MH Daily Bulletin: December 12

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

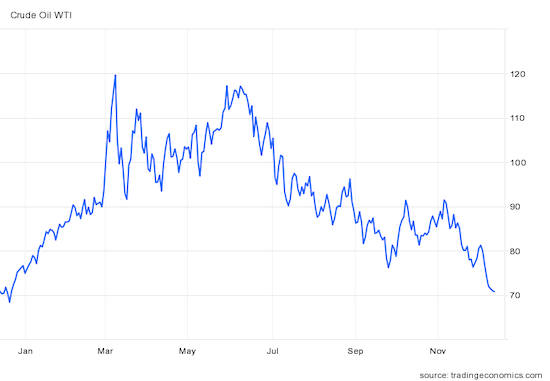

- Oil prices fell 10% last week, their biggest decline in months, following weak economic data from China, Europe and the U.S.

- In mid-morning trading today, WTI futures were up 3.5% at $73.47/bbl and Brent was up 2.6% at $78.11/bbl. After surging late last week on forecasts of cold weather, U.S. natural gas futures were up 9.1% today at $6.81/MMBtu.

- Active U.S. drilling rigs fell by four last week, down by about 295 from pre-pandemic levels, according to Baker Hughes.

- TC Energy reported that last week’s 14,000-barrel spill from its Keystone pipeline, its third significant spill in the past five years, is contained as emergency crews continue cleaning up affected waterways in Kansas and Nebraska. About 622,000 bpd of Canada-to-U.S. oil flows have been lost without a definite timeline for restarting.

- OPEC+ production was 1.81 million bpd short of the group’s reduced quota in November, new data shows.

- China’s fuel exports will likely surge this month as refiners rush to use their export quotas amid declining demand at home.

- U.S. refiner Phillips 66 plans to raise spending on new projects next year by 6%, including for a new plastics plant.

- Venezuelan gas stations are running out of fuel as the country struggles to import enough supply to meet demand.

- Colombia’s state-owned oil company plans to invest $6.2 billion next year on boosting production and improving the nation’s energy security.

- More oil news related to the war in Europe:

- Prices for Russian crude in Asia appear to be holding well above the $60/bbl cap set by G7 nations, as Moscow finds enough shipping and insurance coverage to meet its needs. Much of the impact of new sanctions has yet to show, according to key Gulf officials.

- Cold temperatures boosted European demand for natural gas by 44% the past month, testing the continent’s readiness for winter without Russian energy. An unusually warm November allowed storage sites to remain well-stocked.

- The backup of dozens of oil tankers in Turkey’s Bosphorus strait started to clear Sunday after several days of wrangling over insurance issues.

- Fuel demand in India, the world’s third largest crude importer, jumped over 10% in November as the nation ramped up purchases of heavily discounted Russian oil.

- Estimated costs for Germany’s plan to charter five floating LNG terminals have tripled to more than $10.2 billion, officials say.

- TotalEnergies said it will keep its 20% stake in Russia’s Yamal LNG project in the Arctic.

- Over 1.5 million people in southern Ukraine are without power following a weekend of Russian attacks on critical infrastructure.

- Mexican low-cost airline Volaris is looking to the U.S. to source sustainable aviation fuel.

- An underwater pipeline carrying green hydrogen between Spain and France will likely be completed by the end of the decade at a cost of more than $2.6 billion.

Supply Chain

- A powerful Pacific storm touched down in California over the weekend, knocking out power to thousands as it set course to hit the South and East later this week.

- South Korean truckers voted Friday to end a three-week strike.

- China will stop checking truck drivers and domestic ship crews for COVID-19, removing a key bottleneck from its supply chain network as the nation continues to unravel its zero-COVID policy.

- With South Korean shipyards fully booked, shipping companies are turning to China’s shipyards for newbuilt LNG carriers.

- More U.S. companies are moving shipping operations to the East and South after two years of disruption on the West Coast and growing fears of a dockworker strike.

- U.S. railroads handled 1.23 million intermodal containers and trailers in November, down 5.4% from last year.

- Less-than-truckload rates appear to be holding up despite several months of declining freight volumes.

- More U.S. clothing retailers are shifting goods from air to ocean transport as container rates fall.

- U.S. warehouse development will fall to multi-year lows in 2023 due to rapidly rising borrowing costs for construction, Prologis said.

- Amtrak asked federal regulators to investigate Union Pacific over allegations of delays caused by its freight trains on a key route from New Orleans to Los Angeles.

- In the latest news from the auto industry:

- Stellantis plans to indefinitely halt and possibly shut down its assembly plant that makes internal-combustion Jeep Cherokees in Illinois, citing the rising costs of the electric-vehicle transition.

- Rivian withdrew from joint venture negotiations with Mercedes to produce electric commercial vans in Poland, citing a need to preserve cash.

- Tesla sold a record of more than 100,000 China-made cars in November. Still, the automaker will suspend output at its Shanghai factory between late December and early January due to slowing consumer demand.

- The United Auto Workers union obtained its first victory at a U.S. electric-vehicle battery plant, owned and operated by GM and LG Energy in Lordstown, Ohio.

- Volkswagen-owned Skoda Auto may start withdrawing from the Chinese market next year due to rising competition from local automakers.

- The Canadian government is formulating plans to reduce permitting times for new mines, part of an effort to ramp up production of key electric-vehicle minerals.

- Nickel prices have surged this year amid intense market volatility, leading to higher costs for industrial users, especially electric-vehicle-makers.

- The U.S. administration signaled plans to keep its hefty import tariffs on steel and aluminum despite a recent adverse decision from the World Trade Organization.

- Industrial conglomerate Tata Group plans to start making semiconductors in India within a few years.

- Political demonstrators in Peru, the world’s second-largest copper producer, are threatening to halt operations at mines across the nation.

- Large mining companies are holding production guidance steady for the coming year.

- Cotton prices have fallen 47% since hitting an 11-year high in May, a welcome development for clothing retailers facing uncertain demand

Domestic Markets

- The daily average for new COVID-19 cases rose to 65,569 last week from 43,825 the week before, while average fatalities rose to 426 from 263. New cases are up 56% from two weeks ago, while deaths are up 40% during that period.

- The daily average of new COVID-19 hospitalizations in the U.S. jumped 20% last week from the week before.

- The CDC recommends people in roughly 13% of the U.S. start wearing masks again due to high risks of COVID-19.

- Overall U.S. hospital bed occupancy rose to 80% last week, a figure not seen since the Omicron surge last winter.

- BQ.1 and BQ.1.1, two fast-spreading subvariants of Omicron, have quickly become the most prevalent strains in the U.S. Research suggests the strains are resistant to vaccines and key antibody treatments.

- COVID-19 cases in California are up 114% the past month.

- Health officials in New York City are urging school districts to restart indoor mask-wearing amid a sharp uptick in respiratory illnesses, including COVID-19.

- Congressional leaders will return to the Capitol this week under pressure to negotiate a spending bill by Friday to keep the federal government running.

- U.S. equity funds saw the biggest outflows in over a year last week amid speculation over the pace of the Federal Reserve’s interest-rate hikes.

- U.S. consumers expect prices to climb at an annual rate of 4.6% over the next year, the lowest inflation expectation in 15 months.

- The University of Michigan’s index of consumer sentiment rose from 56.8 to 59.1 in November, boosted by falling gasoline prices:

- U.S. household wealth fell by $400 billion in the third quarter, the third straight quarterly decline, as a drop in stock prices outpaced gains in real estate values.

- A survey of top U.S. CEOs showed companies were planning to slow down hiring and capital investments for the next six months as borrowing costs increase sharply.

- Investors are increasingly hopeful that the U.S. economy will see a “soft landing” and avoid a potentially deep and prolonged downturn caused by rapidly rising interest rates.

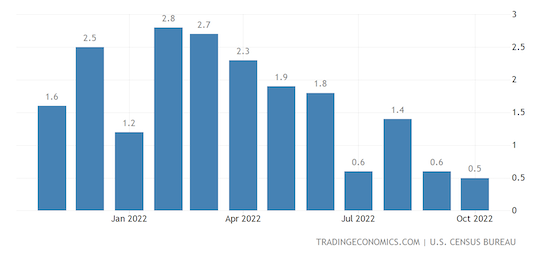

- New data shows U.S. wholesale inventories rising less than initially thought in October, suggesting businesses were carefully managing inventory amid slowing demand:

- Spirit Airlines is offering as much as a 43% pay raise to its pilots over the next two years, more evidence of the bargaining power aviators enjoy as carriers staff up to meet booming travel demand.

- Amgen is in advanced talks to buy drug company Horizon Therapeutics in a potential deal worth over $27.8 billion, what would be the largest healthcare merger of the year.

- Salesforce and Microsoft have joined at least a dozen startups working on software to help companies calculate their impact on the environment.

International Markets

- In the latest dismantling of China’s COVID-zero policy, the nation is turning off its “Communications Itinerary Card” app, which tracks citizens movements through their cell phones.

- Many businesses in China’s biggest cities are keeping strict COVID-19 precautions amid a growing belief that the nation’s declining pandemic statistics do not align with on-the-ground realities.

- Visits to COVID-19 testing clinics are increased 16 times over the past week in as citizens prepare for greater infection risk following the government’s dismantling of its COVID-zero policy. Meanwhile, authorities are setting up more intensive care centers and strengthening hospitals to handle a potential surge in cases.

- More top Chinese state-owned banks are offering big loans to help shore up property developers facing liquidity squeezes.

- GDP in the U.K. rose a better-than-expected 0.5% in October, in contrast to a 0.6% contraction in September.

- Foreign direct investment in Mexico was up 30% in the first nine months of 2022 as more companies look to reshore their Chinese supply chains to North America.

- Brazilian inflation rose a slower-than-expected 0.41% in November, welcome news just days after the nation’s central bank declined to raise interest rates further.

- China Eastern Airlines took delivery of the world’s first China-made larger passenger aircraft, the Comac C919.

- Air India is preparing for a landmark order of some 500 jets from both Airbus and Boeing, according to reports.

Some sources linked are subscription services.