MH Daily Bulletin: August 18

News relevant to the plastics industry:

At M. Holland

- The U.S. reinstated the Superfund Excise Tax on July 1, 2022. It applies to chemicals and substances commonly used in the plastics industry. How is it impacting producers, distributors, importers and processors? Click here to read more.

- M. Holland will be attending the North American Detroit Auto Show on Sept. 14-15. This annual showcase for emerging automotive technologies will be held at Huntington Place in Detroit, Michigan. If you’re attending, please RSVP for M. Holland’s reception or contact Mike Gumbko, Strategic Account Manager, to set up a meeting with our Automotive team.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose about 1.5% on Wednesday on news of a larger-than-expected decline in U.S. crude stocks last week.

- In mid-morning trading today, WTI futures were up 1.3% at $89.27/bbl, Brent was up 1.6% at $95.14/bbl, and U.S. natural gas was up 1.0% at $9.34/MMBtu. Crude is currently trading near the lowest level in more than six months.

- The average U.S. gasoline price dropped to $3.95 a gallon Tuesday, down 21% from June highs.

- U.S. crude stocks fell by a larger-than-expected 7.1 million barrels last week, according to the EIA. Inventories are nearing multi-decade lows.

- U.S. crude exports hit 5 million bpd last week, the highest on record, as WTI’s steep discount to Brent made purchases of the U.S. product more attractive to foreign buyers.

- In a sign of strong demand, U.S. gasoline stocks fell by 4.6 million barrels last week, much higher than the expected 1.1-million-barrel draw.

- Very large crude carrier spot rates are up 58% the past week to over $40,000 per day on key routes, the highest level in two years.

- Australian officials are considering blocking some natural gas exports to help plug domestic shortages, a move likely to further strain global energy supply.

- BP plans to sell its oil assets in Mexico as it seeks to focus more on its renewable energy business.

- Mexico’s flagship Dos Bocas refinery, which has faced billions of dollars in cost overruns, is reportedly drawing concerns from members of the Pemex board.

- The U.S. and the EU say they are studying Iran’s response to what the EU has called its final proposal to save a nuclear deal that would bring more Iranian crude to the global market.

- More oil news related to the war in Europe:

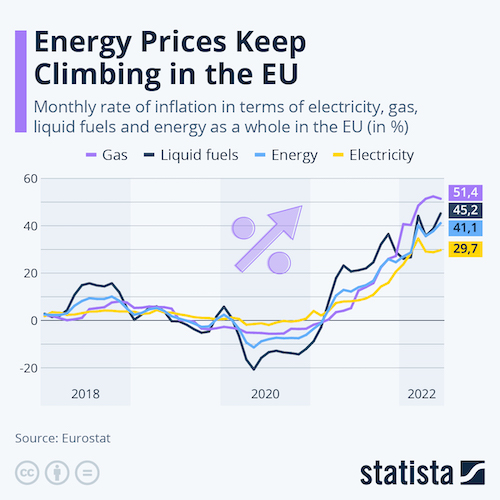

- Annual energy inflation in the EU hit 41.1% in July and prices are up 14.1% since the start of the year.

- Russia’s earnings from energy exports are expected to rise 38% this year largely due to higher export volumes to Asia. The nation’s output is forecast to decline substantially in the coming years, however.

- German power supplier Uniper reported a $12.5 billion loss due to Russian gas supply cuts and has declined to give an outlook for 2022 amid continuing uncertainty.

Supply Chain

- Parts of China are suffering their worst heat wave in six decades, disrupting factories, slashing power supplies and threatening crop yields. On Wednesday, several Chinese shipyards declared force majeure on some orders due to the fallout.

- California officials are urging the state’s 40 million people to use less electricity as a wave of extreme heat stretches power supplies to the brink.

- Historic drought in Spain led at least one city to start importing fresh water on tanker vessels.

- Around 20 ships are stuck in traffic along Germany’s Rhine River, where low water levels continue to impede transport of fuel supplies and materials. Water levels are expected to return to a critical navigable level this weekend, providing some relief, as authorities consider deepening the river at key choke points.

- Backups of dozens of container ships have formed off ports in New York, Houston and Savannah as U.S. importers continue seeking relief from logistics bottlenecks on the West Coast.

- The Port of Los Angeles expects August imports to begin easing from record highs as retailers cancel orders in the wake of a pullback in consumer spending.

- Maritime research group Xeneta says spot container rates from the Far East to the U.S. West Coast are down by one-third this year.

- The Baltic Dry Index measuring pricing in the global bulk commodities market fell 5.3% last week to a six-month low.

- U.S. freight railroads said Wednesday they are ready to reach contract agreements with union workers based on the White House’s new wage recommendations, potentially ending two years of negotiations affecting over 115,000 workers.

- Spot truckload rates in the U.S. are down 12 cents per mile from the average rate in May, according to DAT Solutions.

- The total marginal cost of trucking grew by 12.7% in 2021 to $1.855 per mile, a record-high led by higher fuel costs, according to the American Transportation Research Institute.

- A recent survey from Toronto-based TealBook showed inflation is now the biggest concern of sourcing and procurement executives.

- Taiwanese container line Yang Ming’s first-half profit doubled to nearly $4 billion.

- Boeing and Northrup Grumman will join a White House-backed program to help smaller U.S.-based suppliers increase the use of 3D printing and other advanced manufacturing technologies.

- Soaring gas prices, a key feedstock, have curtailed one-quarter of Europe’s fertilizer output, threatening global food supplies.

- Russian wheat exports dropped almost 30% in July and August due to logistics constraints, new figures show.

- In the latest news from the auto industry:

- One-fifth of U.S. electric vehicle drivers say public charging networks have failed to work when needed, underscoring additional challenges in building out the U.S. charging network.

- Stellantis plans to introduce a new compact SUV later this year, its first new model in nearly a decade, as it prepares for an even larger transition to an electric lineup starting in 2024.

- Dodge unveiled a new all-electric concept car aimed at replacing the Challenger and Charger Wednesday evening, with initial sales expected for 2024.

Domestic Markets

- The U.S. reported 98,940 new COVID-19 infections and 398 virus fatalities Wednesday.

- The White House will likely extend the nation’s COVID-19 health emergency for another three months to preserve services like telehealth and free vaccines, at the same time it prepares to wind down government purchases of COVID-19 vaccines, tests and treatments and to end the crisis phase of the pandemic.

- About 80% of children nationwide have had COVID-19, according to the CDC.

- The CDC will undergo a sweeping reorganization following an internal probe of the agency’s shortcomings in quickly and adequately responding to the COVID-19 pandemic, officials said Wednesday.

- New research suggests the risk of “brain fog” and other neurological symptoms persists for up to two years after COVID-19 infection.

- Initial jobless claims fell by 2,000 last week to 250,000, the first drop in three weeks.

- Minutes released from the Federal Reserve’s July meeting show officials agreed on the need to eventually dial back the pace of interest-rate hikes while also wanting time to gauge how monetary tightening was working to curb U.S. inflation.

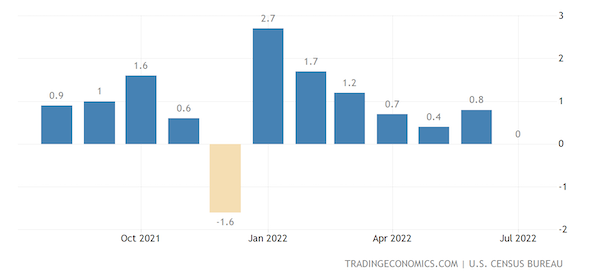

- U.S. retail sales were unexpectedly flat in July on declines in auto purchases and gasoline prices. July’s figures followed a revised 0.8% jump in June.

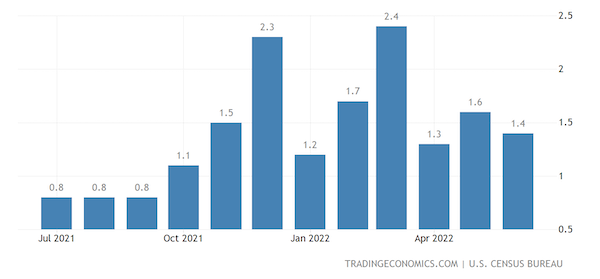

- U.S. business inventories rose 1.4% in June as rising stocks in the retail sector outpaced sales.

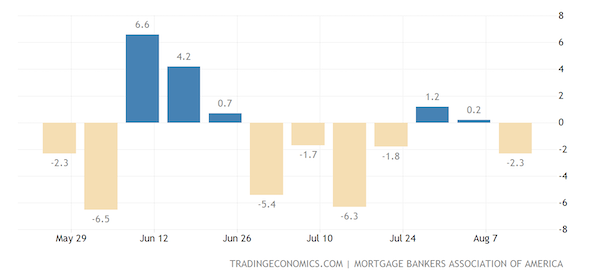

- U.S. mortgage activity fell to its lowest level since 2000 last week amid higher rates and recession fears. Applications were down 2.3% on a substantial decline in refinancings.

- The third hottest July on record is impacting nearly 75% of U.S. farmers, with 37% of respondents in a recent survey saying they are plowing down underdeveloped crops and selling livestock early.

- Lowe’s reported a 0.3% decline in second-quarter sales, the second decline in a row, amid flagging demand from its nonprofessional customer base.

- T.J. Maxx’s parent company cut its forecast for annual sales and earnings after quarterly revenue missed estimates Wednesday.

- Cisco beat quarterly revenue estimates on easing supply chain pressures and rebounding computer chip supplies.

- American roads had their deadliest first quarter in 20 years with 9,560 car-crash fatalities, up 7% from 2021.

- Environmentalists are objecting to a plan by big consumer brands to modify packaging labels to say polypropylene food packaging is “widely recyclable,” underscoring the prevailing confusion and inconsistency of plastic recycling standards.

International Markets

- Global COVID-19 fatalities are up 35% the past four weeks, according to the WHO, which warned that risk factors are set to increase as cold weather approaches.

- Russia reported 33,106 new COVID-19 cases Wednesday, the most since mid-March. The CDC this week elevated the country to Level 3 on its COVID-19 travel warning list.

- The U.S. announced plans for autumn negotiations with Taiwan on a bilateral trade and investment initiative to deepen ties on a range of areas, including technology and agriculture.

- Chinese state media said local governments may sell more than $229 billion of bonds to fund infrastructure investment and plug budget gaps, a further move to shore up the nation’s ailing economy.

- China’s largest property developer Country Garden Holdings warned that first-half earnings probably tumbled as much as 70% amid the nation’s escalating property crisis.

- European Central Bank officials indicated they will continue raising interest rates to combat inflation that has soared above 20% in some member nations, including Latvia.

- Air Canada plans to operate flights at 79% of pre-pandemic capacity this summer as North American carriers continue to struggle with staffing shortages.

- Dubai International Airport raised its annual passenger forecast by 7% after traffic more than doubled in the first half of 2022.

- Major beverage companies in the Philippines, including Coke, Pepsi and RC Cola, warned they are running out of refined sugar, a shortage caused after a major typhoon swept the nation in December.

Some sources linked are subscription services.