MH Daily Bulletin: August 22

News relevant to the plastics industry:

At M. Holland

- The U.S. reinstated the Superfund Excise Tax on July 1, 2022. It applies to chemicals and substances commonly used in the plastics industry. How is it impacting producers, distributors, importers and processors? Click here to read more.

- M. Holland will be attending the North American Detroit Auto Show on Sept. 14-15. This annual showcase for emerging automotive technologies will be held at Huntington Place in Detroit, Michigan. If you’re attending, please RSVP for M. Holland’s reception or contact Mike Gumbko, Strategic Account Manager, to set up a meeting with our Automotive team.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell about 1.5% last week on fears of an economic slowdown weakening crude demand.

- In mid-morning trading today, WTI futures were down 4.0% at $87.14/bbl, Brent was down 4.1% at $92.76/bbl, and U.S. natural gas was up 2.6% at $9.58/MMBtu.

- Average U.S. diesel prices are down 90 cents a gallon the past two months.

- Active U.S. oil and gas rigs fell by one last week, the third week of declines, according to Baker Hughes.

- U.S. shale output will hit a pandemic peak in September on a significant rise in output from the Permian Basin, the administration says.

- U.S. coal exports rose 14.8% from the first to the second quarter and were up 4.6% from a year ago, according to S&P Global.

- More oil news related to the war in Europe:

- European gas prices surged 14% to a record-high at the end of last week, now equating to roughly $410 for the energy equivalent of a barrel of crude oil.

- Germany will start giving coal trains priority over passenger services on its rail network as it struggles with a growing energy crunch. The nation’s industry leaders recently warned that factories could be moved outside the country due to record-high power prices.

- Gazprom will stop all gas flows to Europe on the Nord Stream pipeline from Aug. 31 to Sept. 2 for unexpected maintenance, officials said.

- Russia was China’s top oil supplier for a third month in July, as China’s independent refiners displaced shipments from Angola and Brazil.

- Germany’s Economy Minister rejected calls to extend the lives of the nation’s three remaining nuclear power facilities scheduled for retirement this year.

- Berlin, the world’s largest surviving gaslight network, is accelerating plans to replace its remaining 23,000 gaslights on fears that Russia will scale back its gas deliveries.

- Despite the energy boom, private equity firms are struggling to raise funds for fossil fuel investments. Meanwhile, Warren Buffett’s Berkshire Hathaway won regulatory approval to buy up to 50% of Occidental Petroleum.

- Shell slashed output at a fuel-making facility in Wesseling, Germany, last week after low water levels on the Rhine halted supply flows.

Supply Chain

- About 2,000 workers at the U.K.’s biggest Port of Felixstowe began an eight-day strike on Sunday, threatening more than $800 million in trade and backups that could take weeks to clear. The strike is one of many initiated or planned by British workers in the coming weeks, including a rail-worker strike that all but shut down London transport on Friday.

- Summer droughts are hurting a wide array of industries in the world’s largest economies, including the U.S., Europe and China. In Sichuan, China, an industrial hub with over 80 million people, manufacturers are shutting down factories after officials extended industrial power cuts through the week.

- Water levels on Germany’s Rhine River are so low that some ships cannot sail even when empty, although long-awaited rain began to ease bottlenecks over the weekend.

- Severe heat across the U.S. is causing increased incidences of heat exhaustion and illness among delivery drivers.

- Contract negotiations for 22,000 U.S. West Coast dockworkers reached a standstill over an equipment-handling dispute at the Port of Seattle, reports suggest.

- U.S. imports rose 3% year-over-year to 2.53 million TEUs in July, remaining near all-time highs even as major retailers cut orders to manage inventories.

- Total tonnage at the Port of Houston is up 24% year to date, led by a 92% increase in steel imports.

- China’s merchandise exports grew 18% year over year in July while container throughput at major ports rose 14.5%, almost doubling the pace from June. The nation was alone among major economies in seeing its share of global goods exports rise during the pandemic.

- People as young as age 18 will soon be allowed to drive freight trucks on U.S. roads under an apprenticeship program piloted by the Federal Motor Carrier Safety Administration.

- Deere & Co. lowered its full-year profit outlook as parts shortages leave the world’s largest farm equipment maker unable to meet strong demand.

- Amazon is imposing a new fulfillment fee on third-party sellers between October and January, part of a revenue-boosting effort aimed at countering rising costs.

- U.S. warehouse rents rose 21% in the second quarter from a year ago, according to research firm JLL.

- U.S. rail regulators are considering aggressive new rule-making to force railroads to share tracks and improve competition in response to frequent service meltdowns during the pandemic.

- China’s investment in Mexico is surging as factory owners seek to get around U.S. tariffs.

- Tanker operators haven’t ordered any very large crude carriers in more than a year, the longest dry spell in a quarter-century.

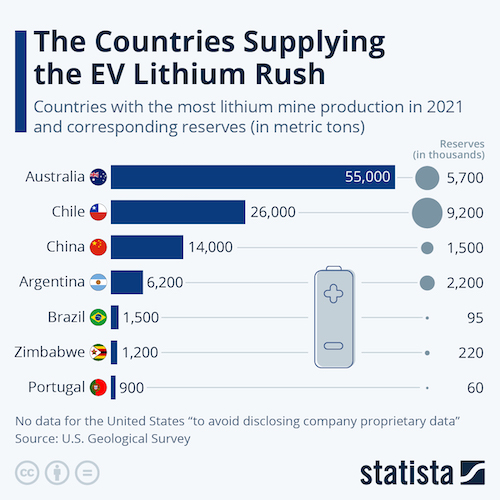

- Australia and Chile appear best positioned to capitalize on the boom in demand for key electric-vehicle battery metal lithium:

- Gap Inc. will soon become the latest U.S. retailer to open its supply chain as a fulfillment service for other companies, joining the ranks of American Eagle, Walmart and Fresh Del Monte in offering similar services.

- Dozens of ships carrying grain and other crops have left Ukrainian Black Sea ports since an export agreement was brokered with Russia last month.

- Maersk will buy hundreds of thousands of tons of green methanol per year starting in 2024 for use in new container ships being built in South Korea.

Domestic Markets

- The U.S. reported 93,741 new COVID-19 infections and 392 virus fatalities Sunday.

- COVID-19 vaccines tailored to Omicron subvariants could become available by mid-September, according to the White House.

- The COVID-19 vaccine made by U.S.-based Novavax has been approved for teenagers between the ages of 12 and 17.

- Arizona and New Jersey saw sharp declines in new COVID-19 infections last week.

- Cumulative monkeypox cases in Los Angeles County more than doubled over the past week to 1,105.

- On Friday, King County in Washington state declared monkeypox a public health emergency, while colleges and universities, after two years of adapting to COVID-19, are now challenged to adjust for a new virus as students return to campuses.

- U.S. companies are reshoring manufacturing and jobs at a record pace, with nearly 350,000 jobs expected to transition from offshore this year.

- More than half of U.S. states experienced a decline in their unemployment rates in July, with 22 reporting unemployment below 3%.

- Some independent U.S. mortgage lenders are starting to fold after a sudden spike in lending rates, potentially leading to one of the sharpest housing bubble bursts post-2008.

- A construction boom is set to deliver 420,000 new apartment rentals in the U.S. this year, the second consecutive year of new units topping 400,000, providing extra supply that could help alleviate record rent prices in some of the nation’s cities.

- GM plans to reinstate its quarterly dividend after suspending it in April 2020 to preserve cash during the early days of the COVID-19 pandemic.

- The parent company of Regal Cinemas plans to file for bankruptcy in the coming weeks after struggling to rebuild movie-theater attendance from pandemic lows.

- Beef prices in the U.S. dropped 0.7% in the four weeks to Aug. 7 from the year ago period, the first monthly decline in more than a year amid better staffing at meat plants, improving supply and weakened demand from consumers.

- Online furniture seller Wayfair plans to cut 5% of its global workforce after suffering a larger-than-expected Q2 loss on soaring supply chain expenses and declining demand.

- One of the worst droughts in over 1,000 years is crippling the Western U.S. farm industry, with more than 75% of farmers and 85% of cattle ranchers saying they have reduced output so far this year.

- Severe drought is forcing some California homeowners to rip out their lawns in favor of arid plants.

International Markets

- COVID-19 cases in Europe tripled over the past six weeks and account for nearly half of all new cases globally, according to the World Health Organization.

- China reported over 2,000 COVID-19 cases on Saturday, a three-month high, leading to new lockdowns in several regions and cities.

- Hong Kong reopened one of its largest pandemic isolation facilities after new cases spiked to 6,445 Friday, a four-month high.

- COVID-19 cases in the U.K. dropped 34% last week to a two-month low.

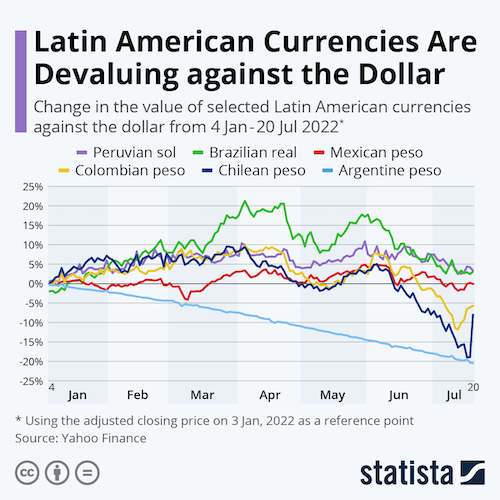

- The euro fell below parity with the U.S. dollar today, as the greenback rises versus the yuan, yen and other foreign currencies.

- Chinese banks cut benchmark interest rates following the central bank’s rate cuts last week aimed at stimulating the country’s floundering economy.

- German investment in China rose to over $10 billion between January and June, almost doubling the previous half-year record despite political pressure on Berlin to pivot away from Beijing.

- Revised statistics indicate the U.K. economy shrank 11% in 2020, the nation’s largest contraction in over 300 years and the biggest among major economies during the pandemic.

- Scandinavian airline SAS scrapped 4% of its upcoming flights due to fallout from a two-week pilot strike and delayed aircraft deliveries.

- More automotive news:

- Luxury carmaker Porsche plans to evenly split production of its 2024 full-electric Macan compact crossover model and its internal combustion engine version, aiming to make 80,000 units of both.

- Tesla is raising the price for its “Full Self-Driving” software in its vehicles from $12,000 to $15,000 for orders made after Sept. 5, its second price hike this year, drawing new criticism because the features require some manual supervision.

- Volkswagen inked a deal with Canada for access to raw materials such as nickel, cobalt and lithium needed to make vehicles and batteries, hoping to avoid difficulties linked to new tariffs and tax regulations in the U.S.

- Volkswagen is nearly sold out for its ID. Buzz electric van with over 10,000 orders so far, led by orders from Norway and Germany.

- Global smartphone sales slumped 9% in the second quarter as consumers reduced discretionary spending, according to research firm International Data Corp.

- Australia is making new emissions rules in a bid to boost uptake of electric vehicles, whose sales have vastly underperformed those in other nations, officials say.

Some sources linked are subscription services.