MH Daily Bulletin: December 22

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

- M. Holland will be closed Friday, Dec. 23 and Monday, Dec. 26, in observance of Christmas.

Supply

- Oil rose almost 3% Wednesday on news of a larger-than-expected draw in U.S. crude stockpiles.

- In mid-morning trading today, WTI futures were down 0.6% at $77.86/bbl and Brent was down 0.6% at $81.67/bbl.

- U.S. natural gas rose 4% Wednesday on expectations of higher demand in an upcoming cold snap. Futures were down 2.0% at $5.23/MMBtu today.

- U.S. crude stocks fell by a larger-than-expected 5.89 million barrels last week, according to the Energy Information Administration. Inventories are 7% below the five-year average for this time of year.

- Minnesota and New York are among states tapping federal funds to help households struggling with rising heating costs this winter.

- TC Energy says it removed the ruptured segment of pipeline that caused an oil spill in Kansas earlier this month.

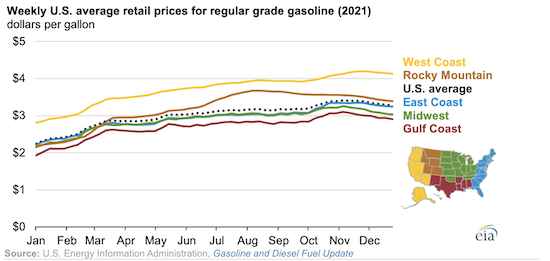

- U.S. retail gasoline prices averaged $3.01 per gallon in 2021, the highest nominal price since 2014:

- OPEC+ officials made comments Wednesday suggesting the group may continue a policy to keep supply tight.

- Equinor injected $3.7 billion into its trading business, as more liquidity is needed to cope with highly volatile energy markets.

- The EU signed off on Germany’s $30 billion support scheme for rapidly expanding renewable energy development over the next few years, particularly wind and solar.

- More oil news related to the war in Europe:

- China’s November crude imports from Russia rose 17% year over year as refiners raced to get ahead of the G7’s price cap.

- Britain set a new record for public borrowing in November, mainly due to the mounting cost of energy subsidies.

- Russia launched a major new Siberian gas field Wednesday to help drive a planned surge in supply to China.

Supply Chain

- Huge parts of the U.S. are forecast to see heavy snow that is likely to cause flight delays and impassable roads during one of the busiest travel periods of the year this weekend. Conditions are expected to be the worst in the Midwest and Northeast.

- The American Chamber of Commerce says Shanghai could see a downturn in business as companies run out of COVID-19 supplies.

- Maersk is preparing contingency plans to avoid disruptions amid difficult contract talks with workers at the Port of Rotterdam.

- Average U.S. diesel prices have fallen 74 cents to $4.596 per gallon since early November, including six straight weeks of declines.

- With tanker demand surging, some companies are selling vessels for double what they paid just months ago.

- MSC completed a $6.4 billion acquisition of the African logistics business of French conglomerate Bolloré Group.

- Russia and Iran are putting a combined $20 billion into a new transcontinental trade route aimed at circumventing foreign intervention and building more commercial links with Asia.

- U.S. chipmaker Micron forecast a steeper-than-expected quarterly loss and said it will lay off 10% of its workforce next year due to a growing glut in the semiconductor market.

- Researchers say the astronomical rise in data storage will require rapid innovation in materials and energy systems in the years ahead.

- Global seed-maker Syngenta will release a new type of hybrid wheat in the U.S. next year after poor weather and the war in Ukraine disrupted shipments to major importers in 2022, sending prices to record highs.

- In the latest news from the auto industry:

- U.S. new vehicle sales are expected to decline this month as high prices and rising borrowing costs push consumers to cut back spending, according to J.D. Power.

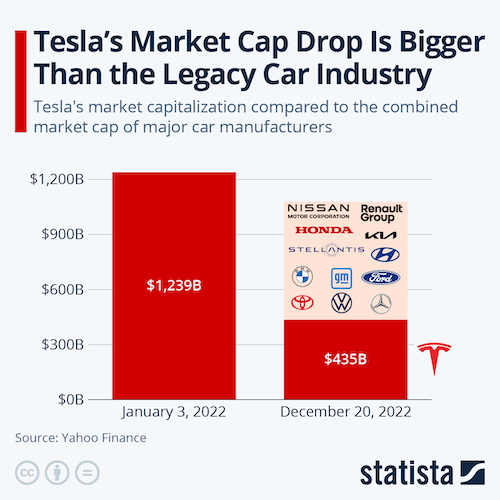

- Tesla is preparing another wave of layoffs and a hiring freeze next spring, according to reports.

- U.S. self-driving truck company TuSimple announced plans to lay off 25% of its workforce, or roughly 350 employees.

- Global investment in electric-vehicle charging infrastructure hit $28.6 billion this year, up 228% from 2021 with China seeing the largest gains.

- Canada is floating a measure to require 20% of all new cars sold in the country to be electric by 2026 and 100% by 2035. Electric vehicles comprised just 7.2% of Canadian car sales in the first six months of this year.

- Hyundai plans to unveil some 17 new electric vehicles by 2030 as it aims to surpass Toyota and Volkswagen as the world’s largest automaker.

- Colorado-based Solid Power is easing some intellectual property rights to allow BMW to start making electric-vehicle batteries at the automaker’s facilities in Germany.

- Indonesia could allocate as much as $320 million from next year’s budget to incentivize electric-vehicle purchases.

- GM’s Cruise unit has branched out from San Francisco to start offering limited self-driving taxi rides in Phoenix and Austin.

- Israeli startup AIR ran the first unmanned test of its flying commuter taxi this week, with plans to bring the vehicle to market within two years.

Domestic Markets

- The U.S. reported 170,205 new COVID-19 infections and 1,024 virus fatalities Wednesday.

- The Conference Board’s index of U.S. consumer sentiment unexpectedly rose to an eight-month high in December, buoyed by easing inflation and falling gasoline prices.

- Initial jobless claims rose last week by a less-than-expected 2,000 to 216,000, while the government raised its estimate of third-quarter GDP growth from 2.9% to 3.2%.

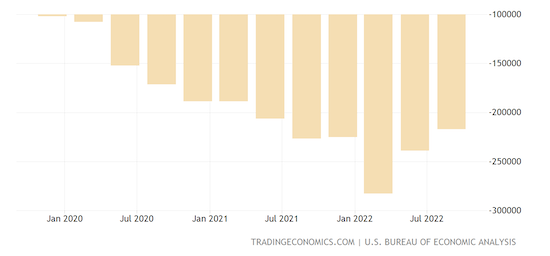

- The U.S. current account deficit narrowed 9.1% to $217.1 billion in the third quarter as exports jumped to a record high.

- Shopper visits to many retail segments, including apparel and electronics, are down this holiday season, according to foot-traffic analyses.

- Year-over-year credit card balances jumped 15% last quarter, the biggest increase in over two decades. High interest rates are hitting new borrowers especially hard, with around 20% of 18-to-20-year-olds in collections.

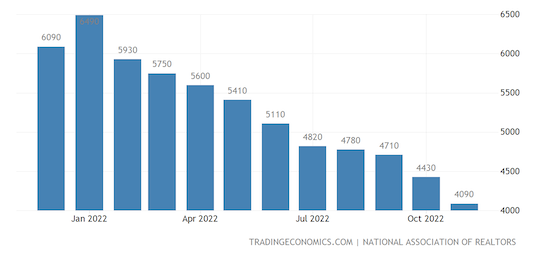

- Sales of previously owned U.S. homes fell for a 10th straight month in November by 7.7%, extending a record decline to a 2.5-year low.

- U.S. mortgage rates declined to a three-month low of 6.34% last week while home-purchase applications fell.

- Surging U.S. farm income is rapidly pushing up prices for land, particularly in the Midwest.

- U.S. investment giant Citadel plans to return about $7 billion in profits to clients after a banner year of earnings.

- Carnival posted a smaller-than-expected quarterly loss as the cruise line managed to control operating costs and ridership returned to 90% of pre-pandemic levels.

- Legal experts say new federal drinking water standards could prompt additional lawsuits against makers of PFAS, or so-called forever chemicals, such as 3M and DuPont.

- New York’s influential state banking regulator proposed new guidance to help financial institutions evaluate climate risks in existing and new business.

International Markets

- In the latest China news:

- Dozens of hearses were spotted in queue outside a Beijing crematorium Wednesday even as authorities reported zero new COVID-19 deaths.

- Officials at the World Health Organization say Beijing’s reporting of COVID-19 data is no longer a reliable guide to the nation’s most recent outbreak.

- COVID-19 cases appear to be surging in Shanghai, with reports showing hospitals crowded with patients and pharmacies running out of basic medicines.

- China’s retail and financial businesses have been hit hard by COVID-induced staffing shortages, according to an international business group operating in China.

- Germany sent its first batch of Pfizer COVID-19 vaccines to China to be administered initially to German expatriates, the first foreign coronavirus vaccine to be delivered to the country.

- Hong Kong further eased COVID-19 restrictions by dropping testing requirements for entry into bars and restaurants.

- South Korea logged 87,559 new COVID-19 infections Tuesday, the highest daily tally in three months.

- Germany’s BioNTech completed building its first mobile vaccine factory made from shipping containers, which will be sent to Africa.

- Global mergers and acquisitions plummeted 37% to $3.66 trillion this year after hitting an all-time high of $5.9 trillion last year, as dealmakers predict a slow path to recovery in 2023.

- Europe’s economy showed surprising resilience with a GDP gain of 1.7% in the first three quarters of 2022, compared with a gain of just 0.2% in the U.S.

- German financial officials expect economic activity to remain subdued in the fourth quarter of this year and the first quarter of 2023 before inflation starts declining. German consumer confidence rose more than expected this month, new data shows.

- Thousands of ambulance workers in England and Wales walked out Wednesday in a dispute over pay, adding to healthcare strains a day after nurses across the nation went on strike.

- British retailers saw a surprise pick-up in demand this month, according to the latest data.

- India’s central bank could raise its key policy rate by an additional 50 basis points to at least 6.75% next year as core inflation remains above 6%, officials said.

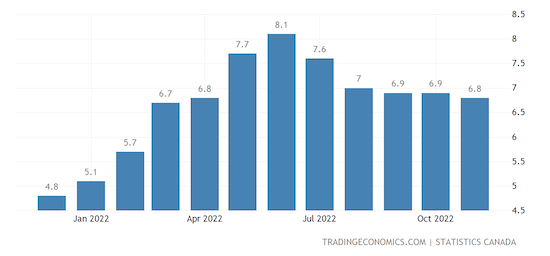

- Canada’s annual inflation rate eased to 6.8% in November but remains high, leaving the door open for another interest rate increase in January.

- Visitor arrivals to Japan jumped to two-thirds of pre-pandemic levels in November, the first full month after the country scrapped two years of COVID-19 travel curbs.

- Airbus executives shared broad goals to deepen the plane-maker’s industrial presence in India, home of the world’s fastest growing airline market.

- Japan-based SMBC Aviation Capital completed its $6.7 billion purchase of rival Goshawk Aviation in a deal that creates the world’s second largest aircraft lessor by number of aircraft.

- Kirin Holdings, Japan’s second largest brewer by sales, plans to buy more factories in North America amid double-digit sales increases there since 2020.

- Europe’s greenhouse gas emissions fell 22% from 2008 levels in 2021, new data shows, led by declines in the mining and utility industries.

Some sources linked are subscription services.