MH Daily Bulletin: August 29

News relevant to the plastics industry:

At M. Holland

- M. Holland’s latest logistics outlook examines current challenges and industry trends that are impacting shipping, trucking and rail. Although the plastics industry is faring a little better than earlier this year, M. Holland’s experts predict disruption to continue well into 2023. Click here to read the full outlook for the remainder of 2022.

- M. Holland will be attending the North American Detroit Auto Show on Sept. 14-15. This annual showcase for emerging automotive technologies will be held at Huntington Place in Detroit, Michigan. If you’re attending, please RSVP for M. Holland’s reception or contact Mike Gumbko, Strategic Account Manager, to set up a meeting with our Automotive team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose Friday to end the week several percentage points higher, pressured by fears that OPEC might cut output.

- In mid-morning trading today, WTI futures were up 2.6% at $95.63/bbl, Brent was up 2.5% at $103.60/bbl, and U.S. natural gas was up 2.3% at $9.51/MMBtu.

- Active U.S. oil rigs, a signal of future production, rose by three last week to a total of 765, according to Baker Hughes.

- The U.S. Department of Transportation today declared a regional emergency declaration for Illinois, Indiana, Michigan and Wisconsin after a fire last week at BP’s refinery in Whiting, Indiana, the largest in the Midwest, cut supplies of gasoline, diesel and jet fuels.

- The U.S. Energy Secretary urged domestic oil refiners to prioritize building inventories over boosting exports, while warning that the administration could take emergency measures, as it already has on the gas-starved East Coast, to preserve supplies for peak hurricane season.

- Some oil exporters are holding off on vessel bookings due to soaring charter rates for very large crude carriers.

- Power prices are rising faster in West Virginia than the rest of the U.S. due to the state’s heavy reliance on coal, whose prices have shot up amid the global scramble for fuel supplies.

- The UAE supported Saudi Arabia’s warning that OPEC may cut production to reverse a recent decline in oil prices.

- Iranian officials say negotiations with the U.S. over a deal that could bring more of Iran’s crude to global markets will continue into September.

- China’s state-owned refiner Sinopec posted a 10.4% surge in net profit to a record-high $6.33 billion in the first half of the year, while revenue rose 27.9%.

- More oil news related to the war in Europe:

- Power prices in France and Germany surged over 25% Friday to new records as supply shortages continue. German officials warned of severe economic consequences even as the nation is on track to meet gas-storage targets.

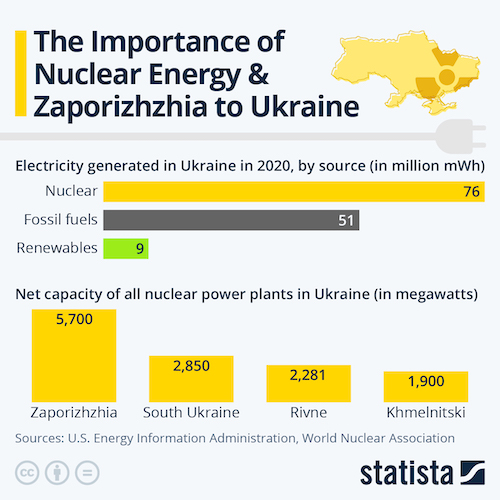

- Russian artillery fired at Ukrainian towns near the Zaporizhzhia nuclear power plant over the weekend, adding to fears of a potential mishap at Europe’s largest reactor site.

- British households will see energy bills rise 80% starting in October after officials decided to raise a price cap. The cap was already raised by a record 54% in April.

- European utility giant Engie is nearing an agreement to import more natural gas from Algeria, potentially raising deliveries by 50%.

- The U.S., France and a handful of other countries are planning to keep dozens of nuclear reactors running decades after their licenses expire in response to global energy shortages.

- TotalEnergies will sell its stake in a Siberian gas field amid criticism over the firm’s continued business dealings in Russia.

Supply Chain

- More than 115,000 workers at Britain’s Royal Mail began striking Friday in a pay dispute that will cause significant disruption for customers, the postal group warned.

- A worker strike at Britain’s largest container port of Felixstowe could extend to Christmas if a pay deal is not reached, according to reports.

- The Baltic Dry Index, which measures the cost of shipping goods worldwide, fell 3.7% Friday to a two-year low on weakness in all vessel segments.

- Overstuffed U.S. warehouses are causing lengthy backups at inland distribution hubs, including Chicago and Kansas City, where companies are tying up transport equipment for weeks at a time to store excess goods.

- Import containers waited an average of 16.4 days for inland rail transport from Southern California ports in July, up from 13.3 days in June to the highest on record.

- Port Houston is tightening rules for on-dock storage of export containers as it copes with surging import volumes and rising congestion.

- Union Pacific has pulled nearly 3,000 of its own railcars out of storage as early data shows freight volumes are 2% higher this quarter.

- The American Trucking Associations’ for-hire truck tonnage index hit 116.2 in July, down slightly from June but more than 5% higher than a year ago.

- Pilot Flying J is taking an equity stake in automated vehicle startup Kodiak Robotics, the first step in the truck stop operator’s wider plan to equip its highway stations for self-driving trucks.

- Truckload carrier U.S. Xpress is cutting its workforce by up to 10% following a 25.5% year-over-year surge in second-quarter labor costs.

- U.S. consumers are cutting back on spending in categories such as apparel and home goods ahead of the year-end shopping season, posing challenges for retailers already struggling with large inventories.

- Abbott Laboratories restarted production of baby formula at its beleaguered plant in Sturgis, Michigan, the center of the U.S.’s months-long product shortage.

- Chinese computer chipmaker SMIC announced plans to invest $7.5 billion for a new production line in Tianjin.

- U.S. grain prices are back to a two-month high as drought conditions through much of the Midwest shrink this year’s crop.

- Top exporter India is poised to restrict rice shipments to ensure domestic supply, a move likely to add to global food market chaos.

- CF Industries says high energy costs forced it to suspend British production of ammonia, a key source of fertilizer for the U.K.’s agricultural sector.

- In the latest news from the auto industry:

- Virginia will follow California in banning the sale of gas-powered vehicles in 2035 due to a 2021 law linking the state to California’s emissions standards.

- GM’s main Mexico plant that makes GMC and Chevrolet pickup trucks will suspend production this week due to supply chain issues.

- The French government is poised to roll out a heavily subsidized program providing electric-vehicle (EV) leases for just $100 a month, a response to concerns that high costs for EVs could slow their adoption.

- Honda and LG will invest $4.4 billion in a joint venture to build electric vehicle batteries in the U.S.

- China’s CATL is working on new battery materials that can improve energy density by up to 20% over current models, a potential breakthrough for electric-vehicle charging range.

- Chinese smartphone-maker Xiaomi is holding talks with Beijing Automotive Group to jointly produce new electric vehicles.

- Suzuki announced plans to create a global development company based in India, further pushing into a market on pace to become an electric vehicle hub for Japanese carmakers.

Domestic Markets

- The U.S. reported 88,594 new COVID-19 infections and 392 virus fatalities Thursday.

- The FDA is expected to authorize Omicron-tailored booster doses this week, an unusually rapid pace of approval enabled by the safety record of the original mRNA vaccines.

- Almost 4 million Americans said they didn’t work because they or someone they cared for was sick with COVID-19 in the first week of July, more than double a year ago.

- Google employees are frustrated by regular notifications of office COVID-19 infections since the company mandated employees return to the office at least three days a week.

- Moderna sued biotech rival Pfizer over alleged patent infringement of its vaccine technology.

- Speaking at last week’s much-anticipated forum in Jackson Hole, Wyoming, the Federal Reserve chairman quashed investor hopes that the central bank would ease monetary tightening amid recent signs of economic weakness.

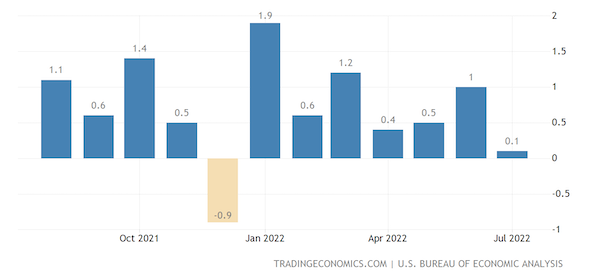

- U.S. consumer spending rose a smaller-than-expected 0.1% in July, weighed down by falling sales at gas stations, new data shows:

- U.S. consumer sentiment improved in August as households’ near-term inflation expectations fell to an eight-month low, according to widely tracked surveys from the University of Michigan.

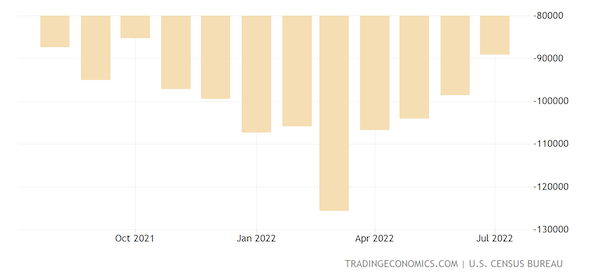

- The U.S. merchandise-trade deficit shrank 9.7% in July to $89.1 billion, the smallest since October as imports declined for a fourth month.

- Robot sales in North America were up 25% year over year in the second quarter, pushing the region’s robotics market to its strongest first half on record.

- U.S. air travel service complaints jumped 35% from May to June as airlines canceled or delayed thousands of flights. Overall, complaints are up 270% from pre-pandemic levels.

- Despite recent improvements in U.S. air travel, consultants say flight disruptions will continue for months amid persistent worker shortages.

- Regional passenger carrier ExpressJet Airlines filed for bankruptcy protection and will shut down after losing a contract with United Airlines.

- The pandemic-driven insurance buying spree appears to have ended, with new policy applications falling 6.5% year to date through mid-August.

- “Laptop landlords,” who use new online tools to buy and rent out far-away homes as a core investment strategy, have helped fuel record-high home purchases made by investors this year.

- Restaurants added more than 74,000 jobs in July, the most since February, but many are still scaling back operating hours due to staffing shortages.

- Workers at a Chipotle Mexican Grill in Lansing, Michigan, became the chain’s first to vote to unionize last week.

- Attention-deficit-disorder drug Adderall is in short supply due to a labor shortage at the Teva Pharmaceuticals facility that makes it for the U.S. market.

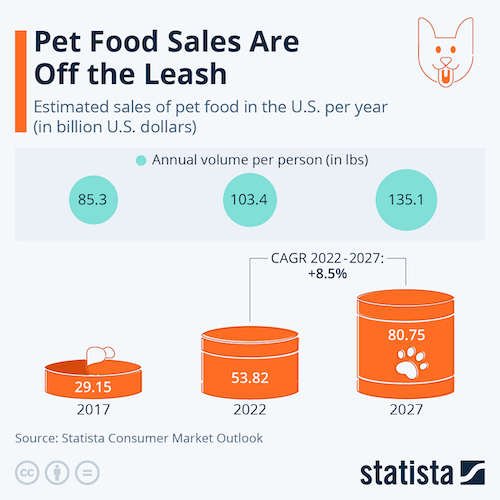

- U.S. pet owners are expected to spend around $54 billion on pet food in 2022, more than double the level from 2017:

- The EPA proposed labeling “forever chemicals” PFOA and PFOS as hazardous substances, a move that would trigger tougher reporting standards and give the EPA more enforcement tools to require cleanup.

International Markets

- Roughly 1.4 million Britons contracted COVID-19 last week, the lowest in two months.

- Germany will impose tighter masking and testing requirements this fall and winter to combat expected flare-ups of COVID-19, officials said last week.

- Authorities in China’s southern city of Shenzhen shut down its electronics wholesale market, the world’s largest, and suspended service at 24 subway stations Monday to help curb a COVID-19 outbreak.

- China is stepping up enforcement of COVID-19 restrictions in advance of its upcoming Communist Party summit even as virus infections fall and its economy stumbles, with economists reducing 2022 GDP growth projections to 3.5%.

- JPMorgan Chase projects that global inflation will fall to 5.1% the second half of this year, down by half from the first six months, as commodity prices and logistics costs ease.

- The European Central Bank raised rates by 50 basis points to zero last month and is expected to make an even larger hike on Sept. 8, analysts say. ECB officials have signaled that monetary policy should be tightened even if economic conditions sour.

- Profits at China’s industrial firms sank 1.1% in July on the impacts of fresh COVID-19 curbs and power shortages from weeks of scorching heat waves.

- The U.S. and China reached an agreement giving U.S. regulators access to audit papers of publicly traded Chinese companies, ending a dispute that threatened to boot hundreds of Chinese companies off U.S. stock exchanges.

- Mexico officials expect the EU to sign off on an updated trade agreement by the end of this year.

- Dell says it has fully ceased operations in Russia after closing its office in the country in mid-August.

- Workers at Portuguese airport services company Portway walked off the job Friday in a protest about pay and working conditions, adding more disruption to European air travel.

Some sources linked are subscription services.