MH Daily Bulletin: August 23

News relevant to the plastics industry:

At M. Holland

- The U.S. reinstated the Superfund Excise Tax on July 1, 2022. It applies to chemicals and substances commonly used in the plastics industry. How is it impacting producers, distributors, importers and processors? Click here to read more.

- M. Holland will be attending the North American Detroit Auto Show on Sept. 14-15. This annual showcase for emerging automotive technologies will be held at Huntington Place in Detroit, Michigan. If you’re attending, please RSVP for M. Holland’s reception or contact Mike Gumbko, Strategic Account Manager, to set up a meeting with our Automotive team.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell about half a percent Monday on competing supply and demand pressures.

- Saudi Arabia warned that OPEC could curb production to correct a recent drop in oil futures, sending prices higher in mid-morning trading today, with WTI up 3.5% at $93.49/bbl and Brent up 2.8% at $99.21/bbl.

- U.S. natural gas was up 2.3% at $9.90/MMBtu in mid-morning trading, nearing its highest price in 14 years amid unceasing demand from Europe.

- The average U.S. gasoline price has fallen for 70 days straight, the longest down streak since January 2015, hitting $3.892 a gallon on Tuesday, according to AAA.

- The U.S. Strategic Petroleum Reserve is down to 453.1 million barrels, the lowest in 35 years, according to the Department of Energy.

- OPEC+ produced 2.892 million bpd below targets in July as sanctions on some members, including Russia, stymied its ability to raise output.

- Leaders of the U.S., Britain, France and Germany discussed efforts to revive a 2015 nuclear deal with Iran Sunday, which could allow sanctioned Iranian oil to return to global markets.

- Libya’s oil production rebounded to 1.211 million bpd, a level last seen before port blockades disrupted output for most of spring.

- More oil news related to the war in Europe:

- European gas prices surged 20% Monday after Russia unexpectedly said it would shut down the key Nord Stream pipeline for three days later this month. The news sent power prices in Germany to an all-time high above $696 per megawatt-hour.

- A Kazakhstan pipeline system carrying 1% of the world’s oil through Russia partially shut down Monday due to alleged damage, adding to concerns over a plunge in European gas supplies.

- Russia’s seaborne crude shipments to European buyers are at their highest level since April as refiners scramble to process barrels ahead of tighter sanctions.

- China’s purchases of Russian fuel have surged to $35 billion since the war in Ukraine began, compared to just $20 billion a year ago.

- TotalEnergies and Italy’s Eni announced a significant new gas discovery at the Cronos-1 well off Cyprus Monday, a boon for European countries looking to replace Russian supplies.

- Charter rates and prices for new LNG tankers are surging as competition rises across the globe to secure supplies.

- Russian authorities are poised to turn over a joint venture between Shell and Gazprom to full control by Moscow.

- Russia’s invasion of Ukraine is prompting collaboration between Canada and Germany aimed at increasing Canadian exports of minerals and hydrogen while reducing Germany’s dependence on fossil fuels.

- The average British household could see its energy bill soar to $4,200 a year in October when officials next raise a cap on prices.

- More Mexican companies are building small-scale solar projects to help power operations as the government’s controversial energy reforms slow the widespread adoption of alternative energies.

- Bangladesh will close schools for one extra day a week and cut office openings by an hour to save power, officials said Monday. The country is battling an energy shortage on the heels of shutting down all its diesel-run power plants.

- Broker March, a unit of March & McLennan, announced plans to launch the world’s first dedicated insurance for hydrogen energy projects.

- Covestro announced plans to expand its polycarbonate recycling capacity at its Shanghai, China, facilities.

Supply Chain

- China’s drought-stricken southwest extended curbs on power consumption Monday due to further losses in hydropower output and surging electricity demand. At least 62 localities saw record-high temperatures, while more firms announced cuts in output.

- Heavy rains and flash floods have inundated Dallas and northern Texas, grounding hundreds of flights and disrupting overland transport.

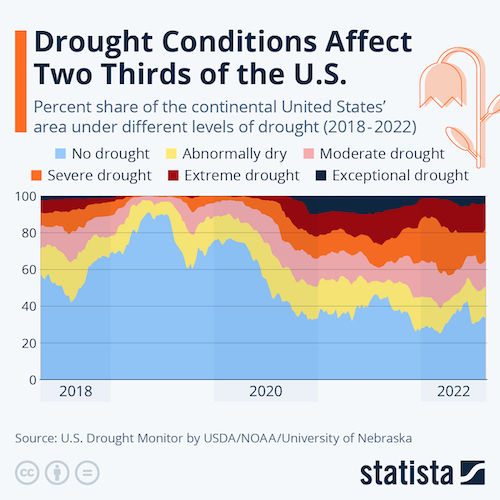

- Unplantable farm acreage has tripled from a year ago as extreme weather, including heavy rains and record-setting drought, wreaks havoc on crops.

- Over 9% of all containers were stuck on ships or terminals around the world in June, nearly five times higher than the monthly average from the prior decade, according to maritime data provider Sea-Intelligence.

- The capacity size gap between the world’s largest shippers and the rest of the field is bigger than ever, according to Alphaliner. The top 10 carriers operate 21.8 million TEUs versus 2.5 million TEUs for the next 20 firms.

- BNSF will resume westbound shipments of food, diesel and other commodities Sept. 4 after a month-long embargo helped clear congestion in its rail network.

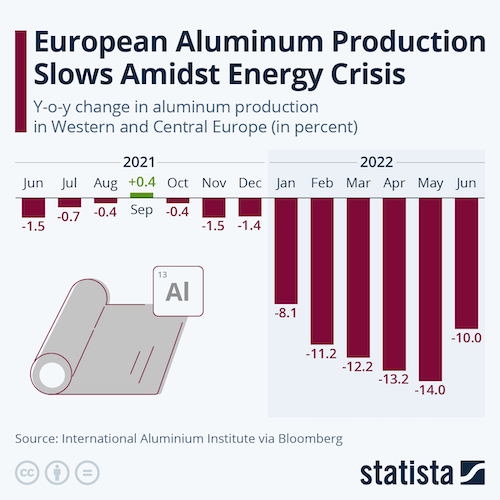

- Record-high European power prices are crippling energy-intensive aluminum production, sending prices for the metal skyrocketing:

- Monster, a maker of popular energy drinks, said it paid $66.7 million in higher freight costs last quarter due to difficulties sourcing aluminum cans.

- In the latest news from the auto industry:

- Hyundai may speed up its plans to build a U.S. electric vehicle (EV) plant following a new law that will exempt EV tax credits for cars built outside America.

- Toyota plans to ramp up material sourcing from India in a bid to reduce high sticker prices for its hybrid vehicles.

- Ford is laying off 3,000 white-collar and contract employees, the latest in its effort to slash costs as it makes a long-term transition to electric vehicles.

- Toyota subsidiary Hino Motors suspended more truck shipments Monday on fresh news of emissions and fuel efficiency data falsification going back to 2003.

- Heartland Express will soon become the U.S.’s eighth-largest truckload fleet after the acquisition of Contract Freighter Inc.’s truckload and Mexican logistics unit.

- Walmart says augmented reality technology has helped the company better predict and manage inventories at over 4,500 locations.

- Gap Inc. opened its first distribution center in Texas ahead of an expected surge of peak-season demand.

- Shipping industry stakeholders agreed on Monday to remove the Indian Ocean from their “High Risk” designation for piracy activity.

Domestic Markets

- The U.S. reported 88,063 new COVID-19 infections and 390 virus fatalities Monday.

- Rising cases of two new Omicron subvariants — BA.4.6 and BA.2.75 — are being followed closely by health officials in the U.S. West.

- Pfizer formally asked the FDA to approve its Omicron-tailored COVID-19 vaccine for people ages 12 and older.

- New variants of Omicron have consistently shorter incubation periods, shrinking the time that infected people can unknowingly spread the virus.

- The White House’s top medical adviser, who was the face of the nation’s COVID-19 response, will retire in December.

- Due largely to COVID-19, life expectancy fell in every U.S. state in 2020.

- Over 4,000 teachers in central Ohio went on strike Monday as schools nationwide continue to struggle with pandemic fallout, including staff burnout, a maze of COVID-19 restrictions and higher vacancies.

- Seventy-four percent of teachers in a recent poll register dissatisfaction with their profession, up from 41% a year ago.

- Petitioning Apple employees pushed back against a policy mandating they spend at least three days in the office beginning next month.

- Over 50% of U.S. employers expect to cut jobs within the next six to 12 months, according to a survey. Meanwhile, Americans say the lowest pay level they would be willing to accept for a new job is $72,873, up 5.7% from last year.

- As the labor market begins to ease, companies are cutting their parental leave policies.

- U.S. companies borrowed 2% more in July to finance their equipment investments compared to a year earlier, a resilient sign despite higher interest rates, inflation and supply disruption.

- The market for initial public offerings is on pace for its worst year in decades as stock market volatility forces more small companies to burn through cash. So far this year, IPOs have raised only $5.1 billion compared to a historical average of $33 billion and more than $100 billion in 2021.

- U.S. imports from Asia by volume rose 2.5% year over year in July and were up 2.7% from June.

- Total consumer spending fell 3.1% in June from a year earlier at restaurants, according to financial firm Rabobank.

- Over 70% of homes for sale in Boise, Idaho, had their price cut in July, the highest share among a growing list of U.S. metros seeing housing markets cool.

- Washington, D.C., will provide first-time homebuyers as much as $202,000 in interest-free loans to help with down payments and closing costs in one of the nation’s most inflated housing markets.

- New apartment construction is expected to hit a 50-year high in 2022, potentially helping alleviate record rent prices in some cities.

- Zoom Video Communications cut its annual profit and revenue forecasts as demand for video-conferencing technology dips from pandemic highs.

- General Electric workers at a jet-engine plant in Alabama are campaigning to unionize in response to grievances about pay and job security.

- The U.S. is expected to spend over $500 billion on climate technology and clean energy over the next decade with the recent passage of new laws focused on infrastructure, chipmaking and inflation reduction.

International Markets

- China reported 1,824 new COVID-19 cases Sunday, the most in nearly three months.

- Japan reported over 200,000 new COVID-19 cases for the fifth straight day on Sunday, nearing all-time highs.

- Led by a drop in manufacturing, output in the 19-nation euro zone declined for a second month in August as record energy and food inflation sapped demand, according to S&P Global. The economies of Germany and France likely shrank, while output was down in Japan, Australia and the U.K.

- The U.S. dollar is surging in value as higher interest rates and recession fears drive demand for the global haven. On Monday, the euro fell to a two-decade low, while China’s yuan hit a two-year low.

- Starbucks posted a 40% drop in China sales in the latest quarter, joining the majority of global consumer giants that saw sharp declines in sales due to the nation’s lockdowns.

- Canadian retail sales rose 1.1% in June, handily beating forecasts on pricier gasoline and higher sales at car dealerships.

- Japan’s factory activity growth slowed to a 19-month low in August as output and new order declines deepened.

- Economists expect Mexico’s inflation to have sped up the first half of August to 8.51%, reinforcing bets that policymakers will again hike interest rates next month.

- The Bank of Israel raised its benchmark interest rate on Monday by 75 basis points, its biggest hike in two decades, as it tries to rein in inflation that has topped 5%.

- The UAE’s non-oil trade reached nearly $300 billion in the first half of 2022, up 17% from last year following new trade pacts with India, Israel and Indonesia.

- Office space availability in central London is up 51% compared with 2019 levels and the highest in 15 years as more employees work from home.

- China extended its tax exemption on new-energy vehicle purchases through the end of 2023.

- British Airways announced an additional 10,000 flight cuts through next March as it adapts to a persistent staffing shortage.

Some sources linked are subscription services.