MH Daily Bulletin: December 14

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose 3% Tuesday, their biggest daily gain in over a month, after U.S. economic data showed weaker-than-expected inflation in November.

- In mid-morning trading today, WTI futures were up 2.0% at $76.89/bbl, Brent was up 1.7% at $82.08/bbl, and U.S. natural gas was down 5.5% at $6.55/MMBtu.

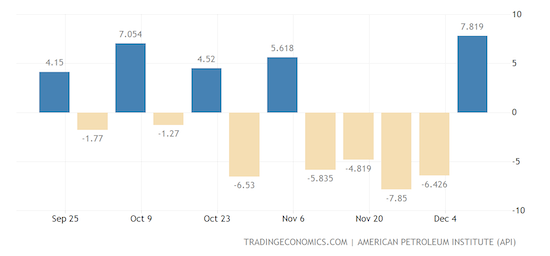

- U.S. crude stocks unexpectedly rose by 7.82 million barrels last week, according to the American Petroleum Institute, marking the biggest weekly build in 1.5 years. Government data is due today:

- Cleanup of TC Energy’s oil spill in Kansas is expected to take weeks, while no official timeline has been given for a restart of the 622,000-bpd pipeline that caused it.

- Freeport’s fire-damaged LNG terminal in Texas faces a long list of regulatory requirements that could further delay its restart beyond March.

- OPEC crude output fell by 744,000 bpd in November, mainly from Saudi Arabia, official data shows.

- OPEC decided to keep its 2022 and 2023 outlook for global supply and demand unchanged, suggesting a belief that the G7’s most recent price cap on Russian oil won’t have much impact.

- British consumers could be on the hook to pay record energy bills this winter as power stations rack up costs to keep the lights on during extreme cold spells.

- China’s exit from COVID-zero enforcement measures could eventually boost its oil consumption by more than 1 million bpd, experts say.

- Energy demand in Northeast Asia could surge the next few weeks amid forecasts of frigid La Nina weather.

- German producer Wintershall Dea plans to invest over $800 million to develop the Dvalin North gas field in the Norwegian sea.

- More oil news related to the war in Europe:

- The Turkish government reached agreement with insurers over coverage requirements Tuesday, promising an end to the tanker backup in Istanbul’s Bosphorus Straight.

- European energy ministers ended a Tuesday meeting having failed to agree on a bloc-wide cap on the price of gas, a measure heavily debated in recent months.

- Canada and Germany announced over $150 million in combined aid to help Ukraine restore power to residents over winter.

- Russian oil exports rose by nearly 3.5% month over month in November to the highest level since April, but falling prices and discounting caused a 4.4% drop in export revenues.

- Russian gas chemical projects are facing substantial delays as sanctions decrease foreign involvement.

- Germany utility RWE plans to expand its renewables activity in the U.K. with the construction of a 600 MW solar farm by 2029.

- Air New Zealand is working with four plane makers to build electric-hydrogen zero-emission aircraft capable of test flights by 2026.

Supply Chain

- Severe thunderstorms and blizzards are forecast to sweep across the central and southern U.S. before reaching the East Coast Thursday. On Tuesday, the storm system knocked out power to thousands in Texas, while causing significant flight disruption near Dallas-Fort Worth.

- Florida’s Orlando airport is asking airlines flying there to carry extra fuel after poor weather disrupted local supplies.

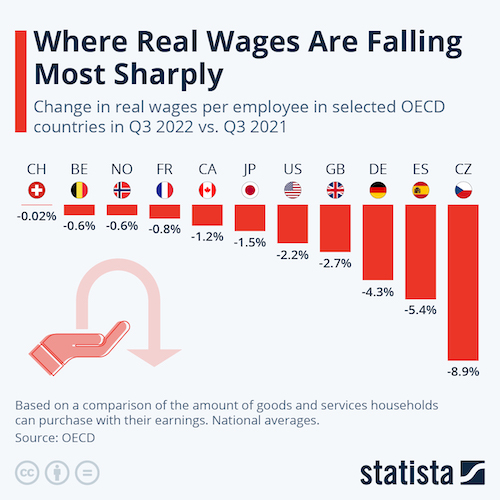

- The U.K. saw the highest number of working days lost due to labor disputes in more than a decade in October. The news comes as more than 40,000 British rail workers began their latest round of walkouts Tuesday, causing widespread disruption to the country’s transport network. Experts point to Britain’s decades-low wages for public-sector workers as a root cause for the strikes.

- U.S. diesel prices fell 21.3 cents last week to $4.75 per gallon, the sharpest weekly decline in almost 30 years.

- The ongoing slowdown of global trade is expected to worsen in 2023, according to the United Nations.

- Container demand is projected to sink next year even as global capacity continues to grow.

- Average spot rates for Asia-to-West Coast containers landed at $1,426 per FEU last week, down 25% from the week before and 90% from a year ago.

- Container lines are starting to send older vessels to scrap after holding on to the ships through two years of tight capacity.

- International freight solutions provider Motive is laying off 6% of its 3,700 employees, citing slowing demand.

- Louisiana is partnering with several firms, including shipper MSC, to build a $1.8 billion container storage facility on the lower Mississippi River, a project expected to dramatically boost the state’s import and export capacity.

- Supply-chain issues continue to slow progress in U.S. solar-power expansion, with installations forecast to fall 23% this year.

- China has a $143 billion support package for its semiconductor industry in the works, a counter to U.S. moves aimed at slowing its tech advances.

- India plans to kickstart its semiconductor industry with a roughly $20 billion fabrication plant to be built by Foxconn in the western state of Gujarat.

- Europe will adopt a plan in the coming weeks to put carbon tariffs on imports of polluting goods, one of the world’s first insertions of climate-change regulation into the rules of global trade.

- In the latest news from the auto industry:

- Ford added a third work crew at a Detroit assembly plant making the company’s high-demand electric F-150.

- Panasonic is branching out from exclusively building car batteries for Tesla with a new deal to supply U.S. electric-vehicle maker Lucid.

- Volkswagen and Italian energy giant Enel formed a joint venture to build 3,000 high-speed charging points across Italy at a cost of roughly $210 million.

- Volkswagen says surging energy prices have dented electric-vehicle demand in Europe.

- DHL’s British parcel unit took delivery of six electric trucks and 30 LNG-powered tractors from Volvo Trucks.

- Waymo, Google’s self-driving unit, applied for final permitting needed to start selling fully autonomous rides in California.

- A bipartisan team of U.S. lawmakers proposed a bill that would force federal officials and agencies to periodically identify and recommend solutions to supply-chain weaknesses.

- British manufacturers are sitting on almost $29 billion of unfinished goods that can’t be sold due to persistent supply issues, a Barclays survey showed.

- Short line operator Regional Rail is acquiring three midwestern operations from Agracel Rail Holdings.

Domestic Markets

- The U.S. reported 56,092 new COVID-19 infections and 573 virus fatalities Tuesday.

- A combination of COVID-19, influenza and R.S.V. is sweeping through the U.S., leading many large cities to encourage mask-wearing again.

- Vaccinations are believed to have prevented at least 3 million COVID-19 deaths in the U.S. since the start of the pandemic.

- House and Senate negotiators agreed to scrap a requirement that military personnel be vaccinated against COVID-19, a concession made as part of efforts to advance the nation’s latest defense bill.

- Declines in the cost of gasoline and used cars led to the smallest annual increase in U.S. inflation in 15 months in November…

- …offering the strongest evidence yet that price pressures have peaked. Prices for food and shelter remain elevated.

- Traders are increasingly betting that the Federal Reserve will stop just short of a 5% terminal interest rate by next March.

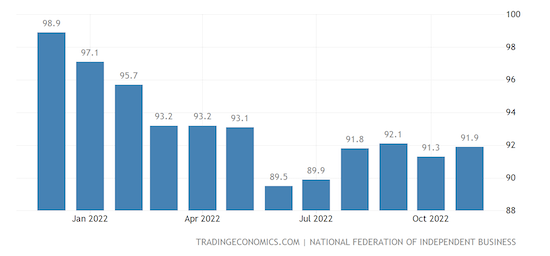

- An index of U.S. small-business confidence rebounded to a reading of 91.9 in November, according to the National Federation of Independent Business. Inflation and worker shortages remained the top issues for owners, the group said.

- Sales of previously owned U.S. homes are expected to fall to their lowest level in over a decade next year, according to industry experts.

- Atlanta is forecast to be the U.S.’s top property market of 2023, according to the National Association of Realtors.

- The U.S.’s sharp decline in office values could soon become a major problem for the budgets of cities and schools that depend heavily on property taxes from corporate building owners.

- A record 39% of the U.S. workforce, or 60 million people, worked as freelancers in 2022, up from 36% last year.

- United Airlines announced a $43 billion list-value order for 200 Boeing jets Tuesday, including 100 787 Dreamliners and 100 737 MAXs, a boon to the struggling plane maker that saw new orders drop in November.

- Boeing plans to keep pushing Congress for production exemptions on its 737 MAX aircraft even if a key deadline passes on Dec. 27 without lawmaker action.

- Startup Boom Supersonic selected Kratos Defense & Security to develop engines for its plan to reintroduce supersonic aircraft in the U.S.

- Eli Lilly plans to launch as many as five new treatments next year, including for obesity and Alzheimer’s, that the drugmaker says could drive growth through the next decade.

International Markets

- COVID-19 cases are surging in Beijing, with the city’s total hospital patients rising sixteenfold week over week while financial firms struggle to maintain trading due to pervasive worker absences.

- China ended comprehensive COVID-19 infection reporting, saying tracking is impossible after it ended mandatory testing.

- China delayed a key economic policy meeting in Beijing this week due to surging COVID-19 infections, offering no timeline for a reschedule.

- China is expected to unveil more stimulus measures next year in a bid to ease disruptions caused by its sudden end to COVID-19 curbs.

- Hong Kong eased more COVID-19 rules Tuesday, including movement controls for foreign travelers and a mandatory COVID-19 mobility app for tracking the population.

- Britain’s central bank is warning that households and businesses face “significant pressure” due to higher inflation and borrowing costs.

- Europe is considering how to loosen rules to let governments more easily support companies affected by the U.S. Inflation Reduction Act, which incentivizes U.S. investment in key industries such as cars, semiconductors and clean energy.

- The Asian Development Bank cut its growth forecasts for developing Asia this year and next due to fallout from Russia’s war in Ukraine.

- Business confidence among big Japanese manufacturers worsened for the fourth straight quarter, according to a closely watched survey from the Bank of Japan.

- Argentinian consumer prices have cooled in recent months but are still set to end 2022 roughly 100% higher.

- Ukraine’s economy is in danger of shrinking by 50% this year, officials said Tuesday.

- Some Spanish airport workers plan to walk out around Christmas and New Years in a dispute over pay.

Some sources linked are subscription services.