MH Daily Bulletin: August 3

News relevant to the plastics industry:

At M. Holland

- The European Union enacted the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation to protect human health and the environment from the effects of chemicals. Click here to learn more about what REACH compliance means for the plastics industry

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices gained less than 1% Tuesday amid competing supply and demand fears.

- In mid-morning trading today, WTI futures were up 0.2% at $94.63/bbl, Brent was up 0.1% at $100.70/bbl, and U.S. natural gas was down .5%% at $7.67/MMBtu.

- U.S. gasoline prices have fallen for the past 49 days since mid-June highs, with the nation’s average price hitting $4.16 a gallon Wednesday.

- The American Petroleum Institute reported a surprise 2.17-million-barrel build in U.S. crude stocks this week. Government data will be released today.

- The U.S. continues to export diesel fuel at a record rate of 1.4 million bpd on rising demand from Latin America and Europe.

- Marathon Petroleum smashed quarterly profit estimates Tuesday, becoming the latest U.S. refiner to benefit from a surge in fuel prices.

- Occidental Petroleum used ample second-quarter earnings to pay down $4.8 billion in debt and launch a $3 billion share buyback program. The U.S. producer was one of several to report strong quarterly results Tuesday.

- OPEC+ will meet today and is likely to approve a modest output increase for the month of September, according to analysts, as the group trimmed its forecast for an oil market surplus this year by 200,000 bpd.

- Venezuela’s oil exports tumbled 27% in July as outages wiped out power and gas supplies to state-run energy firm PDVSA.

- State-owned Petrobras will distribute more than double the second-quarter dividends of its rival producers, as the Brazilian government seeks extra dollars to finance spending.

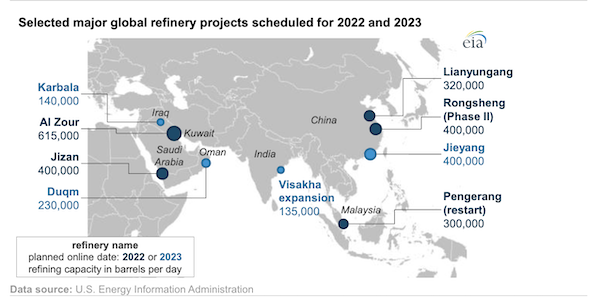

- Global refining capacity is expected to increase by nearly 3 million bpd by the end of next year with the addition of nine projects in the Middle East and Asia, according to the U.S. government.

- More oil news related to the war in Europe:

- The EU has successfully reduced its dependence on Russian gas by 50% since late February, according to officials.

- Covestro, a German maker of polyurethane and polycarbonate material, warned it would be forced to shut down some facilities if Germany decides to ration gas.

- The U.S. placed new sanctions on six Chinese and other firms Monday, alleging the companies helped sell tens of millions of dollars’ worth of Iranian oil products to East Asia.

- South African utility Eskom warned it may need to impose rolling blackouts for the first time in over a week due to capacity shortages.

- Switzerland unveiled plans to build a $2 billion hydropower plant in the Alps, which could serve as a major source of stability for Europe’s ailing power grid.

- India plans to order industries and consumers to use cleaner fuels and aims to establish a carbon market under legislation to bolster its 2070 net-zero push.

Supply Chain

- California’s McKinney Fire, the state’s largest blaze of the year, killed two people on Tuesday after spreading to over 56,000 acres with zero containment.

- A blast of heat will hit the northeastern U.S. later this week, potentially bringing new temperature records to cities including Boston and New York.

- Germany’s Rhine River is coming close to an effective shutdown caused by low water levels, putting at risk the trade of huge quantities of goods.

- Container rates from Shanghai to Los Angeles dropped 24% in mid-July from a year ago, according to the Drewry World Container Index.

- Facing rising congestion at the Port of New York and New Jersey, officials will put a new fee on long-dwelling containers starting in September. Container volumes at the port are 34% higher than pre-pandemic levels.

- Maersk upgraded its full-year earnings forecast by 23% to $37 billion, as lingering congestion in container shipping continues to keep freight rates high.

- Swiss freight forwarder Kuehne + Nagel’s operating profit more than doubled to nearly $2.3 billion in the first half of the year as revenue increased 45%.

- Advanced Micro Devices reported a 70% increase in quarterly sales driven by strength in its data center business.

- San Francisco real estate firm Prologis says up to 500 million additional square feet of U.S. warehouse space may be needed for firms to stow excess inventories.

- Amazon has started soliciting business from other shippers for its intermodal network, putting the e-commerce giant in competition with J.B. Hunt and Hub Group, among other providers.

- In the latest news from the auto industry:

- A Stellantis plant that produces Jeep Compass and Renegade models in southern Italy shut down Tuesday after logistics contractors went on strike.

- While other carmakers are curtailing investment in internal combustion engines (ICEs), Stellantis announced it is investing nearly $100 million in three North American plants to build a new ICE for hybrid vehicles.

- GM prepaid almost $200 million for a guaranteed six-year supply of lithium from Philadelphia-based Livent Corp, reflecting rising concerns in the auto industry that higher electric vehicle use will tighten markets for key battery metals.

- Volkswagen ordered $4 billion worth of the laser technology lidar from Israeli firm Innoviz Technologies, as the automaker prepares to roll out more autonomous vehicles.

- Lamborghini and Ferrari reported stellar earnings Tuesday as demand for luxury cars remains high.

- GM will use a spate of new measures to curb prices in the used car market, including limits on purchasing and warranty transfers for customers who may be looking to flip its vehicles.

- European auto-parts giant Continental is seeking alliances with Asia-Pacific startups to quickly develop technologies for next-generation automobiles.

- Swedish engineering firm Trelleborg will acquire Minnesota Rubber and Plastics for $1 billion in cash, expanding its polymer and plastics business in North America.

- Consumer-goods supplier Helen of Troy is reducing purchase orders as its retail customers report excess inventories.

- Airbus delivered 45 jetliners in July, bringing deliveries this year to just over 340, on pace with 2021.

- Russia is considering a retaliatory ban on the entry of European trucks starting Oct. 1.

- A months-long shortage of imported U.S. french fries has driven Japanese restaurants to turn to China and even drop the item from their menus.

Domestic Markets

- The U.S. reported 116,999 new COVID-19 infections and 375 virus fatalities Tuesday.

- COVID-19 infections in New York fell 15% last week, as the state’s recent wave caused by the BA.5 subvariant begins to ease.

- New research points to heightened health risks for people who catch COVID-19 a second time, raising the urgency to stamp out new virus variants that show little resistance to prior infection.

- Hospital workers who got a fourth dose of Pfizer’s COVID-19 vaccine were far less likely to be infected than their triple-vaccinated peers, according to a new study.

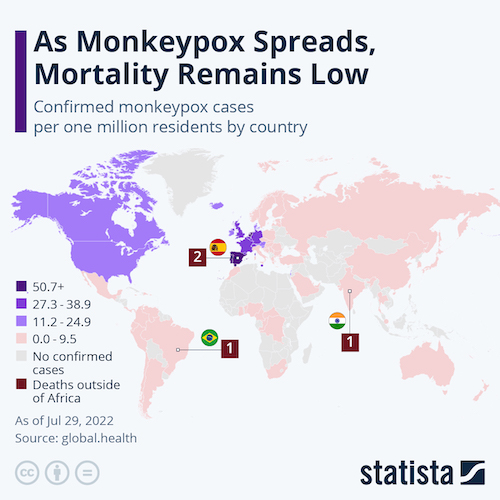

- California became the third state to declare a state of emergency over the fast spreading monkeypox virus.

- The Labor Department reported that U.S. job openings fell to a nine-month low of 10.7 million in June, providing the most recent sign of a cooling labor market.

- New surveys show about 45% of large U.S. businesses plan to decrease spending on consulting and real estate over the next year, a bid to stay ahead of a potential recession.

- U.S. household debt rose by 2% in the latest quarter to $16.2 trillion, with sizable increases noted in mortgages, auto loans and credit-card balances.

- Big card issuers including JPMorgan Chase, American Express and Capital One reported near-record levels of credit-card spending in the second quarter while delinquency rates remained low.

- Chinese investors nearly doubled the number of applications they made last year seeking U.S. regulatory clearance for stakes in American companies, most of which were outside of critical sectors.

- The FAA issued a new directive requiring Boeing to modify a small feature that suppresses wind gusts on 777 aircraft, citing safety concerns.

- U.S. companies are reporting mostly upbeat news this earnings season, surprising investors who were bracing for a gloomier outlook on businesses and the economy. More than halfway into the reporting period, earnings are up 8.1% from a year ago.

- In the latest news from second-quarter earnings season:

- Uber saw little inflationary effect on demand in the latest quarter, with revenue more than doubling to $8.07 billion while the ride-hailing firm saw its first positive cash flow in company history.

- Airbnb swung to a second-quarter profit on a 58% gain in revenue from last year.

- Caterpillar’s 20% rise in North American equipment sales helped to counter lower sales in Europe and falling demand for construction machinery in Asia.

- Starbucks’ U.S. sales rose a healthy 9% as sales in China plunged 44% due to lockdowns. The firm warned that labor costs weighed on income, but reassured investors that U.S. customer demand is strong.

- Marriott International saw revenue jump 70% to $5.34 billion, as occupancy edged closer to pre-pandemic levels.

- Regeneron’s earnings fell more than 70% on a slump in sales of its COVID-19 antibody cocktail after the FDA curtailed its use.

- Gilead Sciences posted a 13% decline in quarterly profit on a downturn in sales of its COVID-19 antiviral drug.

- Sales at DuPont de Nemours rose 7% for the quarter as the top chemical firm warned of rising costs for logistics, materials and energy.

- Electronic Arts posted a 14% gain in quarterly revenue as two of its video game series lifted results.

- Major box stores, including Walmart and Best Buy, are increasing promotions and lowering prices to get rid of excess inventory.

International Markets

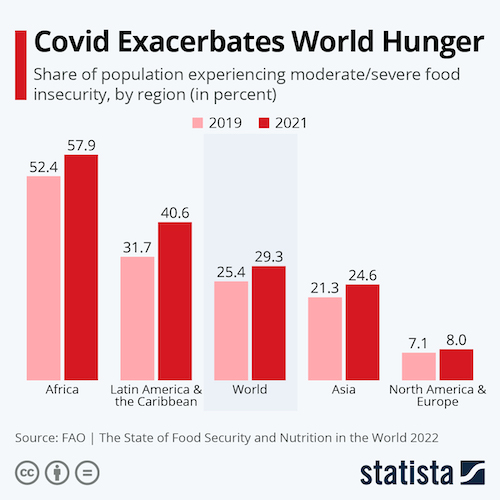

- New data from the World Bank shows global food prices across the globe continue to rise at unprecedented rates, with the overwhelming majority of low- and middle-income countries seeing price hikes of 5% or more in the second quarter.

- Canadian manufacturing activity lost momentum in July, with S&P Global’s purchasing managers index falling from 54.6 in June to a two-year low of 52.5.

- The Mexican government’s inflation-fighting subsidies came at a steep $28.04 billion price tag so far this year, fueling speculation that the country’s central bank will again hike interest rates as inflation persists.

- The value of South Korean exports rose 9.4% in July from a year ago, a larger-than-expected pace led by robust demand from the U.S.

- Over 5,600 companies in England and Wales filed for insolvency in the latest quarter, an 81% increase from a year ago to the highest level since 2009.

- Half of all German companies are struggling with worker shortages, a problem concentrated in the service and manufacturing sectors.

- Air Canada missed quarterly forecasts as higher passenger volumes failed to outweigh costs of labor, fuel and congestion.

- British Airways will halt ticket sales on all domestic and European routes from London Heathrow this week, a bid to manage the airport’s strict passenger limits.

Some sources linked are subscription services.