MH Daily Bulletin: August 5

News relevant to the plastics industry:

At M. Holland

- The European Union enacted the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation to protect human health and the environment from the effects of chemicals. Click here to learn more about what REACH compliance means for the plastics industry

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

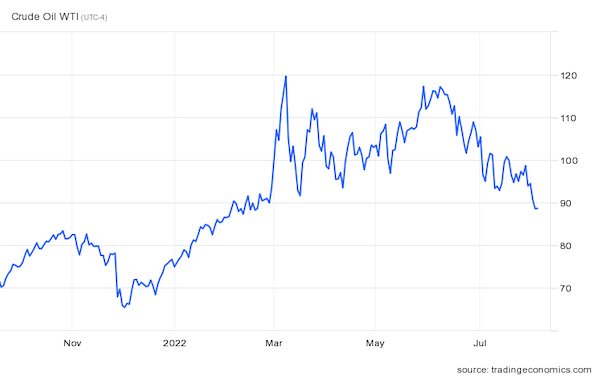

- Oil prices fell over 2% on Thursday, settling at their lowest since Russia’s invasion of Ukraine. WTI futures are down 10% this week.

- In mid-morning trading today, WTI futures were up 0.2% at $88.73/bbl, Brent was up 0.2% at $94.28/bbl, and U.S. natural gas was down 0.3% at $8.10/MMBtu.

- The average U.S. gasoline price fell to $4.139 a gallon Thursday, the 51st consecutive day of declines.

- Cheniere Energy, the U.S.’s largest LNG exporter, saw record second-quarter profit as Russia’s war fueled a scramble for supplies from the U.S.

- ConocoPhillips increased its return of capital to shareholders by 50% to roughly $5 billion through stock buybacks after the largest independent U.S. producer tripled quarterly earnings from a year earlier. The firm says its production should rise at a low-single-digit percentage rate this year.

- Suncor Energy, Canada’s third-largest crude producer, posted a fourfold rise in second-quarter profit.

- Canadian Natural Resources doubled its quarterly profit and announced a new dividend while boosting its full-year spending and production guidance.

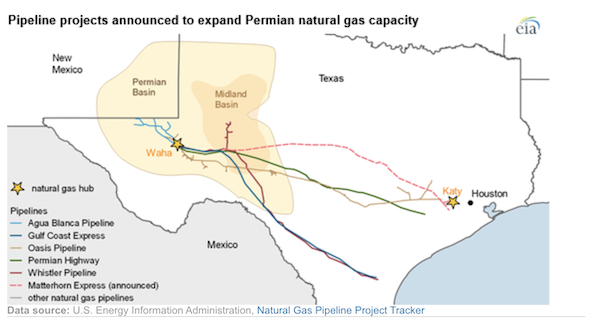

- Five new projects will soon boost the Permian basin’s takeaway capacity to Gulf Coast facilities, according to the EIA.

- More oil news related to the war in Europe:

- The head of the International Atomic Energy Agency warned that Europe’s largest nuclear plant in Ukraine, occupied by Russia’s military since March, “is completely out of control” and sought Russian and Ukrainian cooperation to allow an international assessment of the situation.

- Countries across Europe are imposing new limits on lighting and air-conditioner use to comply with the EU’s plan to trim energy use by 15% through next spring.

- European countries are on track to reach a gas storage filling target by the start of winter, although the cost of replenishing stocks will be at least 10 times higher than the historical average.

- Governments across Europe and Asia are extending their aging fleet of nuclear plants, restarting reactors and reviving shelved projects amid widespread energy shortages.

- German lawmakers will propose a new levy on gas consumers starting in October to help suppliers hit by soaring gas import prices.

- German power supplier Uniper may have to cut output at two key coal plants as the firm struggles to transport supplies on low water levels in the Rhine River.

- Russia says oil exports from its massive Sakhalin-1 project north of Japan have been halted since mid-May after Western producers pulled their involvement.

- OPEC heavyweights Saudi Arabia and the UAE are prepared to boost oil output should the world face a severe supply crisis this winter, according to reports.

- Calgary’s TC Energy Corp struck a deal with Mexico’s state utility to develop a $4.5 billion natural gas pipeline through Mexico’s central and southeast regions.

- China’s State Grid Corp, the world’s largest utility, began construction on a $22 billion, ultra-high-voltage “super grid” aimed at delivering clean power across the country.

- Saudi Arabia’s budget surplus grew 35% to $21 billion in the second quarter on a rise in oil revenues.

- India, the world’s third-largest carbon polluter, approved stricter targets for cutting emissions on Thursday, including a 45% reduction from 2005 levels by 2029.

Supply Chain

- On Thursday, fire crews made their first progress against northern California’s McKinney Fire, which is now roughly 10% contained after burning more than 58,000 acres.

- At least 73 million Americans were under heat alerts Thursday as high temperatures continue to expand in the Mid-Atlantic and Northeast.

- European wildfires have burned over 1.4 million acres so far this year, the second-most in data going back to 2006.

- Stress on global supply chains eased in July to the lowest level since January 2021 amid reductions in port congestion and other backlogs. The New York Fed’s Global Supply Chain Pressure Index fell for a third straight month and is down more than 50% from last December’s record-high.

- The total value of North American trans-border freight moved by truck hit $82.1 billion in May, up 20.7% from the same time last year.

- Union dockworkers at U.S. West Coast ports signaled progress in contract talks with shipping companies, reaching a tentative agreement on health benefits last week.

- Samsung Electronics has reportedly scaled back production at its massive smartphone plant in Vietnam as retailers and warehouses grapple with rising inventories.

- America’s largest warehouse market east of Los Angeles is full and major retailers such as Best Buy and Target are warning of slowing sales as consumer spending declines.

- Bangladesh’s garment exporters say orders have declined as more Western retailers report excessive apparel inventories.

- Canadian National’s quarterly revenue jumped 21% and net profit expanded 28% to about $1.77 billion on continuing strong demand.

- Norfolk Southern’s second-quarter profit was flat at about $819 million as rising costs narrowed the railroad’s margins.

- Italy is close to clinching a deal worth $5 billion with Intel to build an advanced semiconductor packaging and assembly plant in the country.

- Semiconductor maker GlobalFoundries won local approval to build a second factory in upstate New York.

- Canada says it will launch a challenge to U.S. softwood lumber duties under the new framework of the Canada-United States-Mexico Agreement.

- In the latest news from the auto industry:

- Auto supplier Aptiv cut its full-year outlook as European automakers cut production ahead of expected disruption in gas supplies.

- Electric heavy-duty truck-maker Nikola boosted quarterly deliveries following a ramp-up in production, leading to higher-than-expected revenue.

- Toyota took a 42% hit to profit in the latest quarter due to supply constraints and rising costs.

- Embattled electric-truck startup Lordstown Motors reaffirmed plans to produce its first vehicle this quarter and roll out deliveries by the end of the year.

- Rare earths miner MP Materials almost tripled second-quarter net income due to rising demand and prices for materials used to make electric vehicles.

- Albemarle Corp is studying plans for mass recycling of lithium batteries in North America, with a facility planned for construction in the Southeast U.S. later this decade.

- Tire-maker Pirelli posted a 21% rise in adjusted second-quarter earnings on strong pricing power and cost savings.

- Tesla will likely need a dozen factories to reach its goal of selling 20 million vehicles per year by 2030, paving the way for significant new investment over the coming years. The automaker’s commodity and component costs have started trending downward, its chief executive said.

- Online used-car dealer Carvana is aggressively cutting costs as demand from consumers wanes.

- Airfreight company Atlas Air will be sold to a group of investors led by Apollo Global Management in an all-cash deal worth around $5.2 billion.

- G7 nations pledged to invest $600 billion in funding for emerging market infrastructure over the next five years, led by $200 billion from the U.S.

Domestic Markets

- The U.S. reported 117,350 new COVID-19 infections and 377 virus fatalities Thursday. The pace of fatalities has remained steady since May, with more than 12,500 Americans passing from the virus in July.

- U.S. health officials declared monkeypox a public-health emergency Thursday as cases continue to mount across the country, now topping 6,600, the most in the world.

- Non-farm payrolls jumped by a higher-than-expected 528,000 last month and the unemployment rate fell to 3.5%. Average hourly wages were up 5.2% from a year ago.

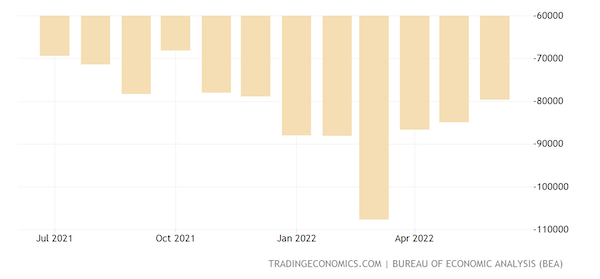

- The U.S. trade deficit narrowed sharply by 6.2% in June to its lowest level in six months. Exports grew 1.7% to $261 billion, a record, boosted by shipments of energy and food.

- Though U.S. jobless claims rose to 260,000 last week, close to 2022 highs, overall conditions in the labor market remain tight, signaled by a decline in U.S. layoffs and a brisk pace of hiring in July.

- Job security in the U.S. tech industry is rapidly declining, with more than 32,000 workers laid off so far this year.

- The Cleveland Fed suggested the central bank should raise interest rates to at least 4% by the first half of next year.

- The average U.S. mortgage rate dropped to 4.99% this week, falling sharply from a 13-year high of 5.81% in June. It is the first sub-5% rate since April.

- Shares of online real estate firm Zillow plunged Thursday after the company predicted a significant contraction in home sales would weigh on its advertising income.

- Roughly 1 in 7 homes for sale had a price reduction in June, according to Realtor.com, suggesting easing pressure in the housing market.

- People continue flocking to Las Vegas despite fears of a recession, with visits to the gambling hub up 12% in June.

- In the latest news from second-quarter earnings season:

- Eli Lilly posted a 4% revenue decline due to a drop in sales of its COVID-19 antibody treatment.

- Kellogg boosted its full-year outlook and said a 14% rise in prices outweighed declining sales volume in its most recent quarter.

- Business jet-maker Bombardier posted better-than-expected results, helped by strong demand for private flying.

- Operating profit at Rolls-Royce fell by more than 50% to $152 million on losses in its civil aviation unit.

- Air Lease Corp posted strong quarterly results as delivery delays from Boeing and Airbus boosted demand for the lessor’s planes.

- Mining and commodities giant Glencore announced over $4.5 billion in share buybacks after posting record half-year profits of $18.9 billion on the back of soaring metal prices.

- Uber rival Lyft posted a 30% rise in revenue in the recent quarter and an increase in operating profit to $79.1 million, well ahead of forecasts, but posted a wider net loss of nearly $380 million.

- Third-party food deliverer DoorDash saw second-quarter revenue rise 30% as consumers stuck to at-home ordering despite restaurant and store reopenings.

International Markets

- COVID-19 hospitalizations in Australia have fallen from all-time highs, an earlier-than-expected peak in the nation’s BA.4/5 virus wave.

- Germany rolled out plans for mandatory mask-wearing and other protective measures in the fall months when officials expect COVID-19 cases to rise.

- Thousands of tourists are stranded in the Chinese beach resort city of Sanya amid one of the nation’s worst COVID-19 outbreaks in recent weeks.

- The Bank of England predicted the country would fall into a recession this autumn, including the worst decline in living standards on record.

- Canada’s trade surplus widened to $4 billion in June on a 2% rise in exports, according to the latest data. The nation’s energy exports hit a record high, but analysts warned they would narrow in coming months due to lower crude prices.

- Mexico’s central bank is expected to hike its benchmark interest rate to a historic high of 8.5% next week.

- Alibaba Group Holding reported flat quarterly growth for the first time in its history Thursday, evidence of the severe impact of China’s lockdowns on its economy.

- Swiss bank Credit Suisse is looking at cutting thousands of jobs across the globe in the coming months in a bid to lower overall costs by over $1 billion.

- Lufthansa expects short-haul flights in Europe to drive a return to operating profit for the full year, with passenger bookings now at 83% of pre-pandemic levels. Separately, the airline’s ground staff reached a pay deal that will end a week-long strike that disrupted thousands of flights.

- Scandinavian airline saw a 32% plunge in passenger traffic last month following a strike among over 1,000 pilots.

Some sources linked are subscription services.