Australia, Germany and elsewhere.

- Russian gasoline exports surged in the first quarter of this year compared to 2022 as Moscow sent growing volumes of fuels to Africa.

- Bolivia says it could save over $250 million per year with new security controls aimed at curbing smuggling of state-subsidized fuel.

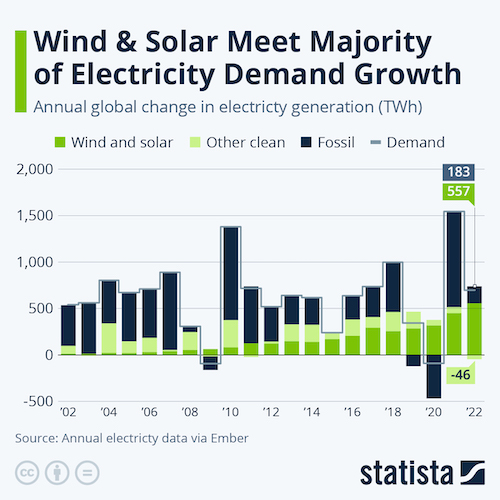

- Wind and solar accounted for 12% of global electricity generation in 2022, a figure that rises to 39% when including other renewables and nuclear:

- Thirteen years after the Deepwater Horizon disaster, BP is resuming expansion in the Gulf of Mexico with a $9 billion investment in a new deepwater platform named Argos.

Supply Chain

- Disruption has stretched into a second week at the ports of Los Angeles and Long Beach as labor talks covering 22,000 dockworkers approach their one-year mark without resolution.

- Unionized dockworkers and employers at Canada’s Port of Halifax reached a tentative contract agreement.

- U.S. rail shippers expect average rates to rise by 3.5% over the next six to 12 months, down from expectations of a 4.6% rise several months ago.

- The ports of Seattle and Tacoma will start offering financial incentives for shippers to use rail rather than trucks.

- The U.S. administration unveiled on Thursday nearly $300 million in infrastructure funding for nine bridge projects across the country.

- Freight technology provider project44 says on-time delivery of truckload shipments in the U.S. has improved but remains behind pre-pandemic levels.

- China’s container depots are reportedly overcrowded with boxes amid a slowdown in the country’s exports.

- North American airlines are using more secondhand and generic parts for aircraft repairs as supply-chain shortages plague the aerospace industry.

- Boeing is halting deliveries of some 737 MAX jets as the plane-maker grapples with a newly discovered supplier quality problem that could stretch as far back as 2019.

- Walmart is closing four stores in Chicago after earlier closing several others in urban areas as the company extends a broader reset of its supply chain for a post-pandemic environment.

- UBS says some 50,000 U.S. stores could close by 2027 due to rising e-commerce activity and other trends.

- U.S. regulators are weighing a penalty against Mediterranean Shipping Company over a congestion surcharge in its tariff.

- The world’s largest iron ore export hub in northwest Australia could see disruption from the nation’s most powerful cyclone in a decade, which started to hit Thursday.

- Apple says it will only use recycled cobalt in its product batteries by 2025.

- Apple is in talks to start making its signature MacBook laptops in Thailand, part of the tech giant’s efforts to expand beyond China.

- Moscow says it will not agree to extend a critical Black-Sea grain deal beyond its current expiration date of May 18, potentially disrupting supplies throughout the globe.

- In the latest news from the auto industry:

- U.S. electric-vehicle startup Lucid Group produced 2,314 vehicles and delivered 1,406 in the first quarter, in line with lowered production targets for the year.

- Volkswagen is pressuring EU policymakers to delay new emissions standards to at least 2026, a year later than planned.

- Brazil is offering incentives for Chinese electric-vehicle giant BYD to build an electric-vehicle plant in Bahia state amid a stall in the government’s talks to take over a closed Ford plant there.

- Honda Atlas Cars Pakistan will shutter its operations for another 15 days, extending the automaker’s longest plant shutdown of the fiscal year, due to the country’s growing economic crisis.

- PepsiCo took delivery of 18 Tesla semitrucks at its distribution center in Sacramento, California.

- Renault entered a long-term commercial partnership with French startup Verkor to produce batteries for the automaker’s premium models.

Domestic Markets

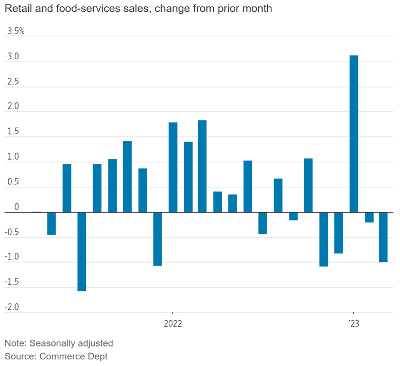

- Retail sales fell 1.0% in March and were revised downward for February:

- Lower demand last week for Fed emergency credit to banks signals that strain in the financial sector is easing.

- Analysts have cut their per-share earnings estimates for 13 of the largest U.S. banks by a median of 4% this year and 15% for 2024, citing impacts from last month’s turmoil that rocked the financial sector.

- Delta Air Lines says growing demand for summer travel will lead to higher-than-expected profit in the second quarter.

- Tuesday’s fire at a Richmond, Indiana, plastics recycling plant is largely extinguished, but officials warned residents to keep doors and windows closed and shelter in place to avoid toxic smoke and fumes.

International Markets

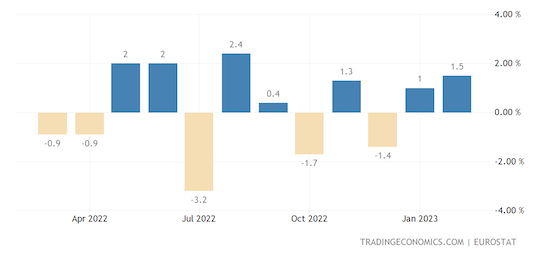

- Industrial output in the euro zone rose a surprise 1.5% month over month in February, mainly due to a rise in production of capital and non-durable consumer goods:

- European policymakers expect the bloc’s central bank to raise interest rates by 25 basis points in May.

- India’s goods and services exports rose 6% in the fiscal year to March 21 while imports surged thanks to a 369.44% gain in imports from Russia.

- Mexican air traffic is rising rapidly amid a boom in corporate “nearshoring” that is driving more relocation to the country.

- Ukraine’s GDP likely fell by 29.1% last year following Russia’s invasion, officials said.

Some sources linked are subscription services.