MH Daily Bulletin: August 19

News relevant to the plastics industry:

At M. Holland

- The U.S. reinstated the Superfund Excise Tax on July 1, 2022. It applies to chemicals and substances commonly used in the plastics industry. How is it impacting producers, distributors, importers and processors? Click here to read more.

- M. Holland will be attending the North American Detroit Auto Show on Sept. 14-15. This annual showcase for emerging automotive technologies will be held at Huntington Place in Detroit, Michigan. If you’re attending, please RSVP for M. Holland’s reception or contact Mike Gumbko, Strategic Account Manager, to set up a meeting with our Automotive team.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices gained about 3% Thursday on positive U.S. economic data and robust U.S. fuel consumption.

- In mid-morning trading today, WTI futures were up 0.6% at $91.02/bbl, Brent was up 0.2% at $96.82/bbl, and U.S. natural gas was up 0.5% at $9.23/MMBtu.

- The average U.S. gasoline price fell to $3.93 a gallon Thursday, down 60 cents the past month.

- U.S. natural gas supplies are still more than 10% below normal levels for this time of year, putting upward pressure on prices.

- U.S. refiners operated at near-capacity in the second quarter on robust demand and multi-year-high refining margins. Executives say utilization levels will remain high the current quarter.

- U.S. oil and gas firms generated $73.7 billion in 2021 profit driven by higher prices. Companies were cautious about capital spending, which reached $144.1 billion, while cash returned to shareholders through dividends and stock buybacks more than doubled from the prior year.

- CenterPoint Energy will delay retiring a coal-fired power plant in Indiana amid uncertainty about the pace of transition to renewables.

- U.S. oil reserves held by 50 large companies rose by 13% over the past five years amid higher mergers and acquisitions activity, according to Ernst & Young.

- More oil news related to the war in Europe:

- European spot power prices declined from near-records Thursday following news of rising German solar supply and French nuclear output.

- Germany’s natural gas import prices surged 153% in the first half of 2022 despite a 24.3% drop in volumes. The nation’s government will temporarily cut sales taxes on natural gas from 19% to 7% to help ease the burden on households and industry.

- Diesel shipments from Asia to Europe are poised to hit a five-month high in August, a market dislocation caused by higher prices at European hubs.

- Spanish demand for gas to generate power jumped 126% in July compared to a year ago, new data shows.

- Britain will extend the life of two coal-fired power plants as a “last resort” ahead of an expected energy crunch this winter.

- Moscow rejected a United Nations proposal to demilitarize the Russian-occupied Zaporizhzhya nuclear power plant in southern Ukraine, raising fears of a potential future disaster.

- Russia has asked buyers from its Sakhalin-2 LNG plant to pay Russian banks instead of U.S. intermediaries, throwing customers such as Japan and South Korea into a dilemma over sanctions that threaten shipments.

- Russia is experiencing a shortage of oil storage facilities, a result of Western sanctions.

- Uniper’s Karlshamnsverket reserve power plant in southern Sweden, which was activated a week ago as drought stretches hydropower supplies, suffered an outage Tuesday, illustrating the fragility of Europe’s power industry.

- Canadian oil firm Keyera and Canadian National Railway are exploring building a new clean energy terminal in Alberta, which would handle daily expedited shipments of cleaner fuels.

- India’s government is studying a slower retirement of aging coal-fired power plants as it also adds newer sites, a move that could jeopardize the nation’s climate goals.

- Australia’s top polluters may be forced to reduce emissions by as much as 6% per year under a new government proposal outlined Thursday.

- BASF, the world’s second largest chemicals company and a major user of natural gas, could be heavily impacted across its many product lines if Germany imposes gas rationing.

Supply Chain

- China issued a national drought alert and resorted to “seeding” clouds with silver iodide in a bid to induce rainfall to its crucial Yangtze River, which has dried up in some parts.

- Apple supplier Foxconn’s iPad factory in southwest China has halted production for six days due to a heat-induced power crunch.

- Over 230,000 truck trailers moved in North American intermodal rail networks in the second quarter, a 25.2% decline from a year ago.

- The Baltic Dry Index measuring pricing in the global bulk commodities market fell 5.3% Thursday, its biggest daily plunge since the start of the pandemic on lower iron ore demand.

- Pricing for bulk shipping’s largest vessels is down below $10,000 per day on average to the lowest in six months.

- Dubai-owned ports giant DP World posted a record $721 million in first-half profit but said earnings would moderate the rest of the year.

- Israeli shipping line Zim saw second-quarter rates fall 6.5% from the first quarter, sending earnings down 15% from market expectations.

- Less-than-truckload carrier Saia is sharply increasing its capital spending plan to expand its U.S. terminal network.

- FedEx faces backlash from its more than 2,000 delivery subcontractors over pay and other issues as they gather in Las Vegas for an expo.

- Aircraft maintenance firm Aspire MRO is starting a 777 freighter conversion program based out of Texas.

- U.S. retailers that stockpiled goods to cushion against supply-chain snarls are finding inventory reduction to be costly as Americans pull back spending.

- China’s semiconductor output tumbled 16.6% in July as supply chains remained under pressure from COVID-19 policies.

- Dockworkers at the U.K.’s Port of Liverpool, one of the nation’s largest container ports, voted to authorize a strike over pay and working conditions.

- Manufacturers of heating and cooling systems expect the U.S.’s recently passed $430 billion climate bill to boost sales through rebates and tax deductions for energy-efficient appliances.

- In the latest news from the auto industry:

- BMW selected Chinese battery-maker EVE Energy to supply batteries for its 2025 series of electric vehicles.

- South Korean auto-parts-maker Hyundai Mobis is considering separating its modules and key parts businesses to enhance efficiency.

- Chinese automaker Geely plans to raise electric vehicles to 50% of total sales by 2023 amid weakening demand for gas-powered cars.

- Tesla slashed delivery wait times for some of its cars in China as it ramps up output from Shanghai after upgrading production lines. The automaker warned Shanghai authorities that a heat-induced power crunch could force it to curb output, however.

- Volvo’s new pilot program will install fast-charging stations at dozens of Starbucks between Denver and Seattle, a bid to provide more amenities while drivers recharge their cars.

- The Geneva International Motor Show scheduled for February has been canceled for the fourth year in a row due to pandemic and geopolitical risks.

- Britain’s electric vehicle (EV) charging infrastructure is lagging far behind the nation’s boom in EV sales, which rose 71% over last year’s levels from January to March.

- Electric-vehicle-maker Rivian canceled the least-expensive trim of its R1T pickup truck due to low demand.

- A top Toyota executive warned that buyers might not shift fully to electric vehicles as fast as expected due to poor public charging infrastructure and high sticker prices.

Domestic Markets

- The U.S. reported 95,652 new COVID-19 infections and 394 virus fatalities Thursday.

- The BA.5 subvariant of Omicron now accounts for nearly 90% of all U.S. cases, according to the CDC.

- New research shows that half of people who were infected with Omicron didn’t know they had the virus.

- Half of U.S. executives say they are reducing or planning to reduce headcounts, while 52% have imposed hiring freezes, according to a new survey.

- More Americans are returning to previous employers after two years of capitalizing on a tight labor market that made it easier to switch positions and boost benefits.

- U.S. existing home sales fell for the sixth straight month in July and were down about 20% from a year ago. Meanwhile, the median selling price eased from June’s record of $413,800 and the average mortgage rate dropped from 5.22% to 5.13%.

- Women made up 14.1% of the U.S. construction sector workforce in July, an all-time high amid persistent labor shortages.

- The Philadelphia Fed’s manufacturing index posted a surprise gain in August, rising by its fastest pace in four months.

- Inflation has driven the cost of raising a child through age 17 to more than $310,000, up 9% from two years ago.

- Kohl’s slashed its 2022 sales and profit forecast as decades-high inflation prompts more Americans to cut back on discretionary spending.

- Streaming subscribers accounted for 34.8% of all TV consumption in July, edging out cable TV for the first time ever, according to Nielsen.

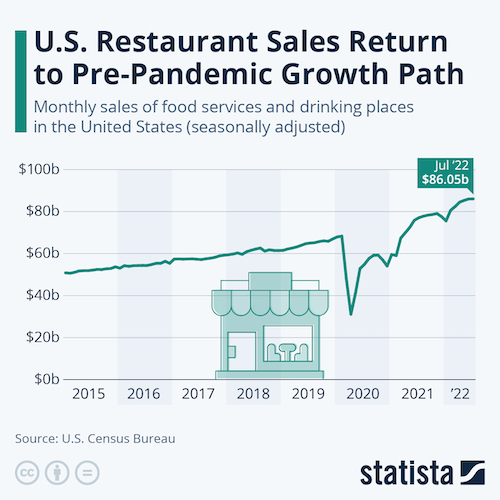

- Nearly half of restaurant operators say industry conditions are deteriorating, despite its return to pre-pandemic growth levels:

- U.S. drive-thru orders rose by 20% over the past two years, with traditional restaurants working to hold on to the curbside and takeout business they developed during the pandemic.

- PepsiCo plans to build a 1.2 million-square-foot manufacturing site in Colorado that will be its largest U.S. plant when it opens next summer.

- Hundreds of “zero-waste” stores selling mostly in bulk or with compostable packaging have opened around the U.S. since 2015, accommodating more Americans trying to cut back on plastic consumption.

International Markets

- Last week, new COVID-19 cases globally fell 24% from the prior week to 5.4 million.

- China’s COVID-19 cases surged to a three-month high of 3,424 Wednesday, largely concentrated in the southern island province of Hainan, which remains under lockdown.

- China’s coastal city of Xiamen started testing caught fish for COVID-19 in a bid to prevent spreading infections.

- Japan saw nearly 255,000 new COVID-19 cases Thursday, a record-high.

- Euro zone inflation hit a fresh record of 8.9% year over year in July, driven largely by higher energy costs.

- German producer prices were up 37.2% year over year in July, the highest rate on record.

- Spain’s trade deficit widened almost sixfold in the first six months of the year to $32.6 billion, driven by higher oil and gas import prices.

- Traders expect the Bank of England to more than double interest rates in the next nine months after inflation came in at a higher-than-expected 10.1% in July.

- The Japanese yen’s historic decline is boosting sales and profits at top Japanese companies.

- Almost half of U.S. companies in Taiwan expect increased Chinese military activity to affect their operations through next year, according to a new survey.

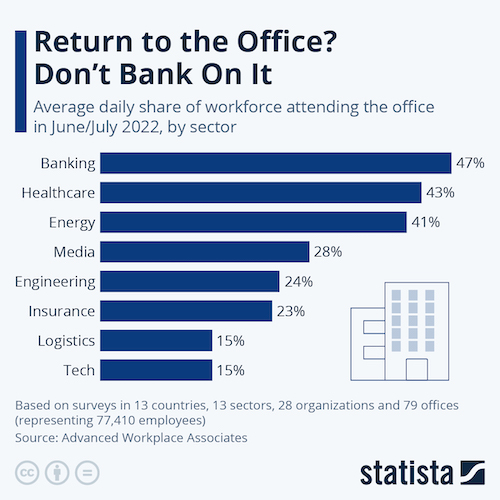

- A recent survey that looked at 80 offices representing nearly 80,000 employees in 13 countries found that average in-office attendance is just 26%.

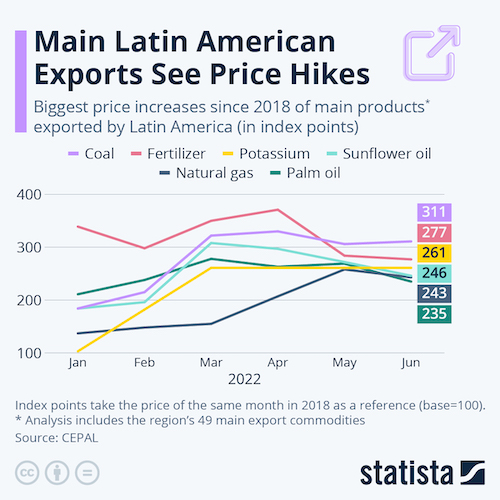

- Prices for key commodity exports from Latin America are up two- and three-fold since 2018:

- London’s train and bus workers went on strike over a pay dispute Friday, grinding the city’s transportation network to a halt.

Some sources linked are subscription services.