MH Daily Bulletin: August 11

News relevant to the plastics industry:

At M. Holland

- M. Holland Company has appointed Ton Koenders as the company’s inaugural director of sales for Europe to support international growth and address customer needs in Europe. Click here to read the press release.

- The EU enacted the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation to protect human health and the environment from the effects of chemicals. Click here to learn more about what REACH compliance means for the plastics industry.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose over 1% Wednesday, helped by encouraging figures on U.S. gasoline demand.

- In mid-morning trading today, WTI futures were up 0.8% at $92.66/bbl, Brent was up 0.8% at $98.13/bbl, and U.S. natural gas was up 2.0% at $8.36/MMBtu.

- OPEC revised its crude forecast lower and said supply and demand were nearly balanced in the second quarter, raising speculation the cartel will suspend its monthly production increases.

- The average U.S. gasoline price has fallen for 57 straight days to 21% below June’s peak of $5 a gallon.

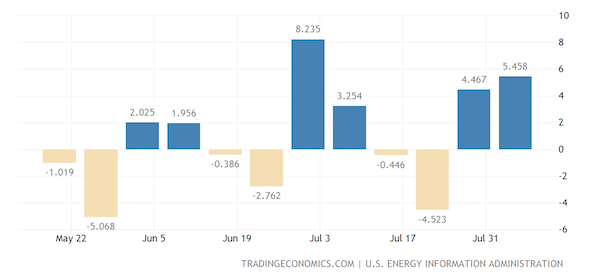

- U.S. crude stocks rose by a larger-than-expected 5.5 million barrels last week while production rose to its highest level since April 2020. Gasoline inventories fell sharply on higher demand as refineries operated at over 94% of capacity.

- Rates for mid-sized oil tankers from the U.S. Gulf of Mexico to Europe hit $57,000 per day this week, a twelve-fold increase from January.

- Top U.S. gas exporter Freeport LNG has retracted the force majeure it initially declared after a facility explosion in June, potentially exposing some customers, including BP and TotalEnergies, to billions in losses.

- More oil news related to the war in Europe:

- Assisted by Hungary, Russia’s Transneft restarted oil flows on the southern leg of the Druzhba oil pipeline Wednesday after Ukraine stopped deliveries due to payment issues.

- Natural gas overtook nuclear as the biggest source of power in Europe last month for the first time in two years, as reactors in France undergo maintenance. France also lost its spot as Europe’s top power exporter, surpassed by Sweden and Germany.

- Europe increased its imports of Russian diesel by more than one-fifth in July.

- Household energy debt in Britain stands at an all-time high of nearly 1.3 billion pounds, about three times higher than September 2021.

- A global rally in coal prices will likely last for years due to re-routed trade flows and higher demand after Russia’s invasion, according to Fitch Solutions.

- Indian companies are using Asian currencies more often to pay for Russian coal imports to avoid breaching Western sanctions.

- OPEC’s crude exports rose by 223,000 bpd last week on a rebound in Libyan production.

- Cuba gained control of a fire at one of its largest oil storage facilities Wednesday, although impacts to the nation’s energy supply could be extensive.

- California officials on Wednesday set some of the U.S.’s most ambitious goals for offshore wind development over the next several decades, a bid to power 25 million homes with the renewable source by 2050.

- A multi-billion dollar hydrogen project in southern Africa was delayed by the pandemic and will now cost 23% more to build, according to Zambia and Zimbabwe.

Supply Chain

- The Rhine River will soon become impassable at a key waypoint in Germany, as shallow water chokes off shipments of energy products and other industrial commodities. The International Energy Agency says effects of the crisis could last the rest of the year.

- Spain and France are dealing with some of their worst drought conditions on record. In Britain, extreme heat over the next four days is expected to pressure water supplies and transport services.

- The U.S. administration urged all parts of the U.S. supply chain, including ports, to move to 24-hour operations to help alleviate backlogs and reduce costs.

- Wages for U.S. truck drivers rose 11% to an average of nearly $70,000 in 2021 as companies focused on worker recruitment.

- About 10% of the global container fleet remained tied up in port bottlenecks at the start of August, according to analytics firm Sea-Intelligence.

- Global growth in container fleets will outstrip demand and ease market tightness starting next year, Hapag-Lloyd predicts.

- Congestion at China’s major container ports is easing as volumes rebound following the loosening of pandemic restrictions. July volumes at the Port of Shanghai rose 16% from last year to a new record.

- The Port of Long Beach saw its busiest July on record with throughput hitting 785,843 TEUs, up a slight 0.13% from last year.

- Maersk now has 71% of its container volumes covered by long-term contract rates that are $1,900 per FEU higher than last year.

- Mexico’s government issued emergency directives Wednesday to guarantee balanced transport pricing for a staple basket of goods on the nation’s railroads, a bid to reduce inflation caused by high transportation costs.

- Airlines will no longer be allowed to carry cargo in the cabins of passenger aircraft in Europe, EU regulators decreed.

- Air Canada plans to expand its cargo capacity with orders for two new Boeing 777 freighters.

- A new warehouse corridor is forming in the desert just outside Phoenix, Arizona, as companies seek alternative paths for U.S. distribution from congested coastal gateways.

- FedEx plans to deploy more robotic sortation machines as it works to optimize a flood of small parcel shipments sparked by the pandemic’s e-commerce boom. Recently, the carrier bought a 10% stake in warehouse automation firm Berkshire Grey.

- Apparel retailer American Eagle launched operations of its newly acquired logistics arm this week, giving small and mid-sized retailers access to dozens of carriers across the nation.

- In the latest news from the auto industry:

- There were 10,600 preliminary orders for heavy-duty trucks in North America in July, down 33% from June and 60% from a year ago.

- Daimler Truck says it will keep prices high even if certain costs begin to fall this year to compensate for lower margins in 2021.

- Honda posted a better-than-feared 9% drop in quarterly operating profit, as a weaker yen helped make up for rising material costs and supply chain constraints.

- Ford says every vehicle it manufactures in Michigan will be assembled using solar and other renewable energy sources by 2025.

- Japan’s Mitsubishi Gas Chemical plans to nearly triple U.S. production of key chipmaking chemical super-pure hydrogen peroxide over the next decade.

- About 30% of U.S. baby formula was out of stock last month, as availability improves but remains significantly below historical levels.

- Boeing delivered its first 787 Dreamliner in more than a year on Wednesday to American Airlines, two years after manufacturing issues curtailed the jet’s production.

- Closely-held freight forwarder Terra Worldwide Logistics is exploring a sale that could value the Atlanta-based firm at $1 billion.

- Toshiba posted a surprise operating loss in the latest quarter as it dealt with a sharp rise in logistics and raw material costs.

- Private commodities trader Cargill reported a 23% gain in fiscal year revenue to a record $165 billion.

- Siemens posted its first quarterly loss in nearly 12 years due to costs tied to its exit from Russia and a $2.8 billion write-down of the value of its stake in renewables equipment firm Siemens Energy.

Domestic Markets

- The U.S. reported 107,077 new COVID-19 infections and 395 virus fatalities Wednesday. The daily average for new cases stood at 109,117, down 15% from two weeks ago.

- The U.S. administration plans to extend the COVID-19 public health emergency past an Aug. 15 deadline, keeping in place federal protections for healthcare, vaccine and testing availability.

- Michigan reported a decline in daily COVID-19 cases for the first time in a month on Tuesday, signaling the peak of a recent wave.

- The Great Smoky Mountains National Park reimposed mask mandates in response to increasing COVID-19 transmission.

- New research is starting to suggest that updated COVID-19 vaccines may have a weaker-than-expected effect on new virus strains compared to existing shots.

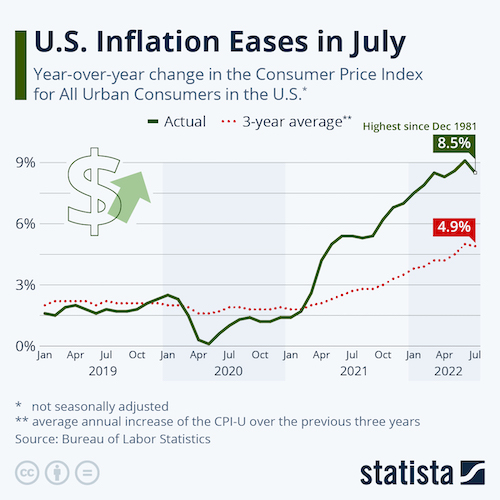

- Producer Prices fell 0.5% month-over-month in July, better than the 0.3% increase that economists expected. Year-over-year, PPI rose 9.8%, versus the 10.4% increase expected.

- First-time jobless claims rose by 14,000 last week to 262,000, the fifth weekly increase in the past six weeks.

- U.S. stocks hit multi-month highs Wednesday after a key inflation reading showed better-than-expected slowdowns in inflation, with the Nasdaq entering a new bull market, marked by a 20% gain from the most recent low. Fed officials responded to the news by affirming the central bank’s path toward higher interest rates this year and next:

- U.S. food costs jumped 1.1% in July, bringing the year-over-year gain to 10.9%, the steepest pace in decades.

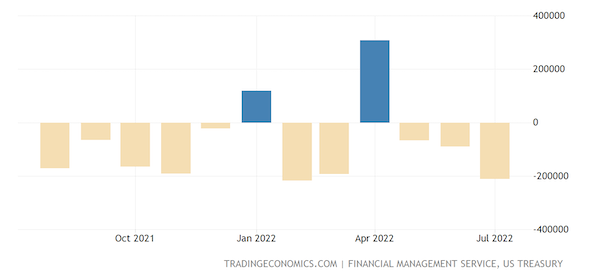

- The U.S. government posted a $211 billion budget deficit for July, down 30% from last year as COVID-19 relief spending fell sharply.

- Social Security recipients are on track for a 9.6% boost in monthly payments next year, what would be the largest cost-of-living raise in over four decades.

- U.S. wholesale inventories rose less than initially thought in June as businesses slowed replenishing stocks while continuing to draw down excess inventories.

- The median U.S. price for a one-bedroom apartment climbed 11% to a new record of $1,450 in July, with rent increases in some cities, including New York City, topping 40% annually. Still, rising mortgage rates mean it is more affordable to rent than to buy a starter home in the majority of U.S. metro areas, according to Realtor.com.

- United Airlines spent $10 million on a down payment for 100 electric vertical take-off and landing aircraft from Archer Aviation. Joby, another flying taxi company, aims to launch commercial vehicles to the public by 2024.

- Google Fiber, a recent spinoff of Alphabet, plans to install its high-speed internet in several new metro areas for its biggest expansion push since 2015.

- Walt Disney saw a better-than-expected 26% jump in quarterly revenue, driven by record results at its theme parks and strong subscriber growth on its streaming platform.

- U.S. consumer spending on video games fell 11% in June and is expected to decline 8.7% this year, according to analytics firm NPD.

International Markets

- Global COVID-19 cases were flat last week while fatalities fell 9%, according to the World Health Organization.

- Mainland China reported 1,094 new COVID-19 cases Wednesday, leading to fresh lockdowns in several cities, including the eastern manufacturing hub of Yiwu.

- New Delhi reimposed mask mandates in response to rising COVID-19 infections in India.

- A South African manufacturer of Johnson & Johnson COVID-19 vaccines will halt production later this month due to a lack of orders, officials said.

- South Korea’s technology exports declined for the first time in two years in July, dropping 0.7% in a sign of cooling global demand.

- Singapore trimmed its 2022 economic growth forecast after data showed a worse-than-expected 0.2% contraction in the latest quarter.

- Hong Kong-based Cathay Pacific’s revenue rose 17% in the first half of 2022 on persistent air cargo demand. Passenger volumes stayed 95.2% below pre-pandemic levels.

- Russian steel producer Evraz is looking to sell its North American subsidiaries.

Some sources linked are subscription services.