MH Daily Bulletin: August 9

News relevant to the plastics industry:

At M. Holland

- The European Union enacted the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation to protect human health and the environment from the effects of chemicals. Click here to learn more about what REACH compliance means for the plastics industry

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose nearly 2% Monday in volatile trading, jumping from multi-month lows touched last week.

- Oil prices turned higher this morning on reports that Russia halted flows on the Druzhba pipeline toward Eastern Europe over transit fees blocked by Western sanctions. In mid-morning trading today, WTI futures were up 1.0% at $91.68/bbl, Brent was up 1.1% at $97.75/bbl, and U.S. natural gas was up 3.2% at $7.84/MMBtu.

- The massive fire at a Cuban oil storage facility spread Monday to a third fuel tank, raising the likelihood that the country will have to resort to expensive floating storage to handle imports.

- China, the world’s top crude importer, brought in 8.79 million bpd in July, up from a four-year low in June but still 9.5% less than a year earlier.

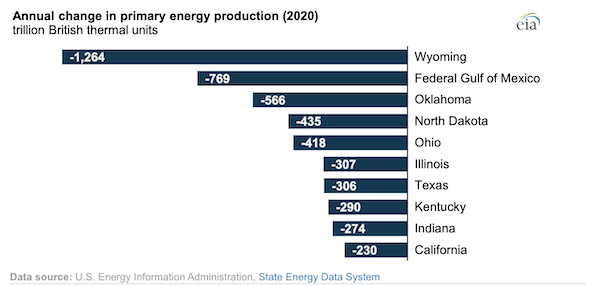

- Wyoming saw the largest drop in energy production from 2019 to 2020, when overall U.S. production fell by the most on record:

- More oil news related to the war in Europe:

- Ukrainian and global officials say Russia is endangering Europe with shelling near Ukraine’s Zaporizhzhia nuclear complex, the continent’s largest, part of an alleged scheme to cripple the nation’s power grid.

- Fuel tanker rates topped $40,000 per day the past two weeks, a 25-year high, on robust demand and longer travel times caused by Russia’s invasion.

- Shipments of Russian crude to ports in southern Europe, including in Italy and Turkey, rose to multi-week highs last week, while shipments to northern Europe continued to decline.

- German and French electricity prices rose to a new all-time high Monday, their fourth record in five days.

- Gas-turbine-maker Siemens Energy expects to post a wider loss this year than in 2021 due to a $204 million charge related to its exit from Russia.

- Spanish firms will not be allowed to lower air conditioners below 80 degrees through at least November, a bid to save power ahead of expected cutoffs from Russia.

- High river temperatures in France continue to reduce the nation’s nuclear output at a time when nearly half its reactors are offline for maintenance.

- Norway moved forward with steps to reduce its power exports Monday as dry weather impacts hydropower generation.

- British water utilities say customers should start using damp towels and spray bottles for showering to save water and energy amid a deepening drought.

- BP continues to reshape its North American oil and gas operations, including yesterday’s $300 million sale of its remaining stake in an Ohio refinery to Cenovus Energy.

- Virginia regulators approved Dominion Energy’s plan to build 176 wind turbines off the coast of Virginia Beach at a cost of roughly $10 billion.

- Congress’ newly passed $430 billion spending bill would send nearly $370 billion to climate and energy security measures, including incentives to promote electrification.

- BP began drilling an appraisal well in Texas for its U.S. carbon capture and sequestration business, part of a plan to bury CO2.

- Experts say low carbon prices in major economies in Asia will do little to incentivize emissions reductions in the most polluting industries.

Supply Chain

- More commercial vessels are sailing Germany’s Rhine River with only partial loads as water levels continue to fall.

- Some container lines are dropping calls at Hong Kong due to the island’s strict COVID-19 restrictions.

- New data shows cargo volumes at Asia-Pacific airports fell sharply in June for the fourth straight month.

- The U.S. trucking industry added 3,500 jobs in July, the 26th month of gains in the past 27 months, although at a slower pace than previous months this year.

- U.S. lawmakers introduced a bill Monday that would ban railroads from raising prices during service emergencies and expand the Surface Transportation Board’s oversight, among other changes.

- The EU’s competition watchdog is launching a new investigation of pricing in the container shipping sector.

- U.S. aviation regulators cleared Boeing to resume deliveries of its 787 Dreamliner jets after a two-year halt in output due to manufacturing issues. As soon as Wednesday, Boeing could start to unlock the nearly $10 billion in cash tied up in 120 already-built planes it has in storage.

- Airbus confirmed slower deliveries of 46 jets in July as a supply crunch left semi-finished jets outside its factories without engines.

- Several Chinese solar-panel suppliers, including some of the world’s largest, have had shipments to the U.S. detained or sent back in recent weeks as customs agents enforce tighter human-rights laws.

- Rail equipment-maker Wabtec saw net income rise 35% in the second quarter on higher revenue in its freight segment. The company’s order backlog rose 8% to $23.2 billion.

- Second-quarter profit at container line Ocean Network Express jumped 15% to $5.5 billion.

- The head of the U.S. Postal Service plans to consolidate 500 processing facilities down to about 65 or 75 regional hubs and may eliminate 50,000 jobs as part of a 10-year break-even plan.

- Qualcomm agreed to buy an additional $4.2 billion in computer chips from GlobalFoundries’ New York factory, bringing its total commitment to $7.4 billion in purchases through 2028.

- U.S. graphic chipmaker Nvidia missed Q2 projections by over $1 billion on a decline in consumer spending on personal computers, especially gaming PCs.

- Micron Technology says government grants will help it invest $40 billion by the end of the decade to expand U.S. semiconductor manufacturing capacity.

- In the latest news from the auto industry:

- Tesla signed contracts worth about $5 billion to buy battery materials from Indonesia, which has been lobbying the automaker to build a factory in the country.

- Audi plans to extend the life of some of its combustion-engine models to give more time for consumers to make the switch to electric vehicles, particularly in the U.S.

- Electric vehicle sales in China are forecast to hit a record 6 million this year as consumers flock to cleaner cars, which made up 26.7% of new auto deliveries in July.

- Canoo will use a third party to build its first electric delivery vans for Walmart, a change from previous plans to begin assembly at the startup’s Arkansas factory by the end of this year.

- Congress’ $430 billion spending bill contains more than $15 billion to retool electric-vehicle factories and build new ones.

- UPS will push further into cold-storage logistics in Europe and South America with the pending acquisition of Italy’s Bomi Group, a transporter of sensitive pharmaceutical products.

- Garment exporters from Bangladesh and Vietnam are bracing for order cancellations from overstocked U.S. retailers.

- Academic publishers are delaying publication of new books as the industry struggles with paper shortages and shipping delays.

- Los Angeles-based A2Z Drone Delivery claims to have invented a new tether system that can handle up to 22 pounds, more than any other drone service on the market.

- Canadian National Railway is adding hundreds of high-capacity hopper cars ahead of forecasts for a rebound in grain shipments.

- Lebanon rejected Ukraine’s first cargo of grain exports since Russia’s invasion, citing the five-month delay in its originally scheduled delivery. The commencement of grain shipments from Ukraine is expected to put a premium on charters of smaller bulk vessels, ship brokers say.

- Russian airlines, including state-controlled Aeroflot, are stripping jetliners to secure spare parts they can no longer buy abroad due to Western sanctions.

Domestic Markets

- The U.S. reported 107,615 new COVID-19 infections and 392 virus fatalities Monday.

- Only 31% of U.S. children aged five to 11 have been fully vaccinated against COVID-19, new data shows.

- BioNTech plans to begin deliveries of two Omicron-adapted vaccines as soon as October, helping secure the company’s fourth-quarter projections after it posted better-than-expected earnings in the second quarter.

- Continued strength in the U.S. job market has led several major banks to predict the Federal Reserve will raise interest rates by at least 75 basis points in September, and potentially more.

- U.S. worker pay and benefits are rising this year at the fastest pace on record, with annual increases of at least 5% in average hourly wages each month this year.

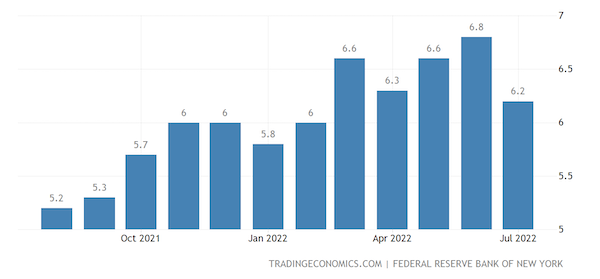

- Consumer inflationary expectations a year from now eased to a five-month low of 6.2% in July, according to the New York Fed.

- Public pension plans lost a median 7.9% in the year ended June 30, their worst annual performance since 2009 due to sharp declines in stocks and bonds earlier this year.

- Fannie Mae’s index of home-buying sentiment dropped to its lowest level in over a decade this month despite growing expectations of a slowdown in price appreciation.

- The number of active U.S. home listings rose 31% from a year earlier in July, a record-high increase for the third straight month in a sign that higher mortgage rates are cooling the housing market.

- More than 1,300 U.S. flights were canceled last weekend due to worker shortages. Disruption continued Monday, with 500 flights canceled and over 2,000 delayed.

- New York City’s transit authority has seen weekday subway ridership plateau at 60% of pre-pandemic levels as many office workers settle into working from home.

- In the latest news from second-quarter earnings season:

- Tyson Foods shares fell 8.4% Monday as the U.S. meat processor reported weaker-than-expected earnings and warned of supply constraints and reduced demand for high-priced beef.

- U.S. drugmaker Novavax slashed its full-year outlook, citing a lack of demand for its recently approved COVID-19 vaccine.

- Insurer American International Group (AIG) beat profit estimates on a 73% boost in underwriting income, cushioning a blow from lower investment returns.

- E-commerce firm Shopify added just 71,000 net merchants in the first half of 2022 compared to 680,000 in 2020, as businesses react to rising costs and lower consumer spending.

- Danish brewer Carlsberg raised its full-year earnings outlook as strong sales in Europe and Asia outweighed higher material costs.

- Macy’s started re-opening Toys R Us concessions inside some stores after the popular U.S. brand filed for bankruptcy in 2017.

International Markets

- The Chinese autonomous region of Tibet posted 18 COVID-19 cases Sunday, ending more than 900 days without an infection and prompting the closure of Tibet’s famed Potala Palace.

- About 7 million people in at least nine cities near the Chinese tourism hub of Hainan went into lockdown Monday as the region experiences China’s worst COVID-19 outbreak since Wuhan in late 2019.

- China’s zero-COVID policy is discouraging young couples from having children and prompting projections of a declining population in the decades ahead.

- COVID-19 now accounts for nearly 15% of deaths in New Zealand, tying heart disease as the nation’s leading cause of death for the first time. The virus is the third-leading cause of death in nearby Australia.

- South Korea reported 55,292 new COVID-19 infections Monday, ending its six-day run of more than 100,000 cases per day.

- Taiwan reported 15,412 new COVID-19 cases Monday, its lowest since April.

- China’s exports to Russia rose by one-third from June to July and more than 20% from the year-ago period, offsetting some of the impact caused by the exodus of Western brands from Russia.

- Mexico’s inflation likely sped up to a 22-year high of 8.13% in July, economists say, bolstering the case for more interest-rate hikes through the rest of the year.

- The Philippines posted its widest trade deficit of the pandemic in June as imports rose 26%, driven by higher fuel costs.

- Chinese tech giant Baidu won approval to deploy the nation’s first fully autonomous taxis in several large cities, including Wuhan.

Some sources linked are subscription services.