MH Daily Bulletin: December 15

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil rose 2% Wednesday after several key industry groups said demand would rebound next year, helped in part by slowing U.S. interest-rate hikes.

- In mid-morning trading today, WTI futures were down 1.1% at $46.43/bbl and Brent was down 0.8% at $82.03/bbl.

- U.S. natural gas prices rose for a fifth day on forecasts of cold weather across the nation this month. Futures were up 2.7% today at $6.60/MMBtu.

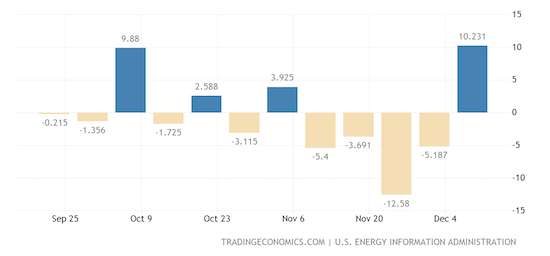

- U.S. crude stocks rose by more than 10 million barrels last week, the most in almost two years, according to the Energy Information Administration.

- OPEC expects global oil demand to grow by 2.25 million bpd next year to 101.8 million bpd. The International Energy Agency sees a slightly lower gain.

- Rebounding road and air traffic in China is expected to boost global fuel demand, putting upward pressure on oil prices.

- U.S. banks disagree on oil-price forecasts for 2023, with Morgan Stanley expecting a rally to $110/bbl, while Goldman Sachs says an early-year surplus will keep prices down.

- Earnings for U.S. oil refiners topped pre-pandemic levels in the third quarter as the industry paces for a record year of profits.

- China’s oil refiners produced 14.5 million barrels per day in November, the highest throughput in a year.

- Italian officials say the government has collected some $3 billion so far from this year’s one-off windfall tax on energy firms.

- Spanish officials opened a probe into alleged anti-competitive behavior between Repsol and privately owned Cepsa, the nation’s two largest oil companies.

- British banking giant HSBC will stop funding new oil and gas fields while requiring more information from energy clients over their plans to cut emissions.

- More oil news related to the war in Europe:

- Europe aims to raise an extra 20 billion euros from its carbon market to invest in projects to lessen the bloc’s reliance on Russian energy.

- Europe is importing diesel cargoes from around the world at near-record rates ahead of an impending ban on shipments from Russia, its biggest supplier, in February.

- Russia’s oil output will probably fall at least 14% by the end of the first quarter next year, the International Energy Agency said.

- A $4 billion nuclear project in Wyoming has been delayed by at least two years due to issues with supplies made only in Russia.

- Reports out of Germany, France and Britain indicate behavior changes from households and businesses have been successful in preserving gas supplies.

- The Czech Republic approved a new measure to cap power and gas prices for firms at the same price as for households.

- Moldova, one of Europe’s poorest countries, plans to sue Gazprom over failing to provide it with contracted gas.

- Canada scrapped a rule that allowed for parts used for the Russia-to-Germany Nord Stream 1 gas pipeline to be repaired in Montreal.

- The U.S.’s landmark nuclear-fusion discovery this week — where for the first time a reaction produced more energy than it consumed — has spurred immediate interest from big investors, according to companies working on the technology.

- Chevron announced plans to form a joint venture with a Swedish investment firm to build geothermal projects in the U.S.

- G7 nations finalized a plan to provide $15.5 billion to help Vietnam transition away from coal.

- BP invested $13.7 million with an Australian startup to make fast-unraveling solar panels that can be deployed in solar farms by a handful of people within minutes.

- An Indian startup is campaigning for farmers to sell instead of burning their crop waste so it can be recycled and used for fuel blending.

Supply Chain

- A massive storm system continued moving across the central U.S. Wednesday, dropping more than a dozen tornados in the South and threatening ice and snow on the East Coast by week’s end. Flight delays and cancellations have been widespread.

- The Cass Freight Index measuring U.S. shipments fell 1.9% in November, its third straight decline to the lowest level since July.

- Long Beach container imports fell by nearly one-third in November as retailers continued shifting trade to East and Gulf coast ports.

- Rail operator CSX will change some attendance policies that were a major sticking point in negotiations with rail workers this year.

- CMA CGM will restrict shipments into South China ports early next year due to inland transport disruptions caused by COVID-19.

- The U.S. will soon add Yangtze Memory Technologies, China’s leading maker of memory chips, and more than 30 other Chinese companies to a trade blacklist that will prevent them from buying certain American components.

- Industry experts say Mexico is close to missing out on a wave of computer-chip development projects due to a lack of competitive incentives, among other issues.

- Member states of the International Maritime Organization failed this week to make progress on a target to eliminate carbon emissions by 2025.

- Popular U.S. holiday meal ingredients will be in short supply this year due to a wide range of logistics issues.

- In the latest news from the auto industry:

- Trucking groups say costs of the U.S. government’s impending plan to tighten tailpipe emissions could sideline some trucking fleets.

- Nevada-based Redwood Materials announced plans to build a $3.5 billion battery production campus in South Carolina.

- Mercedes-Benz will spend $1 billion starting in 2024 to overhaul its global production network in favor of building electric powertrains.

- Tesla hit back at environmental concerns over its German gigafactory by saying it would drill for new water sources to support the plant’s capacity expansion next year.

- Washington state startup Group14 has raised hundreds of millions for a promising new silicon technology that could spur the next generation of electric-vehicle batteries.

- Indian automaker Mahindra will spend $1.21 billion to build a new electric-vehicle (EV) factory in west India. The auto giant says its entry into the U.S. EV market is still several years away.

- Indonesia will start offering subsidies of up to $5,000 on new, domestically made electric motorcycles and cars, officials said.

- Mazda will introduce its first electrified car in the U.S. by 2024.

- Seat-maker Forvia, formerly Faurecia, will lay off hundreds of workers at a Detroit plant after moving operations to Mexico.

- Auto supplier Lear plans to build a 120,000-square-foot plant in Detroit to supply electric-vehicle battery parts for GM.

Domestic Markets

- The U.S. reported 146,480 new COVID-19 infections and 916 virus fatalities Wednesday.

- In preparation for another expected COVID-19 wave, the White House is expected to announce today a resumption of free virus test distribution.

- Long-COVID could be responsible for up to 3,500 U.S. virus deaths, about 1% of the total, researchers say.

- New data shows Pfizer’s COVID-19 antiviral Paxlovid significantly reduces the risk of hospitalization or death in people over age 50.

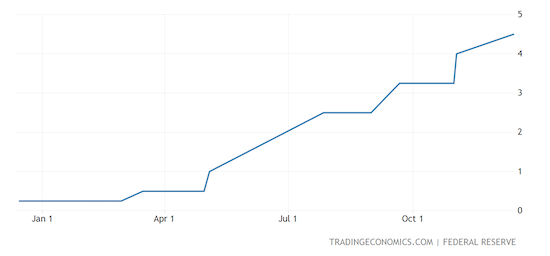

- The Federal Reserve on Wednesday raised its benchmark interest rate by 50 basis points, a downshift from the 75-point hikes it delivered at its last four meetings this year. The U.S.’s new interest-rate range between 4.25% and 4.5% is the highest in 15 years.

- At their Wednesday meeting, Federal Reserve officials said the U.S. would need at least 75 basis points of additional rate hikes by the end of 2023, leading to a higher-than-expected terminal rate of around 5.1%. Rates could start going down in 2024.

- The Federal Reserve predicts the U.S. economy will grow at a 0.5% pace in 2023, a sharp downgrade from the central bank’s September prediction of 1.2%. The unemployment rate, meanwhile, is forecast to rise to 4.6% from its current level of 3.7%.

- U.S. retail sales fell 0.6% in November from the prior month.

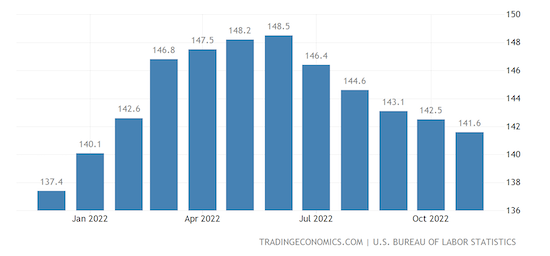

- Initial jobless claims fell by 20,000 last week to 211,000, well lower than expectations, indicating continued resilience in labor markets.

- U.S. import prices fell for a fifth straight month in November, pulled down by declining costs for petroleum products and a strong dollar.

- With the first payments due this month, many small businesses are having to repay their pandemic loans at a time when demand is slowing, and economic conditions are worsening.

- U.S. consumers are expected to fall behind on personal loans and credit cards at the highest rate in over a decade next year, according to credit ratings agency TransUnion.

- Delta Air Lines raised its fourth-quarter profit outlook and projected earnings will double next year amid a persistent rebound in travel demand.

- U.S. airfares are 36% higher than a year ago, according to the latest inflation data.

- Sales of private label supermarket products are surging as soaring inflation pushes consumers away from name brands.

- The New York City administration is studying a plan to overhaul dense business districts with a series of parks and promenades, a bid to adapt to a post-pandemic world of declining corporate office demand.

- Business groups are preparing to mount a legal challenge to the U.S. administration’s proposals that narrows the definition of independent contractors.

International Markets

- On-the-ground reports suggest Beijing’s economic and residential activity has abruptly halted amid surging COVID-19 cases.

- Pfizer will soon be permitted to sell its COVID-19 antiviral pill Paxlovid in China, a response to the nation’s surging infections.

- China plans a wide range of steps, including a near-overhaul of policies in various sectors, to spur domestic consumption and investment over the next decade and beyond.

- Following the U.S.’s lead yesterday, the European Central Bank, the Bank of England and Swiss National Bank each raised interest rates by 50 basis points today and signaled further rate hikes ahead.

- Europe’s executive branch proposed new rules Wednesday that would let nations give more incentives for energy and other tech investment, a response to U.S. subsidies seen as a threat to European industry.

- Germany plans to issue a record $533 billion of debt next year to fund costs associated with Europe’s energy crisis and continued fallout from COVID-19.

- Led by fuel shipments, Japanese imports surged by an annual 30.3% in November, resulting in the 16th straight month of trade deficits.

- British inflation fell to 10.7% in November after hitting a 41-year high of 11.1% the previous month.

- Economic activity in Brazil, Latin America’s biggest economy, contracted in October, according to new data.

- Peru declared a state of emergency Wednesday, suspending basic rights in a bid to restore order amid widespread, violent unrest.

- Canadian financiers are raising concerns that the government’s new proposal to scrutinize foreign acquisitions more closely in the name of national security will deter foreign investment and slow deals in critical sectors.

- Europe’s central bank is converting to a flexible schedule in which employees can work half the days of the year remotely.

- German engineering giant Bosch expects to beat forecasts with over $92 billion in revenue this year. The firm also says it will continue reducing its exposure to China in favor of India.

- Visa plans to invest $1 billion in its business across Africa over the next five years as it pushes for wider adoption of digital payments.

- Microsoft aims to secure internet access for 100 million more people in Africa by 2025 by building out the continent’s telecom and electricity infrastructure.

- Aircraft leasing firms are suing dozens of insurers for around $8 billion to compensate for the hundreds of aircraft stuck in Russia since its invasion of Ukraine.

- Inditex, owner of the world’s biggest fashion retailer Zara, saw profit rise 24% the first nine months of the year as price hikes helped offset weakening global demand.

Some sources linked are subscription services.