MH Daily Bulletin: August 1

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose over 2% Friday, but closed July with their second straight monthly loss.

- In mid-morning trading today, WTI futures were down 4.6% at $94.10/bbl, Brent was down 3.5% at $100.30/bbl, and U.S. natural gas was down 1.1% at $8.14/MMBtu.

- U.S. drillers added crude rigs last month for a record 23 months in a row, indicating more supply ahead.

- U.S. crude production fell in May to an average of 11.60 million bpd, the latest data shows, about 1.25 million bpd below pre-COVID levels.

- U.S. shale drillers are expected to post record second-quarter profits in coming days, reversing nearly a decade of debt-fueled losses.

- The latest data shows OPEC+ underproduced from planned targets at a clip of 2.84 million bpd in June.

- Global oil demand is not declining in a pattern consistent with a recession, energy experts say.

- More oil news related to the war in Europe:

- European short-term power prices surged to the highest level on record in July and are set to rise even more this month, particularly in Germany and France.

- Russia continues to lodge complaints about pipeline equipment delivered from Canada, potentially paving the way for deeper cuts of gas exports to Europe.

- Russia’s boosted gas shipments to China could start to ease overall demand for LNG and help balance the market, leading to lower prices for Europe.

- French utility giant Engie says households, businesses and manufacturers are buying less natural gas amid urgent conservation efforts.

- S&P affirmed Uniper’s long-term credit rating at BBB, fulfilling a key part of Germany’s plan to bail out the struggling power supplier.

- Pemex expects to post an annual profit for the first time in a decade this year after two consecutive profitable quarters and a boost to crude output from new fields, its chief executive said.

- Italy’s Eni quadrupled its net profit year over year to $3.87 billion in the second quarter, matching similar gains at Norway’s Equinor and Spain’s Repsol.

- European policymakers temporarily dropped plans to create a guidebook for sustainable investments, a process marred by recent political division.

Supply Chain

- Mexico declared a drought in the northern state of Nuevo Leon, home to the nation’s industrial capital, a matter of national security on Friday.

- Northern California’s McKinney Fire surged to over 52,000 acres over the weekend, quickly becoming the state’s largest blaze of the year.

- Around 5,000 train drivers across a quarter of Britain’s rail network went on strike Saturday, the second major industrial action on the nation’s rail network this week.

- After receiving a new contract offer, over 2,500 Boeing workers in the St. Louis area canceled a strike that was set to begin today.

- The American Trucking Associations’ for-hire truck tonnage index hit 120.1 in June, up 2.7% from May to the highest level since August 2019.

- The U.S. Transportation Department has launched a safety investigation of TuSimple, a maker of autonomous driving systems for trucks, after a truck using its software veered off the highway and into a cement barrier.

- Despite corporate objections, the U.S. Federal Accounting Standards Board approved a rule requiring public companies to disclose the terms and the size of their supply-chain financing programs.

- The FAA approved Boeing’s inspection plan to resume deliveries of 787 Dreamliners for the first time in over a year this month. The plane-maker is set to quickly expand production of the aircraft.

- Deere & Co. will move production of mower conditioners from Iowa to a plant in Mexico over the next 18 months, the second such move by the farm equipment maker since June.

- The U.S. and Japan announced a new joint research collaboration for next-generation semiconductors that could begin making prototype chips by 2025.

- Dutch firm ASML Holding, the world’s only manufacturer of a machine for making advanced semiconductors, reported record orders in the second quarter.

- In the latest news from the auto industry:

- Toyota deepened its production cut to 5,200 vehicles this month due to disruption from heavy rains in central Japan.

- Renault upgraded its full-year outlook, saying its turnaround plan to improve profitability is delivering faster-than-expected results.

- Canadian auto parts supplier Magna International raised its full-year forecast after posting a 3.6% rise in quarterly sales.

- The share of pure electric and hybrid vehicles in Volvo Car’s portfolio jumped to 31% of total sales in the second quarter.

- Hyundai Motor received a $1.8 billion grant from Georgia to start building a $5.5 billion electric vehicle assembly plant near Savannah.

- Japan’s Nippon Denkai will build a $150 million plant in the U.S. to make copper foils for electric vehicle batteries.

- Today is the deadline for states to tell the federal government how they will build electric vehicle charging infrastructure with a share of over $5 billion from last year’s infrastructure package.

- Italian automaker Alfa Romeo announced plans to build a new car in the U.S. that will be brought to market in 2027, as the firm looks to strengthen its international presence.

- DHL will halt all domestic services within Russia starting Sept. 1, the firm announced.

- Ukraine exported 26,000 tons of corn to Lebanon Monday from the port of Odessa, the nation’s first grain shipment since the start of the war, as the United Nations gears up to supervise renewed exports. Boosted shipments may do little to alleviate global food shortages, however.

- India, the world’s biggest edible oil importer, will receive between 50,000 and 60,000 tons of sunflower oil from Ukraine in September, ending a five-month hold caused by Russia’s invasion.

Domestic Markets

- The U.S. reported 125,355 new COVID-19 infections and 373 virus fatalities Sunday.

- The U.S. president returned to isolation over the weekend after testing positive for COVID-19 in a “rebound” case just days after reporting negative.

- Repeat infections account for 1 in every 7 COVID-19 infections in California, the highest level of the pandemic.

- The U.S. administration will begin its fall COVID-19 booster campaign in September, aided by the $1.74 billion purchase of 66 million Omicron-tailored vaccines from Moderna.

- Experts are warning individuals who are at high-risk for COVID-19 not to wait to get a next-generation vaccine dose in the fall if they have yet to receive their second booster vaccine, saying that current shots continue to offer protection against hospitalization for severe disease and death.

- New data suggests that long COVID has taken at least 4 million full-time equivalent workers out of the U.S. workforce, accounting for around 2.4% of the nation’s working population.

- The S&P 500 and Nasdaq posted their biggest monthly percentage gains since 2020 in July on positive second-quarter results from large firms.

- At least 358 companies have either delayed or canceled financing plans this year, accounting for more than a combined $254 billion in deals, as surging inflation and ongoing energy shortages continue to rattle the global economy.

- American personal consumption expenditures — the Federal Reserve’s preferred inflation gauge — rose 6.8% in June, the biggest 12-month move since 1982.

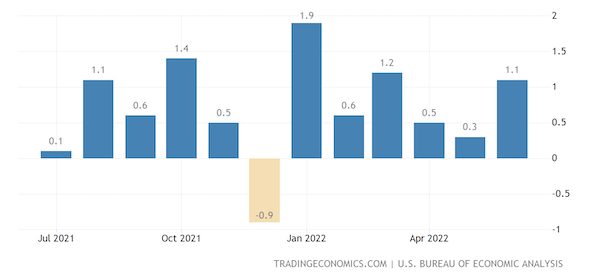

- U.S. consumer spending, which accounts for more than two-thirds of economic activity, grew at a healthy 1.1% rate in June, according to the federal government:

- The University of Michigan consumer sentiment index rose to 51.5 in July from a record-low 50 in June:

- Consumer one-year inflation expectations eased.

- U.S. labor costs rose 1.3% in the second quarter as a tight job market continued to boost wage growth, while real wages declined 3.1% due to inflation.

- Credit card balances for people aged 25 and younger rose by 30% in the second quarter from a year earlier, as surging inflation causes younger Americans to accrue more debt.

- In the latest news from second-quarter earnings season:

- Sony trimmed its full-year forecasts after a 37% drop in operating profit at its key gaming unit.

- Strong sales of AstraZeneca’s COVID-19 antiviral therapy led the firm to boost its revenue forecast for 2022.

- Agricultural and construction machine maker CNH Industrial beat estimates with a 14% rise in operating profit.

- Leading copper producer Codelco saw profit drop 35% to $2.4 billion in the first half, dragged down by lower production and higher costs.

- Procter & Gamble saw net sales rise 3% as higher pricing offset a slip in volume. The firm’s stock fell after it said rising transport and commodity costs would dent forward sales growth.

- Walmart will start selling refurbished items made by Apple, Samsung and Whirlpool to help consumers cope with surging prices for new electronics amid surging inflation.

International Markets

- Japan posted a record 233,094 COVID-19 cases last Thursday, putting pressure on the nation’s hospitals and disrupting some company operations.

- One in every 12 Australian hospital beds is filled by someone with COVID-19 as the nation continues to post record virus fatalities.

- New Zealand’s borders fully reopened to foreign visitors for the first time of the pandemic today.

- COVID-19 infections are beginning to drop from recent highs in the U.K.

- Surprise economic growth in Spain, France and Italy led the euro zone economy to stronger-than-expected growth of 0.7% in the second quarter. Germany’s economy, the euro zone’s largest, was flat.

- Canada’s economy likely grew at an annual rate of 4.6% in the second quarter, leading economists to expect another big interest-rate hike in September.

- Mexico’s economy expanded 1% in the second quarter, its third consecutive quarter of growth, beating forecasts. However, manufacturing activity contracted in July.

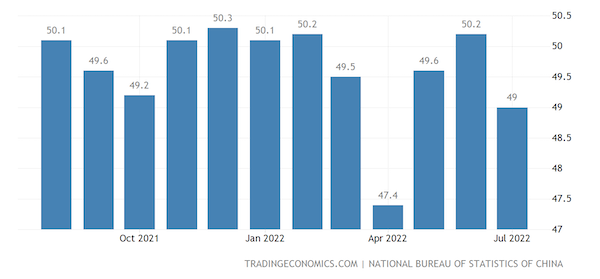

- China’s manufacturing activity unexpectedly contracted in July. Separately, recent trouble in the nation’s property sector has banks worrying over mortgage losses that could extend into the hundreds of billions of dollars.

- Japan’s manufacturing activity expanded at the weakest rate in 10 months in July.

- South Korea’s factory activity shrank in July for the first time in nearly two years on weakening output and new orders. The nation’s exports still rose at a solid pace, led by demand from the U.S.

- British businesses expect to see zero growth over the next three months, a new survey shows.

- U.K.-based bank HSBC will offer some of its British workforce a one-time payment of $1,830 to help offset surging inflation.

- Air France-KLM, Lufthansa and British Airways-owner IAG posted their first net profits of the pandemic in the second quarter.

- Spain-based pilots at easyJet will strike for nine days in August in a dispute over pay, their union said.

- Lufthansa pilots voted in favor of a strike Sunday, threatening further disruption during the busy summer travel season.

Some sources linked are subscription services.