MH Daily Bulletin: February 6

News relevant to the plastics industry:

At M. Holland

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

Supply

- Oil fell to three-week lows Friday as strong U.S. jobs data raised concerns about higher interest rates.

- In mid-morning trading today, WTI futures were down 0.8% at $72.77/bbl, Brent was down 0.4% at $79.61/bbl, and U.S. natural gas was down 0.8% at $2.39/MMBtu.

- Active U.S. drilling rigs fell by 12 last week to a total of 759, according to Baker Hughes.

- A technical malfunction shut down the North Sea’s largest oil field this morning.

- Major Western oil companies handed investors $78 billion via share buybacks and dividends last year, about 50% more than the last time oil topped $100/bbl in 2014.

- Goldman Sachs says oil markets could face a “serious” supply problem in 2024 as spare production capacity runs out.

- The International Energy Agency says there are signs that China could be poised for a stronger-than-expected economic rebound, which would sharply boost demand for oil and natural gas.

- More news related to the war in Ukraine:

- The EU’s ban on seaborne imports of Russian crude oil products, including diesel and naphtha, took effect Sunday. The plan also imposes a price cap of $100/bbl on Russian diesel sales to third-party countries.

- Economists expect new European sanctions on Russian fuel products to raise global prices, especially for diesel.

- Russia’s revenue from oil and gas plunged by 46% in January from a year earlier.

- Analysts are predicting Russia’s oil output will fall by as much as 42% by 2035, while OPEC’s global market share could grow from 30% today to over 45% by 2050.

- India is playing an increasingly important role in global oil markets, buying more cheap Russian oil and refining it into fuel for Europe and the U.S.

- France commissioned a study on potentially extending the lifespan of nuclear reactors to 60 years and beyond.

- Chevron is showing renewed interest in developing Algerian shale fields, which have greater natural gas reserves than the U.S. and are well located to serve Europe.

Supply Chain

- A 7.8-magnitude earthquake and powerful aftershocks struck Turkey and Syria today, killing more than 2,400 people and injuring scores more.

- Temperatures hit record lows in some parts of the U.S. Northeast over the weekend.

- The gap between container shipping rates out of Asia to the U.S. East Coast and the West Coast has narrowed to pre-pandemic levels.

- U.S. intermodal operations in the fourth quarter declined 29.7% from a year earlier, while total volume for all of 2022 showed fell 3.9%.

- FedEx announced another round of driver furloughs at its FedEx Express LTL unit to “align our workforce with operational requirements.”

- Fourth-quarter earnings at freight forwarders DSV and C.H. Robinson Worldwide contracted on declining revenues.

- Etihad Airways is considering converting some of its Boeing 777 passenger jets into freighters.

- Europe’s warehouse automation market is expected to grow at a double-digit pace through 2027.

- In the latest news from the auto industry:

- The U.S. administration plans to make more Tesla, Ford, GM and Volkswagen electric vehicles eligible for up to $7,500 in tax credits after it revised its vehicle classification definitions.

- Supply-chain issues have kept U.S. car inventories tight, putting purchases of new vehicles out of reach for many middle-class households. Ford says new-car prices will probably decline 5% this year.

- Experts believe electric vehicles will make up one-third or even half of all light vehicles sold annually in the U.S. by 2030, up from 7% last year.

- Tesla’s sales of China-made vehicles surged 18% in January. The automaker continues to fluctuate prices in the U.S. and abroad as it responds to changing demand.

- BMW will invest around $866 million in the central Mexican state of San Luis Potosi to produce high-voltage batteries and some fully electric car models.

- German auto supplier Bosch reported a 15% jump in full-year operating profit.

- Taiwan’s Foxconn, the world’s largest contract electronics maker, saw revenue jump 48.2% in January from a year ago to a record-high.

- Following the U.S., Japan’s government will start restricting exports of advanced semiconductor manufacturing equipment to China this spring.

- Honeywell expects semiconductor supplies to reach normal levels by the end of the year.

- Japanese farm equipment-maker Kubota is shifting some of its production to the U.S. and India.

Domestic Markets

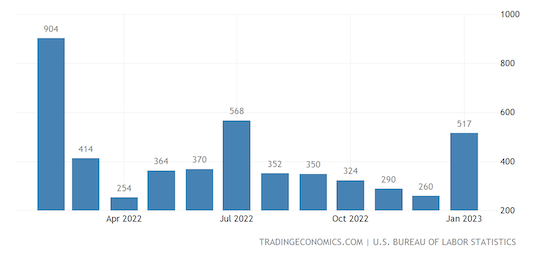

- The U.S. dollar firmed after Friday’s news that the economy added a stronger-than-expected 517,000 jobs in January.

- Economists say the U.S. Federal Reserve is likely to impose at least two more interest-rate hikes and boost terminal rates above 5%.

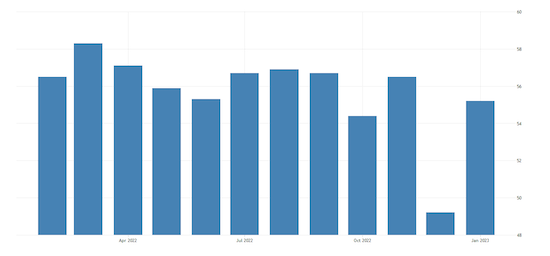

- The U.S. services sector rebounded strongly in January, with a widely tracked purchasing managers’ index climbing from 49.2 to 55.2, signaling expansion.

- Dell Technologies is cutting 6,600 jobs, or 5% of its workforce, joining a growing list of tech companies reducing their staffs.

- Total U.S. credit-card debt soared 18.5% in the fourth quarter to a record $930.6 billion.

- Easing mortgage rates are sparking a rebound in housing, with mortgage applications up about 25% since the end of last year and signed deals rising in December after six months of declines.

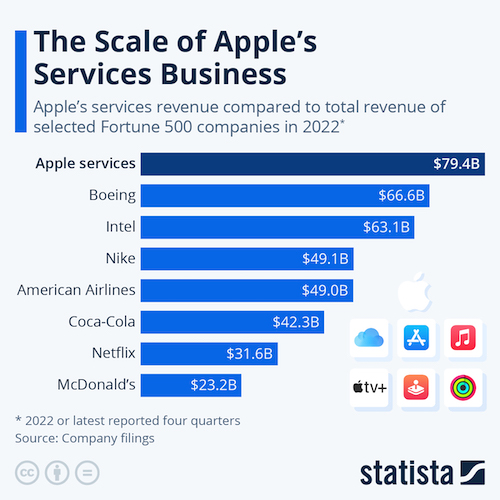

- Apple’s massive services business has quietly surpassed $80 billion in annual revenue, making it larger than many Fortune 500 companies:

- Nestle plans to further raise prices of its food products this year to offset higher production costs, its chief executive said.

- The U.S. Federal Trade Commission is reportedly preparing to file an antitrust lawsuit against Amazon.

- Bed Bath & Beyond missed interest payments on its bonds as the retailer weighs bankruptcy protection.

- Southwest Airlines will reduce the amount of experience prospective pilots must have by 50% as it accelerates hiring this year.

International Markets

- The EU is likely to raise interest rates again in March and May, officials indicated.

- Tens of thousands of U.K. healthcare workers walked off the job today over wage levels, marking the largest strike in the 75-year history of the National Health Service.

- Germany’s service-sector activity rose in January for the first time in seven months while companies showed increased optimism.

- Japan’s economy likely returned to growth last quarter as the country reopened to tourists, analysts say.

- Australia’s central bank is readying to boost interest rates to a decade high this week as core prices continue to jump.

- Rolling power cuts across South Africa dented the nation’s private-sector activity in January.

- Industrial production in Brazil declined 0.7% last year as high inflation hurt household consumption in Latin America’s largest economy.

- The world’s biggest passenger aircraft are being brought back from retirement as carriers rush to restore long-haul air travel.

- Global food prices fell in January for a 10th consecutive month and are now down some 18% from a record-high in March.

Some sources linked are subscription services.