MH Daily Bulletin: February 2

News relevant to the plastics industry:

At M. Holland

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

Supply

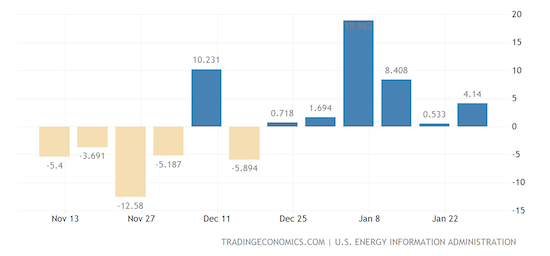

- Oil slid 3% Wednesday after U.S. data showed huge builds in crude stocks last week, signaling an oversupply.

- In mid-morning trading today, WTI futures were down 0.2% at $76.24/bbl, Brent was down 0.3% at $82.59/bbl, and U.S. natural gas was up 1.7% at $2.51/MMBtu.

- U.S. crude stocks climbed 4.1 million barrels last week to their highest level since June 2021, the Energy Information Administration said.

- U.S. LNG exports fell 5% in January as cold weather boosted natural gas demand at home and producers sent less gas to Europe.

- OPEC+ opted not to change its current production schedule, as widely expected.

- OPEC’s oil output likely fell about 920,000 bpd below target in January, primarily due to underproduction in Iraq and Nigeria, according to Reuters.

- Costs to build Canada’s first major LNG export plant have more than doubled from original estimates to more than $10 billion due to labor issues.

- More news related to the war in Ukraine:

- EU nations are looking to strike a deal on a price cap for Russian oil products this Friday, two days ahead of a deadline for implementation.

- Germany’s Uniper expects to post a smaller-than-expected annual loss after lower gas prices reduced the cost of replacing Russian supplies.

- Bulgaria began constructing a long-delayed natural-gas link with Serbia this week that should boost energy security in southeastern Europe.

- Shell’s earnings more than doubled in 2022 to over $39 billion, a record.

- The EU unveiled its Green Deal Industrial Plan Wednesday, an effort to catch up to U.S. and Chinese initiatives supporting green-energy tech.

- Amazon says its recent renewable investments will enable it to operate entirely on clean energy as soon as 2025.

- The World Bank is lending over $300 million to West and Central African nations to support solar, battery and hydro projects.

Supply Chain

- Airlines canceled over 1,800 flights Wednesday after an ice storm hit states from Texas to West Virginia. Package-delivery operations in North Texas were heavily disrupted, according to local reports.

- Natural gas prices are surging in California even as they decline for the rest of the nation, a result of lower stockpiles in the U.S. Pacific and unusually cold weather this winter.

- Union Pacific ended a weather-related embargo on rail shipments in the upper Midwest.

- Long-term container shipping rates declined by 13.3% from December to January, the fifth month of declines, according to Xeneta.

- Asia-to-Europe spot container shipping rates have slipped to pre-pandemic levels.

- FedEx is laying off over 10% of its global management amid a broad shipping slowdown.

- Cardboard box demand slid 8.4% in the fourth quarter, a further indication of flagging consumer demand.

- Ocean Network Express will cancel more sailings after quarterly profit fell 43% to $2.8 billion.

- Chicago lawmakers approved a long-planned expansion of an intermodal hub on property owned by Norfolk Southern.

- Target is seeking an import distribution center in South Carolina after using a temporary warehouse at the Port of Charleston.

- Mexican officials say several airlines agreed to move cargo operations to a new airport on the outskirts of Mexico City.

- In the latest news from the auto industry:

- U.S. sales rose in January for Honda, Hyundai, Kia, Subaru and Mazda, while Toyota’s sales slipped due to tight inventories.

- Volvo Cars, majority owned by China’s Geely, will introduce electric versions of all its models over the next three years in its quest to be all electric by 2030.

- Rivian Automotive will trim another 6% of its workforce, mirroring a cut of the same size last summer.

- A lack of U.S. charging infrastructure dented full-year sales of Daimler’s heavy-duty electric trucks.

- BMW is in talks to launch more electric vehicles in India amid growing demand from luxury car buyers.

- In a fight for financial survival, electric delivery van startup Arrival cut half of its workforce, some 800 people.

- Samsung Electronics reported a 69% drop in fourth-quarter operating profit but said sluggish demand for semiconductors and smartphones could recover in the second half of the year.

- Chipmaker Advanced Micro Devices beat quarterly projections as gains in its lucrative data-center business outweighed a slump in PC demand.

- U.S. chipmaker Wolfspeed plans to build a $3 billion plant in Germany, aided by subsidies from the EU.

Domestic Markets

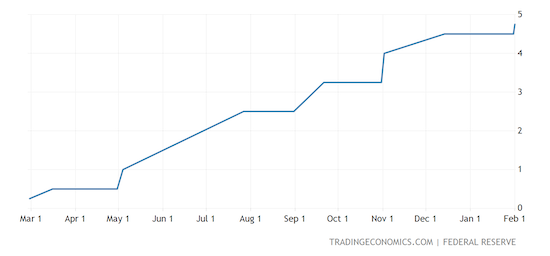

- The Federal Reserve raised interest rates by 25 basis points Wednesday to an overnight benchmark rate between 4.50%-4.75%, a move widely anticipated by investors.

- The U.S. dollar fell to a nine-month low against a basket of currencies Wednesday after central bank leadership indicated the country is making progress in bringing down inflation.

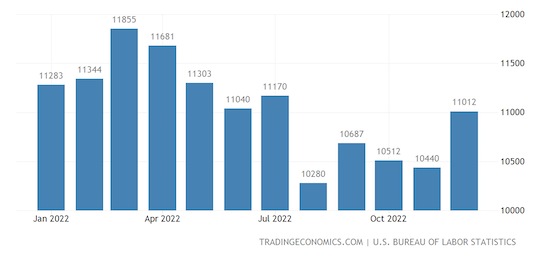

- The Labor Department says U.S. job openings unexpectedly rose to 11 million in December, the most in five months, while layoffs were 15% higher than a year earlier.

- U.S. manufacturing activity contracted for a third month in January, while construction spending unexpectedly fell in December.

- U.S. workers now occupy over 50% of available office space for the first time of the pandemic.

- In the latest news from quarterly earnings season:

- Medical equipment-maker Stryker reported a drop in quarterly profit despite record sales growth and issued an optimistic outlook for 2023.

- Pharmaceuticals giant Merck posted strong fourth-quarter profits, but its outlook for 2023 fell short of analyst estimates due to reduced expectations for its Lagevrio COVID-19 treatment.

- Despite a 6% rise in revenues in the fourth quarter, Honeywell’s earnings slid 29% as the industrial giant forecast slower growth in the year ahead.

- Facebook parent Meta saw revenue drop 4.5% but reported improving conditions in its underlying business and said it would buy back an additional $40 billion in shares.

- T-Mobile missed revenue estimates despite adding thousands of wireless subscribers.

- Johnson Controls, provider of heating and air-conditioning systems for offices and hospitals, missed revenue targets due to supply-chain issues.

- MetLife insurance reported a 33% drop in quarterly profit as a global market rout hit its investment returns.

- Intel is imposing management pay cuts across the board as the company looks to limit expenses in the face of weakening demand.

International Markets

- Euro zone inflation eased to 8.5% in January, its third straight monthly decline.

- German retail sales unexpectedly fell by 5.3% in December, reviving fears of a marked slowdown in Europe’s largest economy.

- The Bank of England raised interest rates by 50 basis points today to the highest level since the Great Recession.

- British manufacturing activity shrank for the sixth month in a row in January.

- British housing prices dropped a larger-than-expected 0.6% this month, their fourth straight decline.

- Canadian manufacturing activity expanded in January for the first time in six months.

- Airbus revived orders for some 75 aircraft from Qatar Airways after reaching a settlement with the airline over a long-running dispute regarding paint defects.

Some sources linked are subscription services.