MH Daily Bulletin: February 9

News relevant to the plastics industry:

At M. Holland

- M. Holland is exhibiting at MD&M West in Anaheim today. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

Supply

- Oil rose 1.7% Wednesday, its third straight gain, on easing concerns about future U.S. interest-rate hikes.

- In mid-morning trading today, WTI futures were down 1.3% at $77.44/bbl, Brent was down 1.2% at $84.08/bbl, and U.S. natural gas was up 2.6% at $2.46/MMBtu.

- The U.S. government lowered its 2023 forecast for natural gas prices by 30.5% to roughly $3.40/MMBtu, a result of significantly warmer-than-normal weather in January.

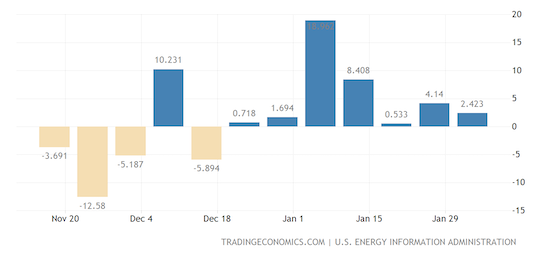

- U.S. crude stocks rose by 2.4 million barrels last week, according to the Energy Information Administration.

- Western oil majors’ net earnings surged to $219 billion last year, up from around $100 billion in 2021.

- BP Azerbaijan declared force majeure on crude loadings from the Turkish port of Ceyhan following earthquakes in Turkey and Syria this week.

- Moscow is considering a windfall tax on large corporations in a bid to cover plunging oil and gas revenues.

- China is reportedly planning to ban the export of several key technologies used in the manufacture of solar panels.

- Owners of the Petra Nova plant in Texas, the world’s largest carbon capture facility, plan to restore operations at the $1 billion facility three years after it shut down, a significant step forward for U.S. carbon capture.

- ClientEarth, an environmental group and shareholder in Shell, filed suit in the U.K. against the company’s board of directors for its policies concerning climate change.

Supply Chain

- Major infrastructure damage is slowing relief efforts to Turkey and Syria after a series of major earthquakes this week as the death toll surpassed 19,000.

- Major U.S. ports will likely see 1.57 million TEUs of container imports in February, a 25.6% decline from a year ago to the lowest level in almost three years.

- Maersk warned of declining demand this year after fourth-quarter revenue and profit fell on a 14% drop in shipping volumes.

- Strong improvement in container shipping schedule reliability stalled at the end of 2022, according to Sea-Intelligence.

- Union locals representing dockworkers at East and Gulf coast sites have opened contract talks with employers well ahead of the current multiyear agreement’s expiration next year.

- Plummeting container ship values are triggering turmoil over loans completed at the high point in the market.

- Manufacturing of shipping containers plunged 47% last year from a record set in 2021.

- North American cargo theft surged 15% last year to a total of $223 million, according to new research.

- In the latest news from the auto industry:

- Toyota reported a surprise 22% jump in net income in its fiscal third quarter, fueled by healthy volumes and a weak yen.

- GM is in talks to take a small stake in Brazilian miner Vale SA’s base metals unit, a business crucial to building electric-vehicle batteries.

- Tesla’s Model Y and Model 3 were the top-selling cars in California last year, outselling popular models from Toyota.

- China’s passenger car sales slumped 38% in January after several major tax cuts expired.

- U.S. used-car prices unexpectedly rose by 2.5% in January, regaining some of the 15% decline from 2021.

- Bank of America introduced a new financial product allowing car buyers to bundle electric-vehicle chargers into a car loan.

- The U.S. electric-vehicle charging infrastructure is plagued by issues, with a sizable minority of stations inoperative.

- Subaru slashed its annual output target by nearly 10% due to ongoing semiconductor shortages.

- Japanese semiconductor equipment suppliers are setting up North American operations near chip manufacturers.

- CMA CGM is reportedly eyeing an acquisition of the logistics arm of French conglomerate Bollore.

- Walmart is opening a heavily automated 730,000-square-foot distribution center in Lancaster, Texas, this year.

- Peru’s biggest copper mines have been able to maintain production despite countrywide disruption stemming from political protests. With copper usage surging and political unrest in some of the major producing countries, some analysts foresee shortages extending to the end of the decade.

Domestic Markets

- The U.S.’s rapidly expanding budget gap poses a significant risk to the current timeline for the country’s debt limit, economists say.

- More traders are predicting the Federal Reserve may end its streak of interest-rate hikes at a higher-than-expected 6%.

- First-time jobless claims rose by 13,000 to 196,000 last week but continue to hover near pandemic lows.

- The job market for IT professionals shrank in January for the first time in over two years, losing 4,700 jobs.

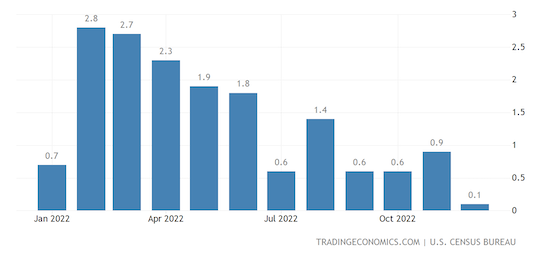

- U.S. wholesale inventories recorded their smallest increase in nearly 2.5 years in December, suggesting businesses were holding back on placing new orders for goods.

- In the latest news from quarterly earnings season:

- Mattel saw earnings plunge as sales fell 22% after cash-strapped consumers pulled back on holiday spending.

- Siemens AG posted an 8% gain in revenue and said it was raising its outlook for the current fiscal year on the back of strong orders.

- Industrial conglomerate Emerson missed revenue estimates as supply-chain snags frustrated its efforts to keep up with demand for automation.

- Consumer brands giant Unilever joined P&G in reporting a drop in quarterly sales as higher prices dented consumer demand, indicating that the trend is likely to continue in 2023.

- Despite higher prices, beverage and snack food giant PepsiCo reported an 11% revenue gain in its fourth quarter, beating analyst expectations.

- Beauty company Coty raised its full-year profit forecast based on China’s economic reopening.

- Under Armour’s earnings surpassed expectations thanks to resilient consumer demand and deep discounts over the holidays.

- CVS Health beat profit estimates as a decline in COVID-19 hospitalizations brought down medical costs for its insurance business. The company also announced it is expanding further into health services with its $10.6 billion acquisition of clinic owner Oak Street Health.

- Uber’s quarterly revenue surged 49% on higher demand for airport and office rides.

- Yum Brands, owner of Taco Bell and KFC, saw sales surge 11% on strong demand for its budget-friendly meals.

- Scandal-plagued Credit Suisse lost 7.3 billion Swiss francs in 2022, its biggest loss since the Great Recession, on a massive outflow of deposits and slowdown in investment banking activity.

- Walt Disney plans to trim about 7,000 jobs and cut $5.5 billion in costs as part of a major corporate reorganization.

- JPMorgan Chase cut hundreds more mortgage jobs this week, adding to job losses across the industry as the housing market cools.

- Hedge fund Hudson Bay Capital Management is the main backer of a big financial package aimed at rescuing retailer Bed Bath & Beyond.

- U.S. Treasury officials are warning financial firms about cyber vulnerabilities related to the surging use of cloud computing.

- Boeing is set to score an order for 15 737 MAX jets from Greater Bay Airlines for some $785 million.

International Markets

- Trade between Germany and China rose 21% to a record $320 billion last year.

- French trade unions are planning a new day of strikes and demonstrations next week against planned pension reform.

- Some companies in Europe say they may unwind price hikes introduced in recent years as soaring costs of energy and other raw materials ease.

- South African businesses say consumers will face much higher prices for essential products due to mandated power cuts that are roiling the nation’s economy.

- India’s central bank raised its key interest rate by the expected 25 basis points to 6.5% Wednesday, the sixth hike in a row.

- The United Nations says global air travel will rapidly recover to pre-pandemic levels by the end of the first quarter.

- Canadian cannabis retailer MedMen, once worth $1.7 billion, reported in a regulatory filing that it is near collapse as the once-hot industry buckles under the weight of high taxes, stiff competition and falling prices.

Some sources linked are subscription services.