MH Daily Bulletin: December 6

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil fell 3% Monday after data from the U.S. service sector bolstered the Federal Reserve’s aggressive course of monetary tightening, potentially hurting fuel demand.

- Oil futures were down in mid-day trading today, with WTI down 4.0% at $73.83/bbl and Brent down 4.2% at $79.21/bbl. U.S. natural gas was down 2.6% at $5.43/MMBtu.

- The average U.S. gasoline price fell to $3.403 per gallon Monday, down 43 cents the past month.

- California launched a special legislative session to consider levying penalties on the oil industry for alleged price-gouging after Russia’s invasion of Ukraine.

- Saudi Arabia lowered most oil prices for its main market of Asia to a 10-month low, a sign that demand remains fragile due to lockdowns in China.

- Venezuelan oil production rose 16% from September to October and will likely keep climbing once Chevron expands its operations there. The country’s oil exports are expected to finance 63% of its government budget next year.

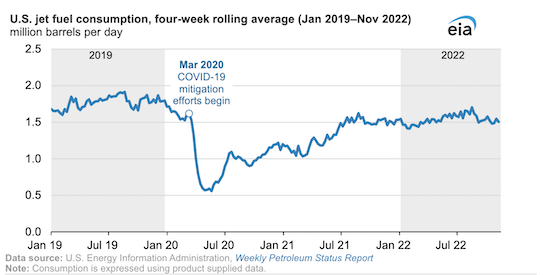

- U.S. jet fuel consumption remains below 2019 levels despite an almost complete rebound in passenger volumes, a sign that airlines are consolidating flights to save on labor and fuel costs:

- More oil news related to the war in Europe:

- Around 19 oil tankers were backed up off the coast of Turkey due to lengthy insurance verifications on Monday, the first day of a Western price cap on Russian crude.

- Poor weather is delaying Germany’s efforts to start importing LNG at floating terminals it built this year to manage the energy crisis.

- European natural-gas demand fell 24% below average in November, largely due to reduced industrial demand amid high prices.

- Britain is still sending natural gas to Europe at a time when the fuel would typically be kept at home, underlining the country’s key role in replacing lost European fuel imports.

- The Netherlands is floating a proposal to cap gas prices for government-owned or state-supported buyers across the EU.

- Prices for some classes of used oil tankers are up almost 90% year to date as new companies leap into the shipping void left by Europe’s newest ban on Russian crude.

- Rates for very large crude carriers have fallen by more than half the past two weeks while smaller tankers find better price stability.

- Russia is re-launching attacks on Ukrainian energy infrastructure, which will likely force more emergency blackouts, officials warn.

- The U.S. administration will meet with oil and gas executives this week to discuss possible measures to support Ukraine’s energy infrastructure.

- Big oil firms are investing millions in companies looking to scale up technology to extract carbon dioxide directly from the air with less energy.

- TotalEnergies is in talks to supply Air France-KLM with sustainable aviation fuel starting next year.

- Italian energy firm Enel will expand the capacity of its Sicilian solar factory by 15-fold to become the largest solar production site in Europe.

Supply Chain

- The FBI is investigating firearm attacks that heavily damaged two power facilities and knocked out the lights for tens of thousands in North Carolina over the weekend.

- The U.S. president signed legislation forcing freight railroad workers to accept the terms of a tentative contract agreement and halt a planned strike. The industry is expected to keep facing challenges, however, due to a massive shortage of workers.

- South Korea is preparing to order striking truckers in the fuel and steel industries back to work.

- Striking British rail workers are planning more industrial action for late December, representatives say.

- Asia-to-Europe container rates are down 50% the past month, according to maritime data group Drewry.

- Taiwan’s TSMC says high costs, lack of trained personnel and construction snags are complicating efforts to get its $12 billion Arizona factory up and running by December 2023.

- Key Apple supplier Foxconn saw November sales drop 11.4% year over year after shipments were affected by a COVID-19 outbreak in the Chinese city of Zhengzhou.

- Top U.S. and EU trade officials pledged to work closely to strengthen semiconductor supply chains at a meeting on Monday, but failed to resolve a dispute over U.S. electric vehicle subsidies.

- U.S. senators are advancing legislation to expand the nation’s parking for trucks after the House of Representatives passed a similar bill in July.

- In the latest news from the auto industry:

- Tesla will reportedly lower record-high production at its Shanghai factory starting this week due to lower-than-expected demand in China. The company’s stock slumped on the news.

- Volkswagen is bringing some of its major plants in China back online after halting output during the nation’s latest lockdowns.

- European exports of hybrid and electric cars rose 69% in value last year to a total of $44.26 billion, beating imports for a second year.

- Ford signed a preliminary deal to supply Deutsche Post DHL with 2,000 electric delivery trucks.

- BrightDrop, the electric truck delivery unit of GM, rolled its first trucks off production lines at a factory in Canada Monday.

- Industry experts say U.S. automakers are unlikely to offer more buying incentives as interest rates rise, a break with historical marketing trends.

- Stellantis is working with a French tech firm to build a process for converting gas-powered commercial vans to electric power.

- TuSimple and Navistar ended a deal to co-develop self-driving trucks by 2024 for unspecified reasons.

- TotalEnergies joined the Castor Initiative, a consortium aiming to develop ammonia-powered tankers to help decarbonize shipping, which accounts for 3% of global emissions.

- Denmark-based Nordic Shipholding sold its fleet of product tankers and is liquidating after a failed turnaround attempt.

- U.S. fast-food chains are reporting steep shortages of lettuce due to unusually high temperatures in major producer California.

- U.K.-based Ocado is pausing construction of new automated distribution centers as online grocery demand eases.

Domestic Markets

- The U.S. reported 51,244 new COVID-19 infections and 207 virus fatalities Monday. The daily average of new cases is up 28% from two weeks ago.

- Average COVID-19 infections in New York City are up by almost 1,000 per day since Thanksgiving.

- COVID-19 statistics are rising in Connecticut and New Hampshire.

- Some 10% of Texas hospitals are reportedly at risk of closing due to fallout from the pandemic’s surge of COVID-19 patients and inadequate state aid.

- Pfizer formally requested U.S. regulators to approve its Omicron-tailored booster shot for children as young as six months old.

- The Federal Reserve is expected to raise its benchmark interest rate by 0.5 percentage points next week, while elevated wage pressures could lead to a larger terminal rate above 5% next year, analysts say.

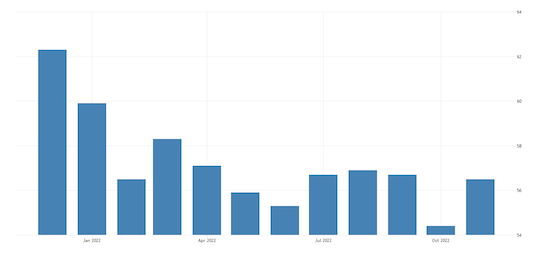

- A key index of activity in the U.S. service sector unexpectedly rose from 54.4 to 56.5 in November, the biggest gain in 11 months:

- U.S. factory orders jumped by a larger-than-expected 1% from September to October, led by demand for transportation equipment, particularly aircraft.

- The U.S. trade deficit rose 5.4% in October to a four-month high as exports fell for the second straight month due to falling energy prices and the effects of the strong U.S. dollar.

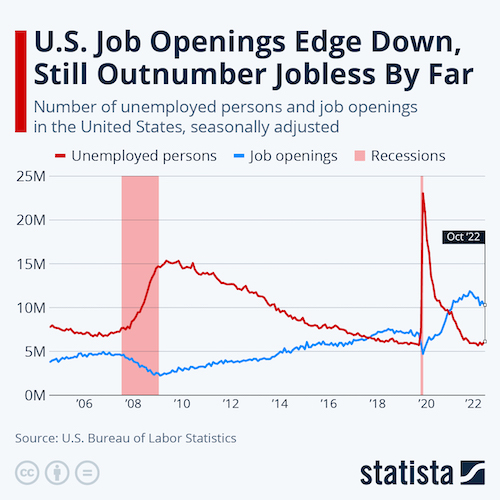

- There are now 1.7 unfilled U.S. jobs for every job seeker, according to the latest data, a smaller proportion than in recent months:

- Some 305,000 Americans lost their jobs at small businesses in October, about 137,000 higher than the previous month.

- PepsiCo is preparing to lay off hundreds of workers at its North American headquarters, a sign that corporate job cuts are extending beyond tech and media.

- Dollar General’s net sales rose an annual 11.1% in the third quarter while inventories rose at more than twice that pace.

- Walgreens launched a 24-hour same-day delivery service to nearly 400 stores across the U.S.

International Markets

- China is set to announce a further easing of some COVID-19 curbs as early as Wednesday as nationwide infections continue falling.

- Average daily COVID-19 cases in France have doubled from a month ago.

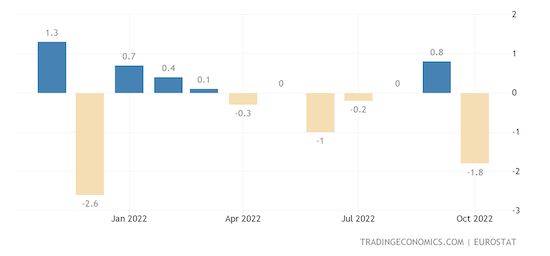

- European retail sales fell 1.8% from September to October, the biggest drop in over a year:

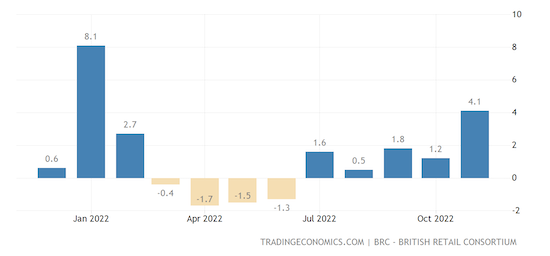

- British consumer spending ticked up last month, according to surveys, while retail sales rose 4.1% from a year ago:

- Real global wages fell for the first time on record in 2022, according to the United Nations:

- Japan’s real wages posted their biggest fall in seven years in October on relentless consumer inflation. Meanwhile, household spending was up for a fifth month.

- Australia’s current account fell into deficit for the first time in three years last quarter on robust demand for imports.

- Deutsche Bank forecasters say German home prices could plummet as much as 25% in an expected market correction.

- The London Stock Exchange launched its first ever carbon-credit fund that allows companies and investors to buy offsets of emissions to help reach their emissions goals.

Some sources linked are subscription services.