MH Daily Bulletin: August 10

News relevant to the plastics industry:

At M. Holland

- The European Union enacted the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation to protect human health and the environment from the effects of chemicals. Click here to learn more about what REACH compliance means for the plastics industry.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell less than half a percent after a see-saw day of trading Tuesday.

- In mid-day trading today, WTI futures were up 1.6% at $91.97/bbl, Brent was up 1.2% at $97.46/bbl, and U.S. natural gas was up 3.6% at $8.11/MMBtu.

- The average U.S. gasoline price dipped below $4 a gallon Tuesday for the first time since early March.

- U.S. crude stocks unexpectedly rose by 2.2 million barrels last week, signaling slackening demand. Counter to recent data, U.S. refiners continue to expect strong consumption for the second half of the year.

- The U.S. government released a flurry of revised projections Tuesday, including slight downgrades for crude production and gasoline consumption this year but record power use.

- U.S. producer Delfin Midstream agreed to an $8.5 billion long-term deal to supply British Gas with LNG from an offshore site in Louisiana. Deliveries are expected to begin in 2026.

- Shale producer Devon Energy plans to buy Validus Energy, an operator in Texas’ Eagle Ford basin, for $1.8 billion in cash.

- More oil news related to the war in Europe:

- National and local governments across Europe are pushing to conserve energy in various ways in response to reduced gas flows from Russia.

- Clarified reports show Ukraine, not Russia, was responsible for halted flows on the Druzhba gas pipeline to Eastern Europe due to delayed transit fee payments. Flows on the route’s impacted southern portion could resume within days.

- European natural gas futures hit a two-week low Tuesday due to better-than-expected storage levels for this time of year.

- German officials indicated lower gas shipments from Russia could lead to a reversal of the nation’s ban on fracking in place since 2017.

- British officials warned that industries and households could see planned blackouts this winter if gas shortages combine with extremely cold weather. Household gas bills, meanwhile, could near $5,000.

- Russia’s natural gas exports by pipeline to the EU and U.K. fell by almost 40% during the first seven months of the year compared to the year-ago period:

- The EU put forward a final offer to revive the 2015 Iran nuclear agreement that could bring the sanctioned nation’s oil to global markets in weeks.

- Egypt is limiting public lighting in an effort to save natural gas supplies for high-revenue exports.

- Bail prices for post-consumer recycled feedstock have fallen dramatically in August.

- Investments in bioplastics surged to $500 million in the first quarter of 2022, up from $350 million in final quarter of 2021.

Supply Chain

- Heavy flooding knocked out power, triggered landslides and submerged roadways in the South Korean capital of Seoul on Monday night. At least eight people died.

- British utilities are imposing bans on the use of hoses and sprinklers due to a growing water shortage after the nation saw its hottest July in nearly 90 years, with more searing weather in the forecast.

- U.S. power companies face a shortage of transformers and long lead times to get equipment just as peak storm season provides the greatest threat to critical gear.

- Contract negotiations with dockworkers at Britain’s largest container port of Felixstowe ended without agreement Tuesday, paving the way for a strike starting Aug. 21.

- Container line profits are expected to surge 73% this year from 2021’s record, led by sustained U.S. demand.

- Tanker operators are reporting record second-quarter profits on higher rates.

- Trucker ArcBest says its shipment volume is flat to start the third quarter but revenue per day is up 18%.

- Container volumes rose an annual 18% in July at the Georgia Ports Authority, the fastest ever start to a fiscal year for the group, which operates the Port of Savannah.

- The Federal Maritime Commission formed a new prosecution unit this month aimed at enforcing tougher new shipping regulations.

- The U.S. president signed a bill into law on Tuesday that provides $52 billion for domestic computer chip production and billions more in related tax credits. The move comes at a time when chipmakers are dialing down near-term spending ahead of expected slowdowns in demand, including Idaho-based Micron, which cut its current-quarter revenue forecast and warned of rising inventories.

- Reports suggest the global computer chip shortage is easing for smartphones and personal computers while supplies remain tight in the auto sector.

- Lenovo Group, the world’s biggest personal computer maker, posted flat second-quarter revenue in its worst quarterly performance in two years.

- In the latest news from the auto industry:

- Gissing North America became the first Detroit-based automotive supplier to file for bankruptcy during the pandemic.

- Taiwan’s Foxconn, the world’s largest contract manufacturer and a major Apple supplier, plans to start building self-driving electric tractors next year at the Lordstown, Ohio, factory it purchased from GM in 2021.

- Tesla revealed lobbying efforts for a new factory near Ontario, Canada. Upgrades at the automaker’s Shanghai factory led to a two-thirds decline in Chinese output from June to July.

- A COVID-19 outbreak among employees shut down a production line at Toyota’s factory in central Japan.

- FedEx’s office supply unit will soon begin testing electric delivery vans made by Ford ahead of potential wider adoption by the parent company.

- Ford raised the price of its electric F-150 Lightning truck by over $6,000, citing rising material costs.

- Thousands of workers at Volkswagen’s main factory in Mexico rejected a new contract agreement, sending parties back to negotiations.

- Boeing says it delivered a five-month low of 26 planes in July as supply constraints hamper production.

- U.S. equipment maker Emerson Electric posted a 47% rise in quarterly profit after demand surged from companies looking to automate their assembly lines.

- Japanese retailers are dealing with a shortage of shelf stockers by using new robot arms made in part by Microsoft and Nvidia.

- U.S. egg prices rose 47% year-over-year in July after one of the worst bird flu outbreaks in history wiped out flocks.

- U.S. beef prices could remain high for several years after farmers trimmed cattle herds this year due to worsening drought conditions and higher feed costs.

- Supply chain issues are causing a major shortage of mustard in France, the world’s top consumer of the condiment.

Domestic Markets

- The U.S. reported 107,515 new COVID-19 infections and 382 virus fatalities Tuesday.

- COVID-19 cases in New York jumped 11% last week, while fatalities also rose.

- Twenty-three state attorneys general have joined legal efforts to scrap the CDC’s nationwide mask mandate on public transit.

- U.S. worker productivity in the second quarter fell at the steepest rate since data became available in 1948. Labor costs, meanwhile, rose 10.8%, elevating inflation.

- The U.S. consumer-price index rose 8.5% in the year through July, a bigger slowdown than expected and down from 9.1% in June, suggesting that surging inflation in the nation may have peaked.

- U.S. consumer spending on credit and debit cards is starting to slow, rising below the pace of inflation at just 5.3% in July, according to Bank of America.

- Online prices in the U.S. fell for the first time in two years in July, ending 25 straight months of inflation.

- Millennials’ net worth more than doubled to $9.38 trillion during the pandemic, led by a surge in home ownership and valuations.

- Homebuyer traffic to real estate websites and sales offices plunged to a decade-low in July, the latest sign pointing to a cooling housing market.

- U.S. college endowments lost a median 10.2% in the year to June, their steepest decline since 2009 due to double-digit losses in equity markets.

- Ride-hailing company Lyft created a new media division to boost on-car advertising and in-car technology features.

- Norwegian Cruise Line shares fell 12% Tuesday after the firm missed revenue targets and said passenger volumes would not return to pre-pandemic levels for another year.

International Markets

- South Korea reported 149,897 new COVID-19 cases Tuesday, its highest daily total since April.

- China reported over 1,000 new COVID-19 cases Tuesday, led by hotspots in locked-down tourist destinations.

- European medicine regulators will begin reviewing data for Omicron-tailored COVID-19 vaccines as it comes in, potentially leading to faster approval.

- The U.K. and China agreed to resume direct passenger flights, a sign that Chinese authorities are slowly loosening their grip on the world’s tightest COVID-19 restrictions.

- Flight bookings to Hong Kong jumped 249% this week after the island reduced hotel quarantine times from seven days to three.

- Japan’s population fell by 726,342 since Jan. 1, the steepest decline since comparative data became available in 2013.

- Consumer prices in Mexico jumped 8.15% year-over-year in July, the largest increase since 2001.

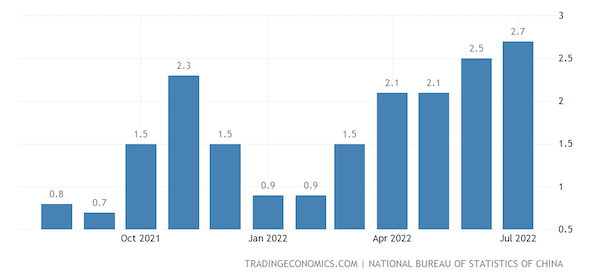

- China’s consumer inflation hit a two-year high of 2.7% in July, led by a steep increase in pork prices. Other indicators point to slowing consumer demand jeopardizing the nation’s growth targets.

- Japan’s wholesale prices rose 8.6% in July from a year ago, slowing from the previous month’s pace on declining material and fuel costs.

- Russia claims its current-account surplus more than tripled in the first seven months of the year amid surging revenues for energy and commodity exports.

- Several hundred thousand nurses in England and Wales will vote next month on a possible strike over pay, a major threat to the nation’s healthcare system.

Some sources linked are subscription services.