MH Daily Bulletin: February 8

News relevant to the plastics industry:

At M. Holland

- M. Holland is exhibiting at MD&M West in Anaheim through tomorrow, Feb. 9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

Supply

- Oil climbed 3% Tuesday following less hawkish comments on interest rates from the head of the U.S. Federal Reserve.

- In mid-morning trading today, WTI futures were up 1.0% at $77.88/bbl, Brent was up 0.7% at $84.27/bbl, and U.S. natural gas was down 1.3% at $2.55/MMBtu.

- U.S. crude stocks likely dipped by 2.184 million barrels last week, countering several weeks of builds, according to the American Petroleum Institute.

- Public transport and refinery supplies in France were disrupted Tuesday as trade unions led a third wave of nationwide strikes against pension reform.

- Norway’s Equinor recorded a record $28.7 billion in profits last year, triple the prior year, despite a slight drop in production.

- TotalEnergies earned $36.2 billion last year, double its net income in 2021.

- U.S. crude production will rise this year while demand is expected to stay flat, according to the Energy Information Administration.

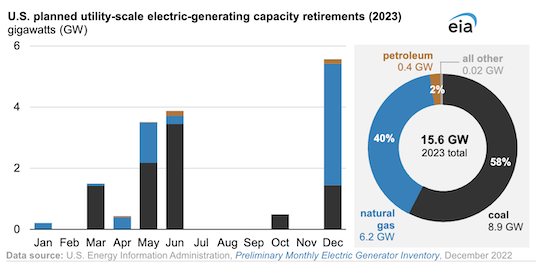

- Coal and natural gas will account for 98% of U.S. capacity retirements this year, researchers say:

- Russia’s use of ship-to-ship crude transfers has soared since Europe banned seaborne imports in December.

- Industrial gas giant Linde forecast higher earnings for 2023 and said it plans to invest up to $9 billion over the next three years in clean energy projects.

- Indiana and Ohio are set for a surge in solar projects this year, which could make them among the top solar-producing states in the U.S.

- The value of global markets for traded CO2 hit a record $909 billion last year, according to Refinitiv.

Supply Chain

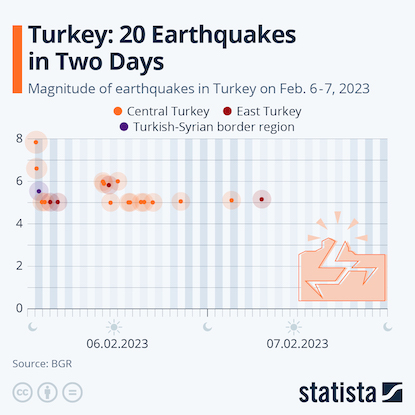

- The death toll from Monday’s earthquakes in Turkey and Syria soared above 11,000.

- A 50-car train derailment along the border of Ohio and Pennsylvania is triggering turmoil along major U.S. rail corridors.

- South Africa surpassed 100 consecutive days of rolling power blackouts Tuesday, a record.

- A South Korean car carrier caught fire on its way to Vietnam this week.

- The Logistics Managers’ Index, a measure of U.S. logistics-sector activity, rose three points from December to a four-month high.

- Residents of California’s Inland Empire, east of Los Angeles, are pushing back against the region’s dependence on pollution-heavy logistics businesses.

- U.S. regulators ordered MSC to justify congestion surcharges the ocean shipper imposed last year.

- An administrative law judge ruled that ocean carriers can no longer restrict intermodal carriers to using specific chassis leasing companies, a win for the trucking industry.

- Spirit AeroSystems says labor shortages are disrupting parts shipments for the airline industry’s top-selling jets made by Boeing and Airbus.

- Airbus deliveries fell by one-third in January as the plane-maker slows the pace of production increases due to the limited availability of engines.

- Big owners of industrial properties near the U.S.-Mexico border say demand is surging for logistics space.

- A U.S. appeals court upheld higher tariffs on some imported steel products, reversing a lower court ruling.

- Growing numbers of carriers and ship builders are betting that methanol, a widely used industrial ingredient, will help global ocean shipping move on from dirty bunker fuel.

- CVC Capital Partners acquired Scan Global Logistics in a deal valuing the Danish freight forwarder at about $1.5 billion.

- In the latest news from the auto industry:

- Hundreds of used electric-vehicle batteries are being recycled for use in California’s power grid.

- Australian startup Recharge won a bid to take over collapsed U.K. battery company Britishvolt.

- Intensifying efforts to produce more raw materials for electric-vehicle batteries is raising the potential for a supply glut.

- A looming shortage of raw materials could hold back U.S. plans for greater electric-vehicle adoption, a trade group warned.

- Brazil’s auto production dropped by 20.3% in January, suggesting sluggish demand for vehicles in Latin America’s largest economy.

- Chinese auto giant BYD is considering setting up its own factory in Europe, suggesting it may have abandoned plans to take over a German plant from Ford.

- Volkswagen saw better-than-expected full-year earnings despite experiencing its worst annual deliveries in over a decade due to supply-chain turmoil.

Domestic Markets

- The chair of the Federal Reserve acknowledged encouraging signs of disinflation but warned that recent robust jobs data could push the central bank toward a higher terminal interest rate than traders expect.

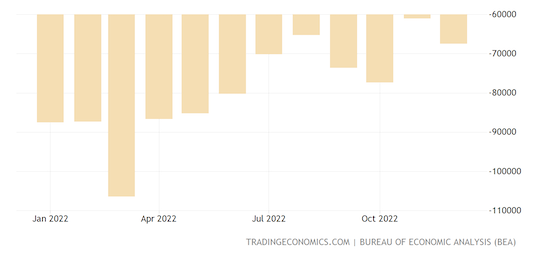

- The U.S. posted a $948.1 billion trade deficit last year, the largest on record. The deficit widened 10.5% for the month of December.

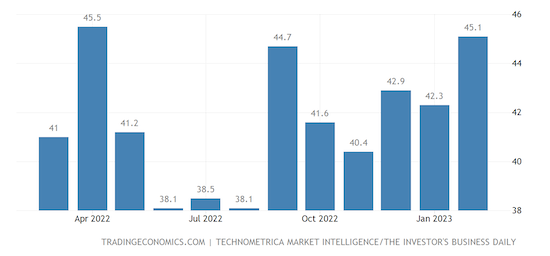

- A leading poll on U.S. consumer confidence rose 6.6% in February but remained negative for an 18th consecutive month.

- The tight market for hourly wage workers has employers raising pay rates and improving working conditions for migrant employees.

- U.S. farm incomes this year are expected to fall for the first time since 2019 due to higher production expenses and falling prices for commodity crops.

- In the latest news from quarterly earnings season:

- DuPont beat quarterly projections and said it expects improved results in the second half of the year, primarily as a result of China’s reopening.

- Royal Caribbean says it is set for record bookings this quarter after posting a smaller-than-expected loss in the fourth quarter.

- Hertz posted record profit of $2.1 billion last year on a recovery in corporate and leisure travel.

- Chipotle saw restaurant visits plunge 10.2% in the fourth quarter, leading to disappointing sales and profits.

- Zoom Video Communications will lay off 1,300 employees, or 15% of its workforce, following a pandemic-fueled growth spurt.

- eBay announced plans to lay off 500 employees globally, or roughly 4% of its workforce.

- Boeing will cut about 2,000 jobs, primarily in finance and human resources, as it makes way for a flurry of manufacturing and engineering hiring.

- Delta Air Lines will raise employee pay by 5% amid an industrywide shortage of workers.

- Holcim AG, the world’s biggest cement-maker, agreed to buy U.S. roofing systems manufacturer Duro-Last in a deal worth $1.29 billion.

- Niche companies that helped buyers gain an edge during the hyper-competitive pandemic housing boom are now stuck with hundreds of homes they acquired on behalf of clients who walked from deals.

International Markets

- The EU’s central bank cut the rate it pays on deposits held by governments to incentivize member nations to redeploy cash into markets.

- Germany’s industrial production fell a sharp 3.1% in December, the steepest decline in nine months.

- About 100,000 British civil servants plan to strike next month in protest over wages and working conditions.

- Canada posted a better-than-expected $119.1 million trade deficit in December on slowing consumer demand for imported goods.

- Unilever plans to build a manufacturing plant in the northern Mexican border state of Nuevo Leon as part of a $400 million investment in the country over the next three years.

- China’s luxury goods market shrank 10% last year, ending a five-year streak of high growth.

- Danish brewing giant Carlsberg says rising prices could hit beer consumption in Europe this year, denting its profit targets.

- Japan’s Mitsubishi Heavy Industries scrapped plans to enter the passenger jet market, ending a 15-year effort that consumed billions in investment capital.

Some sources linked are subscription services.