MH Daily Bulletin: April 5

News relevant to the plastics industry:

At M. Holland

- Todd Waddle, Director of M. Holland’s Wire & Cable and Sustainability groups, joined a recent Art of the Possible podcast episode hosted by IPC. Click here to access the episode, which focuses on the growth in electrification, sustainability efforts across the manufacturing industry and the Electrical Wire Processing Technology Expo (EWPTE) 2023.

- M. Holland will be closed Friday, April 7, in observance of the Easter holiday.

Supply

- Oil was mostly flat Tuesday as investors weighed OPEC+’s plans to cut output with signs of weak economic growth in the U.S. and China.

- In mid-morning trading today, WTI futures were down 1.2% at $79.78/bbl, Brent was down 1.0% at $84.07/bbl, and U.S. natural gas was up 1.0% at $2.13/MMBtu.

- Top U.S. and EU officials pledged Tuesday to cooperate on energy in the face of global attempts to destabilize markets, an agreement coming several days after OPEC+ shocked markets by unexpectedly slashing monthly output.

- OPEC+’s shock announcement to cut monthly output could create a windfall for U.S. shale producers, experts say.

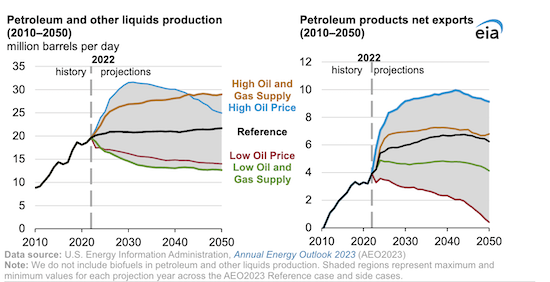

- Driven by international demand, U.S. petroleum and other liquids production is expected to grow 10% by 2050, according to government forecasters.

- Regional players in northern Iraq agreed to restore exports through a pipeline in Turkey, resuming almost 450,000 bpd of piped oil exports, a small but potentially significant boost to global supplies.

- The U.S. administration on Tuesday approved $450 million to be used for clean energy projects near the country’s coal mines.

- Exxon Mobil’s low-carbon unit could generate hundreds of billions of dollars by the end of the decade and potentially outperform the company’s oil and gas operations, executives said.

- Led by buyers in China, Venezuela’s oil exports jumped to a seven-month high in March.

- Turkey’s imports of Russian diesel are at a seven-year high after European sanctions forced Moscow to turn to exports elsewhere.

- Japan plans to invest $113 billion over the next 15 years to develop hydrogen-energy supply chains and boost hydrogen supply to 12 million tonnes a year, up from the current 2 million tonnes.

- Australia expects revenue from its exports of critical minerals to match revenue from coal by 2028 as the global energy transition quickens.

- After six years of largely fruitless efforts, Exxon Mobil has ceased exploratory deep water drilling in Brazil.

Supply Chain

- New data on snowpack water continues to suggest that winter deluges have relieved California of years of extreme drought.

- The widely tracked U.S. Logistics Manager’s Index fell to a record-low 51.1 in March, signaling the weakest growth in the logistics sector since records began in 2016:

- Recent indicators suggest California’s Inland Empire warehousing and logistics mecca is facing a steep slowdown after several years of pandemic gains.

- Walmart’s planned job cuts at e-commerce fulfillment centers across the U.S. will likely eliminate more than 2,000 jobs.

- Container shipping lines brought in a combined net profit of $34.7 billion in the fourth quarter, down 34% from a year earlier for the second straight quarterly decline.

- U.S. lawmakers in charge of homeland security are seeking detailed information on potential vulnerabilities posed by the software on dozens of Chinese-made cranes at domestic ports.

- Walmart’s third-party shipping operators will soon be able to use the retail giant’s proprietary truck-driver workflow app, executives said.

- Houston logistics company Packwell is building a 725,000-square-foot facility at Port Houston to handle the gateway’s growing resin export trade.

- A political standoff over Arizona’s half-cent sales tax used to fund highways could impede the state’s progress in attracting major semiconductor firms to build a spate of new projects there, analysts say.

- Investors are scooping up stocks in Mexican real estate, transport companies and banks on hopes of a nearshoring boom in the country. The rest of Latin America and the Caribbean should also see strong investment, experts say.

- Inventories at apparel retail group PVH, parent of Calvin Klein and Tommy Hilfiger brands, were up 34% last quarter as supply chains normalized from the constraints of the year-ago period.

- In the latest news from the auto industry:

- Ford’s first-quarter U.S. sales rose 10.1%, fueled by pent-up demand for electric vehicles and easing supply-chain disruptions.

- Ford and its union in the Mexican state of Chihuahua reached a deal for the automaker to raise wages 8.2% this year.

- GM sold almost double the number of electric vehicles (EVs) as Ford in the first quarter, surpassing Ford as the second-largest EV producer in the U.S. behind Tesla.

- About 5,000 salaried workers and executives at GM have accepted voluntary buyout offers through a separation program announced last month, the automaker said.

- Stellantis and BMW are working with Panasonic to potentially build multiple electric-vehicle battery plants in North America, according to reports.

- Tesla sold almost 90,000 China-made cars in March, a 35% increase from a year ago.

- Prices for lithium are down more than 30% this year, ending a two-year hot streak as demand slows for electric vehicles.

Domestic Markets

- The private sector added 145,000 jobs in March, well below economist expectations, with the manufacturing sector shedding jobs and service sectors gaining. Wages for existing jobholders rose 6.9% year-over-year, slower than in recent months.

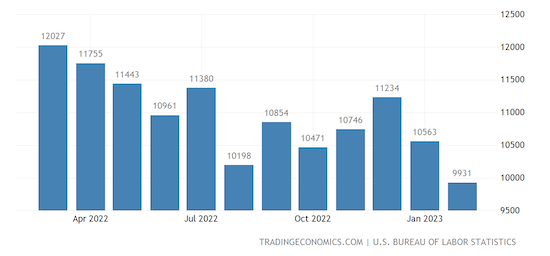

- U.S. job openings dipped below 10 million in February for the first time in two years, but other data shows the labor market remains tight.

- In his first public remarks addressing the issue, JPMorgan’s chief executive said the U.S. banking crisis is ongoing and its impact will be felt for years.

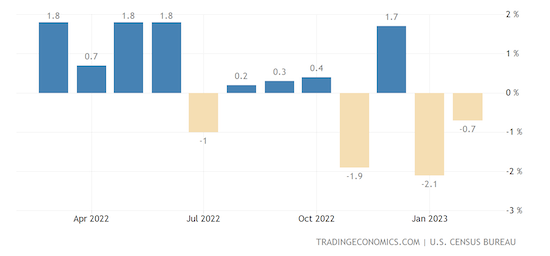

- New orders for U.S.-manufactured goods dipped 0.7% in February, the second month of decline amid lower demand for civilian aircraft.

- The IRS plans to unveil a 10-year, $80 billion spending plan to beef up enforcement with new investments in technology and services.

- Johnson & Johnson is offering to pay almost $9 billion to settle legal claims over its talc powders, what would be one of the biggest product-liability settlements in history.

- Extra Space Storage will acquire smaller rival Life Storage in a $12.7 billion stock deal, creating the largest storage-facility operator in the U.S.

International Markets

- Euro zone producer prices fell 0.5% month over month in February — the fifth straight month of declines — and were up 13.2% year over year, according to official data.

- Analysts expect Germany to narrowly avoid recession and post modest economic growth around 0.1% in the first quarter of the year.

- A top U.K. policymaker suggested the nation’s central bank may need to start cutting interest rates sooner than expected following recent signs of weaker inflation pressures.

- New Zealand’s central bank surprised markets by raising interest rates 50 basis points to a 14-year high 5.25%.

- Swiss bank UBS secured temporary approval from EU regulators this week to complete an acquisition of beleaguered rival Credit Suisse.

- Chinese regulators have slowed their merger review of several acquisitions proposed by major U.S. companies, a reflection of rising economic tensions between the two countries.

Some sources linked are subscription services.