MH Daily Bulletin: December 16

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil fell 2% Thursday on fears that another round of interest-rate hikes across the globe will slow demand.

- In mid-day trading today, WTI futures were down 2.1% at $74.52/bbl, Brent was down 2.4% at $79.23/bbl, and U.S. natural gas was down 4.5% at $6.66/MMBtu.

- Canada’s TC Energy said it is restarting operations in a section of its Keystone pipeline just a week after a 14,000-barrel spill in Kansas triggered a shutdown.

- Europe’s energy crisis, paired with economic resilience in major Asian economies, is boosting demand for oil as a heat source, the International Energy Agency says.

- France’s nuclear industry is not expected to reach previous output levels for several years, officials say.

- Equinor started the second phase of its giant Johan Sverdrup development in the North Sea, boosting output from Europe’s biggest producing field by 185,000 bpd.

- Brazil’s state-run Petrobras has lost $41 billion in market value the past two months amid political turmoil.

- India is considering building several new refineries instead of a single mega-plant as planned.

- More oil news related to the war in Europe:

- Russia has been shipping oil to India in compliance with the West’s $60/bbl price cap, despite threats that it would cease shipping to buyers who recognize the sanction.

- EU ministers agreed to a preliminary deal to cap natural gas prices across the bloc after months of political wrangling. The measure still faces stiff opposition from stakeholders, including the Intercontinental Exchange.

- German lawmakers passed a $106 billion bill to cap electricity and gas prices next year for households and industry, funded in part by new windfall taxes on energy producers.

- Russia declined to say whether it will repair the Nord Stream gas pipelines to Europe that were blown up in September.

- Russia’s Gazprom is starting to send record volumes of gas to China, exceeding contractual obligations.

- Saudi Aramco and TotalEnergies are moving forward on an $11 billion petrochemical project in Saudi Arabia.

- Shell and Brazil’s Eletrobras are mulling a potential co-investment in offshore wind power in the South American country.

- Shell and Dutch energy firm Eneco won rights to build a large offshore wind farm in the North Sea.

- California regulators slashed compensation for homeowners that re-supply the grid with rooftop solar, a move that experts say could slow the state’s energy transition.

- Tokyo will require large homebuilders to include rooftop solar on all newbuilds by 2025.

Supply Chain

- A massive U.S. storm system knocked out power to hundreds of thousands of people across seven states Thursday. Dozens of tornadoes struck the South.

- Texas regulators urged oil and gas companies to protect their equipment amid forecasts of what could be the coldest temperatures in 40 years next week, rivaling the Texas Freeze of 2021.

- Vessel traffic at one of the Panama Canal’s three locks was temporarily suspended Thursday due to a fire.

- Big U.S. ports are reporting steep declines in inbound container volumes for November, including a 26% drop for Los Angeles and Long Beach to their lowest level of the pandemic. The head of the Port of Los Angeles is making a “whistlestop tour” to win back lost business.

- Loaded container imports into Georgia’s Port of Savannah fell 6.2% in November from last year.

- Virginia is conducting studies on whether to build a second inland port.

- Airfreight rates dropped for the third consecutive month in November as hopes deflate for a late peak-season demand boost.

- Scorpio Tankers expects product tanker shipping rates to surge to new highs as cold weather arrives and seaborne exports of refined products reach record levels.

- Container lines are increasingly stepping into inland transport operations to streamline cargo distribution.

- More U.S. retailers are taking the rare step of canceling orders for top-selling items to try to slow the growth of merchandise stockpiles.

- South Korean shipper HMM is looking to buy nine mid-sized container ships powered by methanol.

- Goldman Sachs says commodities will surge in price next year due to continued supply and production shortfalls. Aluminum and iron ore have started to rally on the return of Chinese demand.

- In the latest news from the auto industry:

- The U.S. EPA is considering offering lucrative credits to electric-vehicle-makers next year for cars recharged with power from biofuels.

- California approved an extra $2.9 billion to fund the rollout of tens of thousands of electric and hydrogen charging stations.

- Ford raised the price of its F-150 Lightning electric truck for the second time in three months, a response to continued supply snags.

- Ford and Chinese battery giant CATL are in talks to build a battery plant in Michigan or Virginia.

- Tesla says it has boosted production to 3,000 SUVs per week at its unprofitable factory in Austin, Texas, a number that would still leave the automaker below full-year targets.

- China’s car exports rose 54% year over year through September as its automakers look to establish themselves outside the country.

- Chinese electric-vehicle giant BYD will launch a new brand in 2023 on the momentum of a year of strong sales.

- U.S. electric-truck-maker Nikola clinched a deal to supply dozens of hydrogen-powered trucks to fuel-cell developer Plug Power.

- Honda is using its 11th-generation Accord to test the use of a Google software system.

- Italian premium brakes-maker Brembo plans to expand one of its factories in the northern Mexican state of Nuevo Leon.

- Toyota will use wind turbines to power one of its plants in central Japan.

- Mercedes-Benz secured a supply deal for low-carbon aluminum from Norsk Hydro, part of the automaker’s ongoing efforts to decarbonize its supply chain.

- DHL is eyeing a possible acquisition of logistics operator Schenker from rail operator Deutsche Bahn in late 2023.

- Sudan signed a preliminary agreement to build a multi-billion-dollar port on the Red Sea with Emirati port operator AD Ports and Invictus Investment.

- Poland’s top retailer is considering cutting the number of warehouses in its logistics network and instead using existing stores to ship online orders.

- Costco took a $93 million quarterly charge against earnings related to scaling back chartered shipping that it initiated early in the pandemic, citing recent easing of shipping congestion.

Domestic Markets

- The U.S. reported 109,936 new COVID-19 infections and 711 virus fatalities Thursday. Seven-day averages for new cases and hospitalizations are at multi-month highs.

- U.S. retailers are facing a shortage of cough and cold medicines amid an uptick in respiratory infections, including COVID-19.

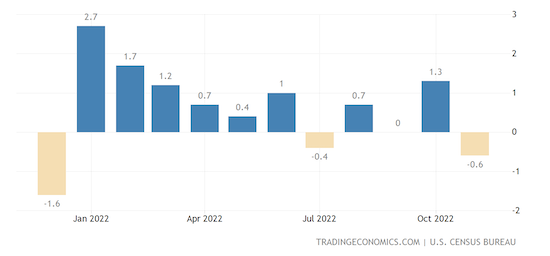

- U.S. retail sales fell by a larger-than-expected 0.6% in November, the biggest decline in 11 months.

- Last week’s drop in first-time jobless claims was the largest since September, suggesting robust demand for workers.

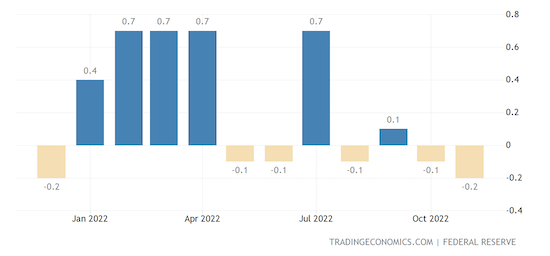

- U.S. factory production fell a surprise 0.6% in November, the first decline since June on a sharp decrease in auto output. Overall, U.S. industrial production fell by 0.2% for the month:

- U.S. business inventories rose a moderate 0.3% in October, suggesting businesses were slowing their pace of stocking.

- The average U.S. mortgage rate dropped for the fifth consecutive week to 6.31%.

- Siemens Healthineers and General Electric’s healthcare business are weighing a potential acquisition of two units being spun off by Medtronic, the world’s largest standalone medical device maker.

- Citigroup is changing its employee work schedule to include two weeks of remote work at the end of the year.

International Markets

- Global new COVID-19 infections were up 2% in the past week, according to the World Health Organization.

- China’s public health officials warned that up to 800 million people could be infected with COVID-19 over the next few months, spurring a run on pharmacies and retailers and leaving big cities short of food and medicine. U.S. consulates in China suspended most services due to surging infections.

- COVID-19 is showing signs of resurgence in Japan and South Korea.

- Tens of thousands of British nurses staged their largest walkout in history on Thursday, putting severe stress on the nation’s healthcare system.

- China’s economy lost more steam in November, with factory output slowing and retail sales posting their steepest drop in six months. Senior officials are setting robust GDP growth targets for next year even as big banks project worsening conditions.

- In addition to raising interest rates by 50 basis points Thursday, a fourth successive increase, the European Central Bank (ECB) laid out plans to shrink its bloated 5 trillion euro balance sheet starting in March. Norway joined the ECB, the U.K. and elsewhere in raising rates by a like amount Thursday.

- The Bank of Mexico raised its key interest rate by 50 basis points to a record 10.5% Thursday. One more rate hike could be in the pipeline, officials indicated.

- Europe’s central bank raised its eurozone inflation projection to 6.3% next year and said price growth would remain above targets through 2025.

- Eurozone factory output declined 2% in October, according to the latest data.

- The French government says the nation’s economy could contract a worse-than-predicted 0.2% in the current quarter.

- With inflation in Hungary expected to peak at 27% early next year, officials there extended a price cap on basic foodstuffs through April.

- A major Russian supermarket plans to continue its rapid rollout of discount stores amid a severe squeeze on living standards in the nation.

- The U.S. and EU finalized another package of sanctions on Russia Thursday, while the EU also pledged to provide Ukraine with 18 billion euros of financing support next year.

- The United Nations shrank its forecast for economic growth in Latin America and the Caribbean next year to 1.3%. Brazilian and Argentinian economic data has slightly improved in recent weeks.

- Canadian home prices fell for a ninth straight month in November while sales also declined.

- Annual inflation in Nigeria, Africa’s most populous nation, climbed for the 10th straight month to 21.47% in November.

- Sri Lanka’s economy shriveled by 11.8% last quarter amid its worst financial crisis in decades.

- The U.S. pledged to provide Africa with $2.5 billion in emergency aid for the continent’s medium- to long-term food security.

- Spanish airport workers called off a planned strike on Christmas and New Year’s after reaching a bonus agreement with employers.

Some sources linked are subscription services.