MH Daily Bulletin: December 30

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

- M. Holland will be closed Monday, Jan. 2 for the New Year’s holiday.

Supply

- Oil fell about 1% Thursday on demand fears stemming from China’s COVID-19 surge.

- In morning trading of the final session this year, WTI was up 0.9% at $79.08/bbl and Brent was up 1.1% at $84.37/bbl. Futures are on track to rise a total of 5% in 2022, their second straight annual gain.

- U.S. natural gas traded at nine-month lows near $4.50/MMBtu Thursday, pushed down by forecasts of mild weather and lower heating demand in early January. Futures were down 3.7% at $4.39/MMBtu in morning trading today:

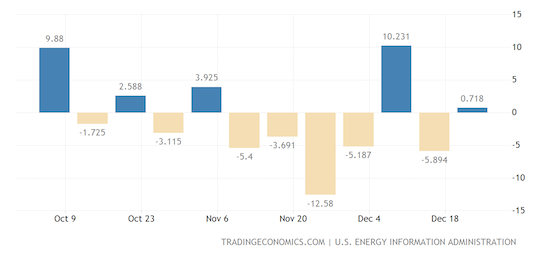

- U.S. crude stocks rose unexpectedly by 718,000 barrels last week as imports climbed and exports fell, the Energy Information Administration said.

- U.S. shale executives report being concerned about rising costs in 2023 amid persistent struggles with hiring and retaining workers, according to a survey by the Dallas Fed.

- TC Energy says its 622,000-bpd Keystone pipeline from Canada to the Gulf Coast has returned to operations after a major oil spill in rural Kansas.

- Canadian oil company Suncor Energy says extreme weather will force a shutdown of its 98,000-bpd refinery in Colorado until March.

- U.S. energy-sector shares have climbed about 60% this year, a sharp contrast to the 21% drop in the S&P 500, after bumper profits following Russia’s invasion of Ukraine drew investors back to the sector.

- The world’s biggest coal miners are set to triple profits to a total of $97 billion this year as many countries that once pledged to quit the dirty fuel turned back to it amid widespread energy insecurity. However, the recent drop in Western natural gas prices is prompting power companies to switch back to gas.

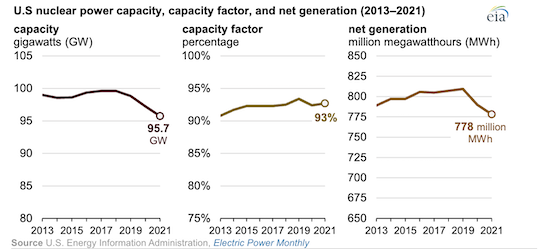

- U.S. nuclear generation declined for a second year in 2021 as more reactors were put into retirement:

- More oil news related to the war in Europe:

- European natural gas prices have returned to pre-invasion levels around $81.91/MWh, down from a peak around $367/MWh in August.

- German officials approved construction of the country’s first hydrogen pipeline network this month as hopes grow that the fuel could help the nation achieve emissions targets while reducing reliance on Russia.

- Kazakhstan is looking at piping huge amounts of crude through Russia to Germany next year, in line with German plans to replace some Russian crude with Kazakhstani imports.

- Poland will likely continue buying Russian crude into 2023 until a key contract for one of its refineries expires.

- Japanese insurers reversed a decision from earlier this month and will continue to provide war-risk coverage for vessels in Russian waters in January, easing concerns about disruptions to LNG shipments.

- Most areas of Ukraine are under power outages following Russia’s most intense shelling in months on Wednesday.

- Renewable power generated 40% of Britain’s electricity in 2022, up from 35% in 2021 and more than quadrupling over the last decade. The boost helped Britain export a record amount of electricity to Europe this year.

- Italian regulators expect electricity prices to fall almost 20% in the first quarter of 2023 as wholesale prices decline and consumers benefit from a series of tax breaks and other government measures.

- British trade groups expect banks to reduce financing for oil and gas producers after a windfall tax was imposed on the industry to help pay for the country’s energy crisis.

- Finland proposed on Thursday a 30% windfall tax on profits from the country’s electricity companies.

- Price caps on energy could cost the Czech government almost $9 billion next year, officials say.

- China broke ground on an $11 billion renewables project in Inner Mongolia this week, part of a massive clean-power rollout to help achieve the nation’s ambitious climate targets.

- Dallas County signed new contracts to power all 55 of its municipal buildings with solar energy for the next three years.

Supply Chain

- In the latest news from Winter Storm Elliott:

- Roads began to open in western New York for the first time in a week on Thursday, while Elliott’s death toll rose by one to a total of 39 in Buffalo.

- Southwest Airlines cut another 58% of its schedule Thursday but said operations would return to normal today. The carrier’s total cancellations surpassed 15,000 for the week.

- Widespread flight cancellations after Elliott have caused one-way airfares to surge over $1,000 on some routes.

- Residents in Jackson, Mississippi, have been forced to boil water after Elliott destroyed the area’s underground infrastructure.

- Much of the U.S. West is again under winter weather alerts after wet and wintry conditions this week flooded roads, blew hurricane-force winds, knocked out power to thousands and killed five people in Oregon.

- Britons will see more travel disruption today as road traffic officers and control-room staff begin a two-day strike, the latest in a wave of walkouts sweeping the country.

- Third-party logistics providers should see surging demand for last-mile delivery of big and bulky e-commerce items through 2025, analysts project.

- Union Pacific is discussing a pilot program that would eliminate freight train conductors in favor of ground-based trucks that could be dispatched to repair trains when needed.

- Supply chain experts say Apple faces months of disruption to its iPhone production due to rising COVID-19 cases in China, even as a key Foxconn facility in Zhengzhou returned to 70% capacity this week.

- Taiwanese chipmaker TSMC kicked off mass production of its next-generation semiconductors this week, following Samsung Electronics in gearing up to supply the next lineup of cutting-edge electronic devices from major brands.

- Officials in Stafford County, Virginia, approved a logistics development totaling 2 million square feet.

- IKEA plans to roll out solar-powered delivery bikes around the world.

- In the latest news from the auto industry:

- The U.S. Treasury released new guidance on tax incentives for electric vehicles starting Jan. 1, offering up to $7,500 in credits for leased passenger cars — including those assembled outside North America — and up to $40,000 for delivery trucks and other commercial vehicles. Europe cheered the measure ahead of what’s expected to be stricter sourcing measures in March.

- The U.S.’s latest guidance on electric-vehicle incentives will likely cause sales to spike in the first few months of 2023, experts say.

- Breakneck growth in electric-vehicle development will keep lithium prices high for several years, according to U.S.-based Albemarle, the world’s biggest miner. Albemarle’s projection stands in sharp contrast to forecasts made by some Chinese suppliers.

- Chinese electric-vehicle giant BYD raised prices for its most popular model by 20% and scrapped an entry-level version of the car, an unusual move amid signs of slowing auto demand in the nation.

Domestic Markets

- The U.S. reported 100,470 new COVID-19 infections and 894 virus fatalities Thursday. The official count of U.S. cases has topped 100 million, which is widely considered significantly understated.

- XBB, a new subvariant of Omicron, is responsible for rising COVID-19 cases in New England, with experts saying the strain appears better at dodging immunity than previous strains of Omicron.

- The seven-day average of new COVID-19 cases in Los Angeles County rose to 14.5%, up from 11.3% last week.

- The U.S. president on Thursday signed a $1.66 trillion bill funding the U.S. government for fiscal year 2023, including record military spending and additional emergency aid to Ukraine.

- Persistently high U.S. inflation will be difficult to tamp down after taking root in the services sector of the economy, economists say.

- Mortgage rates are poised to end 2022 at roughly 6.42%, more than double where they started, for the largest increase of any calendar year on record.

- Rising borrowing costs are threatening to slow the U.S.’s home renovation boom, one of the key factors that helped the economy out of lockdown in 2020, experts say.

- Goldman Sachs is preparing for a round of potentially 4,000 layoffs in January as the bank looks to reverse a recent expansion drive and scale back ambitions in consumer finance, according to reports.

- Silicon Valley workers are rushing to offload stakes in tech startups through private share sales after a wave of job cuts, according to brokers and investors.

- The surging growth of food-delivery companies during the pandemic is starting to slow as inflation-weary consumers switch to in-store pickup and order fewer dishes.

International Markets

- In the latest China news:

- China is likely seeing 9,000 COVID-19 fatalities per day, according to estimates from British researchers.

- Only about 8% of Chinese residents feel comfortable leaving their home amid the current COVID-19 surge, according to a survey by consulting firm Oliver Wyman.

- Authorities will drop COVID-19 screening on imported cold-chain food items for the first time in three years, ending a precautionary measure that most scientists said was unnecessary.

- Rising COVID-19 infections among workers in China’s massive meatpacking industry could soon start to disrupt global supply, driving up prices.

- Britain is the latest country to contemplate COVID-19 testing restrictions for incoming travelers from China. The EU, meanwhile, soundly rejected the measure despite pressure from Italy.

- Rising interest rates prompted a slowdown in bank lending to euro zone companies in November, new data shows.

- Consumer inflation in South Korea stayed flat at 5% in December, in line with expectations:

- India’s current-account deficit surged to $36.4 billion in the third quarter, up from just $9.7 billion a year ago as rising energy prices pushed imports values higher.

- Hong Kong’s exports plummeted 24.1% in November, the sharpest drop in nearly 70 years, amid a worsening slump in China’s economy and global demand.

- Central banks across the globe are scooping up gold at the fastest pace since 1967, a potential sign that some nations are looking to diversify their reserves away from the U.S. dollar, according to analysts.

- Global hedge funds are set to register their worst returns in 14 years after aggressive U.S. interest-rate hikes caused asset prices to plunge.

Some sources linked are subscription services.