MH Daily Bulletin: August 2

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices dropped 4% Monday as weak manufacturing data in several countries weighed on the demand outlook.

- In mid-morning trading today, WTI futures were up 0.8% at $94.64/bbl, Brent was up 0.8% at $100.90/bbl, and U.S. natural gas was down 6.7% at $7.73/MMBtu. WTI is at its widest discount to Brent in at least three years.

- The U.S. emergency crude stockpile dropped to 469.9 million barrels last week, its lowest level since 1985.

- OPEC and its allies meet tomorrow to decide on September output, with analysts pointing to a potential modest increase.

- Analysts say OPEC pumped 28.98 million bpd of crude in July, about 310,000 bpd higher than June but well short of agreed targets.

- Saudi crude exports hit 7.5 million bpd in July, the highest level in more than two years amid rising pressure from the U.S. to boost production.

- Libya’s crude output has rebounded after a series of disruptions that more than halved supply, with nationwide production returning to a four-month high of 1.2 million bpd.

- Australia, one of the world’s top LNG exporters, is considering curbs on exports to manage an expected supply crunch next year.

- Valvoline is selling its unit that makes lubricants, coolants and other auto products to state-owned Saudi Aramco for $2.65 billion in cash as the company sharpens its focus on U.S. retail services.

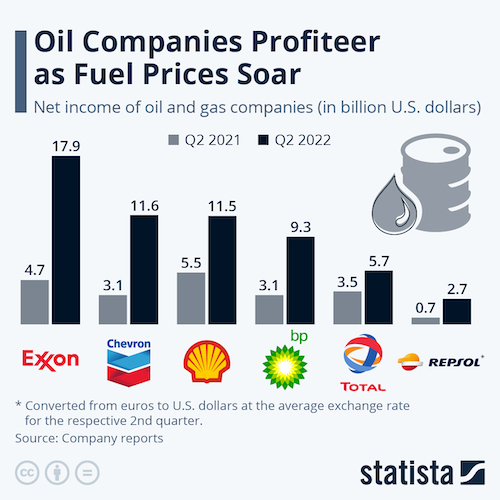

- BP said it would raise its dividend 10% after second-quarter net income reached a higher-than-expected $8.5 billion.

- More oil news related to the war in Europe:

- Russia halted all natural gas shipments to Latvia Monday, sending European gas futures up 6% to a level nearly five times higher than a year ago.

- Gazprom’s daily output sank 14% in July to the lowest since 2008 as exports to key markets fell for a fourth month. The decline in output led India to begin rationing supplies to fertilizer and industrial clients.

- Traders are weighing the possibility of a slight increase in Russian oil exports after the EU recently adopted a number of amendments to sanctions.

- Baker Hughes signed a deal to sell its Russian oil field services business to local management, months after stopping new investments in the country.

- Germany is taking additional steps to secure energy as shipments from Russia drop, including keeping nuclear plants open past planned shutdowns this year and burning more oil and coal for power.

- Italy’s Eni plans to build a second LNG production vessel offshore Mozambique within four years. The producer’s first project in the country, a $7 billion platform, will begin exporting this year.

- Japanese energy investors Mitsui and Mitsubishi wrote down by more than half the value of their minority interests in the Sakhalin-2 natural gas project after a Russian decree handed control of the project to a new Russian entity.

- India’s gasoline demand fell by 8% in July as high inflation and monsoon activity curbed demand from the farming and transport industries. Separately, the nation plans to start a carbon trading market for major emitters in the energy, steel and cement industries.

- South Africa will slash prices for gasoline and diesel this month in an effort to ease fuel costs for consumers.

- Spain’s Iberdrola is buying up solar and wind projects in Poland, which still generates around 80% of its electricity from coal.

- Researchers from France and Hong Kong are teaming up to develop carbon-capture and storage systems to be used on commercial vessels by 2030.

Supply Chain

- The McKinney Fire, California’s largest blaze this year, spread to over 55,000 acres Monday with zero containment.

- Last month was France’s driest July on record and England’s driest since 1935.

- Low water levels in the Rhine are worsening capacity shortages for commercial vessels, which have been forced to halve normal loads in some cases.

- Maersk is warning customers that rail congestion is delaying shipments from Canada’s West Coast to inland destinations.

- Freighter operators are diverting flights from Frankfurt Airport amid continued ground-handling turmoil at the German hub.

- Prices for new VLCCs are 35% higher than they were in January 2021. Soaring costs pushed new orders for crude and product tankers down to a 26-year low in the first half of 2022, according to industry group Bimco.

- In the latest news from second-quarter earnings season:

- Union Pacific’s operating profit rose 14% despite a 1% decline in carload volume. The rail line’s average revenue per intermodal load hit $1,711, up 26% from last year.

- Revenue at CSX rose 28% on gains from higher fuel surcharges along with the acquisition of trucker Quality Carriers.

- Knight-Swift Transportation saw earnings rise to $219.5 million on a 49.1% gain in operating revenue.

- In the latest news from the auto industry:

- Tesla signed new long-term deals with two Chinese battery-material suppliers, Zhejiang Huayou Cobalt and CNGR Advanced Material.

- Chinese electric-vehicle maker Nio is expanding its presence in Europe with the construction of a plant in Hungary.

- Electric heavy-duty truck maker Nikola is moving battery production in-house with the $144 million acquisition of California-based Romeo Power.

- Aurora Innovation added freight giant Schneider to the growing list of fleets testing its autonomous trucking software, as weekly hauls are set to begin between Dallas and Houston.

- Stellantis will spend $99 million upgrading plants in Toronto, Indiana and Michigan to make hybrid-vehicle engines.

- Shenzhen is ramping up use of autonomous robotaxis as a new rule takes effect allowing vehicles on the road without a person in the driver’s seat.

- The White House is reportedly in the early stages of a plan to limit shipments of American chipmaking equipment to Chinese companies.

- Michigan plans to add $1 billion of its own funding to boost competitiveness for computer chip projects following Congress’ recent approval of a sweeping $52 billion incentive package.

- Amazon will begin providing same-day delivery logistics for a handful of retailers through its Prime membership service.

- British retailer Marks & Spencer is buying its contract logistics provider Gist for about $305 million as part of a plan to overhaul its food supply chain.

- The EU blocked a proposal to sanction Russian metals company VSMPO-Avisma, an Airbus supplier.

- South Africa suspended tariffs on most poultry imports for the next 12 months, a bid to ease surging food inflation.

- Amazon’s carbon emissions surged 18% last year as the company grew to handle the pandemic-driven surge in e-commerce.

Domestic Markets

- The U.S. reported 114,021 new COVID-19 infections and 357 virus fatalities yesterday.

- New data shows COVID-19 infections are back on the rise in Florida.

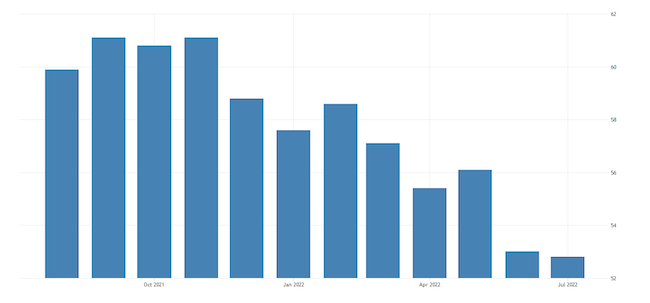

- A widely tracked index of U.S. manufacturing activity fell to a two-year low of 52.8 in July. The data comes as retailers continue to report excess inventories and commodity prices ease.

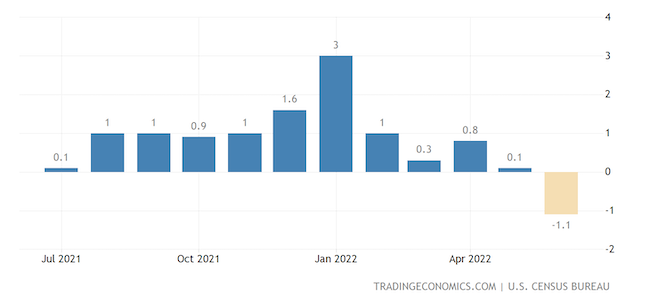

- U.S. construction spending tumbled 1.1% in June on a sharp decline in single-family homebuilding, a reflection of rising interest rates.

- U.S. merger activity slowed sharply in the first half of 2022, with dealmaking down 40% from last year as market conditions remain uncertain.

- U.S. consumers spent 71% more at discount grocery stores from October 2021 to June 2022. Meanwhile, spending at other grocery stores declined by 5%.

- America’s youngest consumers are falling behind on credit card and auto bills while they accumulate credit card debt at a pace not seen since before the pandemic.

- U.S. home-price appreciation slowed sharply in June, according to mortgage software firm Black Knight. Surging rent prices also showed signs of a cooldown.

- Leasing volume for Manhattan office space reached a pandemic-era high in July despite remaining 11.6% below the pre-pandemic average.

- Heineken posted a surprise 24.6% rise in first-half operating profit on higher sales volumes in all regions, notably Asia-Pacific.

- Oracle started laying off employees in the Bay Area yesterday as part of a $1 billion cost-cutting plan that includes thousands of layoffs in its global workforce.

- Activision Blizzard experienced a 28% drop in sales in the latest quarter as consumers limit spending on video games in response to high inflation.

- Estée Lauder is in talks to buy luxury fashion brand Tom Ford for a rumored $3 billion, one of the cosmetic giant’s largest-ever acquisitions.

- Revlon received permission Monday to proceed with a $1.4 billion loan to continue operations while in bankruptcy, just one month after missed payments to supply chain vendors led the firm to file for Chapter 11.

International Markets

- France scrapped all remaining COVID-19 restrictions for incoming travelers Monday.

- A worsening property crisis in China could send one-third of the nation’s steel mills into bankruptcy in a squeeze that’s likely to last at least five years, according to private meetings with executives.

- Factories across the U.S., Europe and Asia struggled for momentum in July as flagging global demand and China’s lockdowns slowed production, surveys showed on Monday.

- England’s central bank is expected to lift its key interest rate by 50 basis points this week to 1.75%.

- German retail sales fell 8.8% in June for the steepest decline in almost 30 years.

- Brazil posted a lower-than-expected trade surplus of $5.44 billion in July, with growth in imports strongly outpacing exports.

- Russia’s economic woes are set to deepen after its central bank warned that last quarter’s 4.3% decline in GDP will be followed by an even larger decline of 7% this quarter.

- Hong Kong’s economy shrank 1.4% in the second quarter, its second straight quarterly contraction.

- Saudi Arabia posted record GDP growth of 11.8% in the second quarter, driven by a 23.1% rise in oil revenue.

- British bank HSBC saw second-quarter profit surge 62% to $5.5 billion as rising interest rates boosted returns on loans.

- Portugal’s civil aviation workers are preparing to strike for three days starting Aug. 19 in a dispute regarding pay and conditions.

- ANA Holdings and Japan Airline maintained their positive earnings outlooks for the year Monday as airlines see a strong recovery in demand.

- Boeing plans to build a new research site in Japan focused on sustainable aviation fuel and other sustainable technology.

- Wind turbine maker Siemens Gamesa is considering cutting 9% of its global workforce, or about 2,500 jobs, in reaction to losses that prompted its main shareholder, Siemens Energy, to launch a takeover.

- Single-use plastic bag usage dropped 20% in England since a tax was imposed on consumers last year.

Some sources linked are subscription services.