MH Daily Bulletin: April 6

News relevant to the plastics industry:

At M. Holland

- Todd Waddle, Director of M. Holland’s Wire & Cable and Sustainability groups, joined a recent Art of the Possible podcast episode hosted by IPC. Click here to access the episode, which focuses on the growth in electrification, sustainability efforts across the manufacturing industry and the Electrical Wire Processing Technology Expo (EWPTE) 2023.

- M. Holland will be closed tomorrow, April 7, in observance of the Easter holiday.

Supply

- Oil settled flat Wednesday as the market balanced recession fears with a larger-than-expected drawdown of U.S. crude stocks last week.

- In mid-morning trading today, WTI futures were down 0.2% at $80.45/bbl, Brent was down 0.1% at $84.93/bbl, and U.S. natural gas was down 3.2% at $2.09/MMBtu.

- U.S. crude stocks fell by 3.7 million barrels last week, according to the Energy Information Administration, putting upward pressure on oil prices.

- Exxon Mobil completed the startup of its new $2 billion crude distillation unit at its Beaumont, Texas, refinery, adding 250,000 bpd of capacity and making Beaumont the second largest refiner in the country.

- Saudi Aramco raised prices of crude to Asia by 30 cents per barrel for the month of May, the oil giant’s third consecutive price hike.

- Record-high fuel demand raised India’s refinery throughput by 2% in February to the highest level in 24 years. At the same time, the nation’s power output grew by the most in 33 years last year on a surge in coal production.

- Fuel lines are growing in Cuba amid an unexplained and worsening shortage of gasoline in the nation’s crisis-stricken economy.

- Federal revenue in Russia from oil and gas fell 43% year over year in March.

- The price of Russia’s flagship Urals crude surpassed a Western price cap of $60/bbl this week, supported by surprise output cuts made by OPEC+.

- Russia is attempting to circumvent Western sanctions by making ship-to-ship transfers of diesel fuels off the coast of Africa for ultimate trans-Atlantic transport.

- A large survey named Canada as the world’s most preferred oil supplier due to the country’s reliability and limited exposure to conflict zones and geopolitical risks.

- Spanish power company Iberdrola announced plans to expand in the U.S. following the sale of about $6 billion worth of gas assets in Mexico.

- U.S. environmental regulators proposed a new rule that would tighten emissions limits on several harmful chemicals from power plants, including mercury and arsenic.

Supply Chain

- The World Trade Organization predicts global merchandise trade will rise by a “subpar” 1.7% this year, higher than previous forecasts but still historically low.

- Global airfreight traffic declined 7.5% year over year in February.

- FedEx is combining its Express and Ground delivery units into a single business, a cost-cutting measure also designed to simplify interactions with customers.

- Britain unveiled a $1.25 billion plan to streamline post-Brexit border checks after repeated delays during the pandemic.

- A survey shows the average annual salary of supply chain and logistics professionals fell 4% in 2022 to $121,150.

- MSC took delivery of its fourth vessel with capacity for more than 24,000 TEUs.

- Boeing restarted deliveries of its widebody 767 this week after a three-month halt caused by supplier quality issues.

- Honeywell landed its first orders for its most powerful generator yet, to be used to power Flying Whales hybrid-electric airships designed to transport heavy equipment.

- Maersk Air is adding two U.S.-China routes to its freighter network.

- Lufthansa is planning a major boost to its regional cargo operations in Europe.

- Apple, which has been carbon neutral in its own operations since 2020, said its suppliers are supporting 13 GW of active renewable energy projects, up from 10 GW last year.

- The EU’s $47 billion plan to boost its semiconductor industry and catch up with the U.S. will likely be approved later this month, according to reports.

- In the latest news from the auto industry:

- Ford and Stellantis expect U.S. tax credits to be cut in half for most of their electric vehicles under new procurement rules taking effect later this month.

- Ford is planning for “dramatic reductions” in the complexity of its vehicle lineup starting in 2024, executives said.

- Stellantis unveiled an electric Ram pickup that is set for release in late 2024, rivaling vehicles made by Ford and Chevrolet.

- New car sales in Britain rose 18.2% year over year in March, the eighth straight month of increases.

- Volvo saw global sales rise 8% year over year in March, spurred by strong demand for its electric models.

- Though backlogs remain robust, orders for Class 8 heavy trucks have eased to more normal rates in recent months.

Domestic Markets

- Initial jobless claims fell by 18,000 to 228,000 after the prior week’s data was revised upward by 48,000.

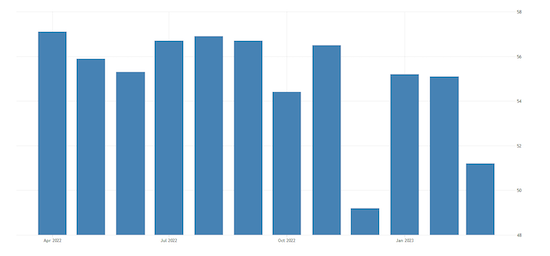

- A widely tracked gauge of U.S. services-sector activity fell from 55.1 in February to a lower-than-expected 51.2 in March, narrowly remaining in expansion territory.

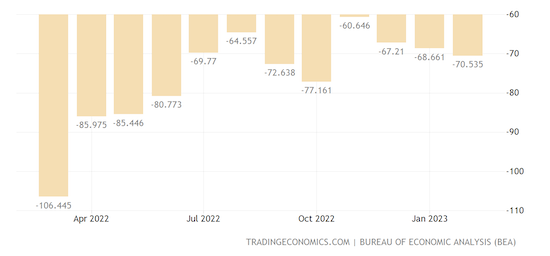

- The U.S. trade deficit rose 2.7% to $70.5 billion in February, a four-month high, as exports of goods declined.

- The average U.S. workweek has dropped by more than half-an-hour over the last three years, according to new research.

- Walmart plans to slow hiring as it builds out its automation technology amid continued inflation pressure, executives said.

- Conagra Brands raised its full-year profit forecast on expectations that consumers will remain loyal to its food products despite higher prices.

- Amazon plans to reduce employee stock awards as the e-commerce giant looks for additional ways to cut costs ahead of a potential economic downturn.

- AbbVie lowered its full-year profit expectations due to a $150 million hit from in-process research and development expenses.

International Markets

- Food may now be the key driver of euro zone inflation, officials said Wednesday.

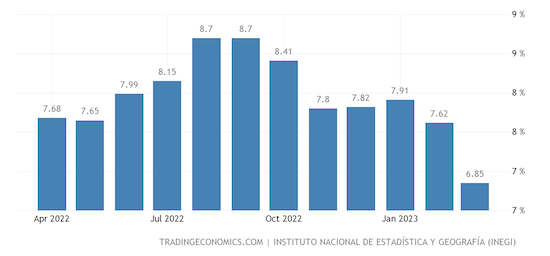

- Mexico’s annual inflation slowed to 6.85% in March, beating forecasts for the smallest rate gain in 1.5 years.

- Russian commercial jets are deteriorating as sanctions block the nation from accessing parts, software and technical skills needed to carry out critical maintenance.

- Brazil is cracking down on Asian e-commerce companies in a tax overhaul.

- Apple will soon open its first official retail store in India in the financial hub of Mumbai.

- Switzerland’s Barry Callebaut, the world’s top chocolate maker, replaced its executive leadership this week as sales falter to inflation-wary consumers.

- Global sales of secondhand clothes surged 28% last year in response to surging inflation, new data shows.

Some sources linked are subscription services.