MH Daily Bulletin: February 15

News relevant to the plastics industry:

At M. Holland

- Last week, Plastics News featured business insight from M. Holland’s market experts, including predictions for 2023. Read the full Plastics News article here.

Supply

- Oil fell 1% Tuesday as traders worried about mounting supplies in the U.S.

- In mid-morning trading today, WTI futures were down 1.1% at $78.22/bbl, Brent was down 0.9% at $84.79/bbl, and U.S. natural gas was down 1.5% at $2.53/MMBtu.

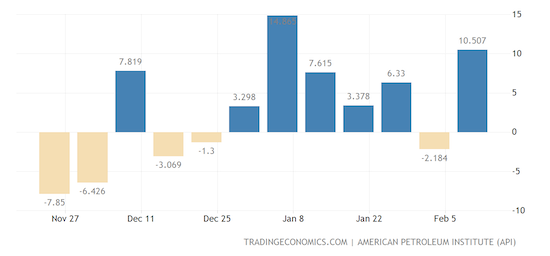

- U.S. crude stocks likely surged by 10.5 million barrels last week, the American Petroleum Institute said. Government data is due today.

- OPEC raised its forecast for global oil demand this year by 100,000 bpd, citing strong economic growth in the U.S., Europe and China.

- OPEC’s crude production slid by 49,000 bpd in January as top producer Saudi Arabia slashed output.

- A rout in U.S. natural gas prices is expected to hurt producers’ first-quarter earnings and cash flow as hedges were largely inadequate to offset expected losses.

- The latest round of European sanctions on Russian fuel exports has sent crude product tanker rates jumping 400%, as hundreds of carriers switched from hauling for traditional producers to hauling for Russia.

- Lost European sales could halve the export revenues of Russia’s Gazprom this year, analysts say.

- Russia’s nuclear exports surged 20% last year, with purchases by the EU climbing to the highest in three years.

- The global oil and gas industry saw net profits rise to nearly $4 trillion last year, up from around $1.5 trillion in recent years.

- Norway is set to become Europe’s biggest natural gas supplier by the end of February.

- Australia’s top court voided a decision by the former administration to block new natural gas exploration licenses on the country’s east coast.

- China’s wind and solar output jumped 21% last year to a total of 1,190 terawatt-hours of electricity, almost enough to cover the nation’s residential power consumption.

- An annual report examining net-zero plans found some of the world’s biggest businesses have made little progress since last year in reaching decarbonization goals.

Supply Chain

- The death toll from a series of devastating earthquakes in Syria and Turkey last week rose to 41,000, with total damages probably surpassing $20 billion.

- The average cost to ship a container from China to the U.S. West Coast fell from $8,607 last April to just $2,618 in January, leading many to believe long-term contract rates will plummet during renegotiations later this month.

- Shipping industry officials are growing impatient with a lack of progress on West Coast port labor talks since the two sides reached a tentative agreement last July.

- The Brotherhood of Locomotive Engineers and Trainmen reached tentative agreements with several railroads, including Canadian Pacific and Kansas City Southern.

- Norfolk Southern is facing regulatory scrutiny following the derailment of a train carrying hazardous chemicals in Ohio.

- Trucking groups are pushing the U.S. to end proof-of-vaccination requirements for non-U.S. citizens entering the country when its COVID-19 emergency status lapses in May.

- South Korean liner HMM’s profit fell for the second straight quarter.

- A drop in volumes of heavy parcels led Pitney Bowes to lower-than-expected revenue last quarter.

- Maersk is suing Evergreen over delays caused by one of its ships getting stuck in the Suez Canal two years ago.

- The rush to secure green-energy metals could lead to a boom in mining in the arctic.

- UPS plans to expand a “smart packaging” initiative that utilizes RFID tags on packages and wearable devices to accelerate throughput.

- Workers at an Amazon warehouse in Coventry, England, plan to strike for seven more days in a push for better pay.

- Taiwanese chipmaker TSMC plans to boost its capital investment in its chip factory in Arizona by up to $3.5 billion before production starts in 2026.

- In the latest news from the auto industry:

- Ford halted production and shipments of its F-150 Lightning to address a potential battery issue.

- The average monthly payment for a new car in the U.S. has soared to a record $777, nearly doubling from late 2019.

- The EU issued a new mandate for all new heavy-duty trucks to reduce emissions 90% by 2040.

- Tesla workers in New York are launching a campaign to form a union, which would be a first for the automaker, labor leaders said.

- Global spending on electric vehicles surged 53% last year to a total of $388 billion, according to new research.

- Tesla made its fourth price adjustment of 2023 for some car models this week.

Domestic Markets

- Retail sales jumped 3% in January, the biggest monthly increase in two years.

- The New York Fed says the U.S. economy may need higher borrowing costs for several years to tame inflation and prevent its resurgence.

- Slightly easing U.S. inflation of 6.4% in January will probably keep the Federal Reserve on track to raise rates again in March, economists say.

- Recession concerns are waning among corporate finance chiefs, but they remain concerned about challenges such as supply-chain disruptions, inflation, labor shortages and the impact of new COVID-19 variants.

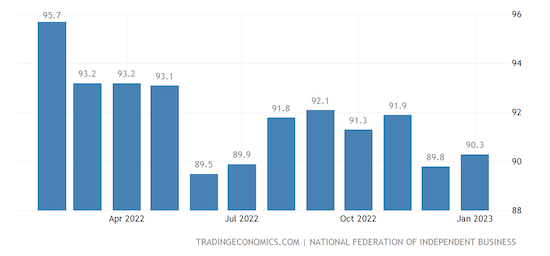

- U.S. small-business confidence improved in January, with a widely tracked index rising 0.5 points to a total of 90.3, which was still below the index’s nearly 50-year average of 98.

- Airbnb recorded its first-ever annual profit last year of $1.9 billion, boosted by a rise in cross-border travel during the fourth quarter.

- Coca-Cola saw global revenue rise 7% last year and said it plans to continue raising prices to offset high costs this year.

- Marriott International saw revenue climb 33% last quarter to $5.92 billion amid a strong rebound for business and leisure travel.

- Aerospace castings supplier Howmet Aerospace expects Boeing and Airbus to fall short of boosted production forecasts this year.

- Boeing delivered 38 airplanes in January, a modest improvement from a year earlier and a significant outperformance of European rival Airbus.

- Walmart plans to close three of its technology hubs and require hundreds of workers to relocate to keep their jobs.

- As the U.S. housing market cools, some real estate agents are returning to their previous careers or taking on side jobs to supplement their income, to offset a drop in commissions.

- Wendy’s plans to cut operational greenhouse-gas emissions by 47% by the end of the decade.

- The White House outlined how nonprofits can access money from the Greenhouse Gas Reduction Fund, a $27 billion “green bank” formed as part of last year’s landmark climate act to support greenhouse gas reduction initiatives.

International Markets

- Euro zone employment surged more than expected to a record-high last quarter, underscoring a surprisingly resilient economy.

- U.K. inflation in January eased to a better-than-expected annualized rate of 10.1%, as core inflation fell to 5.8% and the Bank of England signaled it may soon pause its interest rate increases.

- South Korea’s import prices fell for a third straight month in January, adding to signs of easing consumer inflation.

- Argentina’s annualized inflation rate is running at just shy of 100%, the highest since hyperinflation in the 1990s.

- Nearly three-quarters of Londoners say they would rather quit their jobs than return to the office full-time, according to a new survey.

- Amsterdam’s Schiphol airport will limit passenger volumes in May due to persistent labor shortages.

- Air India ordered 470 jets from Boeing and Airbus, marking the largest deal for commercial aircraft in aviation history.

- Airbus plans to boost production rates of its two biggest jets as it tries to capitalize on resurgent demand for long-haul air travel.

- German industrial conglomerate Thyssenkrupp said its restructuring is progressing slower-than-expected after quarterly results showed operating profit falling by a third.

- Louis Vuitton plans to raise prices as much as 20% in China as the nation’s consumer spending recovers from years of COVID-19 restrictions.

Some sources linked are subscription services.