MH Daily Bulletin: August 25

News relevant to the plastics industry:

At M. Holland

- M. Holland’s latest logistics outlook examines current challenges and industry trends that are impacting shipping, trucking and rail. Although the plastics industry is faring a little better than earlier this year, M. Holland’s experts predict disruption to continue well into 2023. Click here to read the full outlook for the remainder of 2022.

- M. Holland will be attending the North American Detroit Auto Show on Sept. 14-15. This annual showcase for emerging automotive technologies will be held at Huntington Place in Detroit, Michigan. If you’re attending, please RSVP for M. Holland’s reception or contact Mike Gumbko, Strategic Account Manager, to set up a meeting with our Automotive team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose Wednesday on news that the U.S. may make it more difficult for Iran to return its crude to the global market.

- Oil futures were mostly flat in mid-morning trading today after BP reported shutting some units at an Indiana refinery, a key source of supply to Chicago, that was damaged by fire on Wednesday. WTI was down 0.2% at $94.68/bbl and Brent was up 0.1% at $101.30/bbl. U.S. natural gas futures were up 0.6% to $9.38/MMBtu.

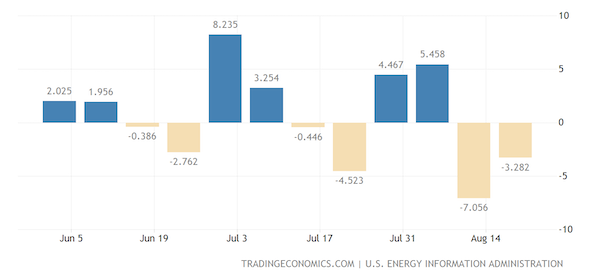

- U.S. crude stocks fell by a larger-than-expected 3.3 million barrels last week, according to the EIA. Crude production was down by 100,000 bpd.

- U.S. crude exports are poised to hit fresh records above 4 million bpd through 2023 on strong gains in the European market. Last week, over 11 million bpd of crude and fuel products left U.S. ports, a 30-year high.

- U.S. shale producers are on course to make nearly $200 billion this year, enough to make the industry debt-free by 2024 and increase investment in natural-gas production, according to Deloitte.

- In January 2023, Exxon Mobil will shut a coker and crude distillation unit (CDU) for two months of repairs at a 520,000-bpd facility it operates in Baton Rouge, Louisiana, one of the nation’s largest CDU sites.

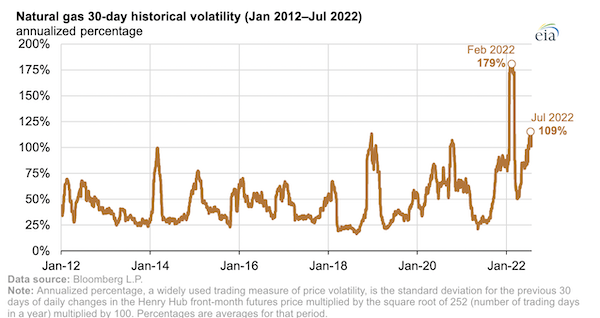

- Price volatility for U.S. natural gas reached its highest level in two decades in the first quarter, reflecting the volatility of the broader global market, government data shows:

- Cnooc, one of China’s three state-owned oil giants and its biggest offshore driller, more than doubled first-half profits from a year ago to $10.5 billion.

- Vietnam plans to build an $18.5 billion oil refinery and petrochemical complex.

- More oil news related to the war in Europe:

- Russia’s oil output will decline for the first time in four months in August on lower output from smaller producers.

- Russia is offering crude discounts of up to 30% to entice some buyers in Asia into long-term supply contracts, according to reports.

- British gas production rose 26% in the first half of 2022 as domestic producers scrambled to replace Russian supplies. For the first time ever, the nation recorded zero fuel imports from Russia in June.

- Norway has overtaken Russia as Europe’s biggest supplier of natural gas, with its output on track to rise 8% to a record-high this year.

- EU energy ministers are soon expected to hold an emergency meeting on remedies for the continent’s spike in power markets, which has devastated smaller businesses without economies of scale. To date, the EU has earmarked roughly $279 billion in rescue dollars for consumers and businesses.

- Russia’s attempts to tighten control over joint gas projects has led to canceled shipments to some buyers in Asia, the nation’s prime export region following Europe’s sanctions.

- Japan will restart more idled nuclear plants and look at developing next-generation reactors, a major policy shift in response to energy shortages caused by Russia’s war.

- India slashed crude imports from the U.S. by 50% as it continues to ramp up purchases of discounted Russian oil.

- Many global oil traders and banks have cut ties with Indian refiner Nayara Energy, a Rosneft affiliate, over sanctions concerns.

- Switzerland voluntary committed to cutting gas use by 15% this winter to help ease European supply shortages.

Supply Chain

- Amid widespread drought, China’s main riverbeds are down to their lowest levels in over 100 years, forcing more factories to shut down due to sharp declines in hydropower supply. Chinese officials declared a drought emergency Wednesday and unveiled significant financial support for industry and agriculture.

- The Rhine River’s water level at a key waypoint in Germany is set to decline in the coming days, curbing cargo transport after conditions eased the past week.

- Extreme heat in Texas is leading more ranchers to slaughter cattle, reducing cattle supply and putting upward pressure on beef prices for years to come.

- The average U.S. diesel price rose on Tuesday to $4.977 a gallon, snapping a 62-day losing streak, the longest in two years.

- Global petrochemical giant Dow Chemical is cutting global polyethylene production rates by 15% amid logistics logjams in the U.S. and Europe that have stymied exports since late 2021.

- The average rate for dry-bulk shipping’s largest vessels plummeted 42.5% last week as demand and port congestion eased. The Baltic Exchange’s price index dropped to $7,188/day, down from $24,000/day in mid-July.

- Operating profit in FedEx’s ground unit declined 17% last fiscal year as tensions grew between the shipper and its independent contractors.

- German exporters incurred $69 billion in extra costs this year due to soaring producer and import prices, an industry group said.

- A strike over pay at Britain’s largest container port of Felixstowe threatens to spark fresh delays and trade losses of up to $1.2 billion, analysts say.

- First-half revenue at Orient Overseas Container Line doubled to $5.66 billion and revenue jumped 58% despite declining container volumes.

- Maersk’s port unit APM Terminals won a contract to build and operate a container terminal in Brazil’s Port of Suape at an estimated cost of $500 million.

- Japanese Pizza Huts are turning to rice to make pizzas after wheat prices soared following Russia’s invasion of Ukraine.

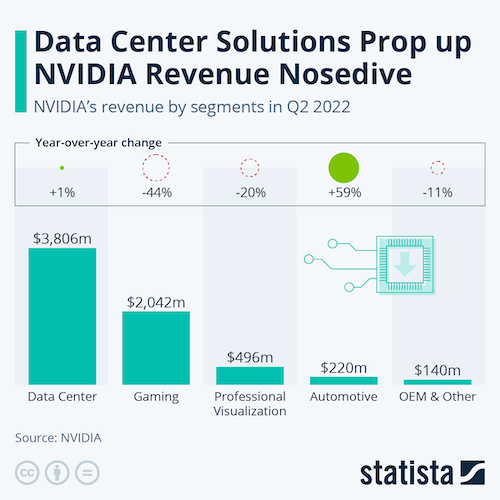

- U.S. chipmaker Nvidia forecast a 17% drop in current-quarter revenue after its key gaming unit saw significant revenue declines in the second quarter.

- Boeing says it plans to boost manufacturing investment in India, aided by defense deals with the nation’s government.

- Visa has issued over 4 billion global network tokens — digital cards used for online purchases — outpacing the total number of its physical cards in circulation for the first time. The firm says e-commerce volume grew by more than 50% during the pandemic.

- In the latest news from the auto industry:

- California regulators will today announce a trailblazing new plan to restrict and ultimately ban sales of gas-powered cars by 2035 in the U.S.’s largest state auto market.

- Electric vehicles, including pure-electric and plug-in hybrids, accounted for 22% of China’s car sales in the first seven months of 2022, the highest proportion among major global markets.

- Power shortages in drought-ridden China are forcing some automakers to suspend electric vehicle charging services.

- England plans to build 1,000 new electric vehicle charging points across the nation at a cost of roughly $23 million.

- The average price for a new vehicle in the U.S. is poised to hit a record-high $46,259 this month, up 11.5% from a year ago.

- Ford is delaying production investments in Spain, citing Europe’s uncertain economic conditions.

- Reports suggest Honda may shrink its extensive supply chain in China due to COVID-19 lockdowns and geopolitical risks.

- Chinese electric vehicle (EV) battery-maker CATL, the world’s largest, more than doubled its quarterly profit after authorities rolled out incentives to boost EV sales.

Domestic Markets

- The U.S. reported 89,698 new COVID-19 infections and 390 virus fatalities Wednesday.

- The FDA will likely authorize Omicron-tailored versions of Pfizer’s and Moderna’s COVID-19 boosters around Labor Day, according to reports.

- The U.S.’s outgoing top health official expects COVID-19 to be treated as an endemic — with manageable surges every season like the flu — by December.

- Between 2 million and 4 million Americans are out of work due to the long-term effects of COVID-19, according to a new report.

- A COVID-19 outbreak at Google’s California headquarters nearly doubled over the weekend, becoming the largest of any employer in Los Angeles.

- U.S. GDP shrank 0.6% in the second quarter, a bigger decline than expected and the second successive quarterly contraction.

- Initial jobless claims fell by 2,000 last week to 243,000 and continuing claims declined, indicating a continued strong labor market.

- The typical U.S. unemployed worker was off the job for 8.5 weeks in July, down from 14.4 weeks a year earlier, signaling continued labor-market tightness.

- U.S. employers added about 462,000 more jobs in the year through March than the Labor Department originally estimated, the agency said Wednesday.

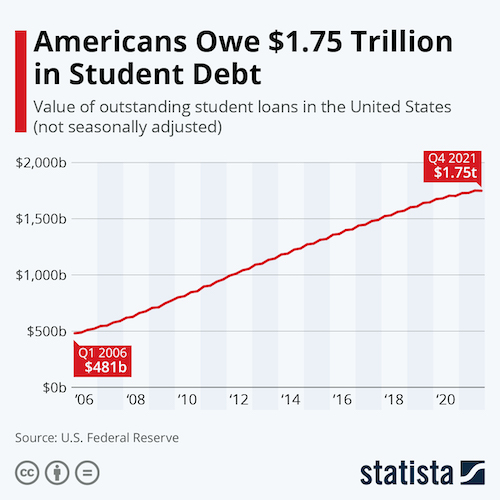

- The White House announced plans Wednesday to wipe out tens of thousands of dollars in student loan debt for millions of Americans.

- New orders for U.S.-manufactured capital goods rose in July, a positive signal of business spending. New orders for durable goods, meanwhile, were unchanged at $273.5 billion.

- U.S. home prices fell 0.77% from June to July, the first monthly decline in nearly three years, according to mortgage software firm Black Knight.

- Pending U.S. home sales dropped a better-than-feared 1% in July but remained at the lowest level since the start of the pandemic. Contracts have declined in eight of the last nine months, according to the National Association of Realtors.

- In the U.S., 7 in 10 pandemic homebuyers have regrets, while 3 in 10 say they overpaid, according to a new survey.

- The median U.S. rental price surged to an all-time high of $1,879 per month in July, according to Realtor.com.

- Suburban rental rates have soared relative to historically higher urban rental rates, with the price gap shrinking 53% over the last three years due to a surge in remote-work opportunities, among other factors.

- Private real-estate funds hold about 23% of their investments in offices, down from 34% three years ago, as remote work upends the traditional office market.

- Amazon plans to shut down its virtual healthcare service by the end of this year as the firm’s $3.9 billion deal to acquire primary care provider One Medical awaits approval from regulators. The e-commerce giant is also among bidders for Signify Health in an auction that could value the home-health-services provider at more than $8 billion.

- Beleaguered malls are adding grocery stores to anchor their revival, as U.S. grocery store openings have outpaced those of home improvement, electronics and superstores over the last few years, with only dollar stores expanding faster.

- Software firm Salesforce cut its annual revenue and profit forecasts on signs of lower client spending.

- U.S. electric vehicle (EV) charging sites are set to become major battlegrounds for new advertising dollars as the number of Americans buying EVs grows sharply.

International Markets

- New COVID-19 infections globally fell 9% last week from the prior week, with cases falling in all regions except the Western Pacific.

- COVID-19 deaths in Great Britain this summer doubled compared with the summer of 2021, new data shows. In a shift to “live with the virus,” the nation is scrapping some testing requirements, including for healthcare workers who present no symptoms.

- Next month, Japan will scrap its COVID-19 testing requirement for inbound travelers who are vaccinated.

- China began opening its borders this week to foreign students for the first time in two years.

- Mexican consumer prices rose 0.42% in the first half of August, pushing annual headline inflation to 8.62%, both slightly higher than market expectations.

- South Korea’s central bank lifted its benchmark interest rate by 25 basis points Wednesday while raising its inflation forecast for the year from 4.5% to 5.2%.

- Brazilian consumer prices fell by 0.73% last month, driven by tax cuts for fuel.

- South African inflation hit 7.8% in July, its highest level in 13 years, on surging costs for food, transport and electricity.

- Unable to sell its consumer bank in Russia due to Western sanctions, Citigroup is expected to announce today that it will wind down the unit.

Some sources linked are subscription services.